Valuation – The peak point for every startup

One of my friendsplanson starting his own venture and he is currentlyworking on developing his product. Recently, he approached me asking about valuation and how he needs to pitch to the investors to raise more money by giving up less equity.

This is an example of how entrepreneurs now a days first look at raising capital by making a significant valuation of their business. However, very few of them know how this valuation machinery operates.

An entrepreneur needs to understand that valuation is more of an art rather than a science. Raising investments will always depend upon how you pitch in front of the investors. The investment pitch may include market size, technology used, the core team members etc. But, it is not always good to raise funds. We must understand the concept of bootstrapping and investment raising. They both have their own ideology. As in certain ideas where scalability is a necessity without any revenue model; funds becomes an important and integral part.

Investors decide to invest in a startup based on the following criteria:

- Market size of the product

The first and most important thing is your product market size. Investors would always invest in a market where they would generate more liquidity of their investment. The market size is the biggest factor in deciding that whether your idea is achievable of the significant valuation percent of the whole market.

For example, the Indian E-commerce Industry is likely to be worth $38 billion by 2016.

- Percentage of market your idea is going to capture

The second thing that affects your incoming cash is the percentage of the whole pie your product is going to capture.

For example,

If the market size of your product is worth $5 billion and at the time of pitching you have captured five per centof the market share which will amounts to $ 0.25 billion (around 25 crores).

The five percent share of total market is actually the base for your current valuation. This five percent defines where you are, and your plans upon this will decide where you will reach and ultimately decides your valuation.

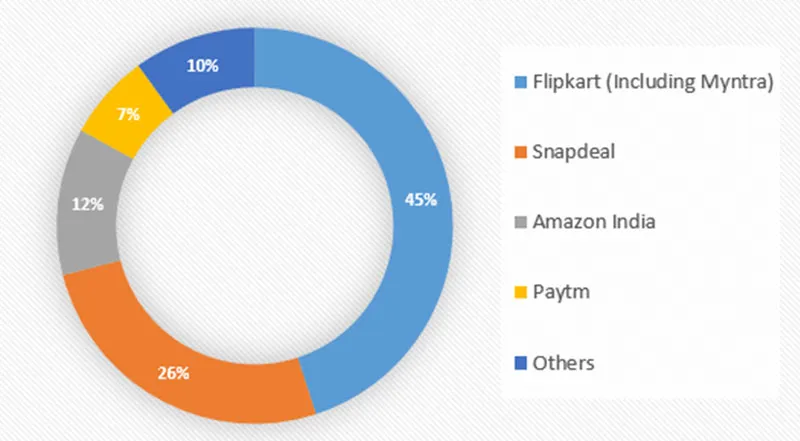

Let us see the Market share of E-commerce Industry in India last year as per the report issued by Morgan Stanley this year:

- Who is going to back you

It is always said that

“Behind every successful person there is someone” but regarding startup, this line can be modified slightly and can be said like “Behind every successful startup there is an investor”.This can be true or false depending how the startup works and which VC or Angel is going to back you. It is exactly how farmer grows their crops.If he knows the important thingss required for the crop to grow, then the crop will grow safe and healthy. The same case applies to startups and its investors.

Also, in case your product has established competitor in the market and he already has big investors, then the chances of raising funds will quite increase from other investors who does not have a product like yours in their portfolio.

How you value your startup

It always depends on the situation what you think your startup values.Moreover, we have seen in thestartup industry, the valuation goes high at certain points,these unwanted high valuations come down very fast after the passage of time.

You might have to accept the market valuation. Incaseyour receivables, turnover or liquidity are more than what an investor offers, then you need to accept the valuation based on the offerings.

Alternatively, tell the investors your valuation based on the principle concepts available, some of them are:

- Venture capital method (VCM)

- Discounted cash flow msethod

- Market comparables method

- Decision tree analysis

These methods can be used to find out the present value of the business with the help of experts, to give a solid base while pitching for investment.

Is it worthy to decide the valuation using one method?

It is not advisable to stop with one method. Most of the investors andentrepreneurs use different methods of valuation as every time you do not get the perfect results using a single method. Number of methods helps in the negotiation process as one can derive an average and come out at a solid figure.

Conclusion

The dream of a billion dollar valuation can become areality but it will depend on how you see towards your product. The approach of creativity, innovation with the right numbers will allow you to reach towards your destination.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)