Will Indian e-commerce ever match up to the Chinese dragon?

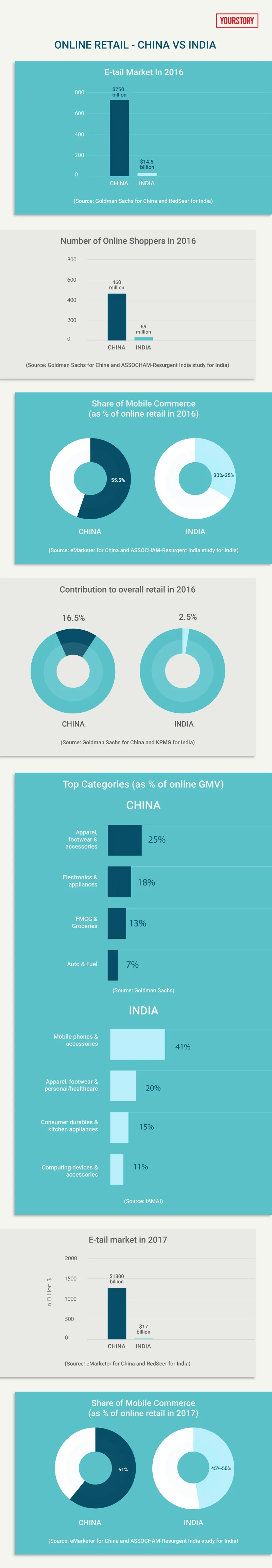

The Indian e-tail market is less than 2 percent that of China, and there are hopes it will catch up. Research, however, highlights the vast difference.

India’s online retail industry has taken up significant space in the investor wallet and mind over the past decade. It has also seen some of the largest funding deals, with Flipkart’s almost-$4 billion funding this year leading the pack. A look at the infographic below will make it clear that India’s e-tail industry is still nascent, and tiny, compared with China’s, the largest online retail market in the world.

It is not just the difference in size of the markets. The consumer base too is drastically different. While China had 460 million online shoppers in 2016, India had only 69 million. By 2020, China will have 660 million online shoppers according to a report by Goldman Sachs, while India will have 175 million according to a study by Google and AT Kearney.

Hope that made foreign investors and companies like Amazon and Alibaba will pump in billions of dollars into the Indian market is strong and the logic straightforward - Indian e-tail is in its infancy and it is best to get in at the ground floor and ride to the top.

A number of India e-tail proponents have, in the past, opined that India today is at the stage China was a decade ago, and that the latter’s super-fast growth came in over the last 10 years. So, India, the reasoning goes, will grow like China did in the last decade.

But will that happen? The Indian e-tail industry’s growth rate came down drastically last year. After growing at 180 percent in 2015, the industry grew at only 12 percent last year, and is projected to grow at 20 percent this year, according to RedSeer Consulting. The industry in China is expected to grow at 23 percent CAGR until 2020. This, despite China being a much more mature market.

A few data points add to the worry that this slow growth is what’s the future of the e-commerce. The average spend per user is drastically different. While the average annual e-commerce spending per consumer in China is forecast to cross $1,800 (around Rs 1.17 lakh) this year, according to data from iResearch Consulting Group, for India this number is between $120 and $140 (Rs 7,800 to Rs 9,000), according to RedSeer Consulting. In 2010, China’s average consumer spend on e-commerce was already much higher at around $600 (around Rs 38,900).

Also, the assumption is that as more Indians get access to internet, more online shopping will be seen. But, India already has 430 million people with access to internet. China has about 750 million. This means about 16 percent of those with access to internet shopped online in India. While 61 percent of those with internet access in China shopped online.

China also had a manufacturing industry boom that led to drastic improvement in income levels across the country. This has not happened in India. China’s GDP per capita in 2007 was around $3,480, while India’s was around $1,860 in 2016.

These issues raise questions over whether e-tail growth will pick up in coming years in India. If it doesn’t, what happens to the billions of dollars that have been pumped in – just Flipkart has raised round $7 billion in the past decade.

Do you think Indian e-commerce will grow like the industry did in China? Share your thoughts in the comments section below.