10 years of Blume: Story of Exotel, the bootstrap champ

Karthik Reddy, Co-founder and Managing Partner of Blume Ventures, writes about his tryst with Exotel, a cloud telephony business, and one of the key companies in the VC’s portfolio.

In 2011, within a few weeks of each other, there were three different mentions of a certain former Yahoo engineer who was building a cloud telephony business out of Bangalore.

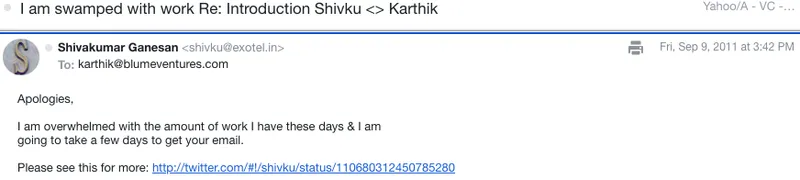

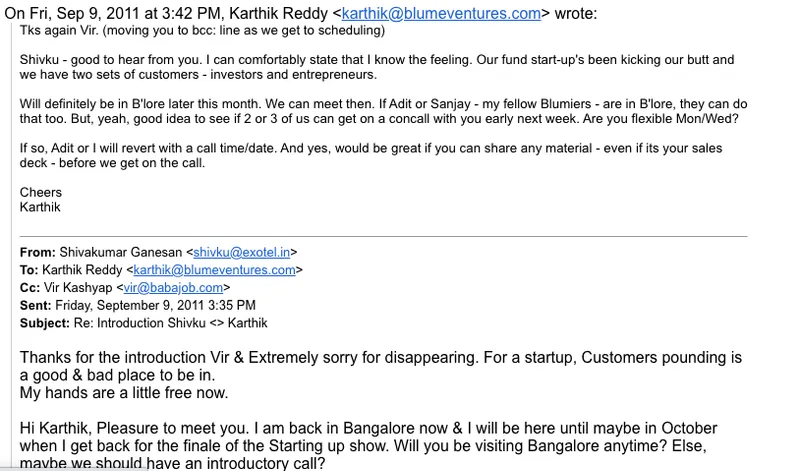

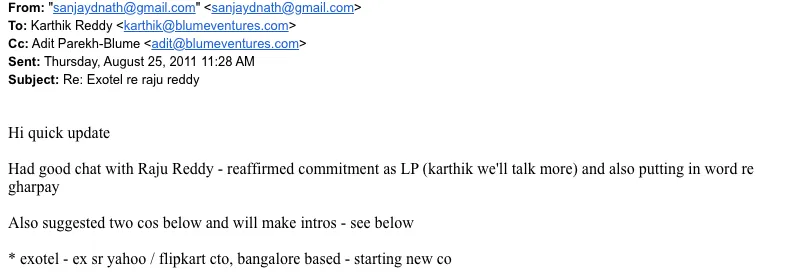

What I was told was this young man was reluctant to talk to VCs as yet. What we used to retort was that we shouldn’t be counted as a VC. Back then, we truly weren’t.

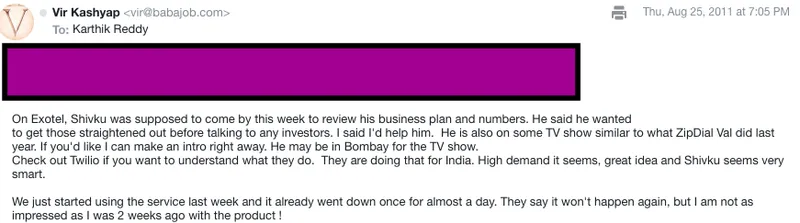

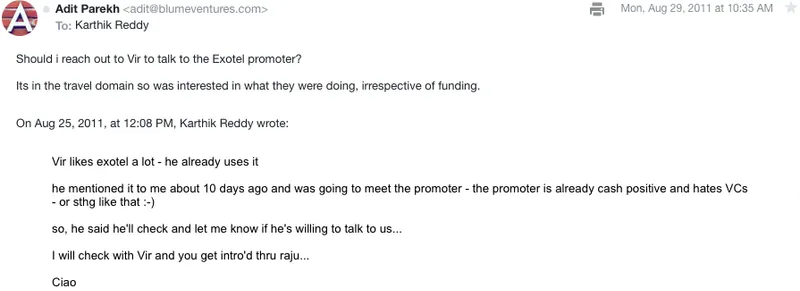

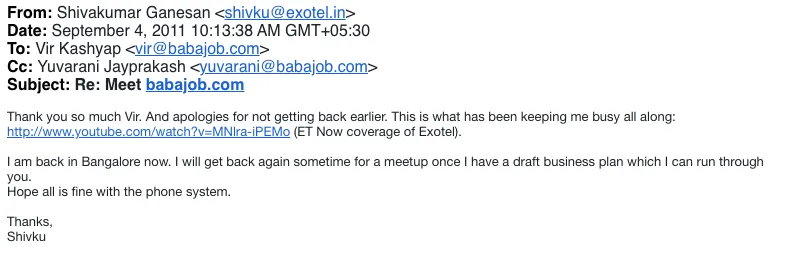

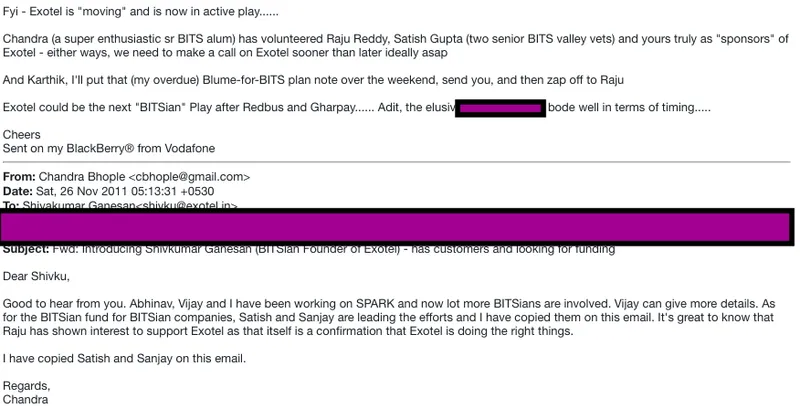

We behaved and modelled the fund and the team to behave like an institutionalised angel investor, married to the beginnings of an early-stage VC. We pushed for introductions — not to cut a cheque as much as to learn more about the business and the founder. Vir (Kashyap), Raju (Reddy) and yet another customer opened the very first doors.

[Vir, who was then the COO at Babajob]

[Raju, founder of Sierra Atlantica, a BITS alum (like Shivku)]

[BITS Angels play in parallel…]

The team was hot then and, now, after many years of lukewarm, is super hot again.

The team has grown to be one of the most well regarded SaaS engineering teams in Bangalore. Shivku also finds mention in a line or two in Big Billion Startup (by Mihir Dalal) as one of Flipkart’s early employees, as well as many mentions in 30 under 30 type lists over the decade.

And for those who haven’t met him enough, you may not know that Shivku’s facial cut and hairstyle changes with every other visit to the hairdresser. The business and product keep evolving with the pace of enterprise communication needs and Shivku’s hairstyle keeps pace.

Ishwar, his co-founder, doesn’t like to be left too far behind and mixes it up too, albeit at a more infrequent pace.

Teen Patti, Exotel variant: The ‘side show’ becomes the main show

Interestingly, Exotel, at the time of our Rs 2.4 crore round (which Blume led with Rs 1 crore, rest was Mumbai Angels), was probably one of the buzziest deals we won.

There were competing angel groups vying for them. Shivku, despite his tentative approach in meeting VCs (see email snippets above, showing challenges of getting our first meeting), was quite pleased presenting Exotel to ET Now’s show called SUPER ANGELS, a desi version of Shark Tank, architected by none other than Sudhir Syal (of ET Now back then, who went on to help build BookMyShow in Indonesia and the Middle East).

As if things weren’t buzzy enough, the show got Shivku and Exotel even more attention. Mahesh Murthy of Seedfund had shown interest. He was one of the four “Super Angels” on the show, which included Vishal Gondal and the one and only VSS (Vijay Shekhar Sharma) too! Now, I have to compete for my humble lead position with contenders on a reality TV show?

There’s a vivid memory of being on a swing in Lucknow as I played my best cards on a Saturday morning extolling the virtues of Blume as Exotel’s best possible partner. Shivku finally agreed, despite telling him I can’t play the entire round and we’ll have to partner with Mumbai Angels for about half of it. There was a curious catch!

I got a call from the show’s host, Sudhir. My memory is not a strong suit and so I shall paraphrase (not embellish). “Yeh kya kar diya aapne; what have you done? — Exotel made it to the Grand Finale of the show! And Shivku was going to get funded for sure by at least one of the four Super Angels and now, you’ve played your hand outside the show!”

I had pulled off a ‘side show’ (reference to a nuance in the Indian variant of poker - “teen patti”).

He smiled at the other end of the phone line. “I have a hack,” he offered, “What if I offered a “special guest” status on the finale? You can compete and win on live TV!”

I’m thinking to myself: What if Shivku gets swayed? What if someone goes rogue and outplays me. I can’t blame Shivku. Well, one had to go with instinct.

And thus played out the rarest of reality TV mini-dramas in startup land.

(Enjoy the segment from the fifth minute to the twelfth minute)

I played the “shark” in the desi version of 2012 “Super Angels”, hosted by ET NOW, to win the Exotel investment publicly on TV! Note the made-for-TV-cheque size.

Building a Ship along the way, while sailing the high seas

We had heard Knowlarity was getting funded by Sequoia even as we decided to invest and we had met Ozonetel in Hyd as well. They all looked like solid founders but the chemistry between the Exotel and Blume offset other risks including the heavily funded competitor.

It was a sign of things to come — there was no fear of being underfunded, there was just strong conviction on building a sizable SaaS business for small and mid-sized businesses.

Easier said than done! For the better part of the decade, SMBs have been an elusive animal to monetise systematically in India. Doubly so, if the monetisation is dependent on business traction of the customer. Exotel’s revenue comes from customers’ needs to digitise communication smartly across various business processes. So, if the businesses falter or don’t scale, the revenue stays flat, or worse, declines.

Rs 2,000 ($40 back then, $26 in today’s exchange rates) monthly ARPUs for the first few years on average meant that they had to innovate constantly to stay alive. Exotel was the first of our startups that started offering its service on a prepaid model.

This was fantastic. Intent to use, intent to pay, zero collection costs — all packaged into positive intent / alignment / process — this was how India SMBs should work.

However, acquiring savvy customers online alone, onboarding to prepaid, pains of customer success, and servicing — all of it digitally in 2013-14 — was an uphill task. Survival instincts kick in.

This time, the realisation was that great innovation and rapid scaling can come by chasing enterprise customers, something we thought non-scalable for a cool SaaS company building with community-led marketing and inside sales.

Reality is that the scale + volumes, and product innovation and stickiness were definitely skewed in that direction. So, the journey switched lanes to the bumpy Indian enterprise fork in the road.

There was a lot of visibility for the company in digital and traditional media as it kept building beyond the odds. Then there was some regulatory scare. Good press can alert various competitors — from large telcos to larger funded companies.

Others in the sector too got similar scares. The company had to double down on ensuring that they were well above board and procured whatever licenses it needed. The bank balance dipped to Rs 14 lakhs at a point in 2014-15.

Investors would show excitement and then shirk away. Over six years, between 2012 and 2018, we lost count of near-miss term sheets, half-hearted term sheets (e.g. ”we will invest $3 million contingent on another $3 million being committed by a co-lead”), merger and acquisition offers from everyone, Indian competitors to Asian telcos to American giants.

Clearly, the segment was considered interesting enough that we needed to see a desi Twilio emerge. The seeming commoditisation and clutter from SMS resellers, true innovators in cloud telephony (read EXOTEL), copy cats, overfunded or overhyped competitors would scare away most of the faint-hearted.

Eventually, these stories are that of the founders’ courage, imbued into a missionary team, with or without venture funding. VC is far from a perfect market. Even more so in the relatively emerging Indian landscape. Exotel’s journey provides ample proof.

The last storms before the calm, the Ship now ploughs on, full steam ahead

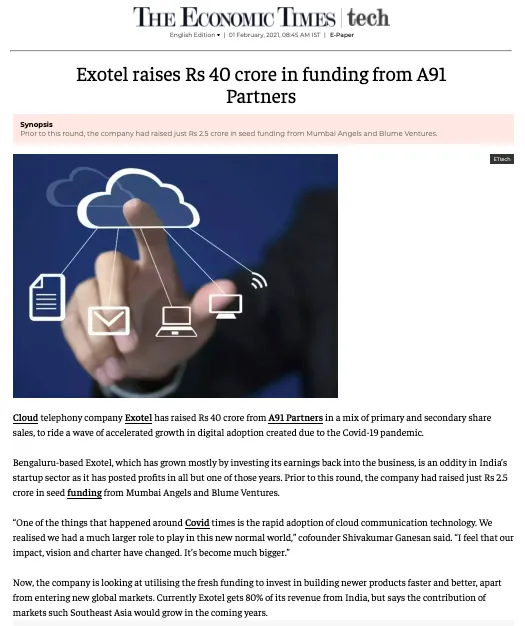

Exotel was a Blume story replete with punchlines. We spoke of full-year revenues and EBITDAs for the last five years, not ARRs and MRRs. We loved to tom tom the fact that here’s a company that scaled the Rs 100 crore revenue mark, with a grand total of Rs 2.4 crore of capital raised lifetime. Not a rupee of personal or company debt either.

The founders didn’t want the liability as long as the company kept growing at 40-50 percent CAGR. The company has had a CSR budget for years now out of its small profit pool each year and was proud of its NGO association. Gross margins were monitored acutely down to one percent movements up or down.

When the most intense (and promising) M&A conversation fell through after six months of effort in 2017-18, it almost broke the spirit of the team. It took another three to four months to recover. We lost two of the top six in the leadership team. Even as an ardent supporter, I was mentally prepared for a plateau.

The team regrouped, reassessed its odds of maintaining momentum and hit the reset button. I’ve always been impressed by their resilience. There was a remarkable maturity that Shivku and Ishwar had always shown. There was a phase where they would rotate CEO positions three times over in the 2012-15 timeframe, as each decided that they needed to get deep into fixing a facet of the organisation and the other had the bandwidth to run as CEO.

The company finally, after many years of pestering by me, decided to create debt lines for working capital and growth, just before COVID. We started discussing the idea of us becoming the market aggregator through M&A. We went fairly deep with one candidate firm of similar size and culture but couldn’t pull that through. We stepped back and said, “It’s time to take our performance back to the market and raise a massive round.” We started pondering about this in late 2019.

No one expected COVID-19. Revenue crashed briefly in the lockdown months of April-May 2020. Every risk had to be backstopped. The curse of the bootstrapped company showed up. No capital reserves to shore up a few months of revenue shock, while they had bootstrapped to 300+ team members now.

Blume Fund I was dry for five years now and angels from that first round were unlikely candidates for a multi-crore lifeline. The company secured whatever lines it could through every means possible. Fortune favours the prepared mind.

Amazingly, the recovery began as swiftly as the revenue shock. Within a few months, we were back to pre-COVID-19 levels but the shock meant we needed to secure a capital cushion. The A91 team had known this team for a very long time, as competition to Knowlarity while they were in Sequoia and there was mutual respect.

It was love (rekindled) in the time of COVID-19. It was a win-win-win. A company that had grown 100X in revenue over eight years and no capital rounds means no interim dilution and a 20X growth in valuation.

Exiting angels walked away with a handsome multiple. Existing angels, founders and Blume didn’t get diluted too much, courtesy a blend of primary and secondary. And the company found a deep-pocketed long-term partner in A91.

Onward now, to the second half of the story

Through many twists and turns has the story turned,

The team finding its sanity through its calm leadership,

The A91 round punctuates with a semicolon,

The story who’s second half we watch with equal anticipation.

(Exotel is a Blume Fund I company. Blume and Exotel have been partners since 2012)

Edited by Saheli Sen Gupta

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)