GHV Accelerator launches Rs 350-cr fund for Indian startups

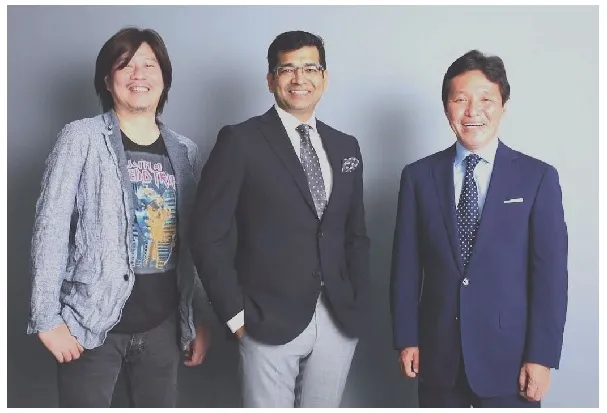

Gurgaon-based Green House Ventures (GHV) Accelerator, along with Japan-based World Innovation Labs (WiL), has roped in Makoto Takano, ex-President of PIMCO, a management firm, and industry veteran. He will join GHV as a board member. A Rs 350-crore fund for Indian startups has also been set up.

GHV had tied up with WiL in 2014 to avail business opportunities in the Japanese business ecosystem. WiL is a VC fund based out of Japan and Silicon Valley with $400 million, and typically invests $5-30 million in early as well as growth-stage technology and Internet startups through multiple rounds of investments, and will continue to follow the same investment pattern for GHV startups. Under its portfolio, WiL has startups like DoctorOnDemand, HMV, Mercari, Gumi, Raksul, GiGSky, HeroHonda, MyTaxiIndia and more.

“India, today, looks like what China was 10 years back and growth here will be much stronger in the next few years. We would like to fund a couple of companies from GHV if there is a strong connection to Silicon Valley or Japan. If we see benefits of cross-border mentorship and regular dialogue, the next step will be to set up a fund or facility, which we can jointly run to continue our relationship,” said Gen Isayama, Co-founder and CEO, WiL.

Makoto Takano is the Founder of MT Partners K.K, which focusses on extensive exposure in investing and management operation of ventures with future success potential. Presently, MT Partners assists 14 companies, including atomixmedia, where Makoto Takano serves as CEO. He is also the Editor-in- Chief of Forbes Japan and also serves as the Director of Nippon Finance Association, amongst others. He has an in-depth understanding of the startup world and is the Managing Director of Genuine Startups, which manages a VC fund (called the Genuine Fund).

After joining the board, he will mentor the Indian startups and will bring with him a vast and exclusive network of potential collaborations and partnerships between the Indo-Japan startup ecosystems. He will also help the startups in raising funds.

With the funds drying up in the Indian ecosystem and the battle getting harder everyday, this will be a welcome gesture in the startup ecosystem and will help give a fillip to early-stage startups.