As ‘cloud wars’ grow fiercer, who will rule the Indian market — AWS, Azure, or a wildcard?

While the cloud wars have so far been fought with elements like storage capacity and customer service, a modern war powered by 'heavy artillery' like AI and deep integrations seem to be on the horizon for 2017.

"The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them. If you do what has never been done and you can do it better than anybody else, you have a monopoly….” notes Peter Thiel, acclaimed Silicon Valley investor and Partner at Founder’s Fund, in his book, Zero to One.

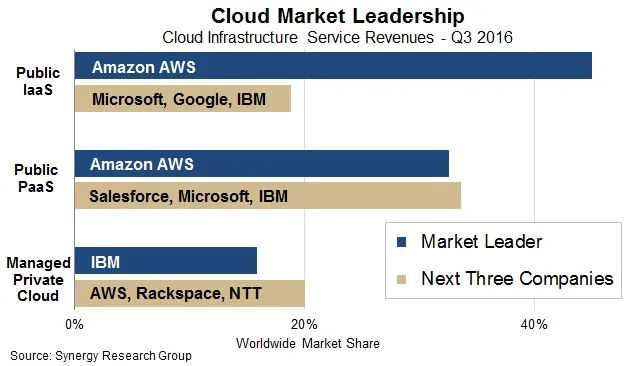

Since its inception in 2006, Amazon Web Services (AWS) has long held a monopoly in the cloud services market. According to a October 2016 report from Synergy Research Group, AWS had a 45 percent share of the public cloud infrastructure-as-a-service (IaaS) market — more than Microsoft, Google, and IBM combined for Q3 2016 — despite Microsoft and Google having much higher growth rates. Competition was tougher in the public platform-as-a-service (PaaS) market but AWS had a lead over Salesforce, Microsoft, and IBM.

Synergy Research also notes that while public IaaS is the biggest of the three main cloud segments, public PaaS is growing much more strongly. The database, IoT, and analytics sub-segments within PaaS are all growing by 100 percent or more per year. And these two segments are where the battle lines for ‘Cloud Wars 2017’ seem to be drawn in India. While AWS has a strong presence among startups in India, Microsoft Azure seems to have a strong network of enterprise clients and has also recently signed an exclusive partnership with Flipkart, SBI, and some Indian state governments.

But the cloud wars are evolving. It is no more just about customer service and storage capacity but about innovation and leveraging multidisciplinary technologies like AI and Aadhaar in the cloud. YourStory reached out to the Indian arms of both tech giants for this story. Here is an overview of the situation.

India in the crosshairs

At an Amazon event in Bengaluru in July 2016, Andy Jassy, CEO of AWS, had noted that AWS had the first-mover advantage in the cloud services space, while others, slow to see the potential, were now playing catch-up. He had said,

There is no compression algorithm for experience. You can’t learn certain lessons without going through the curve.

He had also mentioned that force fitting a product to meet certain consumer needs doesn’t work in most cases. One can give consumers a list of best practices, but they will still use it the way they want.

Talking about India, Jassy had observed that Amazon was seeing a great adoption of cloud services from both startups and large enterprises out of India. Citing multiple examples, he claimed that 89 percent of the top 100 Indian startups use AWS. He was also impressed with the scale and dynamic nature of the ecosystem.

During his recent visit to India in February 2017, Satya Nadella, CEO of Microsoft, announced that Flipkart had signed a partnership, according to which the e-commerce player would adopt Microsoft Azure as its exclusive public cloud platform. Nadella had also noted that the centre of entrepreneurial energy for Microsoft is all around the cloud. Having interacted with many startups and having seen more than 2,000 of them leverage Microsoft’s cloud services, he found the entrepreneurial energy to be remarkable.

Microsoft seems to be on the offensive and upping its game to give AWS a tough fight by leveraging its own multidisciplinary strengths.

Microsoft’s macro focus: leveraging AI, ML in the cloud

In a response to questions from YourStory, Narendra Bhandari, General Manager of Developer Experience and Evangelism, Microsoft India, said that in the last 12 months, more than 2,000 Indian startups had signed up on Microsoft cloud and their usage of Microsoft’s advanced cloud services had also increased by 150 percent. He said,

A significant number of these startups are driving innovation using Microsoft’s advanced cloud services in areas such as big data, IoT, advanced analytics, and cognitive services. They are also using Microsoft’s bot framework to create chat bots and AI-powered products and services.

Talking about Microsoft’s open source push, Narendra noted that currently, about one-third of Microsoft’s virtual machines run open source solutions on Microsoft’s Azure cloud platform. Using Microsoft’s Cloud infrastructure, startups have created a range of IT solutions for retail, e-commerce, banking, logistics, energy, healthcare, and FMCG organisations. He remarked,

These solutions work in areas such as human resources development, customer engagement, communication and collaboration, medical diagnosis, and predicative analytics, among others.

Microsoft also seeks to actively support the open source community and is a leading open source contributor on GitHub. Narendra said, “The Microsoft Cloud can open new possibilities in e-governance, financial inclusion, healthcare, and education, positively impacting the lives of a billion people, being committed to making Digital India a reality.

The elephants in the room: Aadhaar and security

At their event, Future Decoded, Microsoft announced two offerings enabled by Aadhaar — Skype Lite and Project Sangam. Microsoft aims to bring Aadhaar integration into Skype Lite by June 2017. The second platform, Project Sangam, aims to connect the skills learning programmes directly with relevant jobs by leveraging LinkedIn’s job-search platform. Project Sangam will allow users to register with their Aadhaar identity to ensure lifelong access to the platform.

At an earlier event in Bengaluru, Nadella had hinted at the possibility of how Aadhaar-enabled logins could make signing up on Microsoft’s services like Office 365 faster. YourStory asked the Azure team to comment on this and if the Aadhaar integration may be available to other smaller customers in the future. Narendra noted, “We have nothing further to share around this yet and will keep you updated.”

Azure also claims to provide the development platform, security, analytics, and scalability that startups need to build and grow their businesses. Narendra commented,

As Microsoft, we support startups and complement their strengths in innumerable ways including mentorship and technology — driving 5X growth in customers — from 20 to 100 in just a year. We have comprehensive compliance coverage where security and privacy are embedded into the development of Azure.

For instance, Yellow Messenger leveraged Microsoft’s cloud for AI and natural language processing (NLP) capabilities to build an AI-based chat bot for e-commerce that helps users in making shopping decisions across multiple brands. Microsoft also claims to be the only company building a hyper-scale public cloud while also meeting customer needs for private cloud and hybrid solutions.

Inside AWS’s intricate web

While YourStory reached out to AWS for inputs for this story, their representatives were unable to get back to us till the time of filing this story. So, YourStory has looked at AWS’s India-specific moves based on publicly available resources and tried to understand the situation.

Much before Azure and Flipkart announced their cloud partnership, AWS and Infosys had forged an alliance in April 2016 to make it easier and faster for legacy players to transition to the cloud. As a part of the deal, Infosys and AWS would enable clients to move enterprise workloads including mainframe and enterprise resource planning (ERP) to the AWS Cloud. Infosys will also leverage AWS’s offerings around analytics to provide actionable insights and enable enterprises to gain competitive advantage in their industries.

As part of this collaboration, Infosys created a dedicated AWS Cloud Center of Excellence cutting across all Infosys service lines, and had aimed to employ 5,000 AWS-trained and 2,500 AWS-certified resources to focus on the entire portfolio of AWS services.

In June 2016, AWS announced the opening of a new centre in Mumbai to better serve local customers. At that stage Amazon estimated that it had 75,000 active AWS customers in India, with Ola, redBus, Tata Motors, and Hoststar being some of the prominent ones.

AWS also aims to bring AI to the mix to take its partnerships beyond basic computing and data-storage services, as it looks to attract bigger enterprises to the cloud. The India arm of AWS is looking to add AI services such as speech recognition, text-to-voice services, visual search and image analysis, plus video services, to its base infrastructure.

Bikram Bedi, MD at Amazon Internet Services, had told ET that if one looks at the whole AI piece, then it is tough for individual developers to build everything from scratch. To address these needs, AWS offers a family of intelligent services that provide cloud-native machine learning and deep learning technologies to address these different use cases.

Related read from 2016: The battle for cloud – global cloud services fight it out for a piece of the Indian market

The ‘underdogs’ who could come out on top?

If history has taught us one thing it is that winners can come out of nowhere. While Google and Microsoft were competing with each other to capture the mobile space in the mid-2000s, Apple came out of nowhere and dominated the mobile space with the iPhone.

While AWS and Microsoft seem to be the top two players in the Indian market, some startups YourStory spoke to felt that some other players have also shown great potential in the Indian market. In no particular order,

- Digital Ocean is a popular choice in India because of its competitive pricing and suite of services.

- IBM Bluemix is a popular choice, and complimented by Watson's AI prowess.

- While the Google Cloud Platform (GCP) doesn’t seem to be a popular choice among Indian startups or enterprises at present, according to GCP’s website, it aims to have an active presence in Mumbai in 2017.

Neuron is a startup that leverages deep learning models and gives startups the ability to extract deep insights from all sorts of textual data. Veer Mishra, CEO of Neuron, noted that they leverage multiple cloud platforms for their work to better train their modules and to also ensure that they are not wholly dependent on one platform, in case of disruptions. AWS was in fact recently in the news when a human error took down thousands of websites all over the world.

'I sense a disturbance in the force?'

The public cloud services market in India is projected to grow 38 percent in 2017 to total $1.81 billion, according to a recent report by Gartner.

The highest growth will continue to be driven by IaaS which is projected to grow at 49.2 percent in 2017, followed by 32.1 percent in PaaS. The increase of SaaS and PaaS are indicators that the migration of application and workloads from on premises data centers to the cloud, as well as the development of cloud ready and cloud native applications, are fueling the growth in the cloud space.

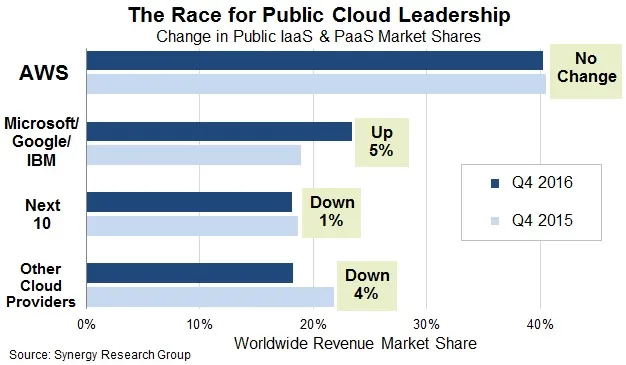

Recent Q4 2016 data from Synergy Research Group shows that while AWS is maintaining its dominant share of the public cloud services global market at over 40 percent, down from its 45 percent market share from the previous quarter, three others cloud providers — Microsoft, Google, and IBM — are gaining ground at the expense of smaller players in the market. In aggregate, the three have increased their worldwide market share by almost five percentage points over the last year and together now account for 23 percent of the total public IaaS and PaaS market, helped by particularly strong growth at Microsoft and Google.

Synergy Research Group noted that while most of the major operators have now released their earnings data for Q4, quarterly public cloud infrastructure service revenues (including both public IaaS and public PaaS) have now reached well over $7 billion and continue to grow at almost 50 percent per year.

With the battle lines drawn and AWS and Azure gunning for pole position, the fight for market consolidation in India will be tough, but there already is a clear winner — the customer — who is being wooed by all the cloud players.

Which domain name would you choose for your website? Click here to tell us.