How did the ban on Rs 500 and Rs 1000 notes change the app and commerce usage?

Me: “Will you take Rs 500 note?”

Shopkeeper: “Only small currency please!”

Me: “How about a card for payment?”

Shopkeeper: “I do not have machine.”

Me: “Do you have mobile? Download the app!”

Shopkeeper: “I don’t have those expensive phones.”

*Shows an old Nokia phone*

History was written as the biggest financial change of independent India came into force on the midnight on November 9, 2016, with PM Narendra Modi demonitising Rs 500 and Rs 1,000 notes. The initial shock gradually warmed up to an applause for such a bold move by the government of India.

As per RBI in the press conference on November 9, there were 16.5 billion ‘Rs 500’ notes and 6.7 billion ‘Rs 1,000’ notes in circulation then. In total, both of these currencies account for a little above 80 percent of the circulation then. That’s massive!

How did it affect the local commerce and other self-employed folks?

Small shopkeepers, street vendors, labourers, maids, janitors, auto and traditional taxi drivers, artisans, rickshaw pullers ‑ most of these folks survive on their daily earnings in cash. A great percentage of them do not have bank accounts or identification proofs. A good share of them cannot read properly. Some of them had no idea about this massive change on November 9.

Although some of these are updated and aware of internet and its possibilities, most of them seem to live in oblivion. A small shopkeeper (selling golgappas and tikki) I spoke to, seemed to have no option but wait for his customers to have either the low denomination currency or the newly introduced ones. He had no credit/debit card machines or a smartphone to download the digital wallet apps.

And this is the capital city of India — New Delhi. It makes one wonder the situation with such folks in smaller towns of India. How would they be handling such a massive change?

“On hearing the news on November 8 evening, I immediately called the fruit vendor as I had to buy fruits in bulk on November 11 for a family celebration. I wanted to check if he would accept a cheque for this somehow or should I draw out cash from ATM while the limit was not active. Shockingly, he had no idea about the news and got extremely worried about his savings (cash at home).”

Surinder K.

Power of cash, no more

Indians for long have believed in the power of cash. Housewives and old folks in India are often heard advising about saving, but in cash or gold. It was touted to be one of the biggest reasons on how Indians survived the last world recession.

Most of this cash became worthless in a matter of couple of hours. Currency turned to waste paper and there was no looking back!

“I just got my kitty money that my mother had been investing in for years. All of it is in cash and I do not have a bank account. How do I save my money from going waste?”

Chhotu (domestic help).

The paradigm shift

Interestingly, this is one massive move that will bring about a mindset change ‑ a paradigm shift in the way we Indians transact our currency! For the first time in our adult life, we were depending on three overlooked sources to survive — smaller currency notes of Rs 100, Rs 50, and Rs 10, plastic money, and digital money.

Credit and debit cards seemed like our best bets. Digital wallets became the talk of every town and then some! Restaurants, grocery stores, cabs, retail stores — everyone was very warm and welcoming, only to the ones with plastic and digital money.

The state of digital platforms — e-commerce and mobile apps

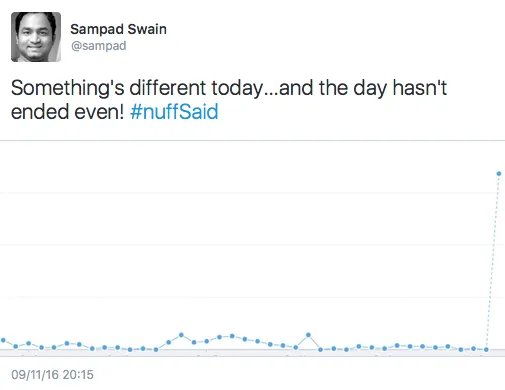

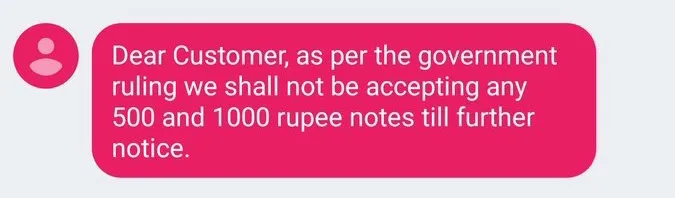

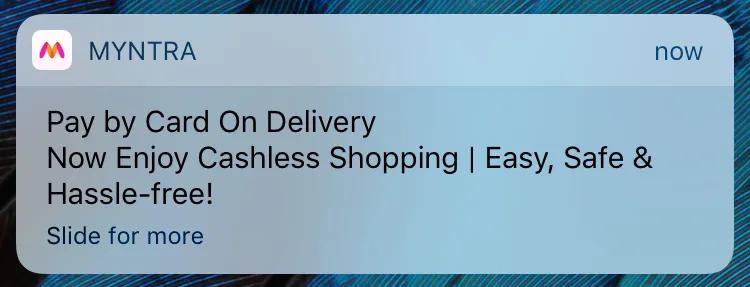

Cash on delivery (COD) orders with all e-commerce platforms in India were canceled, either by the platform or the consumer. COD return for a major e-commerce player was about 78 percent in Bengaluru on November 9. Digital payment transactions skyrocketed like never before.

Front page of newspapers and all quick marketing mediums, read digital media, were pasted with support aka self-promotions of digital money platforms. In parallel, these promotions started a string of accusations and blame-games!

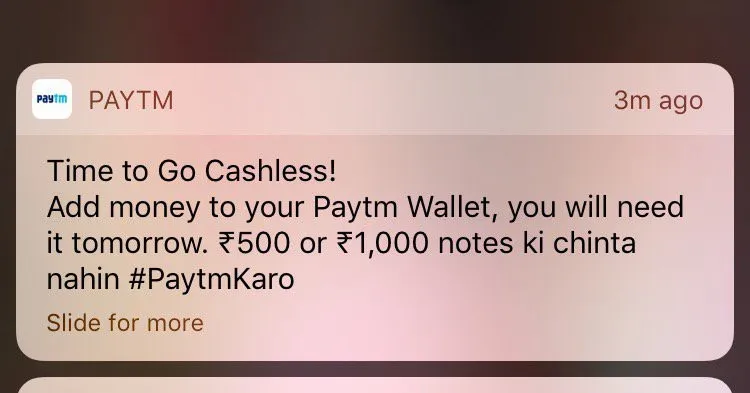

Notifications started pouring in through different apps, retailers, digital platforms to make the best use of cashless situation and claim their share of the pie. Innovative methods were introduced to help the situation such as Wallet on Delivery and Card on Delivery.

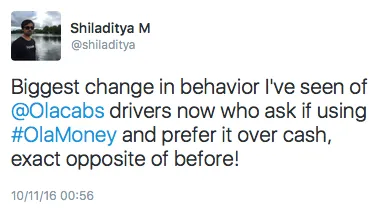

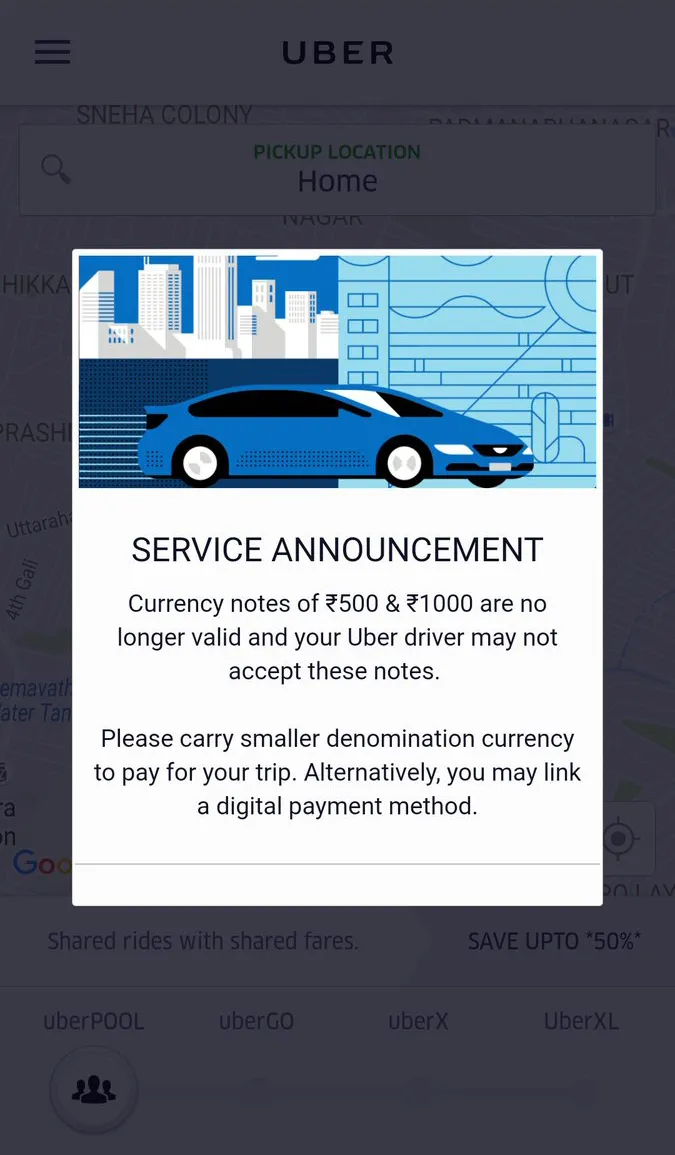

Cab drivers changed their strategies as well, only accepting customers with digital wallets. The companies had to follow suit and send out notifications.

How can digital platforms help?

Each of the small businesses (read street vendors, roadside stalls, etc.) are losing money by the hour. Even the customers without enough hard cash are vary of spending whatever lower denominations they are carrying around. They would rather pay through a credit card, debit card, or a digital wallet. In this situation, businesses have no option but to switch to plastic and digital methods of transactions.

Digital platforms can proactively start scouting for businesses who are not enrolled with digital or plastic payment systems already and help them sign up instantly. They should lower or remove the sign up friction, if any. They can also incentivise the customers who help the businesses in signing up. It is surely the best time to digitise the transactions and evangelism can really help the cause.

How would this shift affect the future of digital commerce?

It seems to bring a positive change. When and how deeply does it change our digital commerce habits, is something that seems to be making everyone in the ecosystem quite excited and curious.

I’d be observing the shift in pattern over the next few days and try to share the possible effect in a story quite soon. Nonetheless, it will be great to read and understand your thoughts on the future of digital commerce in India.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)