The domino effect Ola, Flipkart and Snapdeal’s devaluation will have on the Indian startup ecosystem

From devaluations to firings, the past couple of months have been a roller-coaster for the blue-eyed boys of the Indian startup ecosystem. But then, if the poster children are finding the going tough, what is in store for the startup ecosystem at large?

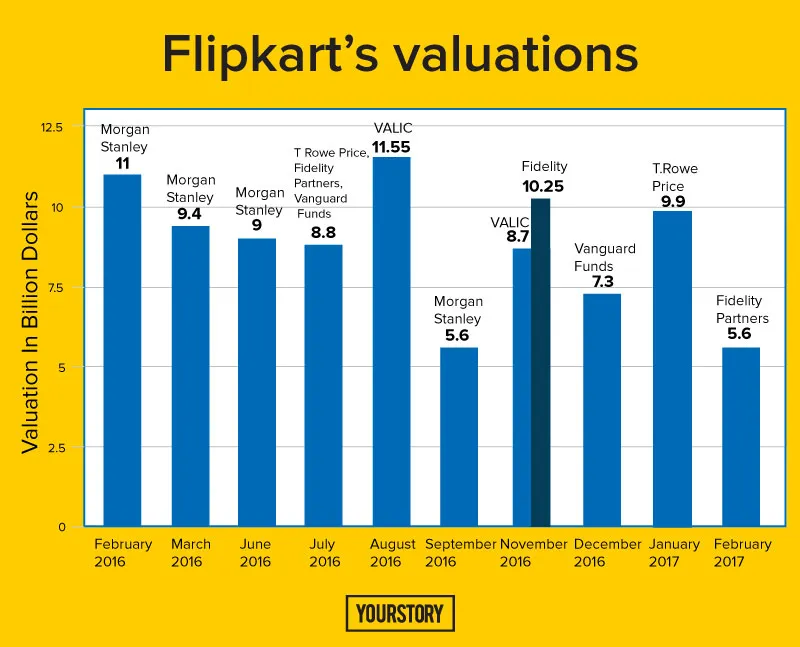

“So, what is Flipkart currently valued at?” asked a colleague nonchalantly. While it sounds flippant, we cannot ignore the fact that in the past few months, the unicorns have been in a valuation wringer, which has had numbers moving up and down like a yo-yo.

Flipkart, the poster child of the Indian startup ecosystem, was devalued for the seventh time in a year, this time by Fidelity Partners. At a $5.56 billion valuation, Flipkart’s shares were valued at $52.13 in November 2016, down by 36.1 percent from $81.55 per share as of August 2016. This was followed by the next domino – the cab aggregator Ola.

Last week, the US-based investment firm Vanguard World Fund marked down Ola by over 40 percent. According to their regulatory filing with the US Securities and Exchange Commission, the current valuation for Ola is now $3 billion, with its shares dropping from $311.27 per share in the previous quarter to $182.70 apiece. During their peak, Ola had raised $500 million at a valuation of $5 billion.

And it doesn’t stop there! Flipkart’s rival Snapdeal is reportedly looking at raising funds at a lower valuation of $4 billion. When they raised $200 million in early 2016, they were valued at $6.5 billion.

It is understood that valuations are normally decided according to a company’s market share, its gross margins, and its rate of growth, among other factors.

Valuations and devaluations are part of the game. They are a mix of market environment, risk appetite, a fund manager’s biases, hot new trends, fear of missing out, the multiples comparable companies are commanding, and of course, expected cash flows and margins. But your valuation does not decide your success. It is just what the investors think the company will be worth if it does as well as they expect it to do.

What will really impact the market is when the likes of Flipkart, Snapdeal and Ola have to accept money at lower valuations.

When unicorns fall from their glorious multi-billion valuations, is the rest of the startup ecosystem shaken up too? A thorough observation of the industry has shown that the devaluations of Ola and Flipkart have set off a domino effect.

Parag Dhol, Managing Director at Inventus Advisors, says,

"For a fund to mark down a company's value, it has to seriously believe that the value of the company is lower than what it was originally marked at. Flipkart and Ola need to raise money in the next six to 12 months. But if they do so at the current valuations, the impact will be seen all across the board for startup deals."

In 2015, we lauded the entry of Flipkart, Ola and Snapdeal in the Unicorn club. Flipkart till its last round of $700 million had raised a whopping $3.2 billion. Snapdeal on the other hand had raised a total of $1.5 billion in 10 rounds from 19 investors. Ola had raised $400 million, the total amount of funding pumped into Ola was $1.7 billion. The first quarter of 2015 saw over $1.7 billion funding in startups.

They instantly became the startup ecosystem’s poster boys and flag bearers. No event and award function was complete without the presence of the unicorns. While there were murmurs of profitability and unit economics, nothing hit a harder turn when in middle 2016 the world dynamics shifted.

Funding started slowing down, news of firing rounds and internal rife began to cloud the startup world. Soon the number of valuation started to seem bloated and over hyped. Murmurs turned to warcry and soon questions never before asked were being asked.

The number can build or destroy a company’s image – but is it just that?

Tightening their purses

There are several dynamics that are a part of markdowns, valuations and devaluations. Looking back at 2015, it was possibly one of the most over-funded years for the Indian startup ecosystem. After China, India was the next big market waiting to be tapped. Foreign investors saw similarities in the demographies and rooted for the ecosystem. It was a no-brainer for many investors to dump and pump money into startups in India.

“Private market valuations are not the best form of price discovery. As most economic cycles are smaller than how long it takes for businesses to actually deliver exits,” says Kabeer Biswas, Co-founder and CEO of dunzo, who had earlier started Hoppr in 2012.

But what started happening was far from what was visualised. The success rates and growth stats that investors expected just weren’t being seen from the startups. This in turn made investors apprehensive of putting in more money, especially for the short-term.

There is no denying that devaluations make investors sceptical of pouring in more money. When the top names falter, investors tend to be cynical about the startup ecosystem in general. This lull has in fact been visible since the middle of last year.

According to Haresh Chawla, partner at True North Private Equity Funds, most of these internet companies are valued at 0.8-1.2x of GMV. Flipkart, he adds, had announced that they would deliver a GMV of $10 billion, and, on that expectation, investors gave it a 1.5x multiple, valuing it at $15 billion. “But the company fell drastically short of its GMV target. The actual figure was only about $4 billion,” Haresh says.

Growing wary of Indian startups

With the bigger funds pausing in deploying new money and looking at their own portfolio companies, the newer age consumer-oriented fast-growing companies were in for a shock. There were no new investors, and the otherwise natural acquirers, like large corporates and global firms were not acquiring at all, or were buying ventures at throwaway prices. This shook up the consumer sector even more.

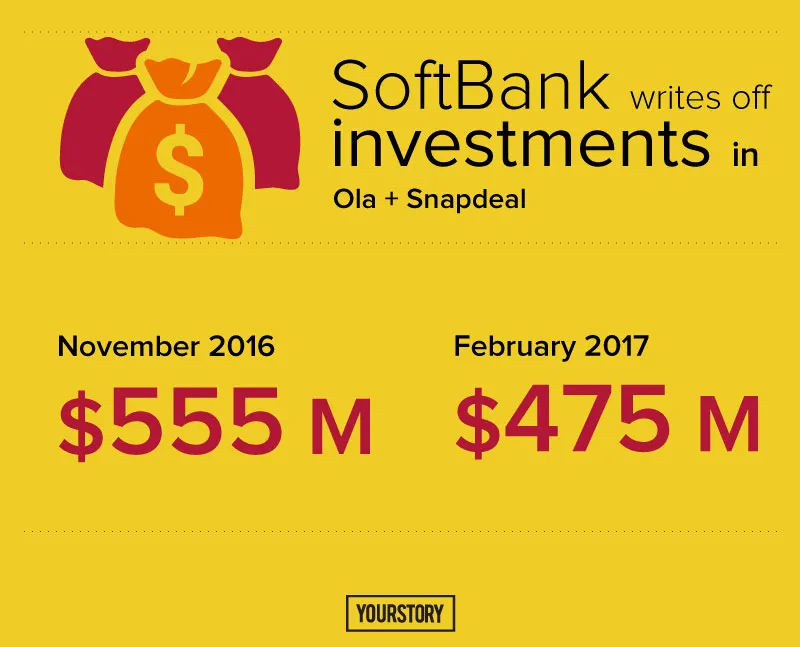

Karthik B. Reddy, Managing Partner at Blume Ventures, says, “The big guys decided to take a pause, and the domino effect started from there. The Softbanks and the Tigers of the world wanted to assess where their positions were. It isn’t about just making investments; it is about seeing where the risk is concentrated.”

However, there is no denying that this brings sanity into the system. Several industry experts believe the markdowns are just a move towards correction. Most of the valuations were beefed up and needed to be corrected. This provides some much needed sanity to the industry.

It in fact is part of the cycle, which isn’t unique to Indian startups. A report by KPMG international and CB insights has stated that last year a larger number of startups in the Valley were taking lower valuations. The billion-dollar badge wasn’t that openly distributed.

A media report quoted the insights and stated that only five venture capital backed companies entered the billion dollar valuation club. This was less than half the number from any quarter in 2015.

CB insights also showed that there were over 19 events where companies raising new money or being acquired were at a lower valuation. These included big names like Gilt, Jawbone and Foursquare.

The right path

Satish Meena, forecast analyst at Forrester Research, says,

“These gigantic valuations are not logical. These unicorns have been hugely funded. This increases the price for hiring good talent too; their annual salaries are often in eight digits or above. These companies also spend a lot more on marketing than required.”

What devaluations do is pass a signal around. While the fundamentals of valuations don’t necessarily change, Sahil Kini, Principal, Aspada Ventures, says,

“Valuations are made keeping growth expectations in mind. A lot of investments made in 2015 had irrational exuberance. I think it will bring down valuation expectations across the board." Series A rounds, which were at $15 million, are now at $3-5 million. Now, Series B and C rounds are much harder to raise, and Sahil believes that that is how it should be.

Kabeer adds that all startups today are focussed on building valuable consumer experiences and in turn build value for the team members and investors. What valuations, he says impacts is the team morale. “Focusing on user experience, every moment of the day and building a rocket ship, should make everyone valuable at the end of the day,” says Kabeer.

Despite this, however, investor and marketer Mahesh Murthy says that these steep valuation markdowns are healthy for the Indian startup ecosystem from a long-term point of view. According to him, valuations have come down to reasonable levels again.

“We’re now seeing a return to sanity, with much lower, more honest salaries being the norm, and smaller, more milestone-defined investments in fundamentally more different ideas,” he says.

Building again

On the whole, markups and markdowns are part of the market dynamics. They are also subjective, and are complicated by incomplete information and over-optimistic or over-pessimistic expectations. Till date, the total investment in Flipkart has been up to $3.4 billion.

As long as the valuation doesn’t drop below that level, early investors would be protected. And it seems most of the key shareholders ( read promoters and early investos ) would have made some money. Of the early stage investors seeing decent exits, Accel has seen in the case of TaxiForSure and Myntra.

Haresh believes that liquidation preferences protect early investors from any value destruction that may arise. “But the wait for exits will be long. However, this protection may not be available to investors who may have entered secondary deals with founders or very early-stage investors at the higher valuations,” he adds.

News has been doing the rounds since late last year that Ola is looking to raise $300 million in funding. There were different speculative news reports where Ola was believed to have raised some funding from Softbank, but the deal is believed to have not gone through.

The next three months are crucial with regard to raising money for Flipkart as well. According to sources, the Flipkart Group now has 15-16 months’ cash left to run with. Flipkart is burning through Rs 6.3 crore a day, although they are now reportedly trying to cut their monthly expenditure by half – to $30 million – as they looks to raise about $500-800 million.

But Flipkart’s valuation has mainly been dependent on GMV. Satish says,

“They are buying sales with dollars, for unachievable targets of GMV, instead of growing organically. Earlier, TinyOwl had tried to scale very aggressively – but it’s not possible to grow in our market unless it’s organic.”

Time to assess

Flipkart and Ola are benchmarks, and have created category leadership in Indian market), – their valuations reflect on others. Other startups also go through the same tough phase.

We spoke to some of the companies that have raised Series A and are looking at the next round and are facing tough time to get money - questions are more, due diligence is more stringent. Bala Deshpande, Senior Managing Director, NEA India at an INK conference said that an investor wants high growth sectors to show in their portfolio. What confuses the whole issue is the different time frames and context to fundraising.

“There are times when investors chased you with term sheets, but the same VCs disappeared later. In our lingo, we have something called FOMO. That is the fear of missing out. There is also something called JOMO that is the joy of missing out, which is operating right now. ‘Yeaaah, I do not have an e-commerce in my portfolio,” she added.

But such a ‘correction’ can bring about a major transformation as far as investments are concerned.

According to Mahesh Murthy, there are “fly-by-night investors” and long-term investors. In an interview with VCCircle, he had said, “For the former, the fall in valuation of topi companies [which fool others] is just a thoughtless bet gone bad, and they might either re-consider their approach to investing and India or move to the next topi target somewhere else. But long-term investors will be encouraged by the prospect of a fundamentally strong digital-driven economy and investing in differentiated and defensible startups at reasonable prices, and growing them over time in a sound and sustainable manner.”

If devaluations are indeed a sign of the sanitising of the startup ecosystem and an economy fuelled by estimates and predictions rather than solid figures, this trend will continue, and we can expect to see more shutdowns and devaluations in 2017.

“I will just say this that as an entrepreneur, stick to building intrinsic value. Valuations is just a price that the market decides to pay or not. Stay on course and stay invested in your company. There’s a pot of gold at the end of it,” said Bala.