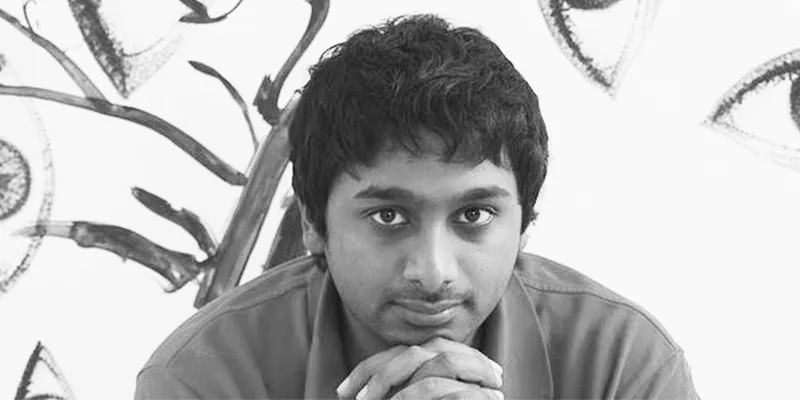

How artist Raghava KK raised $2 M for Flipsicle without a business plan

After we covered Flipsicle’s founder story last week, came the news that Raghava KK had raised 2 million USD (technically, it happened a few months ago). He raised the seed capital from 10-12 angel investors – where angels like Neeraj Arora of WhatsApp, Vishal Gondal of GoQii and John Maeda, partner at Kleiner Pekins’, participated in the seed round.

Raghava managed this without ever drawing up a business plan. Was this a shot in a dark that worked or is this something other entrepreneurs could learn from? YourStory spoke to Raghava to find out.

How it happened

For Raghava, there were two ways of raising capital: One is the old trodden path and the other is the less travelled route. The old way is to make your business plan in 12-15 slides in a power point presentation, after which you try to get a meeting with a VC or an angel investor, where you have 15 to 20 minutes to present it. If they like it, their junior staff will ask you 100 questions, following which they will say they’re interested. Then, you build interest with 10, 20 people, and the person leading the round will create the term sheet for them. This process takes months and even years.

And there’s the new way, as described by Raghava: “I didn’t want to waste time. I wanted to do this differently. I would ask every VC for a chance to interview me for 30 minutes, and I would, in turn, ask them how they could contribute to the company. I made sure I was not just raising money, but smart money from successful entrepreneurs who could help me invent a new business model. I was very clear as to how I wanted to raise the money and what I intended to do with it. I took a term sheet along with me when I met potential investors. So I went to one of the top law firms in New York, negotiated with them, and got a good deal on how we are going to raise it together. I had given myself 10 days, and I planned to meet 30 people. Out of those 30 people, I was going to raise $ 2 million.”

Some of the investors Raghava tapped were also those he had known for a while and hence were familiar with his work, which helped break the ice. Others were tapped through his network of friends and business associates.

How did he go about it?

Raghava didn’t use an AngelList syndicate while raising capital. Instead, he called a friend in Silicon Valley and asked whether he could stay at her house, even borrow her car and put gas in it. Then he hit the road, driving from one side of the valley to the other.

In the mean time, his wife Netra, Co-founder and COO, who was home in New York City, started writing emails to people and booking meetings while he was on the go. He managed to secure about five meetings this way.

Raghava also bulldozed his way into many meetings by going to the place and saying, “I’ve 15 minutes, and do you know anyone who is in this area? Fifteen minutes could change our lives.”

When he encountered investors who weren’t receptive of the idea, he told them, “If you are not going to put money, point me to the person who should be putting the money. Make a call now. You say this is an ecosystem, show me it is an ecosystem.”

After meeting Raghava and listening to his story, it is clear to us that this rather unorthodox approach worked for him because of three main reasons. One, his investors were people he had already built relationships with, much before he approached them for money.

Two, he had a good track record with his previous products. And lastly, his passion and sincerity comes across in everything he says about his company.

So, while this worked for Raghava, we would not recommend you try this approach. But, don’t worry. Raghava has also picked up some valuable lessons on pitching to investors during his journey. We will share them with you soon. Watch this space.