From delivery and eating out to managing restaurants’ supply chain, Zomato wants a bite of all things edible

Zomato has been in business for 10 years now, but in the past year it has diversified into areas where its competitors are yet to make inroads. Its entry into the supply chain business could be a game-changer if it succeeds.

Zomato Founder and CEO Deepinder Goyal is a man on a mission. He wants people to stop cooking every day. And in an era where wallet-conscious consumers are also more health-conscious and concerned about the quality of the food they eat, he knows it’s not an easy sell. And then there’s competition in the form of Swiggy, UberEats, FoodPanda, etc. Those challenges, however, seem par for the course.

Deepinder sums up their ambition when he says, “It isn’t only about delivery or listings or the supply anymore - it is about everything (related to food and food delivery).”

In the past 15 months, Zomato has created a presence for itself beyond food delivery into eating out, food pickup, and even the supply chain.

A year back, it announced Zomato Gold, its subscription programme, which allowed customers to get steep discounts and free dishes at a long list of restaurants. Its loyalty programme, Piggybank, was launched in July this year. Two months later, it acquired TongueStun for $18 million to enter the canteen aggregation place. In October, it acquired WOTU, a raw materials and ingredients supplies platform for restaurants, now rebranded as HyperPure.

To some, it might seem like too much, too soon, and the flurry of activity at their Gurugram headquarters at 3.00 pm on a Thursday afternoon certainly seems to reinforce it. But as an employee assures me, “This is how we work here. It’s always like this!” And once I meet Deepinder in person, I realise that the hustle and bustle is all part of a clear strategy, internally referred to as Triple A and Q (AAA + Q).

“Assortment, Affordability, Accessibility and Quality – it is about being a part of every value in the food chain and being a complete food business,” explains Deepinder.

Zomato started life as a restaurant review platform. In the decade that followed, it has repeatedly upped the ante in food tech. In 2015, it ran a small pilot in delivery and then plunged in full time into a space where rival Swiggy had the first-mover advantage. One of the As stands for Assortment, and yet, Zomato has stayed away from the cloud-kitchen model that Swiggy started, much to the dismay of several restaurant partners.

“We have been saying this for three years. We work for the restaurant partners,” says Deepinder. And supply for Zomato works differently: “It is about helping restaurant partners grow. We are even adding packaging as a part of the quality control.”

An assortment of options

To increase assortment and ease of access, Zomato has invested in Bengaluru-based Loyal Hospitality, which provides ready-to-move-in kitchen spaces, which restaurant brands can use to prepare food only for delivery and even have a delivery-only menu. Swiggy, under the Access sub-brand is also setting up kitchen spaces to help restaurant partners move in and deliver certain menu items. Rival Uber Eats has tied up with Cafe Coffee Day for this.

The advantage for restaurant owners is wider reach at a fraction of the cost. Training on how to prioritise orders only for delivery, etc, is provided by Zomato, so it was a matter of convincing them to tie up with the company. And given that they’ve been working with these partners for close to 10 years, it wasn’t difficult. “We have established a certain trust with them,” he explains.

Why accessibility matters

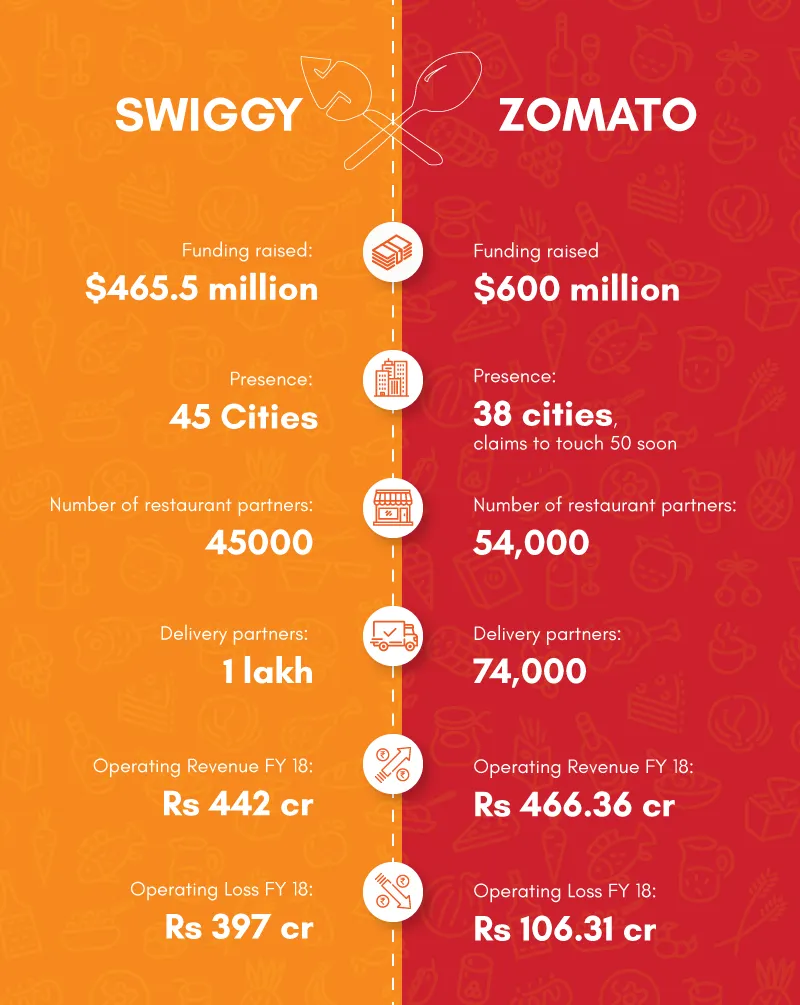

Delivery is one of the biggest growth drivers for Zomato and accounts for 50-65 percent of the company’s overall revenues. (Zomato reported revenues of Rs 466.36 crore for FY 2018.) Despite having started out a year after Swiggy in the delivery space, Zomato has built up a formidable network of restaurant-partners. It has 54,000 restaurant partners at present and in the next couple of weeks, it plans to deliver in close to 50 cities from over 74,000 restaurants.

At 21 million orders a month, it stands neck-and-neck with Swiggy, which reportedly clocks a little over 24 million orders a month.

Another driver for the delivery business has been Zomato Pickup. A user can place an order on the platform and choose to pick it up from the restaurant themselves – usually one close by, because they want to avoid waiting for food.

“There are a lot of restaurants in our building and many of us were doing it (picking up lunch). We spoke to a bunch of restaurants and realised that they get a lot of pickup volume and launched the feature. Today, Zomato Pickup is present in 12 cities," Deepinder says.

Zomato also has a few restaurant partners as a part of Zomato Exclusive, who deliver only through Zomato and no other online platform. In return, Zomato gives them benefits like advertising, better visibility and deeper data insights on consumer behaviour patterns.

The business of affordability

The listings and delivery business takes care of assortment and accessibility. When it comes to the third A, affordability, Zomato has a two-pronged strategy. One is single-serve meals, which it recently piloted. Currently, the single-serve meal options fall in the overall menu and listings The meals fall within the sweet spot of Rs 60 to Rs 100. These include plated or combination meals, Swiggy’s equivalent is Swiggy Pop.

But where Zomato came up with a masterstroke, say industry watchers, is with Zomato Gold, its membership programme for a premium drinks-and-dining experience.

“Usually, when you choose to step out and eat with your family or friends, it is restricted to occasions as a meal with drinks averages at Rs 4,000, but with Gold, that amount can be reduced to Rs 2,000 to Rs 3,000,” says Gaurav Gupta, COO, Zomato.

Users get benefits like a complimentary dish and two complimentary drinks every time they choose to drink or dine at any Zomato-partnered restaurants in India and 8 other markets. Currently, the best performing city for Gold is Mumbai.

“The idea was to create a programme that gives incentives to people to eat out. It works as a privilege programme,” says Gaurav.

Which brings us to the Q – Quality

So why would a company primarily in the business of food delivery want to enter the business of supply chain management? It all goes back to their idea of being present in every aspect of food and food delivery – good food for more people.

According to Gaurav, affordability, quality, and easy access are the main reasons why people choose to eat at home.

“When you say you want home-like food, you are essentially talking about quality. The consumer is asking - can I trust the kitchen and the ingredients? Imagine if restaurants match this 10 on 10 on AAAQ, we would change behaviour and reduce the number of times people eat at home,” he explains.

Adds Deepinder, “Increasing AAAQ (Accessibility, Affordability, Assortment and Quality) is the way we think we can solve for this; and to deliver on Q (quality), we need to transform the ecosystem. Hence our entry into delivering ingredients to build trust on quality through traceability.”

And so, in October this year, Zomato acquired Bengaluru-based raw materials and procurement startup WOTU (We Organise The Unorganised) and rebranded it as HyperPure, which is currently is run by Founder Dhruv Sawhney inside Zomato.

Says Dhruv,

“Sourcing is an operational nightmare for restaurants. From inconsistency in quantity and quality of ingredients to unreliability in delivery of the products to wastage and pilferage, operational challenges, which are not even related to cooking and take up most of the time of restaurants.”

HyperPure procures raw materials and ingredients directly from the source and has tied up with produce farmers and poultry farmers. They have tied up with farmers who don’t use pesticides and have partnerships with larger organisations for big-ticket items. To test and ensure high quality of ingredients and later food, Zomato roped in Equinox Labs, which tests the quality of food produce.

“HyperPure has been streamlining the supply chain by getting everything under one shop. We can even forecast demand for restaurants using machine learning. This eliminates the need for overstocking. And fixed pricing for a monthly duration allows better planning and competitive prices for owners,” adds Dhruv.

The segment in its pilot phase with 300 participating restaurants and reportedly has an order book of $5 million.

Says an investment analyst, “If you look at it, each vertical acts like a separate business. It is one of the main reasons that the team has been overhauling and working on its core management. In the past six months, the team has hired and re-shuffled its staff.”

But according to him what works in Zomato’s favour is the fact that the latter has multiple sources of revenue: advertising revenue from listings, subscription revenue from Zomato Gold, and now services revenue from HyperPure.

“Though Swiggy has a subscription plan (Swiggy Super) the platform’s revenue isn’t as diverse - it primarily comes from delivery. Zomato has added a layer to its existing revenue inflow with B2B supply, HyperPure,” says another investor on the condition of anonymity.

Deepinder believes Zomato cannot be compared with other foodtech companies. “They are different models, especially Swiggy and Zomato. They are all logistics, we were more marketplace driven until last year. If you are just doing delivery you can charge 25 percent - it costs you 18 percent. We are charging seven percent, and to top it Swiggy has its own restaurants, and that adds to the revenue. People still like to compare. But we are different from Swiggy.”

So, what’s next?

“Can’t tell you,” says Deepinder, “Today, we sent out a reminder on information confidentiality. Two years back, I would have told you these things. But today the level of competitive intensity is just too high. The first-mover advantage helps a lot in these things.”

Market experts believe that the 10-year-old company has undertaken on a daunting task, of taking on the challenges getting the supply right. and it will be interesting to see how it gains further success and scale.