$7.3 billion invested in Indian startups in three quarters of 2015

Q1 and Q2 of 2015 were fantastic for startups in India. But Q3 was even better for those startups that were showered with funding. In the past nine months, angel investors and venture capitalists have been pouring more money into early stage Indian startups and late stage companies more than ever before. Between Jan-Sept, $7.3 billion has been invested across 639 deals.

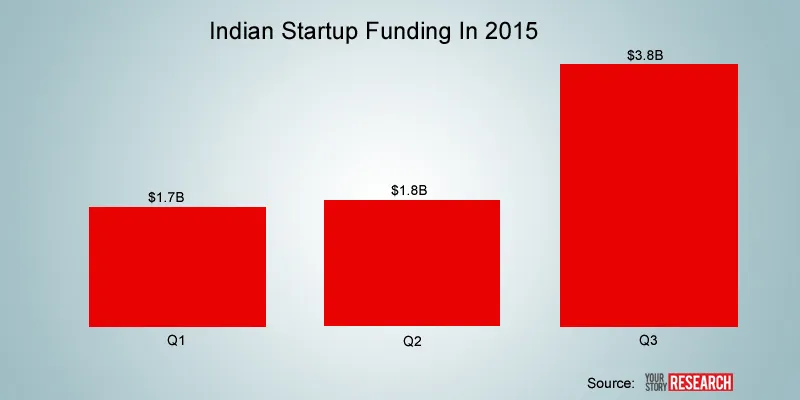

Funding amount has more than doubled

According to YourStory data, the 2015 Q3 funding has shown a growth of about 2x from that of Q1 and Q2. Crunching the numbers from 2014 Q4 also shows the growth is about 200 percent.

According to Rutvik Doshi, director at Inventus Capital, A couple of things are happening here. "An acceleration in number of investments started in Q4 2014 and it continues till date with a minor slowdown (but still higher than last year). The increased pace was largely due to three things: 1) Several VCs raised new and larger funds which led to faster deployment.

2) A lot of late stage capital suddenly became available which boosted early stage investor confidence and thus higher number of early stage deals.

3) The speed was further boosted by sudden explosion of hyperlocal and other mobile-led startups.”

Number of deals on the rise

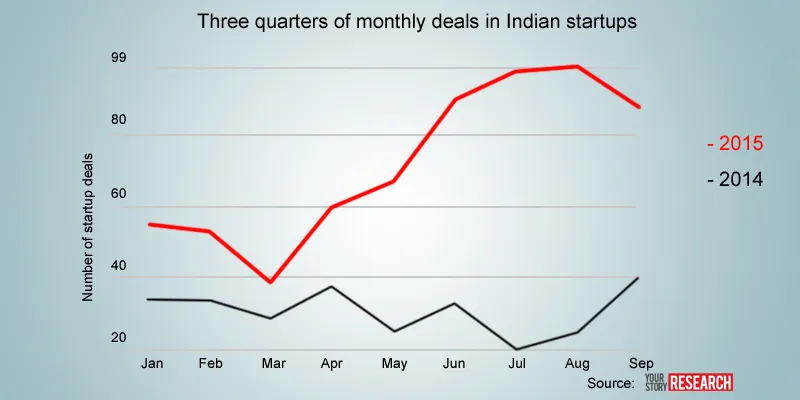

Let us look at the ecosystem through the lens of number of startups that are being funded, instead of the dollar value that is being invested.

The data shows the lowest number of deals in March 2015 was equivalent to the highest number of deals of September 2014. Comparing this year’s July and August with September, September has witnessed a minor dip in terms of number of deals. Rutvik adds, “The slight dip that we observe now is a natural slowdown after a sudden burst of activity early this year.”

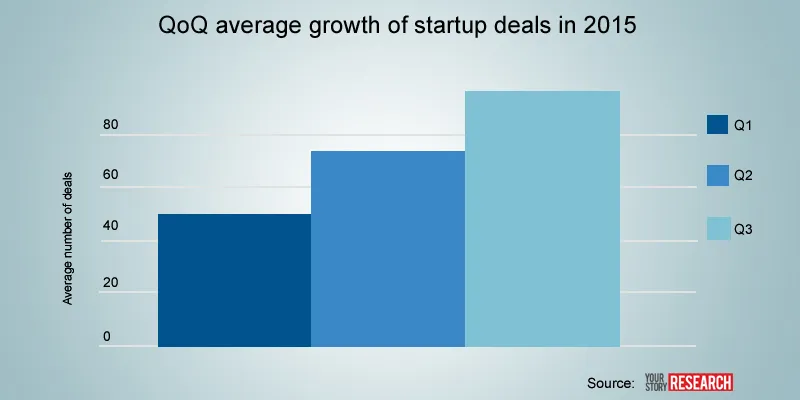

But the Quarter on Quarter average number of deals trend show significant upward growth.

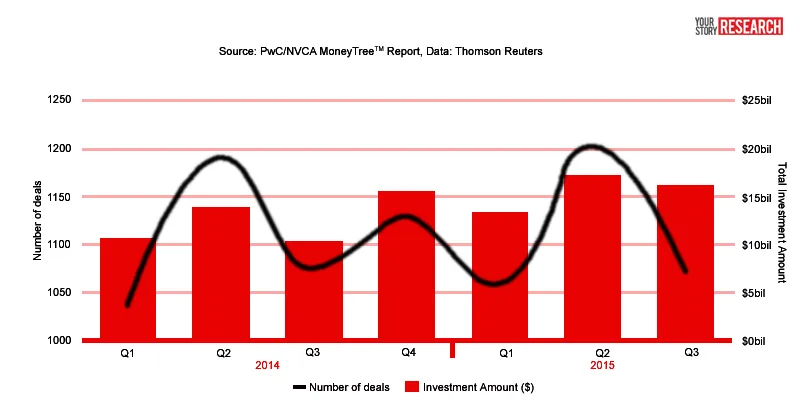

Is the number of startups being funded in India enough for the country’s ambition?

While the highest number of deals for a given month in India was 99, in the US there were 1200 deals in Q2 of 2015. According to PwC and National Venture Capital Association historical data, in Q3 2015 there was a dip in terms of the number of companies being funded in the US, though the invested dollar amount didn’t take that much hit.

And in the US, the amount invested in Q2 2015 was the highest since Q4 of 2000. Q3 2015 was down by 5 percent in terms of money poured in startups in early and late stage deals.

As software continue to eat the world, technology deals have become so hot that other traditional investors don’t want to sit it out and watch the action unfold from the sidlelines. Hedge funds, mutual funds, asset management, and family offices have all been actively participating in investment rounds. We continue to see the money people seek and compete for deals in upcoming hot startups.

On the 69th anniversary of independence, PM Narendra Modi urged the people of India to ‘Startup’ and ‘Stand up’. Now that startups are being championed as the saviors of the future of India, to the point our PM is attending startup summits and taking selfies with startup founders.

Do you think the number of startups that are being funded is low? Let us know your opinion in the comments.

Read: