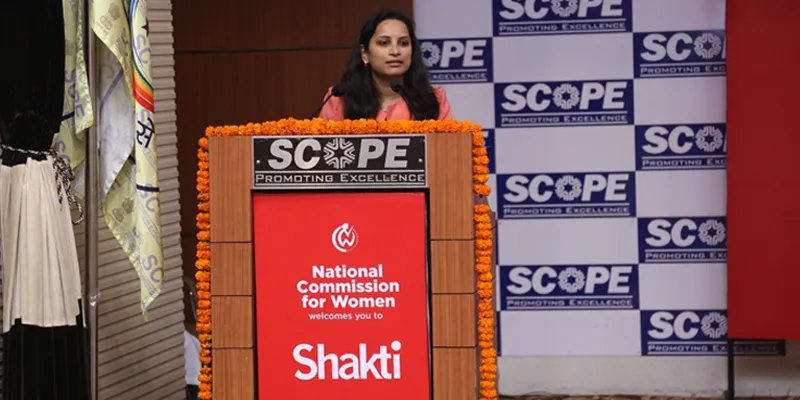

“Starting up is very easy,” says Nidhi Maheshwari, Chartered Accountant, KPMG, at Shakti, an event organised by the National Commission for Women in collaboration with YourStory.

For startups to be recognised under Startup India initiatives, they will be required to submit a simple application with any of the following documents

- A recommendation, with regard to innovative nature of business, in a format specified by the Department of Industrial Policy and Promotion (DIPP) from any incubator established in a post-graduate college in India.

- A letter of support by any incubator which is funded, in relation to the project, by the Government of India as part of any scheme to promote innovation.

- A recommendation with regard to innovative nature of business, in a format specified by the DIPP, from any incubator recognised by the central government.

- A letter of funding of not less than 20 per cent in equity by any Incubation Fund/Angel Fund/PE Fund/Accelerator/Angel Network duly registered with the Securities and Exchange Board of India that endorses innovative nature of the business.

- A letter of funding by the Government of India as part of any scheme to promote innovation.

- A patent filed and published in a Journal by the Indian Patent Office in areas affiliated with the nature of business being promoted.

Startups formed under any structure will have to obtain certain registrations and licenses, such as Permanent Account Number, Tax Deduction Account Number, Director Identification Number (in case of company), value added tax (state specific), central sales tax, service tax, profession tax, shop and establishment license (state specific), etc.

The recent Union Budget has also proposed tax incentives for fledgling companies. These include a tax holiday period for startups incorporated up to March 31, 2019, 100 per cent deduction of profits for three of five years, and continued application of minimum alternative tax. There is also capital gains exemption as well as other tax incentives for manufacturing companies set up and registered on or after March 31, 2016.

Key labour laws that will apply include The Employees Provident Fund and Miscellaneous Provisions Act, The Payment of Gratuity Act, The Employees State Insurance Act, The Contract Labour Act, etc.

Reforms proposed in the startup action plan pertain to scheme for women entrepreneurs and ST/SCs (two such projects per bank branch), compliance regime based on self-certification for labour and environmental laws, faster exits, relaxed norms for public procurement, and setup of Startup India Hub.