How to ensure that you, the startup employee, make money with your ESOPs

For many startup employees, ESOPs or Employee Stock Options is seen as the pot of gold at the end of a tough journey. Esops as a concept can seem deceptively simple, but if the startup employee is not careful or does not understand this concept well it can all disappear like Leprechaun gold.

Like it disappeared in the case of Raghu Varma (name changed). Raghu worked for a startup for a few years at a CXO role, saw the company through a few rounds of funding and then moved out. He had a large chunk of “vested stock options”. He held on to these as he thought the valuation of the company would only go up and he wanted to take advantage of this at that time.

He went to his old startup a couple of years after he quit and a few months before his options were to expire. The company lawyer met him and told him that he should have “exercised” his option when he quit as, according to the fine print in the contract, all stock options would expire after three months from the date of termination of employment.

This is just one of the many pitfalls of not understanding all the legalese that typically accompanies ESOPs. What startup employees or potential employees need to understand is that ESOPs are extremely complicated and if your salary package includes a significant chunk of ESOPs then it is best to invest in a lawyer.

In this article we will attempt to demystify some of the terms that are used and the scenarios that impact how ESOPs turn into cash for you.

What are ESOPs?

"A stock option is not a share in the company. It represents the opportunity to participate in the company’s shares at some point in time," says Kapil Bellubi, a Director at consulting firm American Appraisal, a division of Duff & Phelps.

First things first—just a mention in your offer letter that you will get ESOPs does not translate to actual ESOPs. The details related to the options granted to you will be contained in the Stock Option Plan, which captures the generic details of the plan as a whole for the company and all the employees, and the Grant Document that an employee enters into with the company. This captures details specific to the individual employee’s grant. So ensure this document is drafted and executed. Only then are you legally eligible to ESOPs.

Kapil of American Appraisal explained some of the other more commonly seen terms in the grant document and what they mean.

Every stock option granted to an employee carries the price at which the employee can participate or purchase the company’s shares. This price is called the Strike Price, which in most cases is the prevailing fully diluted stock price of the company on the date of grant.

Mayank Bidawatka, former Head of Marketing and Product at redBus and Co-founder of Goodbox, says the employee should understand what the value of ESOP is. "If the company says the ESOPs are valued at Rs 10 lakh, is it at today’s valuation or based on some future valuation? It has to be at today’s valuation. Also, thorough process should have been followed to arrive at the valuation," says Mayank, who was one of the former employees of redBus who made money when Ibibo Group acquired the company.

Then there is vesting. This phrase stands for the terms and conditions under which an employee becomes eligible for stock options. Kapil of American Appraisal explains that the traditional vesting arrangement specifies the time period that the employee should remain in service in order for their stock options to vest. Vesting schedules provide for either “cliff vesting” or “graded vesting”.

- Cliff vesting: For example, a startup offers ESOPs where the vesting spans four years with a one-year cliff. This means the employee will not get any shares until he has spent one year in the company. At the end of the 12 months, 25% of his shares will have vested. Thereafter, every month, a certain portion of the remaining 75% will vest.

- Graded Vesting: In this the employee gets a certain percentage of the options after each year of completed service, say 25% every year for four years.

The two examples mentioned are standard. “But the vesting schedules can be tinkered with and some companies might say 5% at the end of the first year, 10% at the end of the second and so on. That is not fair as the person has worked hard and he deserves the 25% each year,” says Mayank of Goodbox.

Now comes accelerated vesting—a cause for disputes during many an M&A. Under certain conditions, the regular vesting schedule is thrown out of the window and eligible employees get stocks vested according to the conditions laid out under the accelerated vesting clause. These conditions could be an acquisition, death of employee or termination of employment.

Especially when there is a change in control, such as an acquisition, employees with ESOPs should see their stocks getting vested. However, if the acquiring company is offering stock then the accelerated vesting clause might not kick in.

Alok Goel, Managing Director at investment firm SAIF Partners, says startup employees should think of such scenarios. “It is important to understand what happens to your ESOPs if you leave or in the case of transfer of ownership of the startup,” says Alok, who was earlier CEO at FreeCharge and, before that, COO at redBus. Ibibo Group’s acquisition of redBus was mired in controversy over the handling of some employees’ ESOPs.

Converting ESOPs to shares

So how do you convert the vested options into shares you own? You need to ‘exercise your option’, which means you buy shares of the company at the strike price (explained in the beginning). Say 2,500 stocks have vested and the strike price is Rs 1. Then you need to pay the company Rs 2,500 to get the shares in your name. This is called a cash exercise.

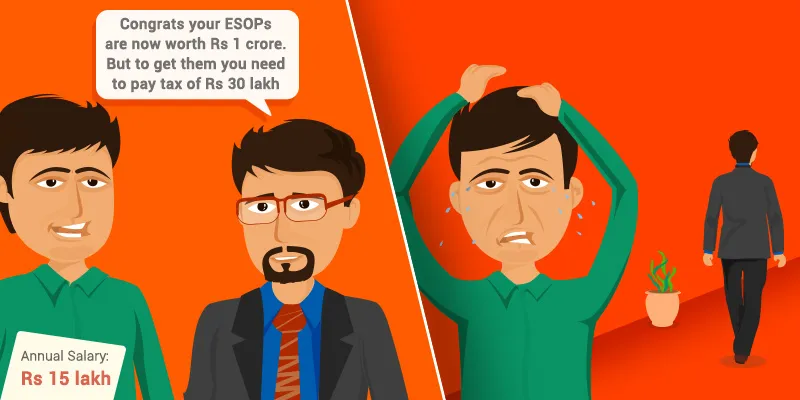

That’s not all. Tax comes into play. Here’s a simplified illustration of how tax is worked out:

- You got 10,000 ESOPs when you joined in January 2015

- The value of each stock in January 2015 is Rs 10; you got it for Rs 1

- In 2016, 2,500 stocks got vested and you paid Rs 2,500 to get them as shares in your name.

- But the value of each share is now Rs 100 as the startup has raised funding at that valuation.

- So your gain is Rs 99 per share, which translates to 99X2,500 = Rs 2,47,500. Now you have to pay tax on this. At 30% the tax amount comes to Rs 74,250

Tax is fine if you are a senior employee and earn a hefty salary but if you are a junior employee tax could pose a problem if it turns out to be a big amount.

American Appraisal’s Kapil says there are two options to deal with all or part of these additional expenses. In cashless exercise, says Kapil, “An employee uses options to buy shares of stock, which are simultaneously sold in order to pay the exercise cost, transaction fees and any withholding taxes due at exercise.” The employee will retain any cash that remains. In swap an employee can use any existing company stock to exercise their options and to cover the exercise cost. But Kapil says the employee would still need to pay transaction fees and taxes.

You can also choose to exercise your options at a later time say after the company has raised multiple rounds of funding and the valuation has gone up manifold. But you will still end up paying long-term capital gains tax. You also need to know that most companies put in a 90-day period in which the employee has to exercise his vested options in case he quits the company.

The long-term capital gains tax will also affect you if you sell your shares that you have converted from ESOPs using one of the earlier methods.

Should you take significant ESOPs

So finally who should opt for a big ESOP component in his or her compensation package? "If you are a junior level employee it is best to optimise the cash component. But if you are at the CXO level and have control over the startup’s outcome then it is good to have significant ESOP," says Alok of SAIF.

But even that is not enough. Anshuman Das, Managing Partner at recruitment consulting firm Longhouse Consulting, says a senior level hire should engage a lawyer and speak to the board to get a better understanding of how they will deal with various situations that could impact ESOPs. “Chemistry fit is most important. Even if everything is done right,there is no guarantee. The employee should remember that every contract is up for arbitration,” says Anshuman.

It is not that founders and investors want to create problems. On the contrary, most would want to reward employees who have helped build a startup. VikramVaidyanathan, Managing Director at Matrix Partners, says this is what he advices founders: “Create a large adequate pool upfront; concentrate your ESOP plan in a few initial hires who you think will create maximum impact. Save ESOPs for new hires that you will need two years after your initial scale up and decide what role ESOP plays – e.g., employee retention/reward – and use it in this scenario effectively and aggressively.”

But founders and employees are human after all and fall-outs are all too common. “There have been instances where the employee is sitting on a large amount of stock and has quit and the founder has told him to sell the stock back to the company at a lower amount right then. A bad founder can say that he will not provide the employee the chance to liquidate the shares in the future,” says Mayank of Goodbox.

As Alok of SAIF says: “When deals happen the only stakeholder who is not directly involved in the discussion is the employee.”

(Please write to us to share your ESOP experience)