Fintech in India is so fragmented that it could end up having very little impact

Indians enjoy their tea and coffee in corner shops. These tea shop entrepreneurs collect large amounts of small change that they deposit in banks on a daily basis. Everyone talks about fintech taking them digital; however, they fail to understand that current technologies like wallets are far too cumbersome for an entrepreneur to handle in a high volume environment like that of a small shop. Only a multi-solution play based on Aadhaar’s finger print identification which is linked to the settlement bank and the issuing bank would make things easy for both the consumer and the tea shop. Unfortunately, there is no systems-based approach in understanding consumer behaviour and the ethnography of the small entrepreneur to make fintech inclusive. Neither banks nor startups are looking at the solution this way.

The startup industry thinks fintech includes digital lending, payments, wallets and payment gateways. Most of these companies are staring at losses and revenues are less than Rs 6 crore. Watching these developments the banking industry knows that the fintech industry requires reorientation of their business processes and business models to go completely digital and make money in the process. Stitching together of the two ecosystems will remain a challenge until CEOs and CTOs see the value behind current technologies and the scale that new business models bring. This development remains in suspended animation.

A confusing journey

Despite this, everyone is bullish about fintech in India because of the growth of smartphones. Currently, smartphones are pegged at having sold close to 200 million units. Unfortunately, only 50 million Indians are digital natives. This is the foundation of the fintech revolution, based firmly on the growth of the consumer revolution. Herein also lies the reason to believe that all financial services (loans, deposits, insurance, investments and securities) will go digital in the coming decade. However, the prospects for the formation of a unified ecosystem are dismal.

Banks have their own vision of building digital branches, and they have outlined strategies to scale up to 100 digital branches across the country. While this is a good thing, it is undoubtedly destined to serve a small portion of digital Indians. Analysts predict that the Indian fintech system will be a hybrid ecosystem with digital and physical plays. The problem today is that banks themselves are yet to figure out the cost structures in a complete digital environment where the role of commission-eating intermediaries is diminished.

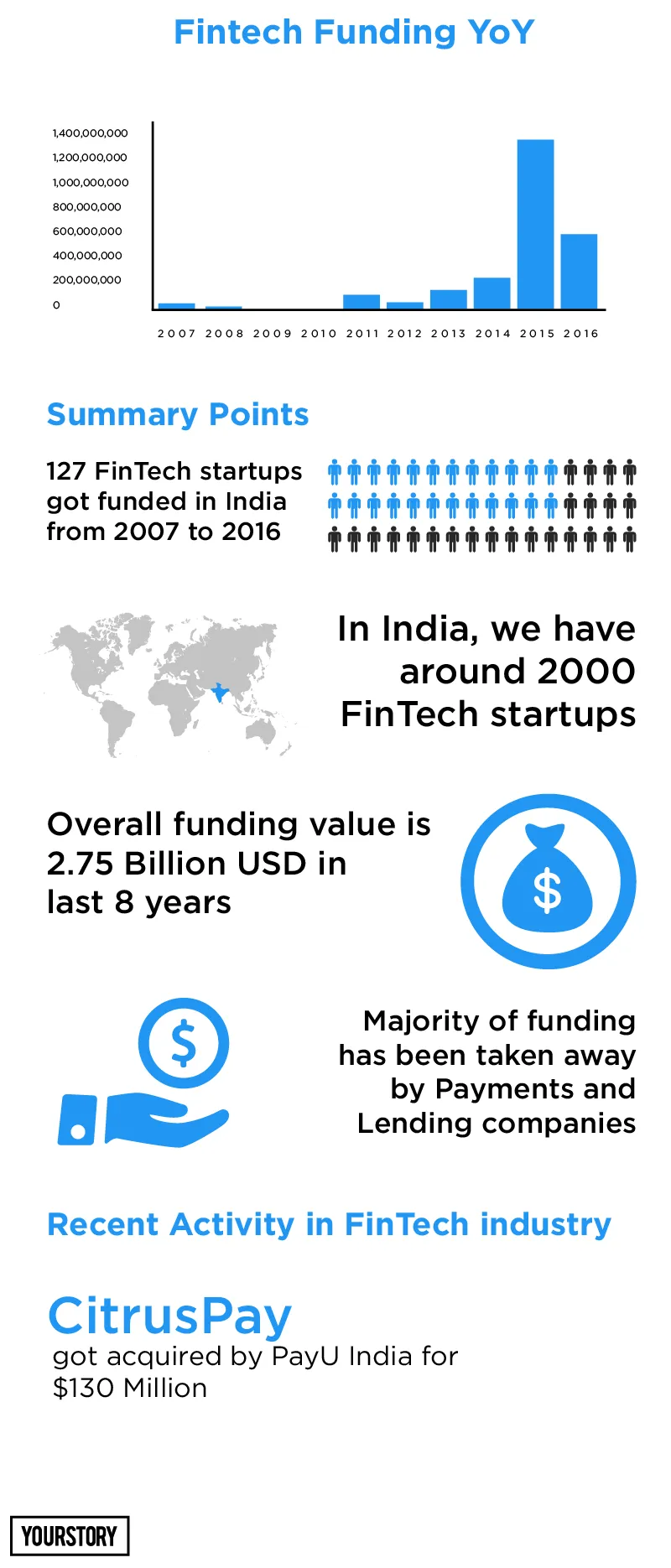

Today, the data looks promising. Data collected by the YourStory Research team shows that there are more than 2,000 fintech startups in the country, and since 2007, over $2.76 billion has been raised by this industry. The bulk of these funds have found their way to wallets and payment gateways, which have together netted close to $1.9 billion in investments so far.

“Compared to 18 months ago, I am seeing a lot more interest in fintech from the conventional firms, both from the banking and securities industries and the providers who serve them,” says Rajesh Kandasamy, Research Director, Banking and Securities, at Gartner Inc. He adds that banks and securities firms have launched funds to invest in startups and have forged partnerships with fintech accelerators. “But these have been experimental. In most cases, the assimilation of such technologies into banks has been sparse,” says Rajesh.

The money, however, is in lending platforms that can leverage technology and play a major role in financial inclusion by serving collateral free loans. According to PWC, India’s digital finance economy is only around $75-$100 billion, and it can only grow with easing regulations and the growth of digital-first lending companies.

The size and complexity of India makes the industry move at a snail’s pace in terms of evolution for a cardless and cashless economy. Banks are playing the wait and watch game; they are dabbling with solutions like the Unified Payment Interface (UPI), which uses biometric and iris identification (based on Aadhaar) to facilitate transactions. However, the UPI will take some time to develop because the banks have to settle the transaction cost between issuing and settlement banks. The whole dream of a “Cardless&Cashless” journey seems to be moving with baby steps.

“There is a reason why corporates slow down on investing in new technology. It is because they have to understand the foundation of this technology, which can disrupt their current business models,” says Srividya Kannan, founder of Avaali, a enterprise information management solutions company. She adds that corporates have to understand not just the technology, but the entire process of digital transformation of business. “This is a harder thing to do than implementing applications and saying one is going digital.”

While banks wait for the startup system to unfold and explode, there are those who do not want to wait for the big institutions to show the way. Here are the guys shaking up the industry.

Startups and India Stack

At least India Stack (includes Aadhaar, UPI, digital document storage and elocker), built by the iSpirit Foundation, has thought through the design of financial inclusion and digital payments. India is a large rural economy and direct cash transfers through Aadhaar have reached eight government departments and 43 districts. With money going straight into the bank accounts of beneficiaries, this development is very significant to the realm of fintech.

The India Stack team looks at the complexity of India as an opportunity and a challenge that needs a solution. The “stack” is open for startups to solve the complexity of financial payments and distribution (lending and collection) digitally.

“Innovation in India will come when there is a systems and design thinking approach. Innovation will not come from large organisations, but from the smaller companies creating platforms to connect real India digitally,” says Sharad Sharma, co-founder of iSpirit. India Stack APIs are open to startups to build solutions for the financial economy.

“Fintech is a very broad term. Retail payments are growing and consumer acceptance needs to gain traction. But it does need a push to gain mainstream acceptance across Indian states, and only a coordinated effort from banks, startups and governments can solve the issue,” says Sridhar Rao, co-founder and CEO of Novopay, which empowers digital payments and money transfers.

In eight years, digital lending platforms have raised around $324 million, and are poised to make an impact with the RBI easing lending norms. At this point of time, the RBI mandates a capital adequacy ratio of 10 percent (for tier-1 capital: common stock and reserves) for an NBFC with an asset size of Rs 500 crore. Any startup company lending digitally must work with an NBFC to give out loans or must have at least Rs 2 crore as net owned funds on the balance sheet to set up a lending platform.

“The RBI is yet to come out with regulations on digital lending. The industry is going to be disruptive and startups need to be given that push,” says Mohandas Pai, MD of Aarin Capital.

Here is why the Boston Consulting Group, in its recent report ‘Digital Payments 2020’, bets on the industry to hit $500 billion by 2020.

- Smartphone penetration will break the 500 million units sold per year barrier

- Merchant acceptance of payment solutions to grow tenfold from current levels. Currently, less than 100,000 merchants are using digital platforms.

- The industry will consolidate, with two or three consumer solutions being on customers’ minds.

- UPI would have achieved scale.

- Today, only 22 percent of the total consumer payments in the country are digital; pegged at $32 billion, this is expected to grow to $500 billion.

Serving loans to small businesses and consumers

There are 8 to 10 million small retailers and more than 50 million SMBs that require working capital loans. Companies like Cashe provide digital unsecured loans to applicants, with only a final verification piece as a non-digital component. “The concept of unsecured credit is big in western markets. There are so many small businesses and consumers that can use short term finance to change their daily lives,” says V Raman Kumar, founder of Cashe.

Today, Indian banks reach only around 30-40 percent of these small businesses. Companies like Capital Float, Zest Money and Faircent transfer money digitally to their consumers and can cover the digital native. There are over 52 Indian cities with a population of a million or more. The fintech market in these 52 cities, which have a combined population of close to 300 million, is currently less than $50 million. Digital lending has great potential and can scale up faster than payments.

Serving consumers and small business on payments

The payments industry claims to have reached more than 100 million consumers. But these numbers can be misleading given that those who are transacting can be very few. The e-commerce industry, which is estimated to be worth Rs 50,000 crore today, works on cash-on-delivery, which constitutes 80 percent of its transactions, and only Rs 15,000 crore are on digital platforms. Payment companies like PayTM and Mobikwik too are part of this ecosystem.

India is still far away from a cardless and cashless economy. Unless large scale unification with the banks, corporate institutions, academia and startups happens, the push towards a digital payments ecosystem will implode.