India’s money trail – from ‘kaudis’ to digital payments

Over the course of the millennia that have transpired since currency first came into use, the way Indians use money has undergone many transformations. A year of demonetisation has shown how there has been a push towards a digital economy, but the love for cash refuses to fade. From cowrie shells and gold coins to paper notes and the modern digital methods — the history of payments in India is varied and intriguing. As the RBI rolls out the Rs 50 and Rs 200 denominations in the Indian currency system, we trace its evolution from the earliest days of recorded history.

Early currencies

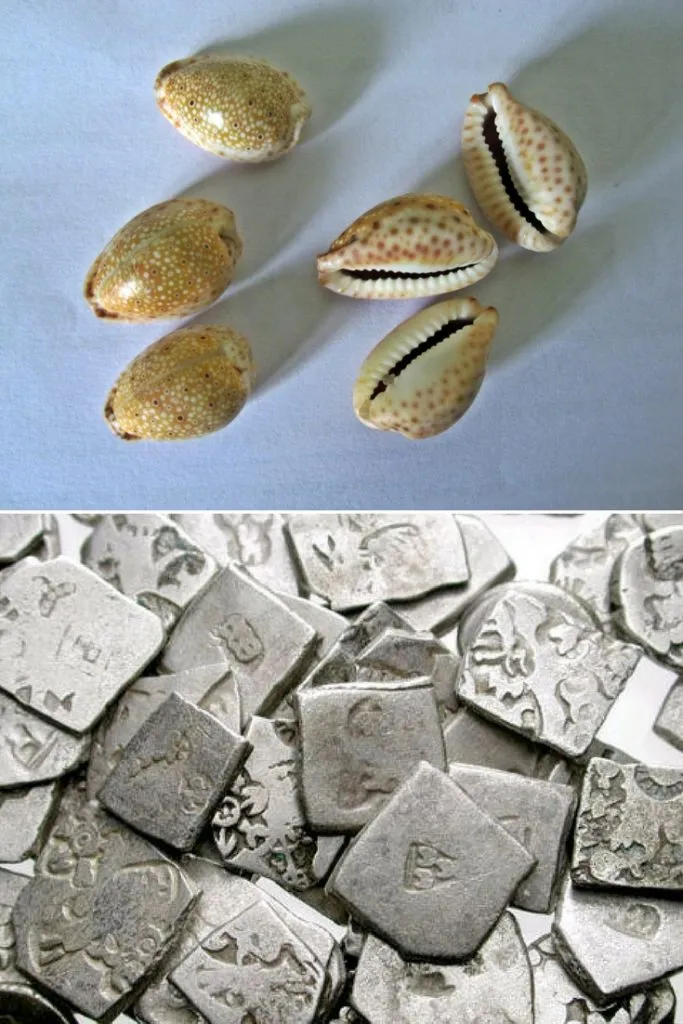

Cowrie shells, found abundantly in the Indian Ocean, were among the earliest forms of currency used in the world. In India, they were colloquially referred to as kaudi and were used in certain areas like Odisha even until the early 1800s.

The first documented instance of coins being used as currency in India dates back to the seventh or sixth century BC. These ‘punch-marked’ coins were stamped bars of metal (usually silver and copper) that were first issued in the Mahajanapada kingdoms of the Indian Iron Age, and they lasted until the end of the Imperial Mauryan period.

The Indo-Greek kings then introduced new types of coins that would influence Indian coinage for many centuries to come. The Kushan empire, which existed from the first to third centuries CE, began minting gold coins which featured mythological deities. The Gupta empire, from 320-470 CE, produced the largest number of gold coins in Indian history, which is why it is often referred to as the ‘golden period’. Coins continued to take on various forms through the subsequent dynasties in India — from the Rajput and Mughal empires in the North to the Maratha and Vijayanagara kingdoms in the South.

It was Sher Shah Suri who, during his five-year rule from 1540-1545, introduced to the nation a new currency which is the ancestor of the modern-day Rupee. After defeating Humayun and taking over the Mughal Empire in 1540, Suri set up a new civic and military administration that issued a silver coin termed the Rupiya, which remained in circulation even during the remainder of the Mughal Period as well as during the Maratha era. The Rupiya remained the dominant standard currency even during the British Raj, despite the East India Company’s efforts to introduce the Sterling Pound in India as early as the 1600s. But the coins issued in Western India (Bombay and Surat) and South India (Madras) provinces differed from their northern counterparts in both design and metrology.

The issuance of a uniform coinage in India was brought about only in the early 19th century when the English, who were now the dominant power in the country, enacted the Coinage Act of 1835. The newly-designed coins saw the traditional Indian images and symbols replaced with the effigy of King William IV, which was itself replaced by the portrait of Queen Victoria from 1840 onwards. However, it was only after the Indian Rebellion of 1857, also known as the Sepoy Mutiny, that the British declared the Rupee as the official currency of colonial India.

When cash was crowned king

Coins initially derived their value from the precious metal used to mint them. This posed a problem for sovereigns who did not possess the requisite gold or silver to prevent a drastic devaluation of their currency. Paper money solved this problem as it bore a promise to pay its possessors the equivalent value of gold or silver from the public treasury. Soon, it no longer mattered that paper money was not backed by anything of tangible value, and it was simply accepted as a medium of exchange for goods and services. But while paper currency was popularised in Asia by Genghis Khan as early as the 11th century, it only gained traction in India a few centuries later.

In the late 18th century, silver and gold coins gave way to hundis, bonds, and shares, and paper currency was introduced in India for the first time. Both private and semi-government Presidency banks could print notes — the General Bank of Bengal and Bihar (1773-75) and The Bank of Hindostan (1770-1832) were among the earliest issuers of paper currency in India. In 1861, the Government of India enacted the Paper Currency Act which granted it a monopoly over the issue of notes and ended the issuance of notes by private and Presidency Banks. Subsequently, the ‘Victoria Portrait Series’ of notes — in denominations of Rs. 10, 20, 50, 100, and 1,000 — entered circulation.

The Indian Independence Movement soon began gathering steam, and its nationalist and economic strategy arm, the Swadeshi Movement, made a big impact on Indian banking. Inspired by the message of reviving domestic processes and products, businessmen and politicians founded several local banks — Canara Bank, Bank of India, Corporation Bank, Indian Bank, and Bank of Baroda, to name a few — for the Indian community from 1906 to 1911.

Soon after, the British Empire faced an acute shortage of silver due to the outbreak of World War I in 1914 and hence began issuing paper currency of smaller denominations (one and two Rupees) hitherto issued only as coins. Meanwhile, India got its first printing press in Nashik in 1928 which soon began printing currency for the entire country.

The First World War left the Indian economy in dire straits, and the need for an apex monetary authority was identified. The Central Legislative Assembly, acting on the guidelines recommended by the 1926 Royal Commission of Indian Currency and Finance, set up the Reserve Bank of India to separate the control of currency and credit from the government and to regulate banking and note issuance throughout the country.

The RBI was formally inaugurated on April 1, 1935, with its Central Office at Calcutta (now Kolkata) which was relocated to Bombay (now Mumbai) in 1937. A year later, the apex bank issued its first series of notes which now bore a portrait of the new British monarch — George VI. The Five Rupee note was the first one to be issued in this series and Rs. 1, 2, and 10,000 notes were subsequently added to the pre-existing denominations.

When the Republic of India was established on January 26, 1950, the portrait of George VI on the Rupee note was replaced by an image of the Ashoka Pillar. This currency remained in circulation unchanged until The High Denomination Bank Notes (Demonetisation) Act, 1978. Under this law, the Indian Parliament halted the use of high-denomination banknotes of Rs. 1,000, 5,000, and 10,000 which were undermining the Indian economy due to their use in illegal financial transactions.

It was in 1996 that the first notes bearing the picture of Mahatma Gandhi were printed. These notes, which featured upgraded security measures and tangible aids for the visually impaired, remain in circulation even today, with the exception of the Rs 500 and Rs 1,000 notes which were replaced after the 2016 Demonetisation.

The birth of the modern banking system

The partition of India after independence decimated the country’s economy and paralysed banking activities for months. Keen to restore economic welfare in India, the government sought to create a mixed economy as opposed to the laissez-faire system which had existed thus far. With this intention, the RBI was nationalised with effect from January 1, 1949, under the Reserve Bank of India (Transfer to Public Ownership) Act, 1948. A few months later, the Banking Regulation Act, 1949, was passed which empowered the RBI to “regulate, control, and inspect the banks in India.” This law was eventually amended in 1965 to place cooperative banks under the purview of the RBI for the first time.

By the 1960s, the Indian banking industry was a large employer and played a key role in augmenting the country’s economy. Since the banks in India, with the exception of the State Bank of India, were owned by private entities, the government led by the then prime minister Indira Gandhi decided to nationalise the banking industry. The Parliament passed the Banking Companies (Acquisition and Transfer of Undertakings) Bill, 1969 and nationalised 14 of the country’s largest commercial banks with effect from July 19, 1969. In 1980, the government further nationalised six more commercial banks after which it controlled around 91 percent of the Indian banking industry.

The Indian banking sector underwent yet another upheaval a decade later. Facing an economic crisis in 1991 — caused in large part due to the USSR collapse and the Gulf War — India introduced liberalisation policies that allowed the entry of private banks into the country. HSBC Bank, ICICI Bank, HDFC Bank, and UTI Bank (now Axis Bank) ushered in a new era for the Indian banking sector. HSBC was the first bank to set up an Automated Teller Machine (ATM) in India; it did so in Mumbai in 1987. Soon, ATMs began spreading through the country and ‘plastic money’, in the form of debit cards and credit cards, slowly began gaining popularity as well.

According to RBI statistics, there are currently over two lakh ATMs operated by 46 banks in India. In September 2017 alone, they accounted for Rs 2,42,264 crores in transactions. Credit and debit card users, meanwhile, accounted for Rs 74,094 crores in transactions at Point of Sale (PoS).

Computerisation first entered the Indian banking industry in 1988, and internet banking in the 1990s. But it was only in the 2000s when online payment systems — like Electronic Funds Transfer (EFT), Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), and Interbank Mobile Payment System (IMPS) — started being used.

A digital economy

While NEFT and other forms of online payment required a computer and often featured lengthy transaction times, the new wave of e-payments brought about by digital wallets has made transferring money a lot easier and quicker. Since internet availability and smartphone usage have become virtually ubiquitous, e-wallets like PayU, Paytm, and MobiKwik are being used by millions for financial transactions, both personal and commercial.

The government too is pushing its ‘cashless economy’ missive with the Unified Payments Interface (UPI) system backed up by the BHIM App — an Aadhaar-based mobile wallet which can be used to make digital payments directly from bank accounts.

The demonetisation move by the Narendra Modi-led government saw a sharp uptake in cashless transactions in November and December 2016 — mobile wallet transactions recorded a 114 percent rise, Point of Sale (PoS) transactions an 88 percent rise, and mobile banking transactions a 30 percent rise. From November 2016 to May 2017, the total digital transactions in India went up by 23 percent, from 22.4 million to 27.5 million. A Google-BCG study also predicts that the Indian digital payments industry will grow to $500 billion by 2020, accounting for 15 percent of the GDP.

But in a country whose economy was 90 percent cash-reliant pre-demonetisation, cash remains the most commonly used medium for financial transactions. RBI data shows that as of April 2017, Rs 2,171 billion was withdrawn via ATMs, while UPI transactions at that point were at Rs 22.41 billion, meaning that UPI replaced cash by merely one percent. Cash withdrawals, which were at a low of Rs 850 billion in November 2016, increased to Rs 2,262 billion in March 2017. Pre-demonetisation in October 2016 and September 2016, this was at Rs 2,223 billion and Rs 2,551 billion respectively.

Unlike digital payments, which rely on a steady internet connection and acceptance from both buyer and seller, cash is quick, easy, and instantly available for further offline transactions. That makes it the mode of payment of choice for Indians right now. This is unlikely to change until the digital infrastructure in the country is improved to the extent that every Indian, no matter how remote their location, can make digital transactions as easily as they can pay with cash.

Digital payments themselves are evolving with the inception of cryptocurrency. Since they are a decentralised and highly secure form of money, currencies like Bitcoin, Ethereum, and Monero are rapidly gaining popularity around the world. While it may take a while for them to be accepted as a formal currency by the world’s governments, they are undoubtedly the next step in this long evolution of payments.

Read Also: The dream of cashless India cannot manifest without adequate consumer education