A year since launch, is Startup India yet to take off?

The supposed beneficiaries of Startup India have been left in limbo. A lack of clarity in the programme’s procedures, as well as mundane restrictions, has led to a good deal of disillusionment.

Dr Harmitsingh Sikh, Founder and CEO of FoodMemories, applied for the SIDBI fund through the Entrepreneurship Development Institute of India (EDII) in May this year. His application has been screened thrice in Ahmedabad, and all three times, he has received the answer: " 'The forms are with the commissioner's office.' I get the same answer every time I call them."

No one has the answer and this is happening across each state in the country. Unfortunately, Harmitsingh’s frustrating experience is matched by those of several other startup founders too. The Startup India policy is as bureaucratic as it gets because most startups that YourStory spoke to were in a similar predicament to that of Harmitsingh.

Nine months after the Startup Policy went live, there seems to be very little fruit in the tree that was supposed to usher in India’s startup revolution.

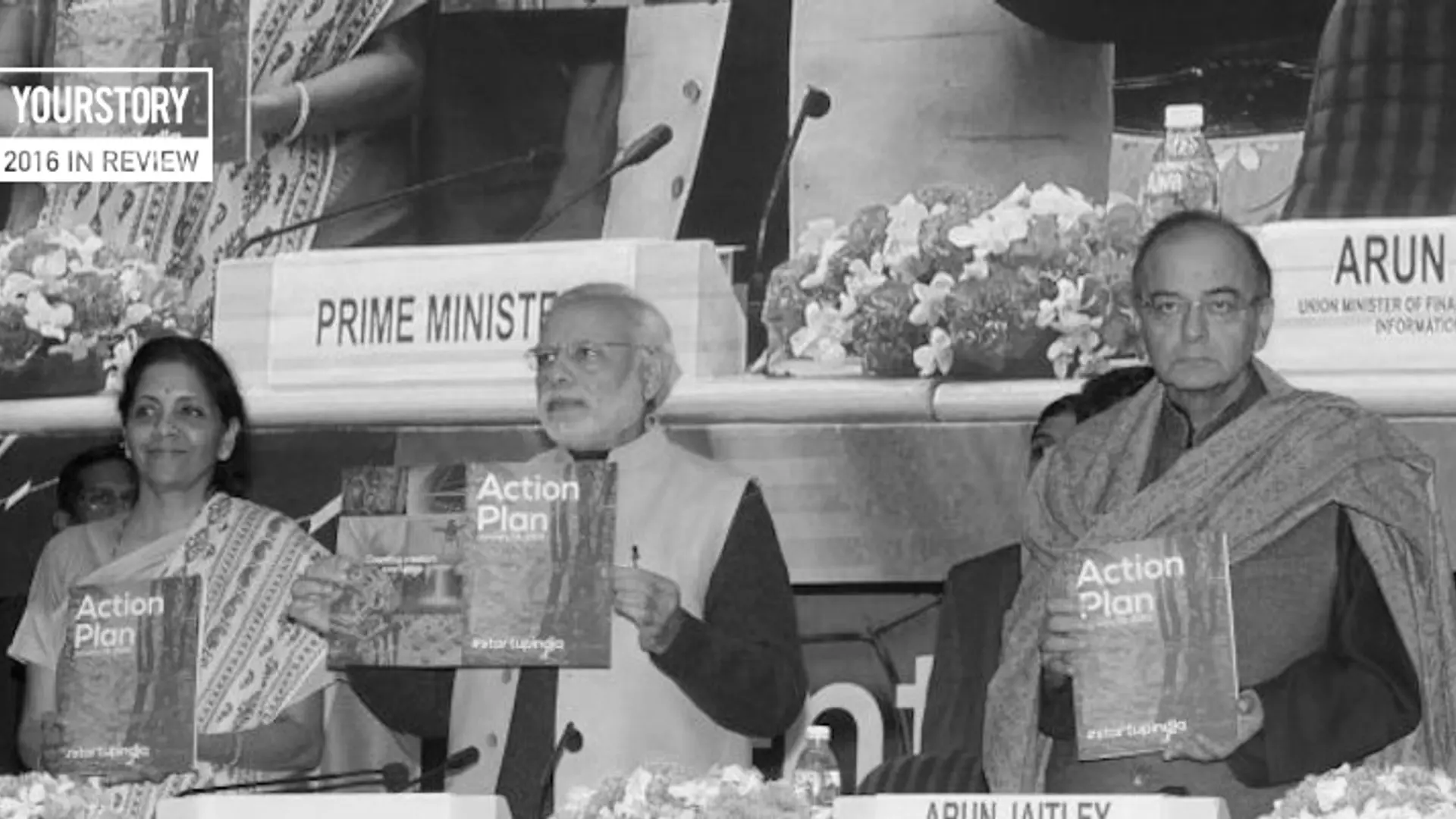

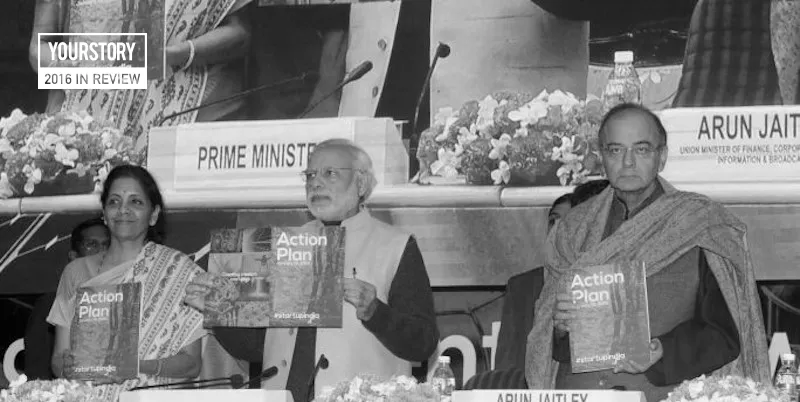

The Startup India Standup India was launched with much fanfare in January this year, with the Prime Minister releasing a startup policy to encourage entrepreneurship in India.

For a thorough understanding of the subject, one must sieve through 22 bureaucratic PDF notifications and notes to understand how Startup India works, and even after that, you cannot say for certain whether it really works at all. It is like a scene out of an Asterix comic book called the ‘12 Tasks of Asterix’, where the Roman bureaucracy asks Asterix to get a form signed and none of the bureaucrats know the signing authority. A startup would be well advised to hire a lawyer to get through these tedious rules and make it simpler for the founders to understand.

Empty measures?

In all, 23,000 queries regarding the policy were answered and 1,200 applications were received, of which only 428 had the relevant documentation.

The funny part is that only five startups have been approved under the policy for funding, after looking at 99 final applications in the early part of the year.

As on December 7, 2016, there were 497 startups recognised by the Startup India policy. Of this list, about 60 percent are healthcare, IT solutions, food processing, agritech, and biotechnology-related companies. There have been no criteria announced for the selection of these startups, and that is something that needs to be disclosed.

The only good thing is that foreign VCs can invest in 10 sectors without RBI approval, which includes sectors like infrastructure, IT, poultry tech, dairy products, and nanotechnology.

However, even infrastructure comes under the ambit of startups. It is always been a game for large conglomerates and there is an explanation in an RBI circular including the same. The DIPP says that this is allowed as per point No:3, sub-section B, of the circular released by the RBI titled Investment by a Foreign Venture Capital Investor (FVCI) registered under SEBI (FVCI) Regulations, 2000. It reads as follows:

Equity or equity linked instrument or debt instrument issued by an Indian ‘startup’ irrespective of the sector in which the startup is engaged. A startup will mean an entity (private limited company or a registered partnership firm or a limited liability partnership) incorporated or registered in India not prior to five years, with an annual turnover not exceeding INR 25 Crores in any preceding financial year, working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property and satisfying certain conditions given in the Regulations.

The Ministry of Electronics and Information Technology (MeitY), the Securities and Exchange Board of India (SEBI), and the Department of Industrial Policy and Promotion (DIPP) have made bureaucratic announcements and seem to have forgotten that very little action is happening on the ground.

The DIPP says in an email that till date 129 crores have been committed by SIDBI under Fund of Funds and it is to be disbursed to Startups only through AIFs. Those registered on and after April 1, 2016 are eligible for tax break for 3 years in a block of 5 years. And all Startups registered under Startup India initiative would be able to exit under the Insolvency and Bankruptcy code. They need not be even recognised by DIPP.

What, really, has happened?

SIDBI is also yet to disclose all the funds it is going to support. Today, only GVFL, Orios Venture Partners, Ideaspring Capital, Kae Capital, IFCI Venture Capital Fund's funds for SME advantage, and the Parampara Early Stage Opportunities Fund have received funding. And between these funds, only Rs 168 crore has been disbursed so far. There has been a proposal to put a further Rs 290 crore into two more funds.

While the Startup India policy is under the purview of the DIPP, it has a rival in the form of a fund set up by Canara Bank.

The CanBank fund, which is separate from the Rs 10,000 crore fund of funds of Startup India, is in limbo as well. The Centre launched this ‘fund-of-funds’ with an aim to help startups from the electronics and IT sector to create intellectual property, expressing a willingness to invest up to Rs 2,200 crore in the initiative. This fund, the Electronic Development Fund (EDF), floated by the Department of Electronics and Information Technology, will invest 20 percent of its fund in nano science research.

According to Ramesh Abhishek, Secretary, DIPP, the government could benefit from more learning. He says,

“There have been many benefits added to the policy. We are making some tweaks so that it makes it easier for startups. We have a long way to go. It has been a great learning experience even for the government. We ourselves had to understand a lot of things in regulations and law. Startups are the next big thing, and we want to engage with them.”

There has been no clarity

A source, on the condition of anonymity, says that the startup policy had no meat and was slow in selecting startups that could qualify under the policy. "It is unfortunate to see that startups recommended by funds and startup bodies are not making the cut at the DIPP," says the source.

Only those companies registering as a startup from April 1, 2016, will be eligible for a tax rebate of three years. They will enjoy the insolvency code, which is notified to allow founders to exit in the case of bankruptcy. They are also exempt from environment laws and don't have to pay a water cess. The government will also bear the startup’s IPR filing costs. "SIDBI is doing a wonderful job of working with VCs," says Naganand Dorasamy, Founder of IdeaSpring Capital.

Saurabh Srivasatava, Co-Founder, Indian Angel Network and Chairman Emeritus of TIE Delhi, says, “There are several funds that are going to work with SIDBI. We have given sanction to many funds, but they have to raise money from other parties before they can close the fund and start investing. With SIDBI, if fund investors invest money in startups in the early stage, they cannot participate in the next round as the startup grows. Herein lies the problem -- this restriction of not participating in the next round deters most investors from subscribing to Startup India's Fund of Funds programme. Investors do not like such restrictions.”

Apart from getting RBI approval for startups to raise external commercial borrowing, the setting up of seven research parks, 15 incubators, and 14 startup centres has yet to pick up pace.

"A lot of the groundwork has been done, and it is only next year that the policy can go into full action," says Sreedhar Prasad, Partner at KPMG.

RBI announcement for cross-border borrowing

The following regulatory changes for the easing of cross-border transactions, particularly relating to the operations of the startup enterprises, are proposed to be made, in consultation with the Government of India.

- Enabling startup enterprises, irrespective of the sector in which they are engaged, to receive foreign venture capital investment and also explicitly enabling the transfer of shares from foreign venture capital investors to other residents or non-residents;

- Permitting, in case of transfer of ownership of a startup enterprise, receipt of the consideration amount on a deferred basis as also enabling escrow arrangement or indemnity arrangement up to a period of 18 months;

- Enabling the online submission of A2 forms for outward remittances on the basis of the form alone or with document(s) upload/submission, depending on the nature of remittance; and

- Simplifying the process for dealing with delayed reporting of Foreign Direct

- Investment (FDI)-related transactions by building a penalty structure into the regulations itself.

- The notifications/circulars under the Foreign Exchange Management Act (FEMA), wherever necessary, will be issued shortly. In addition, the following proposals are under consideration, in consultation with the Government of India.

- Permitting startup enterprises to access rupee loans under External Commercial Borrowing (ECB) framework with relaxations in respect of eligible lenders, etc;

- Issuance of innovative FDI instruments like convertible notes by startup enterprises; and

- Streamlining of overseas investment operations for startup enterprises.

Please do let YourStory know if you have applied for Startup India, and what is happening with your application. Hopefully, the year 2017 will bring positive updates on this front.

(With inputs from Sindhu Kashyap and Aprajitha Choudhury)