$3.5B poured into 815 deals in 9 months — an average of $13M invested per day in Indian startups

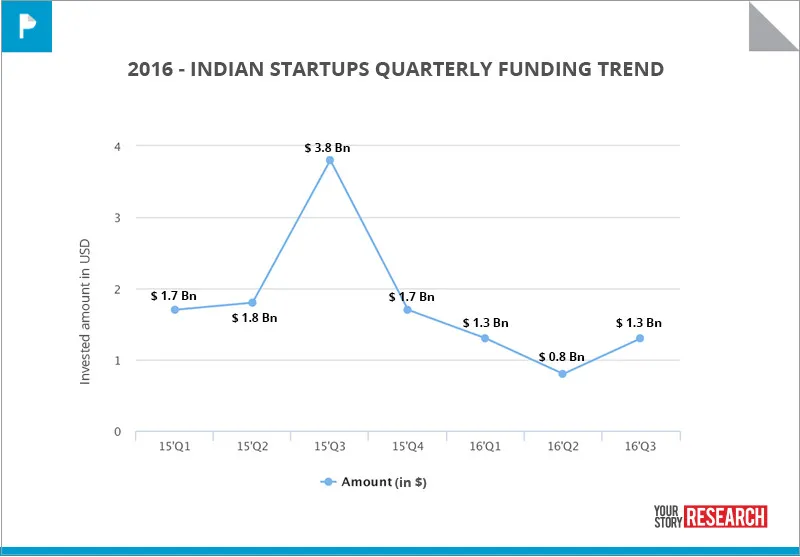

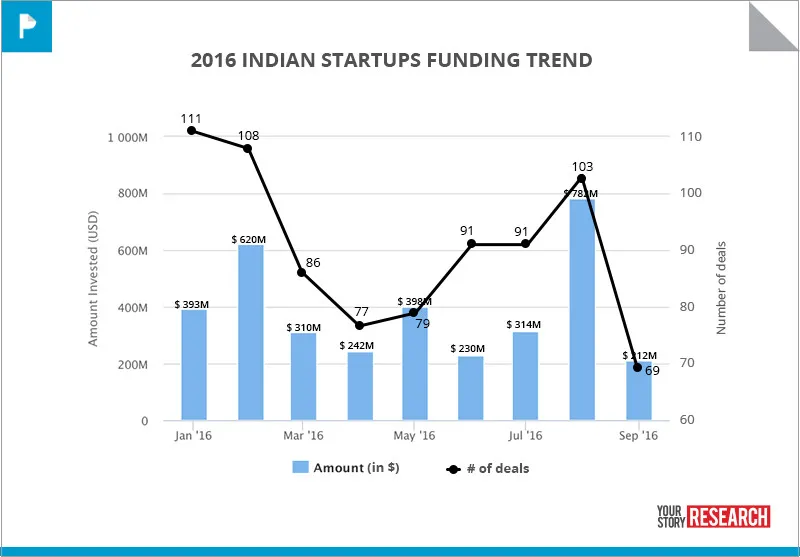

Indian startups saw $3.5 billion angel and venture capital invested across over 815 deals between Q1-Q3 2016, representing a major decrease in the total deal value from the same period last year. According to YourStory Research, between January and September last year, $7.3 billion was invested across 639 deals. This year, while the number of deals has increased by 27 percent, the deal value and ticket size have decreased. To put it in perspective, 2014 had just 300 VC and angel deals in the entire year.

Funding hasn’t dried, it just waned after last year’s exuberance. On an average, half a million dollars were invested every hour in Indian startups over the last nine months. Between Q1-Q3 2016, we saw average VC investment of $12.96 million every day. It was evident that there was investment appetite for sectors across the board.

Last year, the traction benchmarks for Series A companies had gone down while round size and valuations doubled. This year, the startup market has undergone a valuation correction. We saw startups cutting their burn rates and focusing on unit economics. FOMO-fuelled valuations have come down, and mutual funds and hedge funds have cut back their frenetic pace of investments in late stage companies. Pankaj Naik of Avendus Capital reflected on at the recently held TechSparks: “There are deals happening but at a slower pace. Investors are putting money where the unit economics is strong and the growth isn’t being hampered. There is a strong focus on capital efficiency and moats around the business.”

Funding stage focus

Early stage

In the whole of last year, 575 early stage deals (seed/angel) were announced with a total deal value of $578 million, whereas in the last three quarters of 2016 we’ve seen 571 early stage deals made with a total deal value of $223 million. Though a greater number of deals were announced in a shorter time frame this year, the dollar amount invested was lower by more than half.

The momentum at a pre-Series A level indicates that investors have lots of choices to pick from. However, just a few get to graduate to Series A level – what we at YourStory refer to as a ‘Series A bottleneck’. It’s the chasm few startups cross, as the availability of investor money is restricted to more adroit entrepreneurs.

Growth & late stage

Where scalability and unit economics are in place, follow-on funding is not an issue. Institutional investors are coming with bundles of cash to participate in C and D rounds. Around 31 Series C and Series D. But we don’t see a steady flow of growth capital, and it remains to be seen if the momentum of previous quarters is maintained.

Indian funds and family offices have been active this year compared to foreign hedge funds last year.

Edtech is in

In the last nine months, we have seen the investor community paying attention to e-commerce, marketplace and aggregation, followed by enterprise SaaS, fintech, healthcare and edtech. Foodtech and hyperlocal services have also seen their share of investment flow.

The edtech space has been one of the hottest. Test preparation, vocational, e-learning, admission & counselling, preschool and k-12 startups have received investor love over the past three quarters. Sequoia Capital and Sofina’s $75 million investment in Byju's classes, and the follow-on $50 million funding from the Chan Zuckerberg Initiative have been the highlight.

Well-capitalised Indian cities

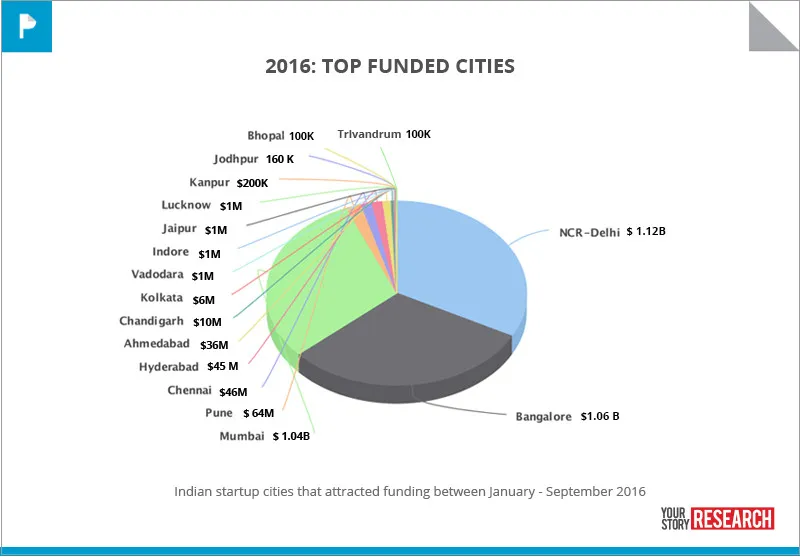

76.4 percent of startups that have raised funding in 2016 YTD are concentrated in Bengaluru, Mumbai and NCR-Delhi region.

NCR-Delhi, Bengaluru and Mumbai have also grabbed the lion’s share in the form of 92 percent of all the startup funding raised in the country. When it comes to deal value, the NCR-Delhi region has attracted $1.12 billion in funding, followed by Bengaluru’s $1.06 billion and Mumbai’s $1.04 billion.

Birth of more unicorns

The unicorn birth rate climb for the first time in three quarters. This year, ShopClues and Hike have joined the prestigious club named after the mythical creature. For the past three years, India has been giving birth to three unicorns every year –Inmobi, Snapdeal and Ola in 2014, and Paytm, Zomato and Quikr in 2015. This year, so far we’ve had two unicorns. Let’s see if any more are born in keeping with the tradition.

In January 2016, ShopClues raised funding from Singapore government's GIC and existing investors Tiger Global and Nexus Venture Partners. In August 2016, Hike announced a funding infusion led by Tencent and Foxconn, along with existing investors SoftBank, Bharti and Tiger Global.

Conclusion

So looking at the funding scene in India, the glass does seem both half full and half empty, based on whether you are comparing the data to 2015’s numbers or not. But if you look at 2014, the ecosystem has really performed well this year.