When will, and can, Flipkart reach this important milestone?

The ecommerce industry has seen a recovery in 2017 and is expected to grow at 30-35% this year. But Flipkart will need to grow faster than the industry to stay ahead in the game.

When Flipkart Group’s FY 2017 Singapore financials became public earlier this month, the attention was on the valuation-slash induced massive 68 percent rise in losses. But, a few key metrics caught our attention and we decided to find out how far the company is from breaking even. This is what we found.

Revenue grew 29 percent to Rs 19,854 crore; losses grew 68 percent to Rs 8,771 crore. However, “fair value loss on derivative financial instruments” (loss due to lowering of valuation) stood at Rs 3,412 crore in FY17. If this is removed then losses grew only by 2.4 percent. A very important metric is gross margin—Flipkart was able to double this from 5 percent in FY16 to 10 percent.

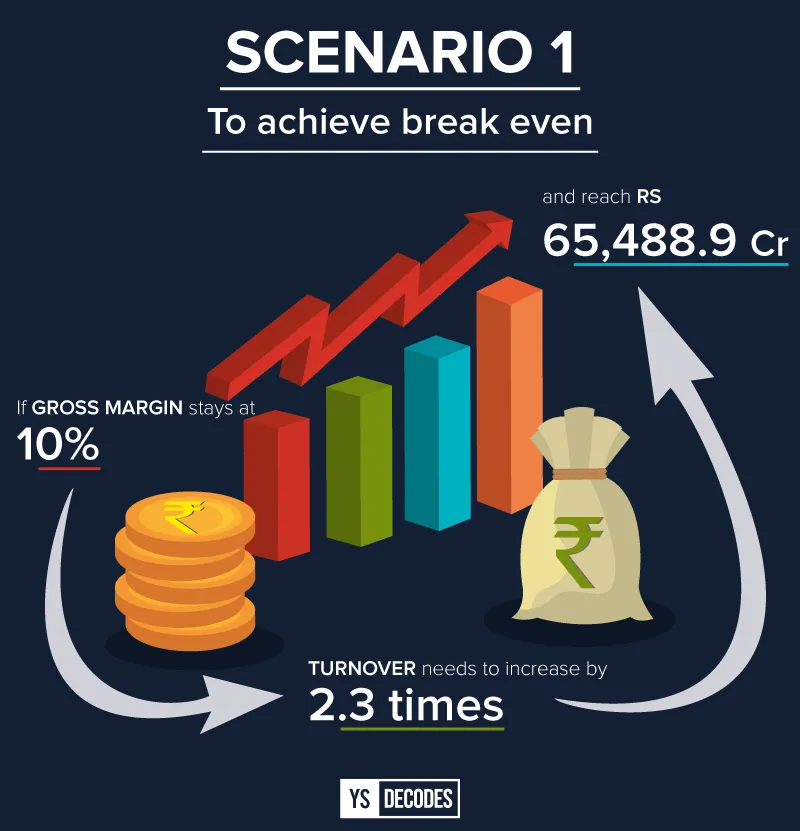

The company’s losses before interest, tax, depreciation and amortization is –Rs 4580.3 crores. In order to break even at the same fixed cost levels we chalked out two scenarios.

The growth

The fact that Flipkart grew its revenue by 29 percent in FY 2017 while keeping costs, especially marketing and advertising (this cost increased by less than 10 percent YoY), down is impressive, say analysts.

Harish H V, Partner India Leadership Team at advisory firm Grant Thornton, says:

The entire sector has performed below potential in the last couple of years. In the last two years growth was around 15 percent. The fact that Flipkart’s revenue grew at 29 percent is very good, considering the realities of the industry that year.”

The ecommerce industry has seen a recovery in calendar year 2017 and is expected to grow between 30 percent and 35 percent this year.

Satish Meena, Senior Forecast Analyst at Forrester Research, says this is the growth rate expected for the next five years.

But Flipkart will have to grow faster than the industry. While it has proved that this is definitely possible even in a slow year, it will be quite difficult for the company to register double the industry growth rate.

K Ganesh, serial entrepreneur and investor, says:

The penetration of Indian ecommerce is still low and the headroom for growth is humungous. They will have to burn money to achieve growth (especially to enter new markets), but they now have deep-pocketed investors so that shouldn’t be a problem.”

Flipkart, which faced a funding drought in 2016, raised almost $4 billion last year. Just two months into 2018 and there is already talk that US retail giant Walmart is in talks to invest in the company. A person with knowledge of the discussions said Walmart is looking to invest upwards of $2 billion into the company. Funding is clearly no longer a challenge.

Also Read: The age of Flipkart

The cost

But with the company flush with funds there is the very real possibility of costs or expenses going up, especially marketing, advertising and employee costs.

Flipkart didn't spend much on marketing and advertising in FY2017 due to lack of visibility on funding. It will spend more on this as it needs to retain market share. If you remove fashion, then Flipkart and Amazon have similar market share, with each at around 30 percent to 31 percent, when not including Myntra and Jabong,” Satish says.

Spends will also increase as Flipkart is now looking to expand its user base into smaller towns and in consumer segments that are not internet-savvy. Apart from advertising and discounting, the company will have to use the data it is sitting on; it will need to build artificial intelligence and machine learning-based tools and start using local languages to reach out to potential customers. The company is already investing in such tools and technologies, but these need to be deployed at a mass scale to get and retain new users.

Flipkart also needs to ensure the existing set of users keep coming back and spend more. For this, it will need to expand and deepen its category offerings.

Making existing shoppers spend more and getting new buyers will not be easy, neither will it come cheap.

“Categories like appliances and furniture still need to grow. It will be incremental increase in spends from these buyers (the ones already shopping online) as no one is going to move their complete spend online. The next set of buyers will take more time to convert. The spends by these consumers will be lower,” Satish says.

Flipkart also needs to come up with an answer to Amazon’s popular subscription service, Prime. Many mature online shoppers have moved to Prime. Amazon is spending millions on Prime and anything that Flipkart comes up with as a response—and the grapevine is that there is going to be a response soon—will require it to spend millions.

The margin

This, however, doesn’t mean that Flipkart has forgotten hard-earned lessons of thrift. We need to go back to the point regarding Flipkart doubling gross margins in FY17 over the previous year.

“Doubling margins is not easy at all. The fact that Flipkart has managed to double gross margins is creditable,” Ganesh says.

To understand why this is such a big deal, we need to just look at the mobiles category—the largest in terms of GMV for online players. This category is notorious for being a low, no and negative margin segment. Only exclusive partnerships ensure high single-digit margins.

Then how did Flipkart ensure high gross margins? The answer lies in the fashion category and in Myntra. Fashion is bringing in high margins at around 20 percent or more. If Flipkart is able to scale furniture then margins could improve as this category too commands high margins.

However, groceries could eat into the margin percentage and Flipkart is definitely scaling up this category this year.

So does increasing margins matter for Flipkart? The manner in which Flipkart is expanding its private label portfolio makes it very clear how important improving margins is for the Bengaluru-headquartered company.

“Only exclusive deals and own labels will ensure high margins. Own labels have margins of upwards of 30 percent,” Ganesh says.

Flipkart has already launched 53 categories under eight private labels since December 2016. The company is set to launch another 165 categories this year in fashion, furniture, and consumer durables. These categories typically offer good margins; its own label will ensure margins as high as 40 percent.

The competition

If Flipkart operated in a bubble with no competition, then there would be no worries about growth or getting to Ebitda positive quickly. But life and business are never so easy. Hence the eternal question of won’t competition with Amazon and Alibaba-backed Paytm Mall drive up costs and take the attention away to protecting territory?

This question is not trivial. Flipkart and Amazon’s cash burn is said to be at 15 percent to 30 percent of GMV. Paytm Mall’s COO Amit Sinha claims their burn is under 10 percent of GMV at Ebitda level.

However, analysts say compared to previous years all the companies are now “better behaved” and are not offering too deep discounts.

Also, if the industry grows as per potential it will not be a winner-take-all game.

Says Ganesh:

This is such a large sector there could be three to four winners. Amazon and Flipkart have both grown. It is not like Amazon has eaten Flipkart’s share. Both have grown. All the retail verticals are very large. Such a large market and such low levels of ecommerce penetration means there is huge room for growth.”

If Flipkart has proved anything in the last decade, it is that it can pull out an ace when the stakes are high.