Flipkart, Amazon, Snapdeal leave no stone unturned for sellers this festive season

The festive season is around the corner. October-December makes up to 40-45 percent of total annual retail in India. Although online retail is only one percent of total retail in India, gigantic marketing has given the online marketplaces a visibility which few offline stores have. E-commerce majors are now evoking excitement among customers for the biggest sales of the year.

Flipkart, Amazon, Snapdeal and ShopClues are carrying their fight with each other for dominance in the market to the festive sales arena – armed with tens of thousands of sellers, millions of products, and vast logistics services.

The key stakeholders are sellers, who have had a tough year with the marketplaces. YourStory finds out how the sellers have been prepped, and where this journey would take them.

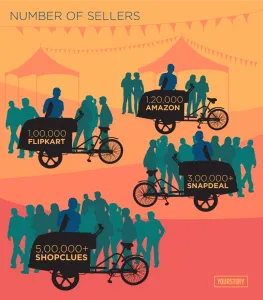

The more sellers the merrier

The strength of any marketplace is the wide variety of selection it can offer, which is decided by the number of sellers on the platform. Seattle-based Amazon, which has established itself strongly in the Indian market in the last three years, has grown its seller base to 200 percent over last year, gaining thrice the selection. Amazon claims that 20,000 new sellers have joined them in the past six weeks to benefit from the biggest shopping season.

With 80 million products, the Great Indian Festival - Tyohaar Bade Dilwala - from October 1 to 5 is Amazon’s biggest sale. Their biggest rival in India, Flipkart – which is launching the famous Big Billion Sales on October 2-6 ‑ claims to get about 3,000 new sellers every week.

Handholding the sellers

E-commerce marketplaces are keen on sellers from rural areas too, even those who are not tech savvy. Snapdeal’s seller facing team is working on ‘Joint Business Plans’ with more than 15,000 sellers across 120 towns. The plans enable sellers to tailor their inventory based on Snapdeal’s predictive analysis to avoid an out-of-stock situation. Snapdeal’s ‘Business Recommendation Engine’ provides information on top selling products, diversification ideas and sub-category level information for sellers.

Amazon has multiple initiatives in this regard too. ‘Amazon Tatkal’ is a studio-on-wheels and assists sellers with registration, imaging and cataloguing services. ‘Amazon Connect’ provides awareness on their services, upcoming innovations, and common issues in the fraternity. Amazon is also opening ‘Seller Cafes’ across 24 towns to offer on-ground help to sellers.

Manish Tiwary, VP of Category Management at Amazon India, explains: “Sellers can walk into the café, set up their Amazon seller accounts and receive basic guidance from trained resources for navigating their accounts and getting their queries resolved. Amazon will also provide the seller community in-person and local language support by an Amazon Trained Ecommerce Specialist (ATES) at the café.”

Financial servings

Most of the prominent online marketplaces provide financial assistance to their sellers through partnerships with banks and Non-bank financial companies (NBFCs). For instance, ShopClues’ Capital Wings - a financing platform for its vendors launched last year - will distribute loans worth Rs 200 crore to the merchants this year. Loans worth Rs 100 crore have already been disbursed to more than 1,200 merchants so far, the company has claimed in a statement.

Similarly, Flipkart launched Growth Capital initiative last year with loan value of Rs 5 lakh–Rs 1 crore for sellers. A spokesperson said that they have already disbursed over Rs 125 crore loans and are targeting to cross Rs 200 crore by the end of the festive season. “The sellers generally use the capital assistance in hiring more manpower, to add more listings to their portfolio, invest in warehousing and order management systems, etc.,” the spokesperson added. Flipkart is partnering with eight different financial institutions for providing loan facility.

Snapdeal has also lined up collateral free loans worth Rs 1,000 crore for its sellers to enable them to stock up for festive season sales. The loans would be disbursed through ‘Capital Assist’, which has partnered with 27 banks and NBFCs. Till now, Snapdeal claims, loans worth Rs 450 crore have been disbursed to more than 2,200 small and medium-sized enterprises.

Honouring the best of the lot

To congratulate the best performing sellers from the festive sales, marketplaces have a bunch of initiatives. Amazon’s Dhoom Machale is a contest to drive in-stock selection of products that are in high demand during the festive season. Their Sales ka Baadshah incentivises top 500 sellers in terms of sales.

The top reward is an all-expense paid trip to the Amazon headquarters at Seattle for top three sellers, picked from a lucky draw of the top 15 sellers.

Flipkart is not falling behind - ‘Flipstars’ recognises high-performing sellers across cities and categories based on their festive season performance. Sellers are evaluated on the highest number and value of units sold, as well as on providing the best service experience to customers on reliability and speed of delivery. Their spokesperson said that more than 2,000 sellers will be rewarded on their performance for the upcoming festive season.

Best performing 100 sellers at Flipkart will be given attractive prizes and incentives worth Rs 50 lakh. There are special awards for best performing women entrepreneurs and debutants. These sellers will be rewarded on a city and category level as well. The prizes include car, domestic and international holidays, and high-end smartphones.

Great expectations

The preparations for the festive sales began months ago. The newly-rebranded Snapdeal claims that in the past six months it has added over 45 new features on its seller panel to help listing, on-boarding, query resolution and reconciliation. “The new seller panel allows sellers to list new products in under an hour, especially in big sub-categories like personal electronics, home appliances, fashion, etc.,” says Saurabh Bansal, VP, Category Management, Snapdeal. Diwali last year recorded about 700 percent growth overall and 15x increase in traffic for Snapdeal. Their categories like furniture, home furnishing, and women ethnic wear had seen 17-20x growth.

Yet, there is a Grinch to steal the festive sales this year.

Indian customer is always wary of prices. In fact, lot of customers come online only for discounts, which are powered by the marketplaces burning cash. But recently, the Department of Industrial Policy and Promotion (DIPP) ruled against marketplaces giving steep discounts.

Usually, sales go up to 8x for most sellers during festive seasons. Electronics are generally the highest sold category in online sales, due to the cash burn which enables major discounts. Without discounts, online players are not fighting each other but against the offline sector – which constitutes 99 percent of Indian retail. Offline players also have promotional offers at the same time.

On the other hand, items which are facing offline shortage will be sold like hot cakes. For instance, Apple iPhone 7 cannot be sold online in black market as in the offline market. But for regular electronic items , customers will not get any discounts. Sellers do not own the brands. They cannot give discounts without hurting their margins. Brands seldom give discounts from minimum operating price (MOP).

Age of private labels

Despite all the preparations, sellers are sceptical. In fact, a vendor who sells on all major online marketplaces told YourStory: “Account managers from these marketplaces are giving projections to us. But we know that if they procure the stock listening to these numbers, we are going to be in a muddle. Nobody is stocking up like last year. We are expecting a maximum of 25-30 percent hike in electronics, unlike 200-300 percent as it used to be.”

According to this seller, Snapdeal, Amazon and Flipkart have asked sellers to invest heavily in product listings, ads, and content. But it is beneficial only to private label sellers. Electronics sellers can’t spend too much on advertising because of competition from other sellers. For private labels, it’s one single owner/seller.

It looks like this time only private labels are going to be benefitted. But Arvind Singhal, Chairman of Technopak consultancy, reminds that very few private labels are powerful right now. “Consumers are largely looking for branded merchandise. Private labels will become important in the future, but it can’t be done overnight,” he says.

According to All India Online Vendors Association (AIOVA) spokesperson, marketplaces have asked the private labels to give discount too. “Amazon even gives a shout out for that particular brand on their home page, Facebook page, and gives push notifications, etc.,” he said. The DIPP ruling had also stated that no one vendor should contribute more than 25 percent to the total sales. This effectively stops Flipkart’s WS Retail and Amazon’s Cloudtail from eating into the majority of sales – which sellers used to complain about.

Whether or not the disturbances and strategies will make an impact will be seen in the coming week. Despite all the shortcomings, sellers surely are looking forward to biggest shopping season of the year. Are you?