Amazon India’s real Prime strategy is not the obvious one

Despite making losses, Amazon India is betting big on Prime, which promises fast and free shipping and allows members free access to movies and TV shows, to acquire a huge customer base and build brand loyalty.

Sri Muktsar Sahib in Punjab is one of the thousands of small towns that dot India; nothing about it really stands out. The town’s only claim to fame is a battle fought in the early 1700s between the Mughal Army and forces loyal to Sikh leader and religious head Guru Gobind Singh. Today, it’s wrapped in small-town obscurity with most of the 100,000-strong population dependent on agriculture. But what if I told you that Muktsar holds the key to Amazon’s success in India?

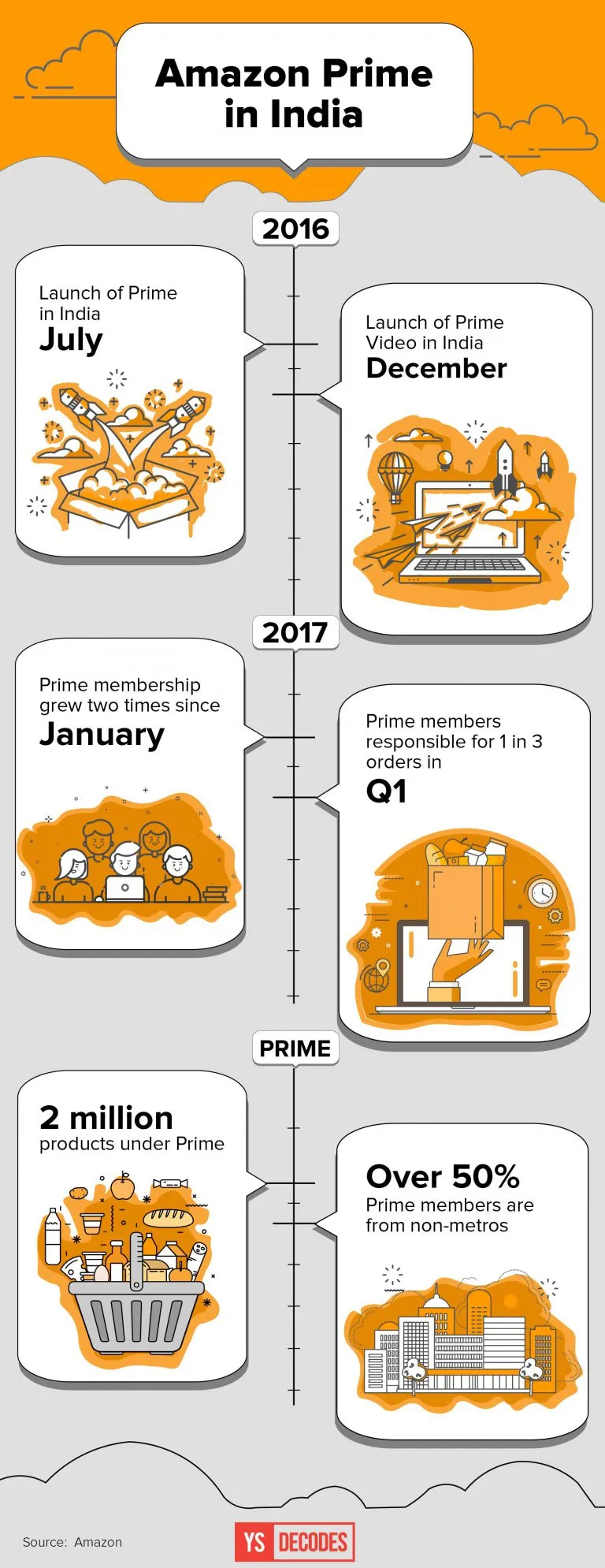

Muktsar, which lies around 400 km, or 250 miles away from national capital, New Delhi, is one of over 100 cities eligible for Amazon’s Prime membership; the company says many residents have signed up to become members. The town, along with others like Nalgonda in Telangana, Gulbarga in Karnataka and Alwar in Rajasthan, is part of a very important experiment that Amazon is conducting in India.

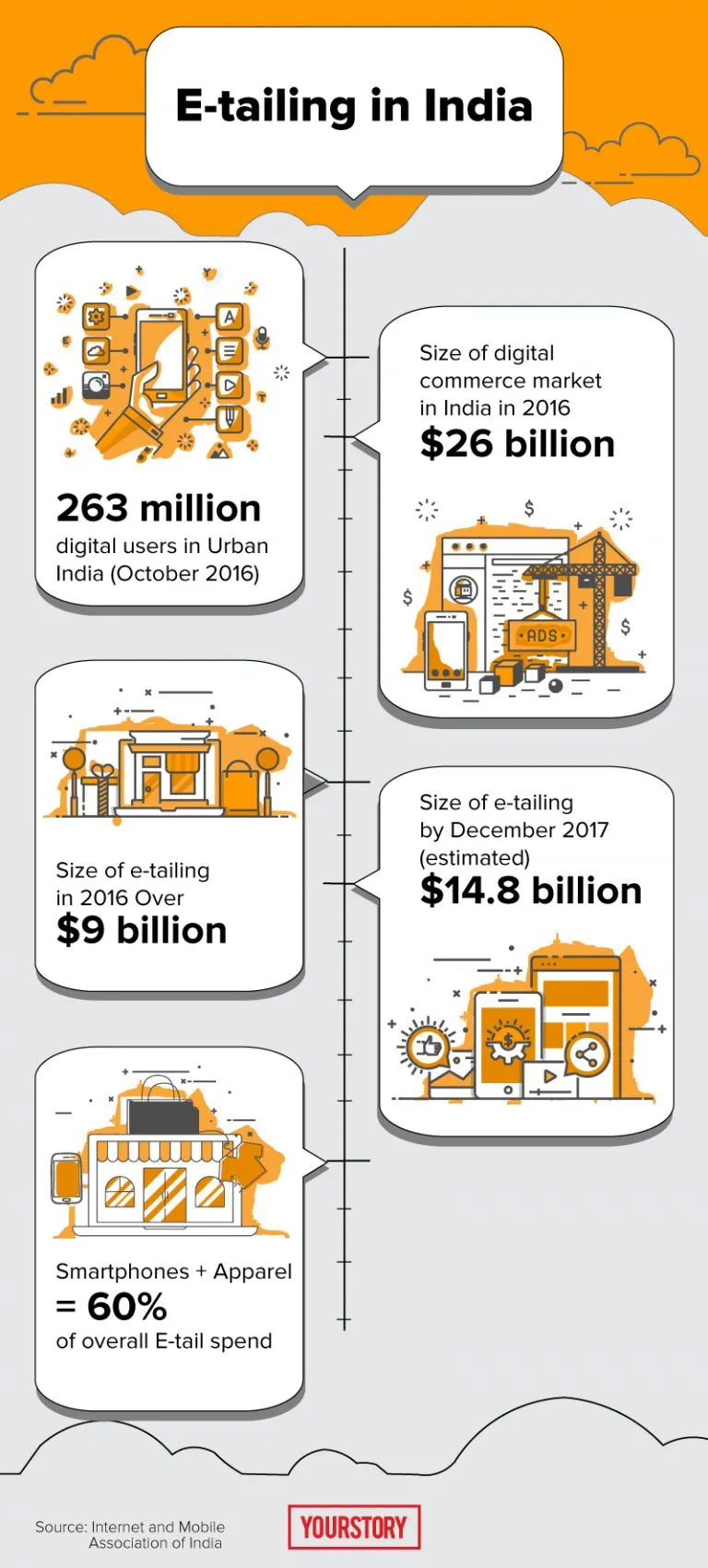

It is common knowledge that Amazon wants to win the Indian online retail market, expected to grow to over $17 billion by end of 2018, according to a study by industry body ASSOCHAM and consultancy firm Resurgent India. It is also common knowledge that Amazon is using its membership programme, Prime, as a growth driver. The company is betting that e-commerce growth will happen not only in large cities like Delhi, Mumbai and Bengaluru, but also in smaller cities and towns. In fact, the expectation is that the next stage of e-commerce growth in India will be driven by small-town residents. And Prime is one of the arrows in Amazon’s quiver as it tries to get Indians from big cities and small towns to shop online on its site and app. A chunk of the $1 billion Amazon incurred as losses in India in FY 2017 is linked to building Prime capabilities. Is the initiative worth the cost?

The short answer – it totally is. The longer answer? Read on.

The Prime proposition

Prime’s value proposition for Indian customers is straightforward. Pay Rs 499, which is under $8, for a year’s membership and get fast and free shipping for millions of products. With next-day-shipping charges at Rs 100 a package for non-Prime customers, a member can recoup the annual fee in about five orders. This is an important hook for value-conscious Indian consumers. Also on offer is free access to hundreds of movies, television shows and Amazon’s original content.

The value proposition for Amazon also seems straightforward. The membership fee is so low that Prime becomes an easy sell. Once a customer opts for Prime, chances are s/he will keep coming back to Amazon.in, the company’s India platform, for all online purchases.

Prime is clearly a great customer acquisition strategy for Amazon. When you speak to Amazon executives, be prepared to hear the phrase “customer-obsessed” many times.

Akshay Sahi, Head of Amazon Prime in India, says:

Amazon is a customer-obsessed company. We want more and more engagement with customers. So we give them tremendous value. The more they enjoy the benefits, the more the flywheel gets spinning for Amazon. When we offer these benefits (free shipping, video streaming, etc.), that's how loyalty is born. Loyalty is earned through the value we provide to customers continuously.”

Loyalty is a serious problem for e-commerce companies. By bombarding customers with steep discounts (in 2013 and 2014, discounts in many categories were consistently higher than 75 percent) in an attempt to entice them to try shopping online, online retailers have inadvertently created a consumer base that go to an e-store offering the best deal.

According to a person who works closely as a consultant with Indian e-commerce firms, the cost of acquiring a new customer can be as high as five times that of servicing an existing customer. A new customer will typically opt for cash-on-delivery (CoD), which is more expensive as higher costs are incurred for delivery and the risk of customer returning the product is greater. The moment a customer converts from CoD to pre-paid, the company saves at least Rs 50, a little under $1, per order. So if a customer becomes a Prime member, Amazon is almost assured of multiple repeat purchases.

This expectation is a fair one as Amazon has seen loyalty get built up through Prime in other markets, especially the US. Studies have found that Prime members in the US spend more the longer they use the service and are highly loyal.

Investing in logistics

One of the key reasons for customers opting for Prime membership is to avail free superfast deliveries. While Amazon has had to invest heavily in logistics even in a developed market like the US, the investments are even more significant in a developing market like India. This is partly because there is no truly reliable supply chain network in India where third-party service providers offer the full range from pickups, warehousing, line haul to last mile. The situation has improved dramatically since Amazon entered India in 2013, with last-mile delivery companies like Ecom Express and Delhivery setting up operations in thousands of cities and towns across India. But warehousing and line haul still pose challenges and result in delays, especially during high sale days.

This is something Amazon cannot afford as it is luring potential Prime members with the promise of fast deliveries. Now imagine that a Prime customer in Agra orders a mobile phone case worth Rs 200 and that case happens to be in a Bengaluru warehouse or fulfilment centre. Amazon must ensure that it covers the 19,220 km, or 1,190 miles, in less than two days.

“If the product is not available at the nearest fulfilment centre then the cost would be two to three times higher compared to standard delivery,” says the consultant quoted earlier. He sought anonymity as he works closely with Amazon.

So Amazon has invested heavily in infrastructure, especially in stocking products in its warehouses. Around two million products are now available on Prime. This means it stocks millions of units of products, ranging from clothing to large electronics, in its fulfilment centres. The fulfilment centres have also increased in number with seven fulfilment centres set up in 2017 so far. It will close the year with 41 operation fulfilment centres in 13 states across India, with a storage space of 13 million cubic feet. A fulfilment centre it launched in Uttar Pradesh in July boasts of 35,000 cubic feet of storage space.

This is just one part of the investment. A large part of the billions it is pumping into the country is going into setting up an enviable logistics network.

Focus on speed & reliability

Manish Saigal, Managing Director at advisory firm Alvarez and Marsal, says, “Amazon believes that speed and reliability are the only differentiators. This is a very ingrained philosophy. All innovations they do are around speed and reliability.” Manish specialises in transport and logistics.

A small aside: Amazon is famously reticent about revealing its internal operations or strategy. YS Decodes spoke to multiple people with direct knowledge of the operations of Amazon Transportation Services, the company’s India logistics arm. However, all of them spoke only on condition of anonymity. Most details mentioned in this article about Amazon’s logistics are based on these conversations. This is the statement Amazon shared:

We will continue to remain committed to investing in our fulfilment and logistics capability to enable and empower sellers to serve customers nationally at lower costs. Amazon has created a robust infrastructure to ensure Prime members continue to have a great delivery experience in India.”

Returning to our narrative, Amazon is building a nationwide surface transport network. The target is to ensure that trucks can cover the distance between any two cities in less than two days. Amazon is able to do this for the top six Indian cities. To ensure speedy deliveries, e-commerce companies in India have primarily relied on air cargo, which is the most expensive means of line haul. It costs about Rs 40 to transport a kilogram of cargo between Mumbai and Delhi, while the cost using surface transport is just Rs 18/kg. Amazon has put extra resources (primarily drivers) to ensure that the distance is covered in 24 hours, which increases the cost to about Rs 25/kg. Nevertheless, this is much cheaper than air cargo. The reason behind Amazon’s rapid expansion of fulfilment centres is to ensure that maximum number of small cities and towns are within easy reach of a fulfilment centre. In theory, this will help reduce costs of line haul over a period of time.

While Amazon has built an enviable logistics network – it is now testing out the possibility of handling deliveries of other e-commerce companies in India – the Seattle-headquartered giant has had to sink in a large amount of money to achieve this.

Amazon’s international losses ballooned five times from a year ago to $724 million in the quarter ended June 2017. Chief Financial Officer Brian T. Olsavsky attributed the losses in part to the company’s investments in India in a post-earnings analyst call.

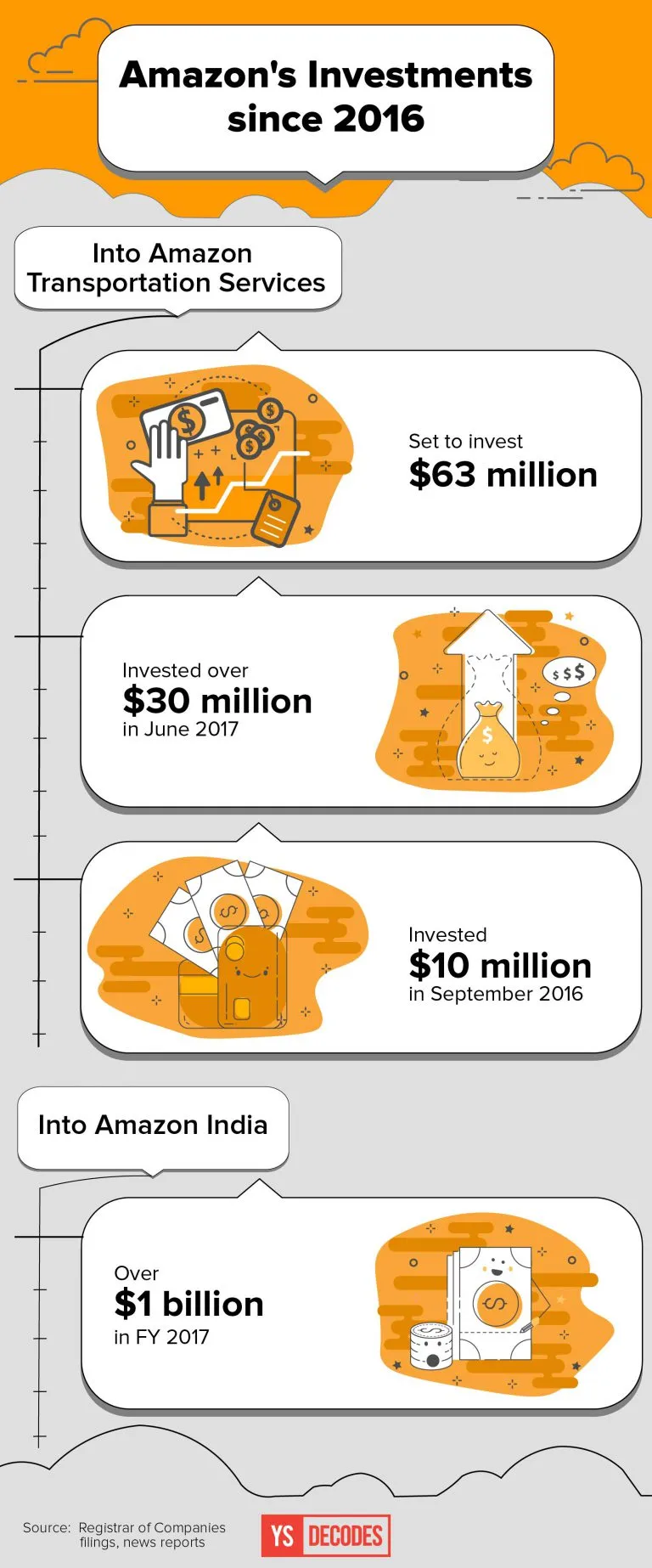

But Amazon is set to invest $63 million into its Indian logistics arm, according to documents it has filed with the Registrar of Companies in India. Amazon Transportation Service received over $30 million in June 2016 and $10 million in September 2016. The company has invested over $1 billion into its Indian subsidiary in FY 2017.

Strategy within strategy

This brings us back to our question of why this focus on and large investments into logistics for Prime make for good strategy.

The first key point to remember is that Amazon would have had to make these logistics investments even if it wasn’t offering Prime.

“Prime is not going to bring you to online shopping. First, Amazon reaches remote customers and then Prime helps. We build infrastructure first for Amazon and then specific infrastructure for Prime,” says Akshay, the head of Prime at Amazon India.

Manish of Alvarez and Marsal also points out that regular delivery is still largely offered for free by most e-commerce players in India, except in a few cases. “From that point of view Prime is a great bait as it encourages customers to move to the next level of expecting fast deliveries. Indian consumers are not going online for immediate consumption. That is under 10 percent of purchases right now. Prime is meant to change this. Consumers will start expecting super-quick deliveries (which only Amazon can offer at scale right now). It is a habit-formation tool,” Manish says.

Another very important angle is Amazon’s focus on two interlinked offerings – Pantry and Grocery. Amazon has got approval from the Indian government to invest $500 million in grocery, where it can stock and sell even its own private label. The company is expected to launch online food retailing across the country during India’s biggest festive season, Diwali, in October.

Amazon already offers a hyperlocal grocery delivery service – Amazon Now – in four cities. Amazon Pantry, which offers packaged food and household essentials from third-party vendors, is available in over 25 cities.

When it launches grocery at scale Amazon needs to ensure delivery within a few hours, like it does with Prime Now in the US. For this Amazon is setting up smaller fulfilment centres in many cities to ensure these within-a-few-hours deliveries.

There is a lot of overlap between logistics for Now, Pantry and Prime. The same logistics infrastructure can be used for all three. Grocery delivery typically does not happen through the day; the peak hours are in the morning and evening. Yet the infrastructure needs to be in place and the same infrastructure can be used to deliver Prime products. This will ensure lower per unit or per order cost.

The proof of the pudding…

So are Prime members growing, especially in smaller locations, to justify these investments?

Amazon claims Prime membership in India has doubled since January 2017. Prime members also accounted for every third order between January and March this year and were responsible for over half the orders on Amazon Pantry.

In July, Amazon’s India Head Amit Agarwal claimed that 50 percent of Amazon Prime members were not from the metros. Amazon declined to confirm this number. Their statement: “Prime has grown in India not just in metros but also in smaller cities since we launched Prime a year ago.” If we consider the official Indian classification, then six cities – Delhi, Mumbai, Kolkata, Bengaluru, Chennai and Hyderabad – are considered metros. However, Indian e-commerce users are concentrated in the top 20 cities. If 50 percent of Prime members are concentrated in six cities (and we do not know how many of the remaining are from the other 14 top cities), then Prime is still primarily a big-city phenomenon.

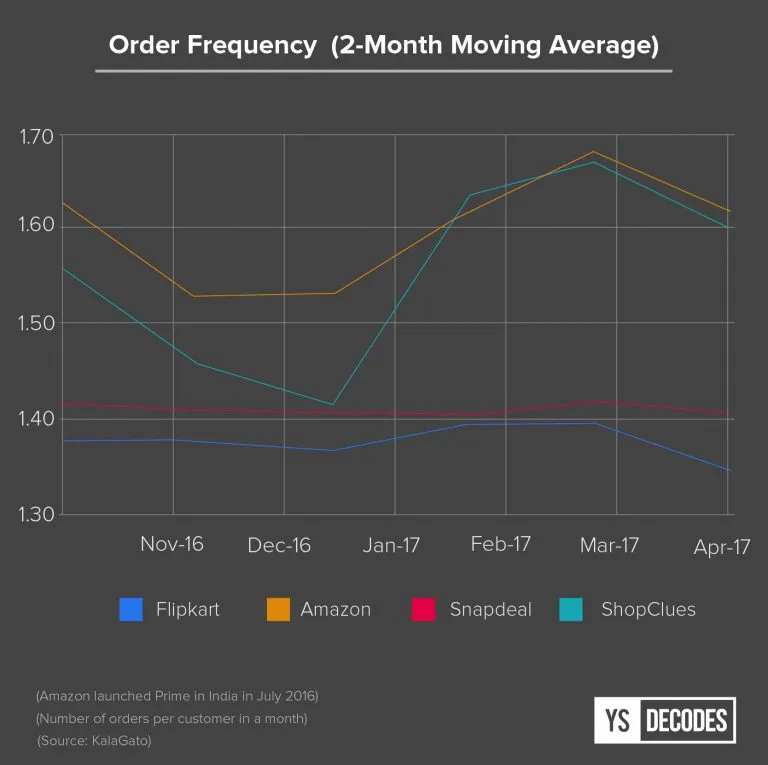

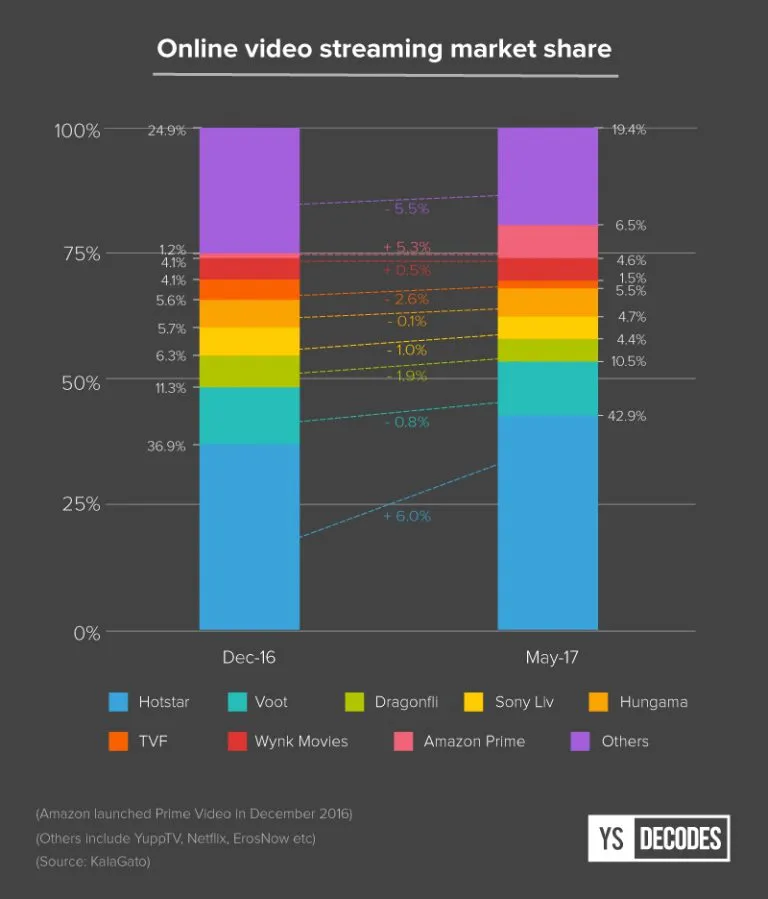

The video streaming service that Amazon offers with Prime is also a great tool for customer acquisition. "For Amazon, its Prime Video service is a great customer acquisition and retention strategy. By selling its prime subscription for less than 1/12th the cost of NetFlix and bundling the offering with Amazon Prime Delivery – Amazon has ensured that customers have no reason to shop elsewhere and that they keep coming back," says Aman Kumar, Chief Business Officer of market and competitive intelligence firm KalaGato.

However, even the content Amazon offers through its video streaming service, Prime Video, is very much aligned to the tastes of a small group of Indians who watch international content. Amazon is said to have set aside Rs 2,000 crore, over $300 million, for the video streaming service in India. The company didn’t confirm this amount. The company has bought the rights to many Indian movies in several languages, along with announcing the launch of a number of original series made by Indian production houses. That is a smart move – 28 percent of the total television viewership is cornered by movies. But television shows, or serials as they are called in India, that revolve around tussles between mothers-in-law and daughters-in-law (aka saas-bahu shows) are what have worked in the past. That said, nothing can match the viewership of cricket in India. Over 730 million viewers tuned in for the T20 World Cup in 2016. The India-Pakistan match, the most anticipated clash for Indian cricket fans, during the Champions Trophy in June 2017 registered a cumulative reach of 201 million viewers.

In video streaming, Amazon faces tough competition from players like Hotstar, the online streaming property of Rupert Murdoch’s Star India. Hotstar, which holds the digital broadcast rights for the Indian Premier League, has cornered massive market share, primarily due to cricket streaming.

“But content is only a freebie. The faster delivery is the actual pull factor,” Manish says.

This brings us back to the large city-small town breakup. While Amazon is making heavy investments in logistics even for small cities and towns, e-commerce right now is still a very metro city phenomenon. Prime, while covering over 100 cities, is primarily finding takers among big city consumers.

Mrigank Gutgutia, Engagement Manager and e-commerce expert at advisory and research firm RedSeer Consulting, says:

Metros are right now the primary market for Prime. The mature consumer base is there and the value proposition for them is very strong. Tier-II and III cities and towns make up less than 25 percent of the market right now. But small cities and towns will contribute much more in the future and all e-commerce companies need to build a robust base there.”

That’s going to be the true test of Prime – how many consumers from small cities and towns can it get on board as members? It might seem like a no-brainer for small-town shoppers to get on the Prime bandwagon if it offers them fast deliveries, considering the lack of organised retail in these place.

Today, if a Prime member orders a Galaxy J7 Prime phone, eligible under Prime, for delivery in Bengaluru the phone will be in his hands in around 48 hours. Back in Muktsar, however, a Prime member will get the phone only after a week. And this gap is what Amazon needs to bridge.