Expanding reach with 1000 cities, how does Lendingkart stack up in numbers?

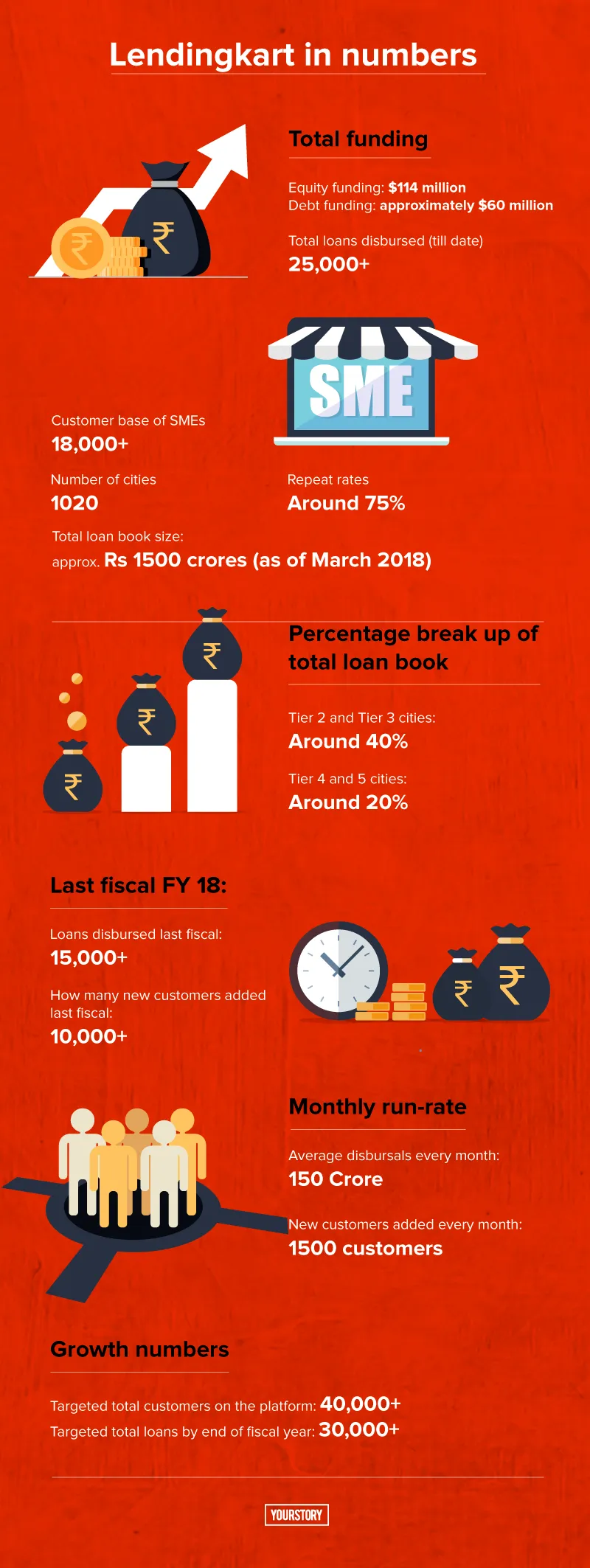

On Tuesday, NBFC Lendingkart Finance Ltd. stated that it has expanded its reach and facilitated loans to 1,000 cities in India, disbursing more than 25,000 loans across 26 diverse sectors.

In a statement, the company said that it has received requests from more than 650,000 MSMEs till date and has evaluated over 150,000 requests to validate the creditworthiness of applicants.

Speaking on the milestone, Harshvardhan Lunia, CEO and Cofounder, Lendingkart Technologies, added,

“When we started Lendingkart, we wanted to ensure that we reach every nook and corner of the country. And disbursing loans to applicants across 1000 cites while having offices only in Bengaluru, Mumbai, and Ahmedabad is a strong testament of it.”

According to the company, at present around 40 percent of total loan book comprises borrowers from Tier 2 and Tier 3 cities while around 20 percent are from Tier 4 and Tier 5 geographies.

Some of these towns include Zirakpur (Punjab), Rudrapur (Uttaranchal), Dhenkanal (Odisha), Veraval (Gujarat), Aurangabad (Maharashtra), Jhalawar (Rajasthan), Salem and Madurai (Tamil Nadu), Bina and Katni (Madhya Pradesh), Jamshedpur (Jharkhand), Unnao (Uttar Pradesh), Jhajjar (Haryana), amongst others.

Speaking to YourStory, Harshvardhan said that the platform is adding close to 20-25 cities every month. Further, only 2,000 of the 50,000 customers coming on the platform on a monthly basis are from Tier 1 cities.

Most of Lendingkart’s customers are MSMEs involved in the last-mile and are borrowing for the first or the second time. The average ticket size of loans requested on the platform is Rs 4 to 5 lakh with an average duration of 12 to 15 months. And the typical age of the borrower is anywhere close to 33 to 40 years of age.

Considering the run-rate, the company is positive that it will be adding close to 300-400 new cities by the end of this fiscal year.

So, what worked for Lendingkart?

Harshvardhan says that a strong reason for this growth is by understanding the needs of the consumers and answering their requests in a timely manner, even if it’s a rejection.

Next is the convenience of the digital platform which saves time from from cumbersome physical checks and submitting documentation. Being completely digital also allows SME owners to reach Lendingkart at any given point of time.

Harshvardhan does not deny that reference is a huge part of incoming business requests.

Inch wide and mile deep

Harsh accepts that unlike its competitors, Lendingkart plans to focus on its current offerings and take it to more customers this year. He adds,

“We want to have a focussed approach and unlike competition not do different things or look at differentiated offerings for things. So, not much will change for us this year, accept for growth.”

At present, Lendingkart looks at providing working capital loans and inventory management advances as credit.

Earlier in January when the company closed its Series C of $87 million, Harshvardhan stated that they were looking at launching a bill discounting credit product for MSMEs. The founder states that it is still in the works and will be launched in the second half of the year.

“We will stick to MSMEs and anything that can help them with their business. But the market is so huge that the merit lies in growing the business, until we have reached a scale and size.”

Battling it out

Lendingkart faces competition from Bengaluru-based Capital Float who in April had announced it had closed its Series C of $67 million.

The latest fund-raise took Capital Float's total equity funding to nearly $110 million, and total debt funding from banks and NBFCs to $130 million till date. While Lendingkart in January said that it raised a total of $114 million in equity funding and close to $60 million in debt funding cumulatively.

In April, Capital Float said that the company has close to 60,000 customers and is adding 10,000-12,000 new customers every month. The founders also say that close to 50-70 percent of the loans are for repeat customers.

On the other end, Lendingkart states that it has more than 40,000 customers on its platform and is adding close to 1,500 customers every month.

Capital Float announced that it had added close to 50,000 customers alone last fiscal, while this number stood at more than 10,000 for Lendingkart.

The company also disbursed close to Rs 4,500 crore in loans through its platform, while looking to disburse another Rs 5000 crores this fiscal.

In comparison, Lendingkart had stated that it looked at reaching a target of Rs 1,500 crores in loans disbursed by end of March 2018 and reach a loan book to Rs 2,500 crore by end of FY 19.

Clearly, while Lendingkart is looking to take its basic lending product to the masses, Capital Float is looking at product diversification to cover the entire gamut of credit and increase its customer base.

![[Funding alert] VC firm Blinc to invest Rs 100 Cr in six startups](https://images.yourstory.com/cs/2/e641e900925711e9926177f451727da9/22265cf85e81b81fec5f899e3c7452e3348eee838936ca9df1e9f1fbb89af75f-1618375614525.png)