Financial Inclusion at the Bottom of the Pyramid

This article is a part of the SparkTheRise campaign for which YourStory is an online media partner

Though credit scoring is an essential first step toward inclusion in formal financial systems, 400 million people scattered across rural, urban and semi-urban India still lack access to this basic tool. Though in recent years this population has benefited from microfinance and loan systems, these mechanisms are also finite, failing in themselves to confront deeper issues of financial inequality. This is where InVenture comes in.

While working with the United Nations Population Fund, InVenture Founder and CEO Shivani Siroya surveyed nine countries on the effects of microfinance. “At the time, the average microloan in sub-Saharan Africa was about $90. In India and Southeast Asia it was $300,” she says. “And the problem was that, no matter what, [people] were not getting out of the system of microfinance.”

Though funds were helping small businesses get off the ground, the limits on the amount of funding available prevented them from scaling past a certain point. More importantly, says Siroya, the system then in place did nothing to help people join the formal financial system.

After a stint with Unicef, Siroya returned to the corporate world where she realized that the key to facilitating financial inclusion was to create a system for quantifying credit-worthiness among the recipients of microloans. “The way microfinance decides to give a loan out,” says Dasami Moodley, Director of Business Development for India, “is best guess. There’s no standard or quantifiable way of doing it.” If small business owners could somehow track their use of initial micro-funding, they could demonstrate in a quantifiable way their worthiness of larger investment, bridging the gap between the world of microfinance and formal financial inclusion.

In 2010, Siroya and a team of just six people launched a pilot program in Mexico, Ghana, Mali and India to test the core revenue sharing platform, InSight. By 2011, says Siroya, the time had come to look closely at the product being built. “What our mission really is is financial inclusion. And at the end of the day what does that really mean to us? It means access to capital and the tools to manage money,” she says.

InSight, the team realized, could facilitate that by generating data that could be translated into a meaningful credit score. With that in mind, InVenture narrowed its scope to southern India and the continued success of InSight, first removing any complications or barriers to the program’s simple usage, then using social networks like LinkedIn to gauge the usefulness of, and potential competition for, its product.

The pilot program saw stunning advances. Today, InVenture partners with three major Indian banks accepting InSight scores from more than 4,000 users in India. On average, InSight users increase savings by 6% and revenues by as much as 30%. Moodley describes the Insight score as “that formal piece of paper” that provides the necessary step between the closed circuit of the microfinance system and the opportunities provided by financial formalization.

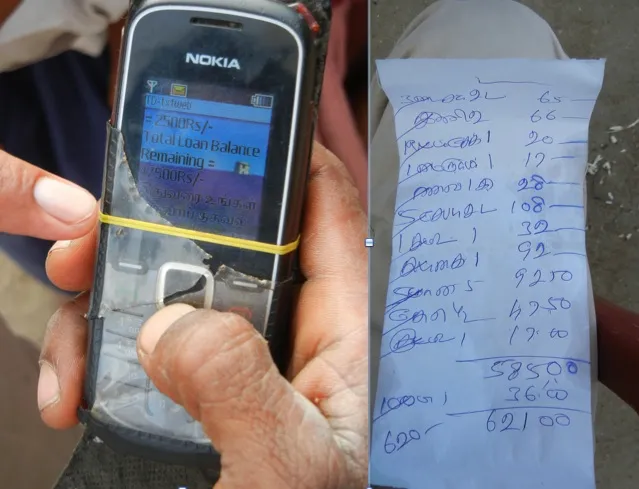

The system’s combined simplicity and community orientation have helped to facilitate InSight’s growth. The program itself could not be easier to use, requiring a free daily text from any phone that includes a series of numbers and letters indicating revenues and subdivided expenses. After a month of consistent usage, InVenture uses the data to create a credit score. With that InSight score and, accompanied by other demographic and verifiable data, InVenture connects entrepreneurs to potential lenders.

Neither are these credit scores based solely around numbers. A creative variety of metrics goes into creating a whole credit picture, something reflective both of personal financial responsibility and of one’s larger financial and community network. An InSight user, for example, can improve her credit score by recommending a successful new user. If a recommended user proves unreliable, that can damage the recommender’s score as well, thus creating a self-policing system.

Ultimately, says Siroya, the goal for InSight is “to become the standard,” to gain broad recognition as an effective tool for measuring credit among India’s lowest earners, and a mechanism for promoting financial inclusion. With InSight, says Siroya, “you’ve finally given somebody the opportunity to prove their own trustworthiness.”

Moodley, who works on the ground in and around Bangalore and Chennai, has seen the positive effects first-hand. Without a credit score – often without so much as a state-issued ID – it is difficult for small entrepreneurs to feel comfortable approaching formal financial institutions, which will not issue loans to informal customers. With an InSight score, Moodley says, “they have their suit of armor.”

Find out more about InVenture here.

If you have a great idea and need a platform to showcase, please submit your idea for Spark The Rise- and get your project funded.