Internet penetration may be rising, but the urban-rural digital divide remains a reality in India

India is rising, but 60 percent of Indians don’t have access to the internet and many large pockets are not penetrated by the information highway. Your Story explores the state of the internet in India and lists down the opportunities ahead for internet-based consumption.

In metros and major Indian cities, the buzzwords are artificial intelligence and Blockchain. But in the 6,00,000 villages and 7,935 towns, the buzzwords remain loan waivers, subsidies, and political power struggles. For the internet has not penetrated rural India as deeply as religion or politics.

India’s internet consumption – though on the rise – largely remains an urban phenomenon. In December 2017, internet penetration in urban India was at 64.84 percent as compared to 60.6 per cent in December 2016. In rural India, however, internet penetration was at 20.26 percent in December 2017, from 18 percent in 2016. The report, titled Internet in India 2017, was released by the Internet and Mobile Association of India.

Things have changed radically in urban areas in the last decade, but have been slow in rural areas. It’s the next 10 years that promise to transform India’s hinterlands.

To bridge the digital divide, the Narendra Modi-run BJP government has disbursed Rs 34,000 crore to lay high-speed internet in 150,000 villages by 2019. But the Bharat Net Programme, earlier called the National Optic Fibre Network, whose high-speed optic fibre network aims to change the lives many Indians through internet services is yet to make an impact. Only 67,271 villages have been covered till now and the government needs to double its efforts in one year to reach the target . Even then only 30 percent of Indian villages will have internet coverage.

A Deloitte India report released in January 2018 revealed that with only 17 percent internet penetration, rural India is lagging behind in connectivity owing to challenges in deployment of fixed broadband networks.

But despite that, things are positive.

Mohandas Pai, Chairman of Manipal Global Education, says: “Digital connectivity is going to make Indians productive. Information will change the way people work, there will be several new businesses and ideas that will make policy makers play catch-up, and eventually support this new wave of growth in the country.”

Betting on the internet

These seeds of change were sown way back in 2005 with several businessmen betting on the future of India.

Kishore Biyani, the Founder of the Future Group, was among them. In December 2005, when retail was becoming the next big thing, he conceived an online play to catch consumers on the internet. In April 2006, he launched FutureBazaar.in, which became a Rs 120 crore business by 2009. Back then, internet penetration in India was as low as 5 million people, but Biyani was right to bet on consumption.

“India’s consumption will continue to grow as incomes are on the rise,” Kishore says.

Although the limelight of the retail internet was stolen by Flipkart, Snapdeal, and several others by 2014, there was no denying that the bets made by Biyani, on the country’s fortunes, remain relevant even a decade later.

According to TRAI, the number of broadband connections in India is 276.52 million.

While this data tells us how India has leap-frogged into the digital era, consumption today largely remains an urban phenomenon. It may have touched the lives of 90 million Indians in 10 years, but what of the 450 million middle-class Indians living across the country? Will they take less than a decade to use the internet? Also, around 600 million rural Indians are poised to adopt the consumer internet. The question is how and why are middle-class and the rural households poised to go digital?

Sreedhar Prasad, KPMG Partner and Head of Consumer Markets at the consulting firm, has a thought. “It is going to increase manifold because of four or five things. It will be led by aspirations of the rural consumer, because of inexpensive data plans, and fall in smartphone prices,” he says.

KPMG's Sreedhar says the following is bound to happen in two to three years:

- Middle school kids in cities will consume the internet on smartphones.

- Native language content will be consumed by migrant workers.

- Data plans of all telecom operators will be fall.

- Smartphone costs will drop to below Rs 4,000.

- Urban Indians will begin to subscribe to content on the internet (Amazon Prime, WYNK, Byjus).

- Indians, who used the net for marriages and jobs, will now use it to explore content.

- There will be internet-first brands (in FMCG, apparel and electronics).

Democratising consumption

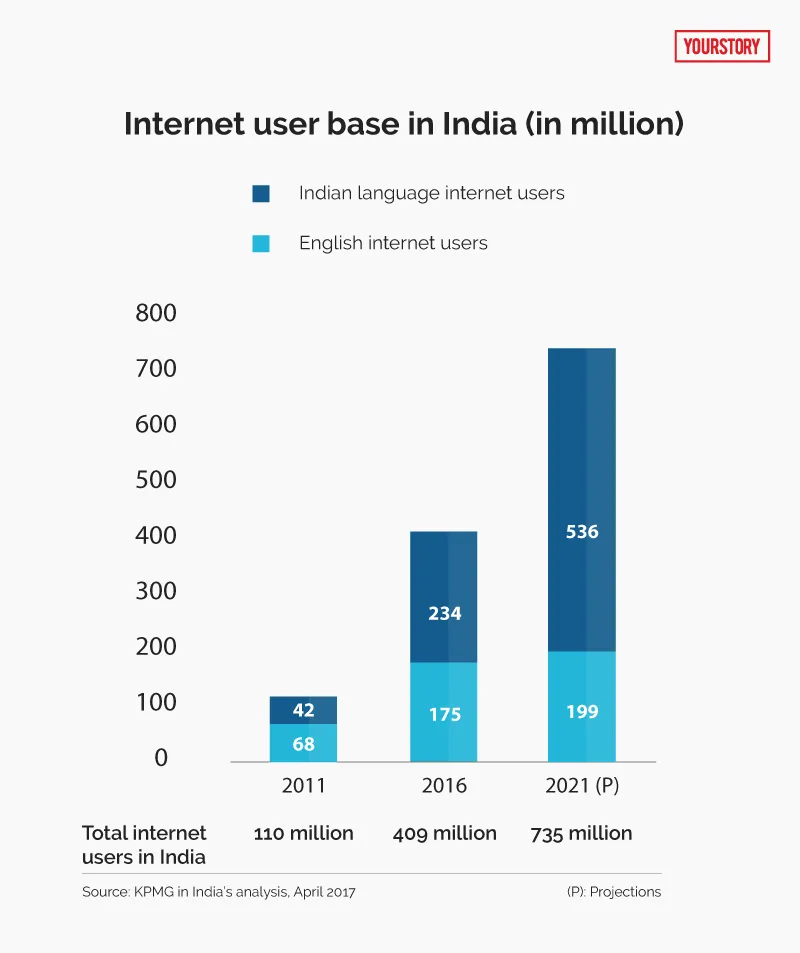

According to PWC, the internet has gone from a mere 75 million users in 2010 to 450 million people in 2017. This number is expected to exceed 600 million by 2020. Large-scale adoption of the internet has enabled several new businesses to push products and services over it.

Chetan Anand, Director, PWC, says, “Internet has brought the convenience of communication, education, shopping, entertainment, banking, and a host of other services into the hands of every individual. It has actually democratised consumption and has played a pivotal role in changing the lives of Indians.” He adds that consumption is not restricted to e-commerce powered physical products but also data-driven virtual services.

The Indian ecommerce industry, according to PWC, was worth about $4 billion, in 2010, and is worth $50 billion by Gross Merchandise Value (GMV) in 2017. The growth in B2C ecommerce is testimony to the increased consumption.

Professor S Sadagopan, Director, IIIT-B, says: “Today, the internet has built services where people don’t really have to own assets. Businesses like Uber, Ola, Oyo Rooms, Flipkart, and Amazon have shown that you can build a great business without really owning any asset.” He adds that technology is at the forefront of every industry and for Indian businesses, be it family or corporate, which are learning from global changes.

Internet in the other India

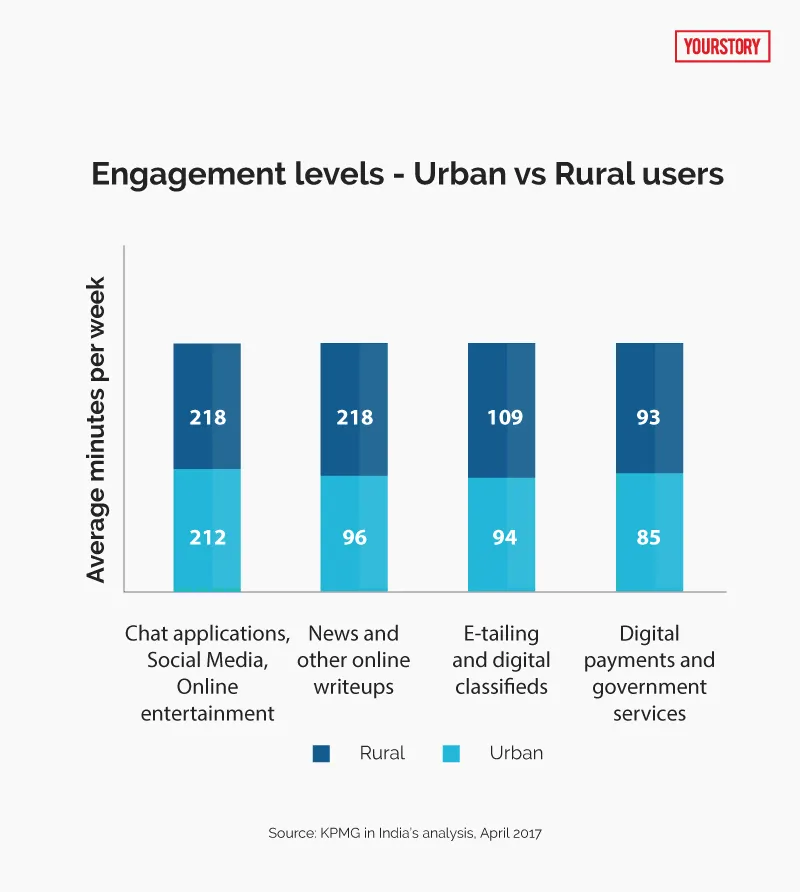

In rural areas of India, smartphones and not laptops are becoming the primary consumption devices. According to a recent report released by the Internet and Mobile Association of India (IAMAI), most people in rural areas access the internet for entertainment, followed by online communication and social networking. But across small towns and villages, the internet is driving growth in various industries and sectors.

- The truck operators

Bhaskar Bonepalli, owns about 10 trucks, and is an agent to 100 truck owners in the agricultural market town of Hoskote, just outside Bengaluru. His is a cash business; he is contacted by logistics companies to hire trucks and provide cargo delivery schedules to truck drivers. He gets several calls from brands, but has no knowledge of how many trucks are available. He grapples with not being able to use all the 110 trucks at his disposal. So he goes online. Downloading an app called LOBB gives him access to the demand and supply side of the business.

“I can seamlessly connect all my trucks to the demand made available on the LOBB platform; it increases my truck utilisation and keeps my network happy. I even transfer payments online via the unified payment interface,” says Bhaskar, who owns Bhavya Roadlines.

The tech company that is working with 10,000 such truckers and 200-odd brands is LOBB. Venu Kondur and Jayaram Raju, both veterans of the tech and logistics industry, created this platform to increase faster movement of goods across the country.

“Only when goods move faster across the country will the GDP grow faster, and technology is an enabler for that growth,” says Jayaram Raju, Co-founder of LOBB, the company whose ARR is going to be $15 million by the end of FY2018.

- The content explorers

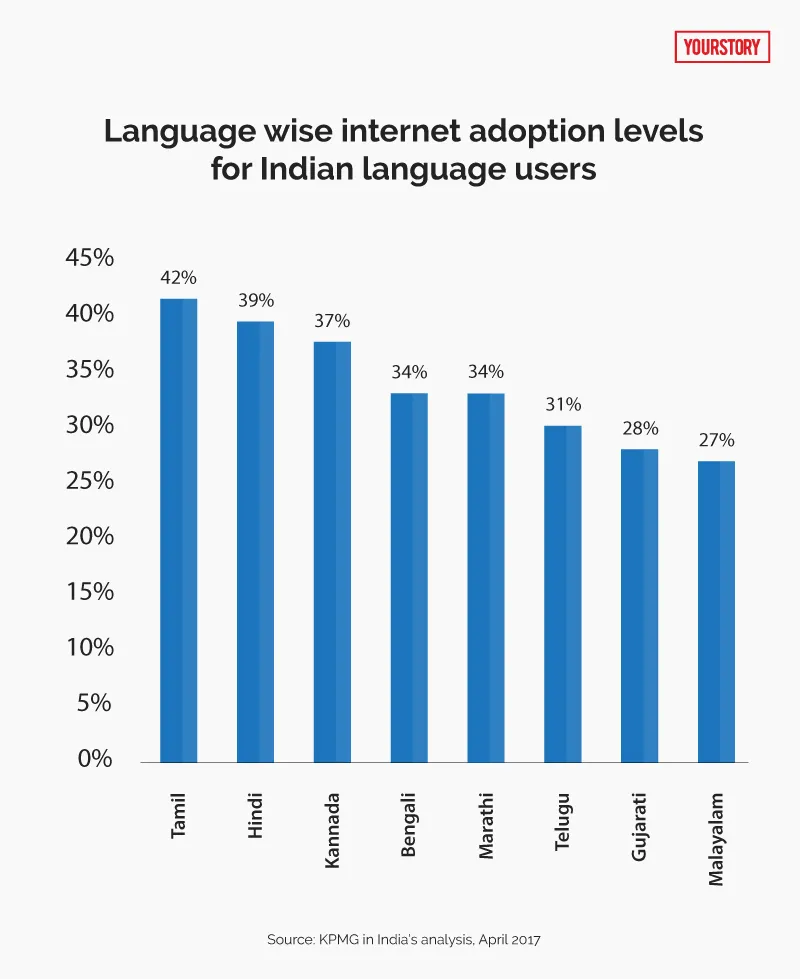

Venkatesh Kumar, from Kuppam, a small town in Andhra Pradesh, works at Bengaluru airport as a taxi driver. He uses his smartphone to consume political and entertainment news. He subscribes to Daily Hunt, a news aggregator for local language content. “I get two trips a day, at the airport, I spend a minimum of five hours reading content in Telugu,” he says.

Veerendra Gupta, Founder and CEO of Dailyhunt, says: “We are focussed on ensuring that our audiences get a great personalised experience when they come to the platform.”

This form of smartphone-based consumption and communication is also impacting small retail stores spread across India.

- The small store example

There are more than 12 million small stores, according to the Retail Association of India, and technologies are transformation.

Roshan Setty , a fourth-generation small department store owner, in Malleshwaram, Bengaluru, owns Venkateshwara Stores and has enabled digital POS in his store. He uses SMS and WhatsApp to promote offers and even has a digital TV, where FMCG companies compete for ads and customer eyeballs.

“For a very long time my family was working on 3 percent net margins; life was about savings and putting money back into adding product category. We did not connect with our customers through any technology. Using the internet and apps, we have been able to work with brands better and serve customers faster. We have doubled our margins in the process,” Roshan says.

Prem Kumar, Founder & CEO, SnapBizz, whose technology works with small stores, says, “The ubiquitous kirana or the small retail store, which is taking care of every neighborhood’s small and significant requirements has leapfrogged from a calculator to cloud for day-to-day operations.” SnapBizz, which has raised $10 million, works with more than 3000 kirana stores and has brought them into the cloud.

Smaller stores have adopted technology to automate supply chain and enhance consumer engagement. Within the confines of a traditional setup, digital tools such as SMS offers and in-store LED screens are making an impact on customer perception and sales. Kirana stores are now being transformed into a virtual supermarket, providing customers with an enhanced shopping experience.

According to a survey conducted by Snapbizz, of over 600 kirana stores spread across urban India, almost “half are sending promotional offers via WhatsApp and SMS using our push offer service”.

Promotional messages account for 53 percent of the total SMSs sent to customers. In Mumbai alone, more than 5 lakh text messages were shared with customers. Some stores have noticed increased sales with the help of customised texts and visual engagement solutions. About 23 percent shop owners communicate and engage with customers beyond the regular communication by sending across festive greetings and store information.

“We have noticed that the changes at the macro-economic level, including digital India, inclusion, and skilling of the bottom of the pyramid as well as at the store level where the new generation enters the business with a renewed outlook, are steering the appetite to adopt technology to simplify business,” says Prem Kumar.

- A case for education

Shreedhar Prasad, of KPMG, states that “children in Grade 8 grade will start consuming content through smartphones”. Studies show this may well be true.

A study by Google and KPMG says:

- The online education industry, worth $247 million today, is expected to grow to $1.96 billion by 2021.

- 280 million kids will enroll in schools by 2021 and with parents focusing on digital interventions, this will mean a 39 percent market share.

- Online reskilling is very popular in India with 38 percent market share.

“Education will be hybrid, which will be a mix of the online and offline world,” says Mohandas Pai, Chairman of Manipal Education.

- Tech in agriculture

In the heat of Tirunalveli, a Tier IV city in Tamil Nadu, Benjamin Raja toils 14 hours a day, ensuring that the right amounts of water are in his 100-acre farm and the right amount of fertilizers are injected into the crop. He grows vegetables and fruit for retail stores in cities like Bengaluru. He has increased the yield of watermelon from 2 tonnes per acre to 6 tonnes per acre, with the help of IoT devices.

“I use the networks to get information on cropping patterns and soil conditions to increase yields,” says Benjamin Raja of Farm Again. He has aggregated 5,000 acres of farms across India and uses the internet to collect real-time information on crops from farmers across India to give them advice on cropping, fertiliser use, and market linkages. His business supplies to Reliance Retail and Future Group.

- Ecommerce, payments and stock trading

Reghu Kumar, Ravi Kumar, and Shrinivas Viswananth started Upstox with the objective of making retail stock trading democratic.

“India is going to grow in a totally different way than the US did. In the US, you saw the economy boom first and then the internet gave it a new strength. In India, you are seeing the internet boom first, which will then be followed by an economic boom,” Shrinivas says.

In India, services like payments have leap-frogged; an individual can send money to someone instantly with government infrastructure. In the US, it still takes a few days to clear payments. The other impressive thing about the Indian payment ecosystem is that the US is focused on low-volume, high-value transactions. In India, it's the reverse.

“We use the internet for a lot for high-volume, low-value transactions. The story is not the same, but there is growth; look at the economic growth numbers,” Shrinivas says.

Upstox is increasingly looking at Tier II cities as there’s a new aspirational class growing in these areas.

“A lot of young adults with their first or second job are looking to take a foreign trip or buy luxury goods. For them, the traditional areas of savings such as gold and real estate have lost their lustre,” Shrinivas says. With internet connectivity mushrooming in every part of the country, these people are just as connected to the world as someone living in Delhi or Mumbai.

It's a big shift that’s happening in a short period of time and there are market opportunities everywhere. No wonder Amazon India serves even the remotest parts of India these days.

Akhil Saxena, Vice President, India Customer Fulfilment, Amazon India, says, “We have now launched our own delivery services in Leh-Ladakh, Lakshadweep, Tripura, Jharkhand, and Meghalaya. This will ensure that customers in these regions now have the benefit of faster, reliable Amazon deliveries. We have seen significant new customer acquisition from Tier II, III, and IV cities, including Prime memberships,”

For Amazon, this growth in the delivery network will also create numerous opportunities for local entrepreneurs to scale their business under Amazon’s “I Have Space” and Service Partner Programmes. Amazon has added 5,000 IHS partners and 100 Service Partner nodes in the last few months, strengthening their last-mile capability.

The Service Partner programme is one of the last mile models by Amazon Logistics where entrepreneurs act as Amazon’s local distribution network providers and create the last mile delivery footprints. The company now has over 350 Service Partner nodes across the country, including in Agartala, Nagercoil, Allepey, Havelock islands, Shillong, Porbandar, Lonavala, Faridkot, Jind, Haldwani, and Bhilai to name a few.

So, let us just jump back to cities for the moment, consumers are already using payment platforms like Perpule and BluPay for self-checkouts in physical stores. It is only a matter of time where consumers in rural regions to will begin to use digital modes of payment Perpule for example integrates UPI and all form of payment for individuals to use the network to go cashless and check out without a line. Over 60000 customers use Perpule on a regular basis to avoid lines in retail stores such as HyperCity, SPAR and More.

Ultimately, consumption is increasing as GDP is growing at 7.2 percent. If India continues expanding its consumer base, the internet will play a major role in winning new consumers in all verticals. It took a decade to have 90 million internet-based consumers; it will now take less than five years to possibly double that number and in two decades may be will have networks cover all individuals in India (rural and urban).

“All this depends on growth supported by good governance. If incomes rise, the internet businesses will succeed and India will continue to grow in physical and digital environments,” Mohandas Pai says.