PayPal

View Brand PublisherHow cross-border trade in services will drive economic growth in a post-COVID 19 world?

As the world is still grappling with the COVID-19 coronavirus and governments move back and forth between lockdowns and reopening borders, businesses continue to be impacted especially those involving goods. However, there has been an uptick in the demand for digital services.

Prior to the pandemic, the 2019 Handbook of Statistics estimated that international trade in services accounted for seven percent of the world’s GDP. Sectors that felt minimal impact included finance, telecom, and computer-related services, which could be delivered online. Amidst the lockdown, more businesses transitioned online and began reaching out not only to domestic customers but leveraging the global consumer base.

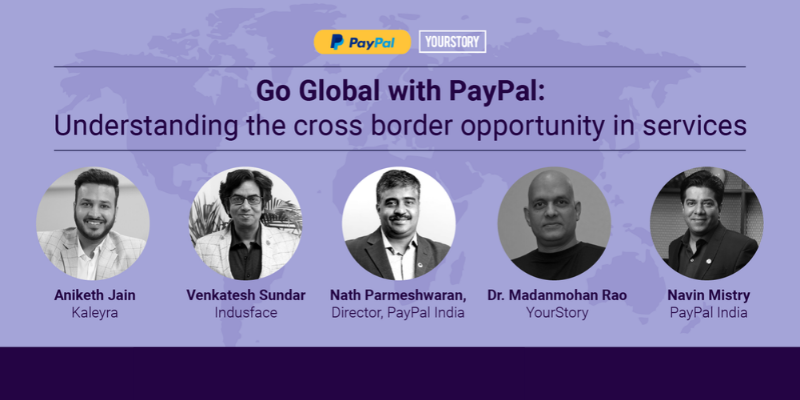

To better understand this newer trends that are emerging, PayPal and YourStory have partnered to organise a series of webinars focused on helping Indian businesses scale operations and leverage this global opportunity to help revive the economy

In the first session on Understanding Cross-border Trade in Services, Madanmohan Rao, Research Director at YourStory, spoke to Aniketh Jain, Chief Revenue Officer, Kaleyra; Venkatesh Sundar, Chief Marketing Officer and Co-founder at Indusface; and Nath Parameshwaran, Director, PayPal India about the opportunities that are opening up; broader business trends; risks and how to overcome them when doing global trade in services.

On a growth trajectory

“When we first went into lockdown, we saw an initial impact both in India and in Europe where we have a large presence. While retail and on-demand services were affected, banking and fintech really picked up,” said Aniketh.

Being sector-agnostic offered Cloud communications platform Kaleyra a significant advantage, he added. The sudden and unexpected need to go digital and automate processes saw a lot of small and medium customers signing up on Kaleyra’s platform.

Aniketh says that the team’s preparedness to handle this surge remotely was a great advantage. “One of the things that worked for us is that we were all prepared to work remotely. We ran a beta and were ready to function with a small 24*7 support team at 10 days’ notice."

While remote working is the inevitable option, one of the major concerns has been security.

Venkatesh, who heads marketing, and previously served as CTO of global award-winning security platform Indusface, believes that digitisation certainly is going to be a long-term winner and COVID-19 will be like ‘rocket fuel for faster adoption’.

“However, whenever digitisation happens, the number of security incidents associated with that are also significantly higher. Today, digitisation is suddenly being adopted for all kinds of things, and security suddenly is becoming a key aspect of that decision making to launch digitisation quickly,” he says.

As a platform that has been supporting small and medium businesses, especially in the IT/ITES space, for several years, PayPal is in a position to help these businesses grow and survive.

“Today, India is starting from a position of strength and we should never waste a crisis like this. The reason why I'm so bullish about this opportunity is because of three trends. Despite an initial slowdown, our exporters have shown resilience. Second, we have a track record of services exports with the big boys of the BPO industry having been here for a long time. Last, but not the least, is our medical fraternity. Doctors from India are respected and trusted across the globe. With digitalisation, visa restrictions don’t matter as they can sit in India and offer value. And I believe demand will be in our favour,” says Nath.

Opportunities and priorities

While rapid digitisation has presented a lot of opportunities, companies also need to be aware of risk mitigation in terms of security breaches. Venkatesh believes that while the line between internal and external application was already blurred in the pre-COVID 19 era, in a post-pandemic scenario, where people are working from home, that has exacerbated further.

“What you consider internal is still public. So security is a must-have. The analogy I would like to give is, if you want to go fast, you don't question the braking system. The braking system is a must-have to really go fast. So security is a must-have braking system for the digitisation wave to really take off. It’s not only about risk mitigation.”

Another key aspect of scaling in the current scenario is the ability to pivot and partner where opportunities arise. Aniketh says that Kaleyra, which is a profitable bootstrapped organisation, had to shift gears to make an impact.

“After the outbreak, the government was really looking out for private players who could deploy some tech solutions. We covered the entire ‘104’ helplines for the Government of Karnataka along with a group of founders called Project StepOne. In Europe, we partnered with the Red Cross to help citizens. As a small business, you have to realise that it’s important to shift gears and seek out opportunities,” he says.

Scaling securely

Nath highlighted that security and trust was the bedrock of doing successful business, and that PayPal had been offering both service providers and recipients secure payments to ensure seamless trade.

He believes that another key trend that will emerge is countries becoming self-sufficient and looking inwards to protect their citizens. “However, economics is going to score in the long term when small businesses abroad want to outsource their work to India. This is where digitalisation is going to give the advantage. I would say remain optimistic, don't be blind to changing trends and strike when the opportunities arise. See how you can target and serve your users specifically on the needs that they have in a post-COVID-19 world.”

Future scape

Speaking about opportunities, Aniketh says that Kaleyra is investing in bringing a simple cloud product for MSMEs.

“Typically small and medium businesses never betted on technology. Suddenly, they are starting to think about automation. They are asking questions like ‘Can I have a simple CRM? ‘Can I get beyond WhatsApp?’ I see a lot of Indian startups eventually becoming technology MSMEs, and in line with Nath’s view of self-reliance, that is going to become a priority.”

He adds that India’s reliance on global CRM products should shift to a more localised global-quality product that comes at a fraction of the cost. Aniketh believes that governments are also going to start collaborating with tech companies to create agile solutions to the challenges they are facing.

PayPal, which has an overview of multiple transactions trends believes there are four key opportunities.

“The first is wellness. India is perfectly poised to see growth - whether it is yoga classes, or other types of health-related services. The second is in skill upgradation. People are looking at learning new skills or upgrading existing ones. India has a strong reputation in the market and will do well in this space. Next is hobbies and passion. A lot of Indians who live abroad will be looking to learn music or dance online to reconnect with their roots, and that will drive demand. And last but not least, will be the rise in silver tech with more senior citizens adopting technology for the first time to buy things online,” says Nath.

The panellists also felt that the adoption of digitisation was likely to be a long-term trend and that a rollback was unlikely.

“I don't see why that would happen. Digitisation was already happening. This situation has just accelerated it and I do not see a reversal of trend unless an organisation messes up the adoption so badly that they give up on it,” says Venkatesh.

Industry speak

The session ended with a presentation by Navin Mistry, Director of Growth, SMBs and New Initiatives, who outlined which industries would see an increase in demand and how PayPal would enable their growth.

“We really see a very big opportunity in cross-border trade for services. Demand is high for communication tools like video conferencing as we have all moved away from the physical office and have started connecting virtually. . The next big demand will be for learning management systems as it goes online. The third area we have seen a big shift in is the entertainment industry, particularly media streaming. Telemedicine, healthcare, and the self-care industry will also see a huge spike,” says Navin.

PayPal has been leveraging its global platform to offer secure payments in multiple currencies across 200 markets.

The other features PayPal offers in India include streamlined checkout across devices; OneTouch for fast easy payments; tokenised transactions to keep financials secure; fraud protection and risk modelling; and flexibility with CHOICE- allowing the consumer to use their preferred financial instrument to make a payment.