Will banks dominate m-commerce in the near future? HDFC thinks so

Indian banks have long been considered slow in adapting to technology, and accused of having ‘innovation blindness’. This is because of many factors, like red tape, employee reluctance to change, and the volume of transactions, among other reasons. With India and the world going mobile with their digital payments and transactions, a wave of ‘pre-loaded’ wallet providers such as Paytm, Mobikwick, Oxigen, and PayU Money etc are now the defacto solutions for a vast majority of the Indian population.

Most Indians, in general, are not early adopters of new technology. But adding in discounts or cashback schemes seems to accelerate the process. As of now, there is no clear brand loyalty in the Indian scenario, and consumers tend to go with whoever provides the best deal or discounts.

As a largely mobile-first internet country not used to transacting online, people were and are generally not comfortable with providing their credit card details to a third party, fearing hacks and other safety hazards. So pre-loaded wallets turned out to be a good alternative for consumers who needed to pay online but did not wish to share their credit card details.

While pre-loaded wallets are a good alternative, they may not be the best long-term solution. Indian consumers are happy now because of the offers and schemes which are part of the customer acquisition strategy of these startups and established players. But what happens when they achieve their desired user base and the discounts suddenly stop?

As soon as users load money into their pre-loaded wallets, it ceases being money, and is transformed into ‘credits’, which can be cashed in the somewhat narrower halls of these service providers. While financial advisors may advise diversification of money, keeping money in different pre-loaded wallets earns the end users no interest on their money, which they would have got from banks. Like many people, I have kept a few thousand rupees across multiple wallets for many months to a year. Though we may not feel the pinch now, as transaction volumes increase, we will stand to lose interest on larger sums of money that lie dormant in our wallets for long periods.

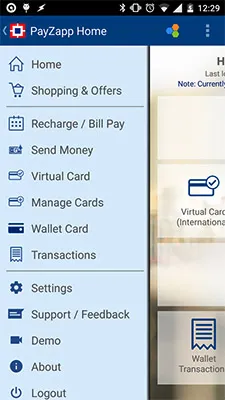

The best long term solution would be for banks to provide digital wallet services that provide secure end to end services. For the FY 2014-15, HDFC noticed that 63% of all their transactions were conducted through digital channels. So, backed by this data and their research, they launched PayZapp. PayZapp is a mobile payment solution that aims to take prepaid wallets head on by providing one-click payments instead of two-factor authentication. They do this through a mobile app,and require the user to register and login through the mobile number linked to their bank account.

They also launched ‘SmartBuy’, a virtual marketplace for goods, to meet the requirements of users. It allows users to transact through e-commerce portals such as Flipkart, Makemytrip, Cleartrip, Yatra, Big Basket, DTH and bill pay facilities. As the user has registered through their mobile number registered with the bank, they have replaced the two factor authentication checkout with a single PIN. Users need to enter their credit or debit card numbers only once on signing up.For added security and convenience, there is an in-app NetSafe Virtual International Card. Users can also transfer money to friends and family instantly through email IDs or mobile numbers.There is no restriction on daily or monthly limits, as payments are done through linked cards. Speaking about Payzapp,Parag Rao, Business Head, HDFC,confirmed that they will be adding many more e-commerce platforms and partners to the team within the next few months. They would also provide these services to Non-HDFC bank customers.

The payment scenario is very interesting in India right now, with the government innovating at the policy and execution level to promote Immediate Payment Service(IMPS). IMPS allows consumers to make instant payments to individuals, merchants, or enterprises through internet, web, ATM, or mobile phones. NPCI carried out a pilot on mobile payment system with four member banks in 2010, and introduced RuPay to Indian eCommerce in 2013. Then, in 2015, Paytm rolled out IMPS with the aim of reaching 50,000 retail outlets.

In 2014, RBI issued guidelines about Payment Banks, stating that telecom operators, supermarkets chains, electronic wallets, and prepaid instruments players could open Payment Banks. These would function to accept deposits and basic savings. They would also provide remittance service for users excluded from the digital financial system, such as labourers, low income households, etc. These players could issue ATM-cum-debit cards to access funds, but restricted to a maximum balance of INR 1 lakh per customer.

App: PayZapp