SaaS-enabled marketplaces (and why we like them)

One of the areas that we’ve focused on for a while at Matrix India is India SME SaaS i.e., Indian companies selling SaaS products designed for Indian SMEs. While we have taken multiple bets in the space - Practo, Belong, and Limetray, among others, we feel that India SME SaaS, despite being a large opportunity, still remains (largely) unexplored.

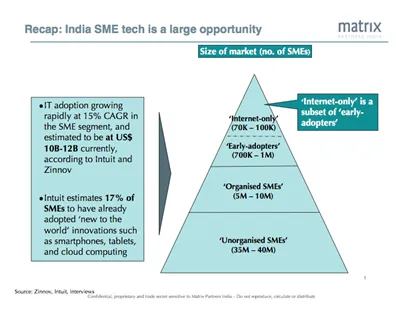

Although the Indian SME market carries some baggage in terms of size, over the last 2-3 years we’ve seen (albeit anecdotally) an almost secular adoption of technology, with layers outside the ‘early adopters’ also beginning to spend on tech:

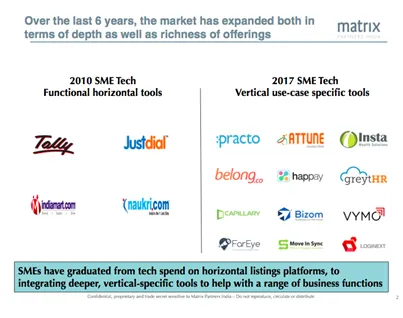

In harmony with this increase in tech spend, the offerings to Indian SMEs have also increased in terms of depth and breadth, with several vertical-specific solutions emerging.

Given this context, we felt that the time was right to go in-depth into the opportunity. We proceeded to speak to almost 80 SMEs across verticals (including pharma, auto services, professional services, retail, and others). Our findings are condensed here - they are meant less as a prescriptive solution of what to do in order to serve the Indian SME, and more as a conversation starter on India SME SaaS.

The challenges of selling to Indian SMEs

As we spoke to an increasing number of Indian SMEs as well as companies trying to serve them, 3 main challenges in selling to them emerged:

Tough sales force economics: Sales force efficiency metrics in India compare unfavourably to global SaaS benchmarks, primarily driven by a FOS-heavy sales model, lower ARPU than global peers, and at-par or higher churn:

Mobile-first approach: We are not the first to arrive at this insight (and will certainly not be the last!) but the Indian SME will probably not engage with a product unless it has a simple, intuitive, and mobile-first interface.

High market fragmentation: Finally, Indian SMEs are highly fragmented (in terms of distribution by size, even more so than their counterparts in China and the US); This makes aggregating them harder and more expensive.

SaaS-enabled marketplaces (SEM) - the silver bullet?

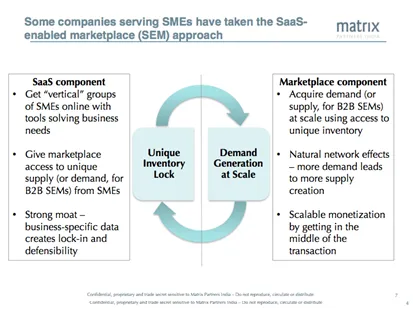

During the course of our conversations, we came across an interesting approach to cracking the India SME riddle. Some companies were building out their business in two parts to serve SMEs more effectively -

- A traditional SaaS piece; a tool to serve a core function

- A marketplace leg; using the unique inventory obtained as a result of the SaaS piece, to seed a transaction marketplace

The SaaS and marketplace legs go hand-in-hand in creating a reinforcing cycle. The SaaS piece helps in seeding marketplace supply with unique inventory, and creates a data lock-in. On the other hand, the marketplace piece helps SMEs with access to new demand and helps solve the top-of-mind problem of more revenue for them, while being a source of scalable monetization for the SEM courtesy a cut of the transaction.

SEMs in practice

Consumer-facing SEMs seem to have hit a sweet spot with the Indian SME. A large majority of the SMEs we spoke to were open to spending money monthly for lead generation. However, they have gradually moved their spends away from legacy horizontal platforms towards vertical SEMs more in tune with their needs.

Verticals help them provide more context about their offerings (using photos, detailed cataloguing) as well as distinguish themselves (via ratings and reviews). Many vertical SEMs also provide specific help in selling online e.g., simple CRM tools, logistics and delivery, and payments.

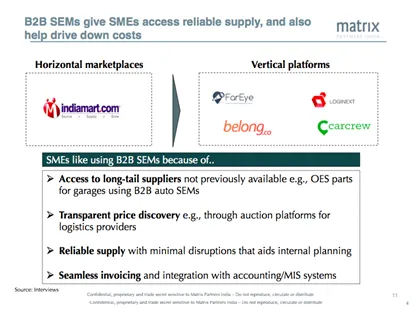

On the other hand, the value that B2B SEMs bring to the table include better selection, transparent pricing, limited supply disruptions, as well as seamless invoicing.

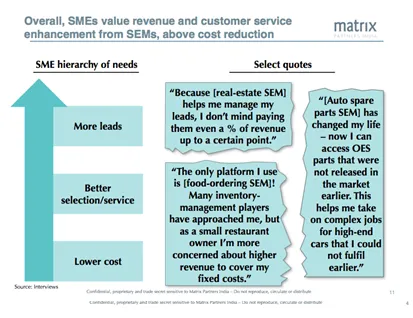

Overall, there is also a clear hierarchy of value that SMEs see from these platforms. New business or ‘dhandha’ is on top of the pile, followed by better selection, and finally lower cost.

Solving both parts of the SEM

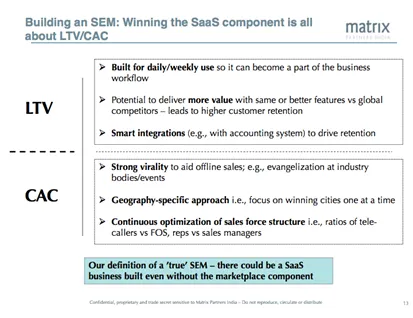

Moving on to what it takes to make SEMs work, the SaaS piece needs to have its own legs to stand on. While dwelling on traditional SaaS metrics is beyond the scope of this piece, we saw companies that did well adopt some hacks to get both sides of the LTV/CAC equation working for them.

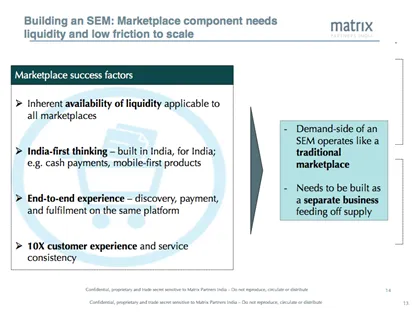

On the other hand, winning the marketplace piece is all about generating liquidity, much like the way a traditional stand-alone marketplace would operate.

Examples of SEMs

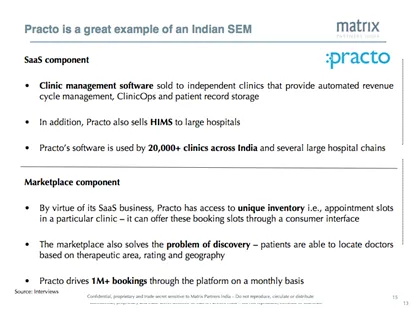

There are already examples of Indian SEMs that have scaled. Practo is an example of a company adopting the SEM approach in health care, with a clinic management SaaS piece helping create enough supply to build a consumer-facing bookings and transactions marketplace on top of it.

BookMyShow of course, is another classic example, with the market-leading ticket booking marketplace being built on the back of an inventory management platform for movie theatres.

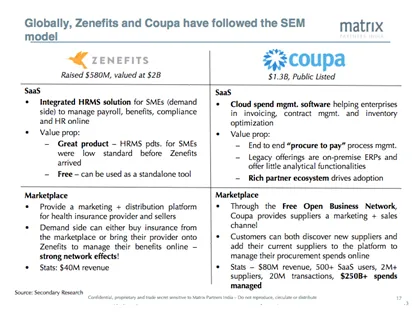

Globally, Zenefits is an example of the SEM model: Giving away the HRMS solution for free, and building a marketing and distribution platform for health insurance on top of it. Coupa is another global example of a B2B SEM - building spend management software to help companies invoice and manage contracts, while also giving them access to a supplier marketplace that is built as the other leg of the platform.

When to SEM - a handy guide

Based on our learning, we tried to put together a handy reckoner to help budding Founders think about SEMs and when they may want to adopt this approach. Overall, the following considerations are important in the choice of SEM vs non-SEM -

- Depth of the transaction stack i.e., SaaS leg becomes critical deeper into the marketplace hierarchy of classifieds → matching → bookings → part of payments

- Low tech adoption on the supply side: Worthwhile getting supply online using a marketplace to augment the SaaS piece

- ‘Consumerized’ supply base: Fragmented and small

- Opaque pricing in the marketplace: SaaS provides the transparency

- Multi-layered distribution chain: Scope for margin capture

- Perishable inventory: High opportunity cost

The sequencing of SaaS-first vs marketplace-first is however up for debate, and depends on such factors as the nature of product/service, tech readiness across the SME base, and fragmentation of buyers/suppliers.

As we come to the end of this piece, we want to reiterate our commitment to investing behind interesting India SaaS (and SEM) models. This piece is by no means intended to be the gospel on SEMs, but we do hope to start a conversation. Bouquets and brickbats are welcome - just drop us an email!

(Matrix India SaaS team: Matrix Partners India is an investment firm with Rs 4,500 crore under management. The firm invests in companies targeting the Indian consumer market at the seed, early and early growth stages. The firm has invested in several market leading companies in the consumer technology space, including Ola (local transportation), Quikr (online classifieds), Practo (digital health platform), Dailyhunt (mobile local language platform), Mswipe (mobile POS), Limeroad (mobile social commerce marketplace), Five Star Finance (SME lending), Treebo (digital hotel chain), OfBusiness (B2B marketplace) and Belong (recruitment SaaS and marketplace) among others. Matrix Partners has a global network of funds investing in the US, China and India with US $4 billion under management. Further information is available at www.matrixpartners.in)

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)