The e-commerce acquisition spree continues in 2015

Large players in the e-commerce business are on an acquisition spree, in their quest to consolidate their position in the high growth cash-intensive sector. Also, they wish to further boost their capabilities, with the right technology and talent.

After a successful spate of mergers and acquisitions in e-commerce in 2014, momentum continues to build up in 2015. With larger players like Flipkart and Snapdeal on a high after having received record-breaking investments last year, they are looking to add more power to their engines through strategic acquisitions. The objective is to expand their portfolio, increase their customer base, and provide a better user experience to customers.

The first 5 months of 2015 in the e-commerce space have been buzzing with acquisitions. Here’s a summary of the top acquisitions this year and the trends they portend for the future:

Flipkart–WeHive Technologies Pvt. Ltd

In the first major M&A activity in the e-commerce space this year, Flipkart picked up a stake in the marketplace and auctions startup WeHive Technologies Pvt. Ltd. This acquisition will help Flipkart increase its market dominance by scouting for mobile-focused companies.

Mahindra -BabyOye

The Mahindra Group acquired the leading online baby-care product brand BabyOye in February. This came with an intention to integrate its own offline baby care products store, Mom&Me, with the online retailer.

Foodpanda - Just Eat India

Food is one space that is seeing lot of traction in India, with the credit going to Zomato, a leader in this segment. To give tough competition to Zomato, in February, online food-ordering platform Foodpanda bought its biggest rival in India, Just Eat India - just three months after acquiring Pune-based competitor TastyKhana. After closing the deal for an undisclosed amount, Foodpanda is now present in over 200 cities in India and partners with over 12,000 restaurants.

Ola Cabs - TaxiForSure

The Indian taxi market segment too is seeing a lot of action of late, given its immense potential. Everyone is interested in taking a share of the gigantic $8 billion (Rs 48,000 crore) market, of which only 5% is organized.

In March this year Ola bought TaxiForSure for $200 million in a cash-and-stock deal.TaxiForSure was actively looking out for a big investment to keep up with the cash-rich Ola Cabs and Uber. This acquisition added value both on the supply and demand side, for Ola. Apart from a huge customer base, TaxiForSure added 15,000 cars to Ola’s fleet of more than 100,000 cars.

Flipkart - AdiQuity

In its first major acquisition this year, in March, Flipkart acquired mobile ad network AdiQuity, that has a history of mobile innovations to its credit. The acquisition comes at just the right time;Flipkart has been planning to foray into fee-based businesses such as online advertising and brand consulting for vendors, so as to boost profitability prior to a potential public listing.

Snapdeal - Freecharge

This is one of the biggest acquisitionsthe Indian e-commerce sector has seen so far. Snapdeal acquired online mobile recharge platform Freecharge for an undisclosed sum in April this year. Sources privy to the details said it paid over Rs. 2,800 crore ($450 million) in cash and stock to seal the deal.

This acquisition made it clear that companies are willing to do anything it takes to strengthen their capability in the mobile space to maintain their lead in the market in the long run.As a result of the deal, Snapdeal gained a large customer base from Freecharge, especially from Tier 2 & Tier 3 cities.

The Freecharge app alone had 10 million downloads and 1 million+ daily transactions prior to its acquisition, and together the two entities now enjoy a 40 million+ customer base and a total of 30 million+ application downloads.This acquisition overtook Flipkart’s acquisition of Myntra last year, which was in the range of $350 million.

Flipkart - Appiterate

In keeping with its strategy of focusing on the mobile segment, online marketplace Flipkart acquired Delhi-based mobile engagement and marketing automation company Appiterate at end of April. Although the financial details were not disclosed, the move was initiated so Flipkart could leverage Appiterate’s innovative technology and skilled employees as a means to get an edge over rivals. Flipkart is giving it all it can to surge ahead in building the mobile ecosystem in India.

Snapdeal–MartMobi

In May, Snapdeal made its next big kill when it acquired MartMobi, a Hyderabad-based mobile technology startup for an undisclosed amount. The move will help Snapdeal strengthen its mobile platform for merchant partners.

More acquisitions to come…

Flipkart has openly said that it is still looking at acquisitions in logistics, technology, mobile and other e-commerce sites and hasn’t acquired as many companies as expected. The commerce giant is flush with funds and is identifying targets.

Chinese e-commerce giant Alibaba is also looking at acquisition of Indian e-tailers that have a large customer base as well as a robust network of merchants. Snapdeal too has clearly demonstrated this intent by acquiring other companies that can add more to its existing capabilities.

Deals there were called off

While many mergers and acquisitions took place this year so far, there have been quite a few failed deals that could have made their way to the high profile M&A list.

Amazon's proposed deal to buy Indian lifestyle e-tailer Jabong.com could have been the biggest-ever buy for the US-based e-com giant but was scrapped for unknown reasons. The valuation could have been around $1.2 billion.

Investments galore!

Apart from acquisitions, this year has seen many big investments in the e-commerce sector. Alibaba invested the highest amount so far this year- $545 million - in Paytm, apart from Ratan Tata personally investing an undisclosed amount in the company.

ShopClues too raised $100 million, while CarDekho received $50 million in investment. CaratLane got a funding of $31 million while Practo and CarTrade each have raised $30 million. Big VC firms were quite focused on investing in China and India, and the first quarter of 2015 saw 67% more deals in India than in China in absolute numbers.

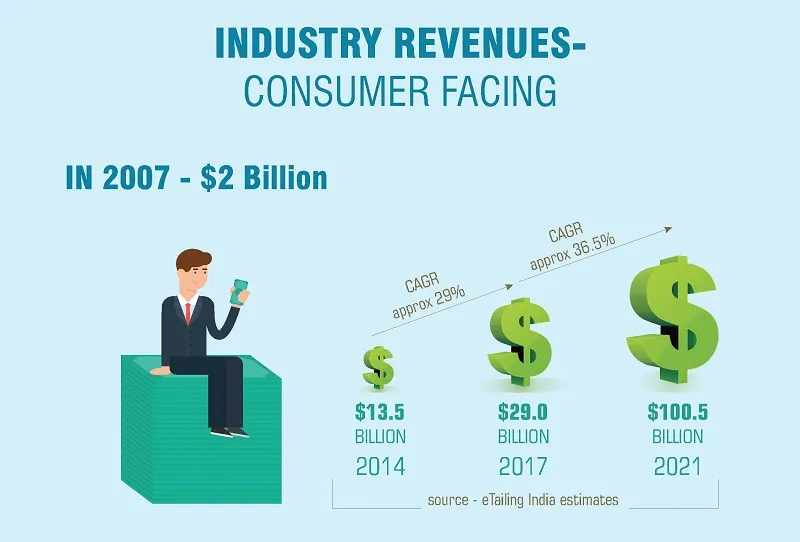

According to e-tailing India reports, the e-commerce sector in India is expected to grow far faster in 2015 compared to last year.Therefore we’ll see lot more action this year. With money flowing into large e-commerce giants from investors, consolidation in the sector is inevitable.

Apart from this, consolidation will make it simpler for e-commerce companies to identify marketing solutions that meet their objectives, and help them grow at a much faster pace. The e-commerce market is all about‘survival of the fittest’.This consolidation spree is thus likely to continue until we see the ‘last man standing’, who will be the undisputed king.

About the author

Ashish Jhalani is the founder at eTailing India & Indian School of eBusiness (ISeB), angel investor, mentor and an advisor. He is on FICCI's retail as well as ASSOCHAM's FMCG Committee. Ashish Jhalani, set up a successful e-commerce venture in the US named mysolitaire.com which he ran for about 8 years.