Why are biggies like Ola and Uber looking closely into autos and e-rickshaws?

Ola has been offering autos for four years, and so has Jugnoo. Uber has now re-entered the fray, leading to the question: will autos always be an important mode of transport in India?

Auto rickshaws are ubiquitous with transport in India. For close to 60 years now, different forms of the rickshaw have been the primary mode of transport. Beginning with the pedal-powered cycle rickshaws to the more popular three-wheelers, and now a growing push towards e-rickshaws, autos have always been popular.

“They are easy and simple. Just get on the road and hail an auto. Quick, simple, and completely hassle-free, especially if you have to rush somewhere,” says a 42-year marketing executive in Bengaluru.

No wonder that for several years now, auto rickshaws have been giving the comfortable cabs and the convenient buses a run for their money.

So much so that Bengaluru-based cab aggregator Ola launched Auto as a category in 2014. And early this year, Uber re-launched Uber Auto for a pilot run in a few parts of the city. Jugnoo, the Chandigarh-based startup, has always focused on Autos as a category.

A booming industry

This, of course, comes as no surprise. Industry players have pegged the three-wheeler market to touch a million units in production in the next few years. A news report suggests that the domestic market will touch close to 6 lakh to 7 lakh units by 2019-2020. The report also suggested that passenger-carrying three-wheelers will cross the half-a-million mark in the same time period.

Siddharth Agarwal, Category Head, Ola Auto, says:

“When we talk about mobility for a billion riders, it means providing them with solutions that they like and are comfortable with. When we launched Ola Auto in 2014, the idea was to provide the user easy options to travel. From there we have just added services that will help the end rider. Ola Auto possibly is the only auto service that has Auto WiFi, which provides the rider an option to connect with wifi even in an auto.”

On Friday, Ola also launched the Auto Unnati benefit programme for their Auto driver partners. Explaining the rationale behind this benefit programme, Siddharth says it is to ensure that driver partners make money under any circumstances.

Auto Unnati provides Ola Auto drivers an initiative - Chalo Befikar, which provides the drivers with Rs 40,000 performance-based financial benefit, family welfare, and insurance programmes. The programme also provides a cover of Rs 5,00,000 to driver partners.

“When you talk to driver partners, you realise they are generally focused on day-to-day wages. And these daily earnings are what run their family. If we want to build Auto as a category, we also need to ensure that the driver partners are happy,” he says.

Increased and digitised rides

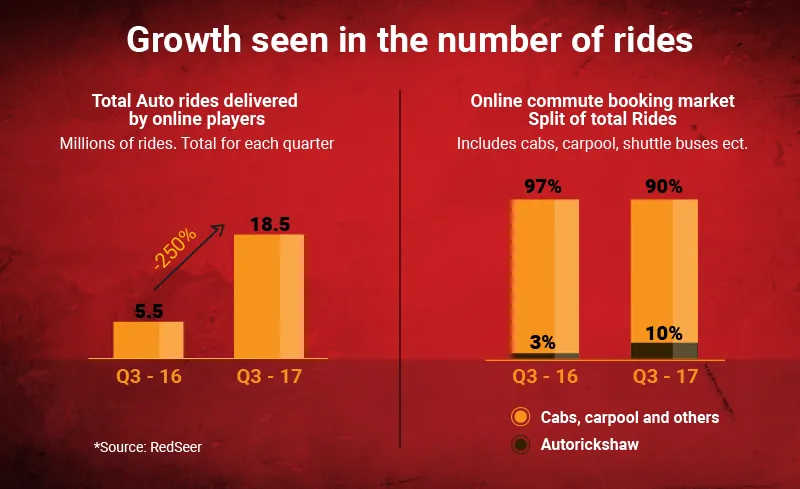

From 2016 to 2017 there has been a significant rise in auto rides. According to a RedSeer report, online bookings for auto rides in 2016 were at 3 percent; in 2017, this rose to 10 percent.

The main reason for this push and growth can also be attributed to driver strikes, which constricted the supply of cabs. However, the fact that autos are still a preferred mode of transport also comes into play. What platforms like Ola, Uber, and Jugnoo have done is streamlined and digitised the access to an auto.

“It is cheaper and simpler. When I was using an auto for a week, I realised how much cheaper an auto ride actually was,” explains a 32-year old consultant. Apart from being cheaper, the auto for many is also synonymous with convenience. Several people have been used to hiring and hailing an auto for close to 60 years now.

“The consumer behaviour shift to hiring an auto online is simpler to make. These people are used to hiring an auto. While they might still ask why do I need an app, what an app essentially does is ensure transparency of service,” an analyst says.

Ola currently has a fleet size of 2,00,000 autos. And the drivers who have signed on to Ola claim that their income has seen a significant increase - close to 40 percent.

“I get the option of flexible timing and rides. To top that, there is no need for me to loiter and drive aimlessly on the road, or wait and haggle for a ride,” says a 35-year old auto driver.

Ola adds that auto drivers have seen a reduction in idle time by close to 35 percent and 22 percent reduction in fuel cost.

A move away from the old auto

An auto is great as a last-mile connectivity option, especially in Tier I cities like Delhi, Mumbai, and Bengaluru. The auto also has multiple use cases.

Samar Singla, Founder and CEO, Jugnoo, says,

“Autos as a category, however, needs to grow. Just using it for a ride doesn't help. That is why we also use it as a mode of delivery, especially in Tier II and III cities. We already have close to a lakh autos, which are used for multiple use cases like delivery, which makes the unit economics healthy and viable.”

He adds that auto as a mode of transport is pretty stagnant. The next phase of growth, according to Samar, is the e-rickshaw. Ola too has piloted the e-rickshaw category in Nagpur, while Jugnoo has done so in Chandigarh.

The switch is happening on a big scale, especially with a government push and focus towards getting over 31 million electric vehicles on road by 2030.

“The electric auto is closed and pollution-free, and it will therefore be more quickly adopted,” an analyst explains. Also, the costs are significantly lower. Ideal for last-mile connectivity, the e-rickshaws are four-seaters, and can cover longer distances. Delhi-based SmartE is looking closely at this space, and aims to get over 100,000 e-rickshaws on the road by 2022.

Currently, Delhi seems to be a thriving hub for e-rickshaws. According to a report by Centre of Civil Society, between April 2013 and March 2017 the number of registered e-rickshaws in the city was at 29,123, but the number of unregistered vehicles was more than a lakh.

There are also companies like Gayam Motor Works, which is developing a e-rickshaw with a battery swapping system and Li-Ion battery.

However, an Asian Development Bank report states that close to 600,000 electric rickshaws that use lead-acid batteries are plying Indian roads.

In that sense, these players are different. Contenders like Kinetic Green and Mahindra & Mahindra are also looking closely at the EV space.

All in all, autos will continue to be a thriving and growing mode of transport, in whichever form.