[App Fridays] With a hybrid encryption approach, Yoti aims to make digital identity verification and transactions more secure

With an ‘encrypt your data and share only what is needed’ approach, Yoti aims to increase trust in peer-to-peer transactions and help business identify customers.

Digital ID verification gives individuals and businesses an easier and more secure way to prove their identities online and enable transactions.

Transforming paper ID documents into digital identities and parsing them through third parties comes with its own risks, given recent data breaches and hacking attempts.

Yoti which recently launched in India provides a digital identity solution that includes hybrid encryption. The company’s website notes that it uses AES 256-bit encryption to secure data and details. The name and date of birth are stored separately, to ensure there is no ‘profile’ of users for hackers to target.

YourStory tested the Yoti app and also spoke to Madhu Nori, International Commercial Director of Yoti, to understand more about the company’s India plans. Here is an overview.

Story so far

Yoti was founded in 2014 by serial entrepreneur Robin Tombs, along with Duncan Francis, and Noel Hayden. After being in public beta for some time in the UK, the company officially launched the app in November 2017 and over 500,000 people have installed the app, so far. Robin, founder and CEO of Yoti explained that after three years of hard work by the team and a successful UK launch, they were bringing Yoti to India, where nearly 300 million adults have smartphones. He said in a statement,

“As we live more of our lives online, the way we prove who we are is outdated. Yoti makes it faster, simpler and more secure for people and businesses to prove identities and know who they are dealing with. We are helping them fight back against everyday issues - such as identity fraud and online scams - which cost time, money, and emotional distress.”

According to Madhu, on an average, Yoti sees about 5000 installs a day.

Prior to joining Yoti, Madhu worked with the Bharti Group and had helped start the Bharti-Softbank joint venture in India. Yoti comprises a 215-member global team, headquartered in the UK, with an Indian office in Mumbai.

“India is a large and key market for us. For our current phase of growth, we see key three markets - UK, the US and India. Consumers are increasingly aware of the relevance and the impact of linking identity to access services and are keen to protect the misuse of private information. We are making significant technology investments and have designed our product to work with multiple verification sources including Aadhaar, PAN, and driving licence databases, he informs.”

The founding team of Yoti has invested $35 million with the aim of fixing the outdated identity system.

Madhu has made frequent visits to India in the recent past to meet and work with regulators and companies and is serious about the company being in India for “the long haul.” On his visits, he also met Ajay Bhushan Pandey, CEO, UIDAI to explore possibilities on how Yoti could be added as consumer enabling layer on top of Aadhaar.

Yoti is already working with leading businesses in India and details of the specific brands will be disclosed by the end of this month. Madhu added,

The notion of identity verification is central to many businesses, whether it is classifields, banking, or peer-to-peer transactions. We are seeing a positive response from businesses in India.

How Yoti works

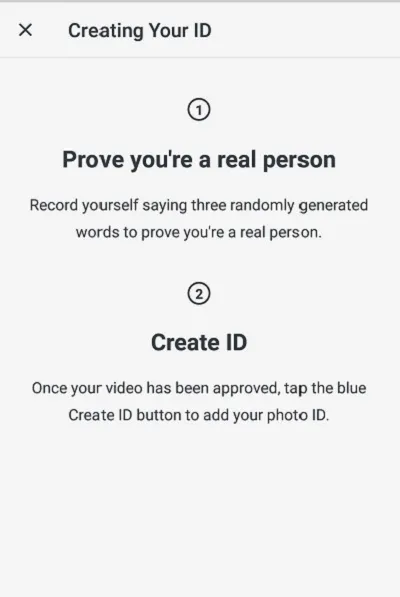

On installing the app, users can sign up by taking a selfie and speaking three random words that pop up on the screen into the microphone. In the final step, they will need to scan their passport with their smartphone.

The passport scan at the time of verification is used to verify details like name, date of birth and nationality; the company notes that this data is then deleted from Yoti’s systems.

In the coming months, Yoti will also support other Indian documents like Aadhaar, driving licence, and PAN.

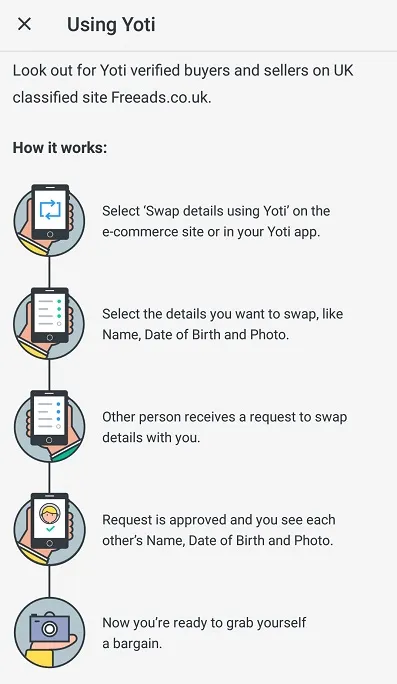

The app uses hybrid encryption to secure user details and puts individuals in control of their data - people know exactly what details they share and with who, instead of disclosing their full identity with a paper ID document.

Yoti claims that the app is so secure that only the individual can see his personal data – it is not visible to even Yoti.

Yoti’s use cases include helping people prove identities to businesses without showing and photocopying paper documents. Logging into websites securely using biometrics instead of passwords and also confirming identity details during peer-to-peer transactions on classified websites and even dating platforms are other use cases.

According to its founders, Yoti will always remain free to use for end consumers and the company will earn revenue from businesses directly. The aim is to help businesses slash the time and cost required to verify customers and help them fight the growing threat of identity fraud.

Sector overview and future plans

India is considered one of the most susceptible markets in Asia to online scams, with 48 percent of consumers having experienced retail fraud directly or indirectly. Platforms like Facebook, Google, and Truecaller are some of the other players in the space that directly or indirectly help businesses and people verify identities and built trust.

On the global front platforms like LexisNexis, Experian and Equifax help businesses verify identities of people and ascertain their creditworthiness.

Madhu estimates the global market for verification and background checks is about $32 billion and Yoti’s USP is that its solution is available at lower costs and more secure, compared to current industry giants.

Yoti is also working on leveraging Blockchain technology and had also presented one of their Proof of Concept applications at the World Economic Forum in Davos. The demo showcased how Yoti could be linked to an asset, which could then be stored securely on a private Blockchain.

Yoti’s goal for 2018 is to reach two million installs and also work with more businesses and local governments. Madhu noted that Yoti customises its workflow to work with different local infrastructure. For example, the company works with the Department of Motor Vehicles (DMV) to authenticate drivers' licences. In India its aims to partner with local bodies in a similar manner.

Website - Yoti

You can also find the app here for Apple and Android devices.

![[App Fridays] With a hybrid encryption approach, Yoti aims to make digital identity verification and transactions more secure](https://images.yourstory.com/cs/wordpress/2018/03/Yoti-Robin-2.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)