‘Average device in India is only 10 months old!’ What does the data of 8M mobile app users in India indicate

In her recent report on Internet users, Mary Meeker mentioned that India tops the list of countries in adding new Internet users this year. In 2014 alone, India added 63MM+ new Internet users. With 232 million Internet users, India is growing at more than 37 per cent Y-o-Y. Interestingly, 65 per cent of India’s Internet traffic comes from mobile. Another recent report by IAMAI and KPMG indicated that India will reach 236 million mobile Internet users by 2016, and 314 million by 2017.

The California-based mobile intelligence company focusing on personalizing mobile experiences and monetization, Quettra, has shared insights on Indian mobile app users for the month of June. Quettra software, which currently resides on over 8M Android devices in India and over 135M devices worldwide, collects install and usage statistics of every application present on the device. The company helps mobile developers improve the core metrics affecting their businesses. Founded in 2013 by Ankit Jain, who was previously heading ‘Search & Discovery’ for Google Play Store, Quettra raised $2.9M seed funding in August 2014.

The analysis

Speaking about this report, Ankit says,

There’s been a lot of recent focus on India with the proliferation of mobile devices and tech investment into this populous country. The rate of innovation has been compared to that of Silicon Valley in the 2000s and the tech-renaissance there is one that hasn’t been quantified.

This report is a deep dive into the app ecosystem in India as of June 2015. The report analyzes Android users from India and presents a comprehensive and detailed analysis that not only sheds light on the movers and shakers of the app industry in India, but also focuses on emerging apps and trends that can make an impact. The goal of this report is to provide app stakeholders the information they need to improve the success of their apps.

Methodology

For this report, a sample of the subset of users active from January 1, 2015, to May 31, 2015, is used. Google apps (e.g. Gmail, YouTube, Maps, Hangouts, Google Play etc.) and other commonly pre-installed apps have been excluded since this study exclusively considers Android users. Normalization is performed to account for any panel churn and bias that might occur as a result of a broad and diverse user base. Only apps with over 10K installs worldwide are considered.

Highlights

Quettra claims that the report takes a first stab at the extremely mobile-device-powered India. Here’re key highlights of the report:

- On a given day, an average Indian WhatsApp user spends 25% of his/her total mobile time on WhatsApp Messenger with an average of 27 sessions a day!

- Mobile recharge apps are on the rise. There's over 130 recharge apps but the top three make up over 50% of the market. PayTM alone has > 30% penetration and growing.

- Uber's growth is accelerating in India while Ola's is slowing down at about 11% Android Device Penetration.

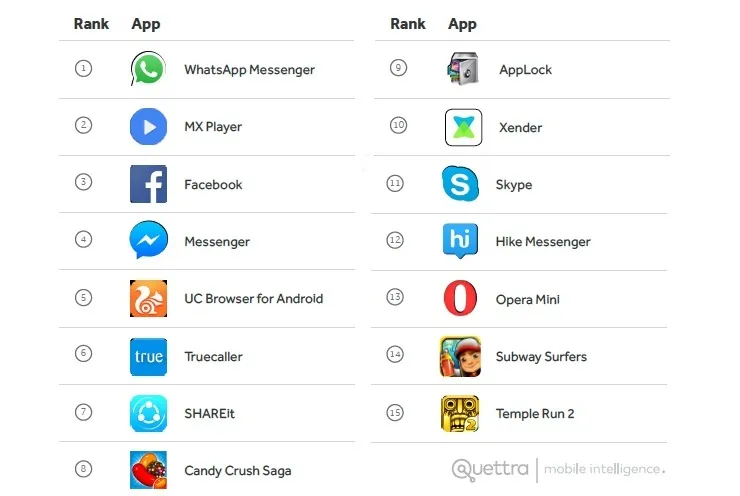

- The only India-made app that breaks into the first-15 most installed apps on phones in India is Hike Messenger.

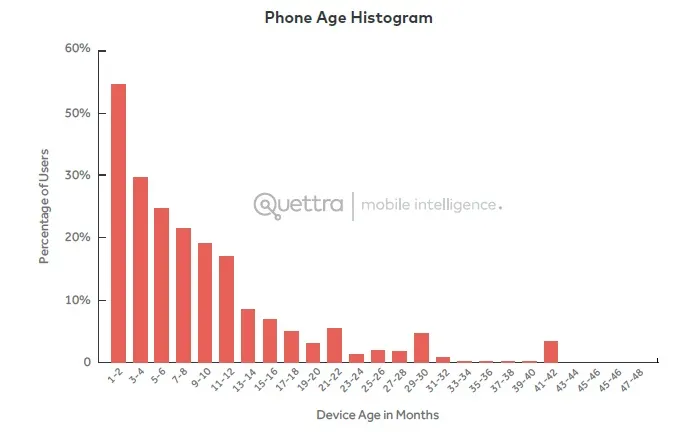

- The average device in India is only 10 months old.

- Arcade games dominate the list of top installed, used, and paid apps.

- Clash of Clans is the new major game addiction. The average Clan user in India spends 28% of his/her phone time on this app. Although the user base is 1/4th that of Candy Crush Saga, it is growing fast!

According to Ankit, the reason for the reduction of average age of device can be attributed to more devices lighting up as well as the new and resale market really flourishing with users wanting to upgrade their devices at ever increasing velocity. The report says,

With a lot of device option available at different price points and loose contracts with mobile operators, it doesn’t take much to frequently change the mobile device.