Dear entrepreneur, here’s why you should be interested in the mega fundraises of Flipkart, Ola and Paytm

What do the large fund raises of 2017 say about the Indian startup ecosystem and why should other entrepreneurs care?

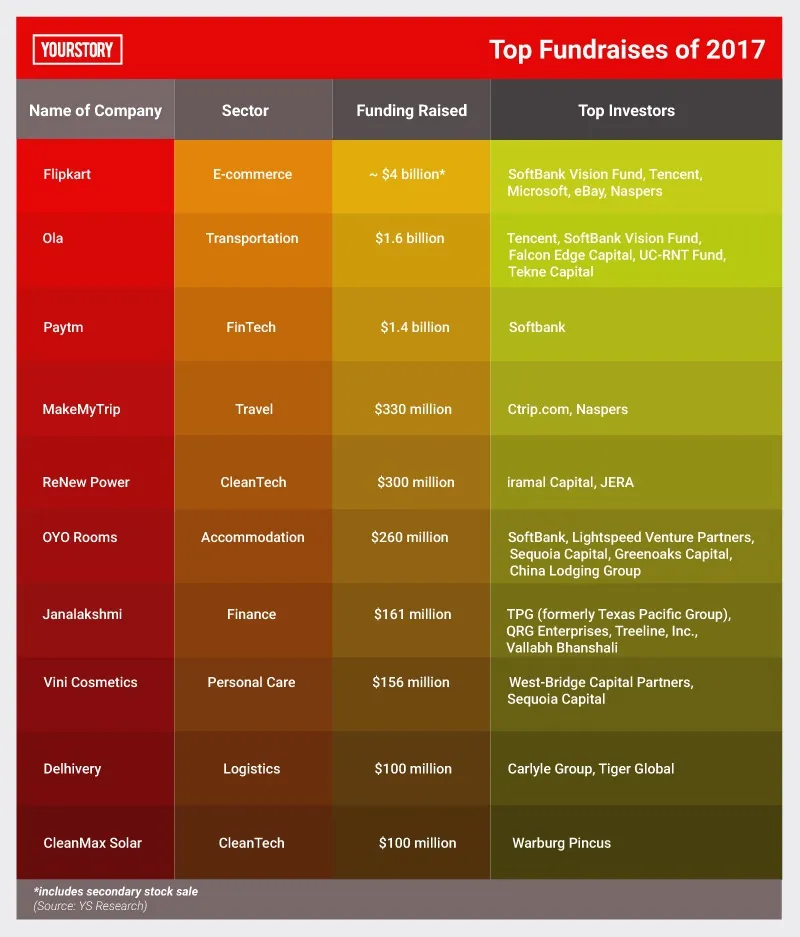

Ten companies in India have mopped up almost $8.5 billion in equity funding in 2017. Considering all equity deals put together amounted to $12 billion (across 653 deals), the top 10 companies cornered 70 percent of the entire funds raised by startups this calendar year.

2017 is also the first year where the Indian startup ecosystem has seen multiple deals of over $1 billion, with Flipkart, Ola and Paytm part of the billion-dollar club Following a $1.1 billion fund raise from Tencent and SoftBank last week, Ola is the newest member of the club. The company also shared that it is in talks to raise an additional$1 billion soon.

What is interesting to note is that four of the Top 10 companies have SoftBank as a common investor. The Japanese investor, that is closing a monster $100 billion fund, has emerged as the top backer of the Indian startup ecosystem. As an entrepreneur (who spoke on the condition of anonymity) put it, “The heart of the Indian startup ecosystem has become Japanese.”

The startup scene has changed tremendously since last year. 2016 was all about doom and gloom. Startups raised only around $4.9 billion in 2016, almost half of the $8.6 billion raised in 2015, and about 970 startups, including investor-backed ones, shut shop. The expectation was a continuation of this depressed sentiment. However, things panned out differently, and there are several reasons why investors, especially the early stage ones, are upbeat about India.

So, what do these mega fundraises say about the Indian startup ecosystem and what will the impact be on other, smaller firms?

Consolidation of capital

“The main story is that there is consolidation of capital. Investors are now backing market leaders,” says Raja Lahiri, Partner (Private Equity and Transaction Advisory Services and Regional Market Leader) at advisory services firm Grant Thornton. Flipkart, Ola and Paytm are obvious examples of this trend. Oyo may not have reached the stage of a Flipkart or an Ola, but the funding it has received puts it in that bracket.

Rahul Chowdhri, Founding Partner at Stellaris Venture Partners, says these larger rounds are a sign of maturity of the startup ecosystem. “There are now several scaled up startups from India. We will see larger rounds in the future. It is a good sign for startups as it is clear that late stage investors are ready to invest in India and investors are backing Indian companies even in areas where there is strong foreign competition,” he says.What does this convergence mean for other startups?

In e-commerce and taxi hailing we have already seen how the scaled up players have become deterrents for new entrants. In taxi hailing Ola and Uber are the only real players left and are fighting for market dominance. In e-tail it may not be as stark - going beyond Flipkart and Amazon- a handful of companies, like ShopClues, Lenskart and Firstcry, are making their mark. However, these mega deals clearly signal that only companies with a clearly differentiated business plan or operating in defensible niches can hope to compete.

Scale is always a barrier to entry. Who can compete with an Ola or an Uber? Those spaces are gone (for new startups),” says Raja.

The one sector where this does not seem to be the case – where smaller and younger companies are also finding many backers – is Fintech. Over 90 companies in Fintech have raised funding in 2017, amounting to over $2 billion. Of this Paytm accounted for $1.4 billion.

Mobikwik, a competitor of Paytm, raised about $34 million in August. There were a number of Series B, C and even D rounds like that of digital lending company Capital Float (raised $45 million), online insurance broker Coverfox (raised $15 million) and mobile payments company Mswipe ($31 million). This sector, which is turning out to be the darling for investors this year, got a fillip post last year’s demonetisation. While Paytm has garnered a lot of attention, market share and capital the industry overall is still evolving, with new RBI regulations and government initiatives like UPI. creating fresh possibilities for startups.

Large fund raises = acquisitions?

That is what others in the ecosystem are hoping. “Trickle down funding/acquisitions/acqui-hires will happen when the big ticket funding frequency increases and that too into more number of startups, creating more unicorns,” says Robin Alex Panicker, Co-founder of Thiruvananthapuram-based software product startup BasilGregory.

This has happened to some extent in the past. Flipkart made multiple acquisitions over the years, with Myntra, Jeeves and Jabong among the most notable. Snapdeal, before its fortunes took a nose dive, was also a voracious acquirer, with its most prominent acquisition being the $400 million Freecharge. Paytm too made multiple investments and acquisitions. It is reportedly in talks to make an investment in BigBasket along with Alibaba.

Raja agrees that M&A activity is set to get a boost. He, however, cautions against expecting a sudden spurt.

Rise in competition

Entrepreneurs who are not in online retail, taxi hailing and payments cannot sit back and relax. These unicorns have already made their intentions clear to get into as many adjacent sectors as possible. Flipkart has said it aims to become a one stop destination for any online transaction from shopping to ticket booking. Paytm’s entry into movie ticketing has caused BookMyShow quite a bit of heat. Ola has in the past tested out food deliveries. With Uber launching its food delivery service UberEats, could Ola be far behind?

“This is something we worry about. Some of these companies have raised so much money they need to get into multiple segments and sectors to justify the funds raised and their valuation. Many of them have too much money to spend. When we look at early stage companies that operate in one of these spaces that a big, well-funded company can easily enter we evaluate much more,” says an early-stage venture capital investor, who did not want to be named.

However, Rahul says that such moves are to be expected. He points out the example of Amazon getting into video on demand, leading to more competition for Netflix. “Other startups need to have defensible business models. There is also the possibility that the bigger companies could invest into an existing startup in whose space they want to enter. More competition is good for the market,” says Rahul.

Too big to fail?

One of the positives of the entire Snapdeal episode was that there were few ripples because of the company’s implosion. Snapdeal was among India’s few unicorns and had raised multiple rounds of funding amounting to over $1.7 billion from marquee investors including SoftBank and Alibaba. Yet it is business as usual in the startup ecosystem, after the Snapdeal debacle, which shows a certain amount of maturity.

That said, questions are being raised on how much more money will have to be poured in for some blockbuster exits to happen. These questions are primarily targeted at Flipkart, the biggest of the Indian unicorns, which has raised over $7 billion so far. “They have spent so much money and yet their leadership position is not completely defensible even now. They have not built a clear differentiation in the minds of consumers. How much more money will it take?” asks an analyst at a Singapore-based fund, who asked not to be identified as he is not authorised to speak to media. “Also, is the Indian market large enough? Have we overstated the market?” These are troubling questions not just for Flipkart or any of the other companies in our Top 10 chart, but also for all founders and investors in India.

While India might have been able to absorb a Snapdeal quite easily, can we afford another heavyweight’s crash-and-burn?

With these multi-billion-dollar funding deals expectations have gone up – the exits they provide will have to be spectacular. Tiger Global got a part exit when SoftBank invested in Flipkart. The company is also set to buy back employee stock options to the tune of $100 million. But that isn’t enough. Says Rahul:

One large company failing is one thing, several failing is something else. There is expectation from these companies (the ones who have raised large funds) to do well, succeed and give large exits. There have been some good IPOs in India but these valuations are of a different level and so expectations are also of a different level. The founders and management of these companies are good and smart. They have gone through some tough times and I am sure the lessons from that have been learnt.”