Unicorns of 2021: Mamaearth, GlobalBees latest to join unicorn club

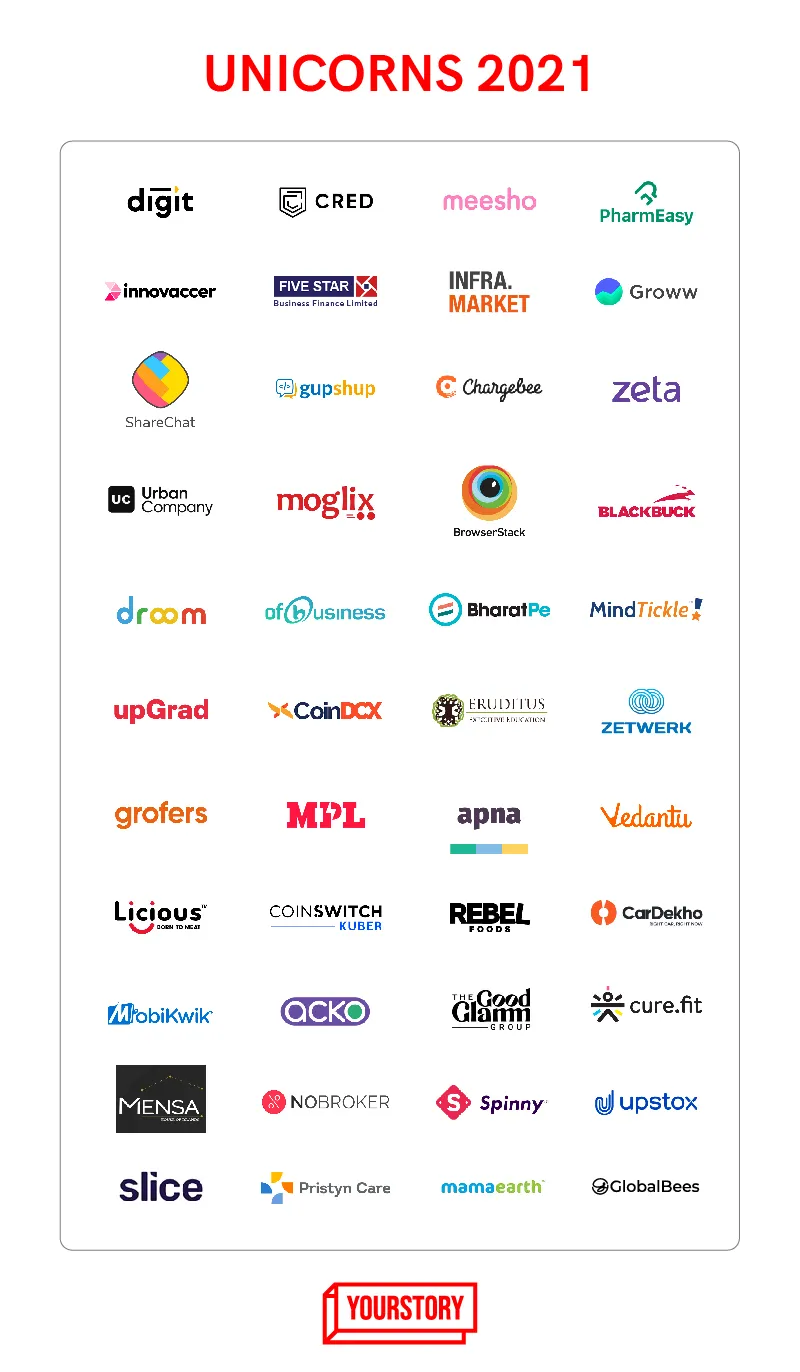

We are in the last month of 2021, and the Indian startup ecosystem already has 44 new unicorns, surpassing the projected numbers this year.

And the countdown begins… especially if you’ve heard and have been tracking the projections for the number of unicorns that will emerge from the Indian startup ecosystem.

In the last month of 2021, the Indian startup ecosystem has already added 42 new entrants to the coveted $1 billion valuation club. The country is already cheering in its new unicorns — (insurtech), (healthtech), (NBFC), (social commerce), (B2B ecommerce), (fintech), (healthtech), (fintech), (conversational messaging), Mohalla Tech (parent company of social platforms and ), (SaaS), (home services marketplace), (B2B commerce), (fintech), (SaaS), (logistics), (automobile), (B2B commerce), (fintech), (sales enablement), (higher education), (the first Indian crypto startup to reach unicorn status), (edtech), (B2B manufacturing), (online grocery), (esports gaming), (job and professional networking platform), (edtech), (D2C fresh meat brand), (crypto startup), (cloud kitchen startup), (autotech startup), (fintech), (insurtech), The Good Glamm Group (content commerce), (Healthcare), (D2C), (proptech), (used car marketplace), (fintech), (fintech), (healthtech), (D2C), and (ecommerce).

Heading into 2021, research firms and industry experts had predicted that India will see a significant increase in the number of unicorns. An earlier NASSCOM report had stated that India will have 50 unicorns before 2021 ends.

In 2020, even with a pandemic wreaking havoc on the economy, 11 startups from India attained unicorn status while reached a $5.5 billion valuation as an independent entity after its spin-off from . Already, India’s unicorn club boasts startups like fintech majors Paytm and Zerodha, mobility player Ola, foodtech startups such as , and , , , among others.

Nevertheless, these new unicorns have boosted hopes higher for the ecosystem. Let’s have a look at the 44 unicorns of 2021.

Digit Insurance

Bengaluru-based startup Digit Insurance is the brainchild of Kamesh Goyal. The platform leverages technology to simplify the process of buying general insurance with services like smartphone-enabled self-inspection and audio claims.

Valued at $1.9 billion, Digit Insurance is the first Indian startup in 2021 to enter the much-coveted and tracked unicorn club. Although the fundraising amount was not disclosed, a few media reports suggest the funding took place in two tranches of $84 million and $18.5 million. A91 Partners, Faering Capital, and TVS Capital Funds participated in this round of funding.

Since its inception in 2016, Digit Insurance has so far raised a total of $244.5 million. It claims to be a profitable venture, having seen profits in all three-quarters of FY21. Also, it grew 31.9 percent between April and December of 2020, earning a premium of $186 million. It claims to have a customer base of 1.5 crores.

A few key milestones achieved by the company in its journey so far are:

- January 2021: Raised $84 million / Series Unknown

- August 2020: Launched an online DIY insurance advisory tool for SMEs

- February 2020: Actor Anushka Sharma and Indian cricketer Virat Kohli join investor consortium

- November 2019: Named Asia's Best General Insurance Company of the Year

- June 2019: Raised $50 million / Series Unknown

- July 2018: Raised $45 million / Series Unknown

- July 2018: Acquired ITI Reinsurance Ltd. for $72.8 million

- June 2017: Raised $47 million / Series Unknown

Innovaccer

Founded in 2014 by Sandeep Gupta, Abhinav Shashank, and Kanav Hasija, this YourStory 2015 Tech30 company is valued at $1.3 billion after its latest funding round led by Tiger Global Management.

Existing investors Steadview Capital, Dragoneer, B Capital Group, Mubadala Capital, and M12 (Microsoft's Venture Fund) participated in the round, along with new investor OMERS Growth Equity.

Although the amount of funding remained undisclosed, it is estimated to be around $105 million. Prior to this, the startup had raised $70 million as part of its Series C round in February this year.

Since its inception in 2014, the company has raised around $229.1 million.

A few key milestones achieved by Innovaccer in its journey so far are:

- February 2021: Raised $105 million / Series D

- February 2021: Earns NCQA PHM Prevalidation

- October 2020: Launched Risk Adjustment Solution for Improved Coding Accuracy

- February 2020: Raised $70 million/ Series C

- June 2019: Awarded as the "Best Healthcare Big Data Platform" in 2019 MedTech Breakthrough Awards

- February 2019: Launched Its AI-Based Data Activation Platform at HIMSS19

- January 2019: Raised $11 million/ Series B

- May 2018: Raised $25 million/ Series B

- July 2016: Raised $15.6 million/ Series A

- October 2015: Recognised among 30 most disruptive Indian startups in YourStory's Tech30 list

- May 2015: Raised $2.5 million/ Seed

Five Star Business Finance

Image Credit: Ahamed.

Five Star Business Finance, a lender to small businesses, raised $234 million for a valuation of $1.4 billion. The round was led by existing investors Sequoia Capital India, with participation from Norwest Venture Partners, as well as new investors, led by KKR with participation from TVS Capital.

The investment will be made through a combination of primary infusion in the company and secondary shares sold by existing investor Morgan Stanley Private Equity. The company’s other existing — Matrix Partners and TPG Capital — continue to stay invested.

The lender plans to use the capital to expand its lending business to provide much-needed financing solutions to more of India’s small businesses, which comprise a large and growing segment of the country’s economy.

Five Star Business Finance has its presence in 262 branches spread across eight states of India in the southern and central part of the country. As of December 31, 2020, the company’s AUM stood at Rs 4,030 crore, and its GNPA stood at 1.29 percent.

Meesho

Vidit Aatrey, Founder and CEO, Meesho

The social commerce platform Meesho joined the unicorn club earlier this week with its fund-raise of $300 million in a new round, led by SoftBank Vision Fund 2. The company is now valued at $2.1 billion.

The round also saw participation from existing investors Prosus Ventures, Facebook, Shunwei Capital, Venture Highway, and Knollwood Investment. With this funding, the startup plans to build a single digital ecosystem for 100 million small businesses.

The small businesses Meesho is targeting include individual businesses owned and run by women entrepreneurs and homepreneurs, who have become financially independent and successful over the years through Meesho and have carved out their own identities.

Infra.Market

The B2B commerce company Infra.Market raised $100 million Series C funding led by Tiger Global. Existing investors Nexus Venture Partners, Accel Partners, Sistema Asia Fund, Evolvence India Fund, and Fundamental Capital GmbH participated in this round of funding. The current fundraise takes Infra.Market's valuation to $1 billion.

Founded by Souvik Sengupta and Aaditya Sharda in 2016, Infra.Market is a procurement marketplace that leverages technology to provide an enhanced procurement experience for all players in the construction ecosystem.

The company is targeting the $140 billion construction materials market with a strong focus on the infrastructure sector.

CRED

CRED, the Bengaluru-headquartered fintech startup founded by Kunal Shah, has turned into a unicorn following the closure of its Series D funding at $215 million, with a post-money valuation of $2.2 billion.

CRED had last announced its Series C funding round of $86 million in January 2020, with a valuation of $800 million.

Now, with this latest round of funding, the fintech startup has closed to tripled its valuation. The Series D round was led by a new investor — Falcon Edge Capital — along with existing investor Coatue Management. It also said Insight Partners joins its cap table.

PharmEasy

As a digital healthcare platform PharmEasy connects over 60,000 brick and mortar pharmacies and 4,000 doctors in 16,000 zip codes across India. It digitises the entire supply chain to provide easy access for pharmacies to procure the products.

PharmEasy also provide SaaS solutions for pharmacies to use in procurement combined with delivery and logistics support, and credit solutions to buy over 200,000 medicines from over 3,000 pharmaceutical manufacturers.

The company raised $350 million in a Series E round led by Prosus Ventures and TPG growth at a reported valuation of $1.5 billion, making it the seventh startup from India to enter the unicorn club this year.

Groww

Online trading platform Groww was founded in 2017 by four former Flipkart executives — Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal. At present, Groww has over 1.5 crore users. Over 20 lakh new demat accounts were opened on its platform since June 2020.

The startup entered the unicorn club with its recent Series D round where it raised $83 million led by Tiger Global. Existing investors such as Sequoia India, YC Continuity, Ribbit Capital, and Propel Venture Partners participated in the round as well.

Groww focusses on simplicity and transparency, and has been designed as an adviser or ‘buddy.’ Its platform is powered by intelligent UI and UX. The startup offers paperless investing options, letting customers buy and sell mutual funds online.

The startup uses technology like image processing, which uses machine learning models. This helps automate manual workflows, reduce error, and increase user ease throughout the journey.

Gupshup

Gupshup, the Silicon Valley-headquartered conversational messaging tech startup, is co-founded by IIT-Bombay alumni Beerud Sheth. Gupshup’s mission is to build the tools that help businesses better engage customers through mobile messaging and conversational experiences.

It raised $100 million in funding from Tiger Global at a valuation of $1.4 billion, and entered the growing unicorn club.

According to Gupshup, its API enables over 100,000 developers and businesses to build messaging and conversational experiences, delivering over six billion messages per month across 30-plus messaging channels.

ShareChat

ShareChat — the Indian language social media platform's parent company Mohalla Tech, which also houses short video app Moj — on Thursday said it raised $502 million in its latest round led by Lightspeed Ventures and Tiger Global, along with participation from Snap Inc, Twitter, and India Quotient, among others. With this round, the Indic language social media startup has now become a unicorn, valued at $2.1 billion.

ShareChat will use the fresh funds to grow its user base and build a world-class organisation. It is also looking to strengthen its creator community, AI-powered recommendation engine, and platform health.

Chargebee

Rajaraman Santhanam, KP Saravanan, Thiyagarajan Thiyagu and Krish Subramanian, Co-Founders, Chargebee [Image Credit: Chargebee Website]

Founded in 2011 by four friends — Rajaraman Santhanam, Thiyagarajan Thiyagu, Saravanan KP(CTO), Krish Subramaniam (CEO) — Chargebee’s product automates complex billing and revenue operation challenges that arise as subscription businesses scale into large enterprises and also provides key reports, metrics, and insights into the subscription business.

San Francisco-based SaaS startup Chargebee has recently raised $125 million in Series G funding, co-led by new investor Sapphire Ventures, and existing investors Tiger Global and Insight Venture Partners, along with participation from another existing investor, Steadview Capital.

Chargebee is now valued at $1.4 billion, which triples its valuation in less than six months.

The company recently brought out enterprise-class capabilities like usage-based billing and a dedicated data centre for Europe.

Urban Company

Urban Company co-founders (from left to right): Abhiraj, Raghav, and Varun

Urban Company, the home services marketplace startup, raised $188 million in its latest funding round led by Prosus. The latest fundraise by Urban Company also saw the participation of two new investors – DF International and Wellington Management. The startup is now valued at around $2 billion, according to reports.

According to the Registrar of Companies (RoC), Urban Company issued 2,613 equity shares and 50,490 compulsory convertible preference shares (CCPS). This latest round of capital infusion takes Urban Company into the coveted unicorn club as it was last valued at around $933 million during its funding round in 2019.

Formerly known as UrbanClap, Urban Company is backed by marquee investors such Tiger Global, Accel, and Elevation Capital (formerly known as SAIF Partners), among others. Ratan Tata and Kalyan Krishnamurthy are among the leading angel investors.

Urban Company's latest funding round saw the collective stake of its three co-founders — Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra diluted to 24.66 percent.

Moglix

Moglix Team

, a Noida-based B2B industrial goods ecommerce marketplace, on Monday, announced that it has raised $120 million in a Series E round led by Falcon Edge Capital and Harvard Management Company (HMC). Existing investors including Tiger Global, Sequoia Capital India and Venture Highway also participated in this round.

With this round, Moglix becomes the first industrial B2B commerce platform in the manufacturing space to become a unicorn.

This latest round of funding takes the total funds raised by Moglix to $220 million.

Leaders from the startup and manufacturing communities such as Kalyan Krishnamurthy, CEO Flipkart, Vikrampati Singhania, MD, JK Fenner and Shailesh Rao, ex-Google, have been investors in Moglix.

Founded in 2015 by IIT Kanpur and ISB alumnus Rahul Garg, Moglix aims to digitally transform the supply chain of the manufacturing sector in India. It provides solutions to more than 500,000 SMEs and 3,000 manufacturing plants across India, Singapore, the UK and the UAE.

Zeta

, a banking tech startup, has become the latest unicorn after raising $250 million in a Series C funding round from Softbank Vision Fund 2 at a valuation of $1.45 billion.

Sodexo, a France-headquartered food service company, also participated as an additional minority investor in the round, with Avendus Capital acting as the financial advisor.

Founded in 2015 by Bhavin Turakhia and Ramki Gaddipati, the banking startup works with over 25 fintech firms and 10 banks, including HDFC Bank, Kotak Mahindra Bank, IndusInd Bank, Yes Bank, RBL Bank, and Axis Bank.

Zeta has close to 750 employees, with offices across the United States, Asia, United Kingdom, and West Asia.

BrowserStack

Homegrown SaaS startup has secured $200 million in Series B funding at a $4 billion valuation, making it India's 15th unicorn of 2021. It also becomes the year's second SaaS unicorn after Chargebee, which achieved the feat in April.

The funding round was led by BOND, with participation from Insight Partners and existing investor Accel, which had invested $50 million in a Series A round in 2018.

BrowserStack, which Ritesh co-founded with Nakul Aggarwal in 2011, has been a category leader in software testing on the cloud and counts over 50,000 customers and more than 4 million developer signups. It caters to giant corporations such as Microsoft, Twitter, Barclays, Expedia, and several others, powering over two million tests across its 15 global data centres every day.

The startup plans to use the capital to make strategic acquisitions, expand product offerings for developers, and ramp up scale across the globe to fulfil its vision of becoming the "testing infrastructure for the internet".

BlackBuck

Rajesh Yabaji, Co-founder and CEO of BlackBuck

, an online trucking platform, has raised $67 million at a valuation of over $1 billion. The round was led by Tribe Capital, IFC Emerging Asia Fund, and VEF. Existing investors Wellington Management, Sands Capital, and International Finance Corporation also participated in the round.

The startup said it will use the funding to further penetrate the market and launch new service offerings for its customer base.

The company will be investing heavily in product and data sciences capabilities, with the aim towards enabling more efficient freight matching for the Indian trucking ecosystem.

BlackBuck digitises fleet operations for the truckers and operates a marketplace to help match trucks with relevant loads. The startup has close to 700,000 truckers and 1.2 million trucks on its platform, and it claims to be seeing over $15 million in monthly transactions.

Droom

Sandeep Agarwal, Founder, Droom

, the AI-driven online automobile marketplace, has been valued at $1.2 billion in the latest round of funding, marking its entry into India’s unicorn club. The company has closed the first leg of its ongoing pre-IPO growth funding round of up to $200 million.

In addition to several existing investors participating in the round, new investors including 57 Stars and Seven Train Ventures participated in the first closing of the round in Q2-21.

Droom is a tech and data science-driven online automobile marketplace that offers buying and selling of automobiles in India. Droom has more than 1.1 million automobiles to choose from, with a listed inventory of $15.7 billion+ from over 20.6k+ auto dealers, and has a presence in 1,105 cities.

Droom has built the entire ecosystem around used automobiles for the digital economy, including Orange Book Value (used vehicle pricing engine | 503 mn+ queries), ECO (1,000+ points vehicle inspection | 150k+ inspections), history (history records for used vehicles | database of 250 mn+ vehicles), discovery (dozens of pre-buying research tools), and financial services (loan and insurance).

The company is pursuing a dual-track approach for a possible IPO, and aims to be listed either on NASDAQ or in India in 2022.

Droom’s current annual run-rate is $1.7 billion for GMV and $54 million for net revenue. The company remains on track to touch a GMV of $2 billion and net revenue of more than $65 million in CY2021. With the current scale, technology-oriented business, and operational efficiency Droom is nearing profitability.

OfBusiness

OfBusiness Team

Gurugram-based B2B startup has entered the unicorn club after raising a $160 million round led by SoftBank's Vision Fund 2. Existing investor Falcon Edge Capital also participated in the round, according to a release shared by the firm.

The funding was raised at a valuation of close to $1.5 billion, almost double its $800 million valuation in April this year. This makes it the 18th Indian startup to become a unicorn this year, following automobile marketplace Droom and online trucking platform BlackBuck.

OfBusiness aims to be profitable, by crossing more than $1.1 billion revenue run rate in commerce by September 2021. The firm claims to be growing four times year on year.

Apart from operating in the B2B raw material supply chain, the startup also provides services in infrastructure and manufacturing areas such as food processing, engineering, heavy machinery, and capital goods.

BharatPe

Ashneer Grover

Fintech startup has turned a unicorn after it raised $370 million in a Series E round led by Tiger Global at a post-money valuation of $2.85 billion.

One of the leading fintech startups in the country, it was founded in 2018 by Ashneer Grover and Shashvat Nakrani. It has been a rapid rise for this startup to get into the unicorn club as it was last valued at $900 million during its previous funding round in February this year.

As a company that provides interoperable QR code and lending services, BharatPe serves over 70 lakh merchants across 140 cities. It processes over 11 crores of UPI transactions with loan disbursements of over Rs 1800 crore. The point of sale business of BharatPe processes payments of over Rs 1400 crore per month.

Perhaps, the most ambitious plan of BharatPe is taking over the distressed PMC Bank in partnership with Centrum Financial Services as it has already got in principle approval from RBI to establish a small finance bank.

Mindtickle

Mindtickle founders (from left):Nishant Mungali, Krishna Depura and Deepak Diwakar

, the Pune and San Francisco based tech startup that provides sales readiness technology, said it has raised an additional $100 million in Series E funding at a valuation of $1.2 billion led by SoftBank Vision Fund 2.

This funding round also saw participation from existing investors — Norwest Venture Partners, Canaan, NewView Capital, and Qualcomm Ventures. Mindtickle said it has now raised $281 million in total.

The startup was founded in 2011 by Krishna Depura, Deepak Diwakar, and Nishant Mungali.

upGrad

Mumbai-based higher education startup has raised $185 million in a continuous round led by Temasek ($120 million), IFC ($40 million), and India Infoline Finance ($25 million) to reach a valuation of $1.2 billion.

In August, it became India's third edtech unicorn after BYJU'S and Unacademy, and is reportedly in talks to raise a larger round of $400 million at a $4 billion valuation.

upGrad's founder group consisting of Ronnie Screwvala, Mayank Kumar, and Phalgun Kompalli, will continue to own over 70 percent of the company.

CoinDCX

, the crypto exchange, has closed a $90 million Series C funding round, led by Facebook Co-founder Eduardo Saverin’s B Capital Group. The Series C funding round raises CoinDCX’s valuation to $1.1 billion, making it the first Indian cryptocurrency exchange to reach unicorn status. The round also saw participation from existing investors such as Coinbase Ventures, Polychain Capital, Block.one, Jump Capital, among others, alongside other veteran investors.

Sumit Gupta, Co-founder and CEO, CoinDCX, stated, ‘The funds raised will be allocated to expand (bring more Indians to crypto/ make crypto a popular investment asset class in India) and strengthen our workforce. We will hire talent across multiple functions, and focus on new business initiatives.’

Founded in 2018, CoinDCX claims to have onboarded more than 3.5 million users. It will now carry forward the vision of making crypto accessible in India and accelerating its efforts towards bringing 50 million Indians into crypto.

Eruditus

, the Mumbai-headquartered edtech startup that offers professional education courses through collaboration with leading universities, has entered into the coveted unicorn club with a valuation of $3.2 billion along with its latest $650 million fundraise.

The $650 million Series E funding round into Eruditus was led by Accel and SoftBank Vision Fund 2, along with its existing investors — the Chan Zuckerberg Initiative, Sequoia India, Bertelsmann, Prosus, and Leeds Illuminate.

Eruditus will use this funding to develop new courses, create new products and industry verticals, besides expanding to newer verticals such as governments and enterprises. It will also be used for market expansion and to fund acquisitions.

Zetwerk

Zetwerk's founding team

B2B manufacturing startup raised $150 million in Series E round at a valuation of $1.33 billion, making it the latest entrant to the unicorn club. The firm also claims to have become profitable on the EBITDA level.

The round was led by New York-based D1 Capital, with Avenir and Mumbai-based IIFL Asset Management Ltd joining in as new investors. Existing investors including Sequoia Capital, Lightspeed Venture Partners, and Greenoaks Capital also participated in the round. The Bengaluru-based firm will invest the funding into research and development, expanding into new geographies, and team building.

“We grew so fast that we still have to do more development on our software and our team,” Amrit Acharya, CEO and Co-founder, Zetwerk told YourStory.

Grofers

Albinder Dhindsa, Co-founder, Grofers

entered the coveted billion-dollar unicorn club after's Zomato invested $120 million in the grocery delivery startup. In August, Co-founder and CEO Albinder Dhindsa confirmed to Livemint that the company has "comfortably passed unicorn status".

Founded by Albinder Dhindsa and Saurabh Kumar in December 2013, the Gurugram-based startup was started to solve the on-demand pick-up and drop-off services for Indian consumers in partnership with local stores, which were struggling to solve this problem.

Also backed by Softbank, eight-year-old Grofers is now betting on express deliveries.

MPL

Esports platform Wednesday turned unicorn, post raising its Series E funding round led by Legatum Capital, at a pre-money valuation of $2.3 billion.

Existing investors, including Sequoia, SIG, RTP Global, Go-Ventures, Moore Strategic Ventures, Play Ventures, Base Partners, Telstra Ventures, and Founders Circle Capital, also participated in the investment round.

Recently, the esports and skill gaming platform had begun operations in the US, and completed two years of operations in Indonesia, making it the only mobile gaming platform from India with a growing international presence. At present, MPL has over 85 million registered users globally.

MPL will use the fresh capital to finance its global expansion, invest in its home-grown technology, and drive continued growth in the Indian market.

Apna.Co

Job and professional networking platform Apna.Co has secured close to $100 million in Series C funding led by Tiger Global. The round also saw participation from Owl Ventures, Insight Partners, Sequoia Capital India, Maverick Ventures, and GSV Ventures.

With this round, has attained a total valuation of $1.1 billion.

The startup aims to go into overdrive to sustainably solve the immense challenges of unemployment, poverty, and upskilling.

The company plans to use the proceeds to further strengthen its presence in the 28 cities it is operational in and expand pan-India by the end of 2021 to help accelerate India’s economy.

Apna also plans to double down on its edtech platform for skilling, invest in hiring exceptional talent, and building world-class engineering and product capabilities. It plans to build a global enterprise by venturing into new markets such as the US, South East Asia, the Middle East, and Africa, starting in 2022.

Vedantu

The founders of Vedantu

Edtech startup Vedantu, focussed on live online tutoring, has confirmed that it has raised $100 million in Series E funding led by Singapore-based impact investing fund ABC World Asia.

The round also saw strong participation from existing investors – Coatue, Tiger Global, GGV Capital, and WestBridge among others.

With this latest round of funding, Vedantu’s valuation is at $1 billion, making it the newest unicorn in the block.

The funds will be primarily used to strengthen product engineering functions as well as expanding into newer categories through both organic and inorganic routes.

Licious

Abhay Hanjura and Vivek Gupta, Co-founders, Licious

D2C fresh meat brand on Tuesday entered the coveted billion-dollar unicorn club.

The Bengaluru-based startup raised $52 million in a Series G round led by IIFL AMC's Late-Stage Tech Fund, with a valuation of $1 billion.

Speaking on the development, Vivek Gupta and Abhay Hanjura, Co-founders, Licious, said,

"Although the funding for the D2C sector has grown significantly, FMCG is still not considered the most attractive category. We expect that Licious' unicorn status will change that. The fresh meats and seafood sector is still largely underserved and unorganised that holds a vast opportunity of $40 billion."

They added, "As the category leader, we aim at paving the way for the second wave of young startups that can join hands in fully harnessing the potential that the industry has to offer. We will continue to build the category through investments in technology for supply chain excellence, product innovation, talent, and vendor partner upgrades."

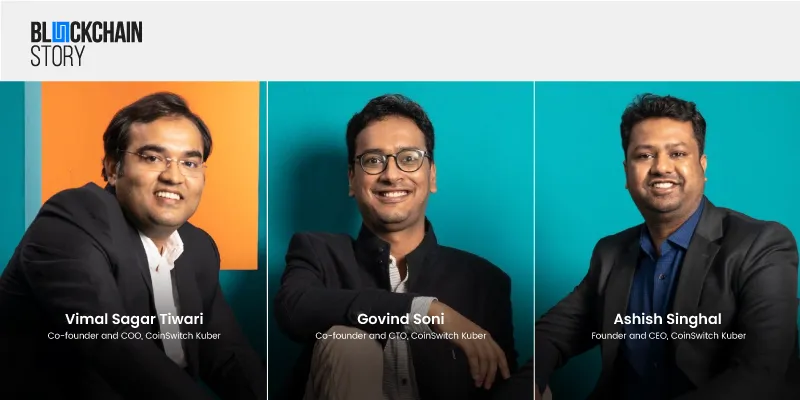

CoinSwitch Kuber

Indian crypto exchange announced its $260 million Series C round of funding from Andreessen Horowitz (a16z), Coinbase Ventures, and existing investors Paradigm, Ribbit Capital, Sequoia Capital India, and Tiger Global.

With a valuation of $1.9 billion, CoinSwitch Kuber becomes the second Indian crypto startup to enter the unicorn club, after CoinDCX became the first in August 2021. The new round brings CoinSwitch's total funding to over $300 million.

a16z is a global, leading venture capital firm known to back bold tech entrepreneurs, and Coinbase is an early pioneer in creating crypto economies and operating one of the world’s largest crypto exchanges.

The platform plans to utilise its Series C funds for onboarding 50 million users, introducing new crypto products such as lending and staking, hiring leadership and talent, adding new asset classes, onboarding institutional investors/clients, launching an ecosystem fund, and building crypto awareness and education.

Rebel Foods

Team at Rebel Foods

Cloud kitchen startup Rebel Foods is the latest entrant to the unicorn club following a $175 million Series F funding round led by Qatar Investment Authority (QIA), with participation from existing investors Coatue and Evolvence, at a valuation of $1.4 billion.

Rebel Foods operates over 450 kitchens globally across 60-plus cities in over 10 countries, with key brands such as Faasos, Behrouz Biryani, and Ovenstory Pizza.

Outside of India, Rebel Foods has presence in — Indonesia, United Arab Emirates, United Kingdom, Singapore, Malaysia, Thailand, Hong Kong, the Philippines, and Bangladesh.

With the fundraise, Rebel Foods said it will continue to focus on growing its international footprint, improve its technology, and focus on brand acquisitions.

Co-founders Cardekho

CarDekho

Jaipur-headquartered automobile classifieds platform CarDekho has raised a $250 million round of funding, including $200 million Series E equity and $50 million debt in its pre-IPO round.

With the latest fundraising, CarDekho joins the unicorn club with a valuation of $ 1.2 billion and becomes the first unicorn based in Jaipur, Rajasthan.

The funding round was led by LeapFrog Investments, a global impact investor focused on financial services and healthcare access. LeapFrog will support the company’s plans to deliver quality and affordable vehicles, insurance, and finance to millions of new emerging consumers. Improved mobility remains a proven driver of access to healthcare, education, and employment opportunities.

Other new investors who participated included US-based Canyon Partners, Mirae Asset, and Harbor Spring Capital. CarDekho’s existing investors Sequoia Capital India and Sunley House invested further, reaffirming their confidence in the company.

This is the largest-ever fundraise by CarDekho and the proceeds will be used to accelerate growth in the used car transactions, financial services and insurance businesses, build robust product and technology functions, increase brand awareness, and expand into new markets.

Amit Jain, Co-founder and CEO CarDekho, said, “CarDekho, from being a car research portal, has evolved to become a complete ecosystem for car buying, lifecycle management, and selling. We are committed to empowering our customers and providing them with a convenient and hassle-free experience. The new fundraise will help us expand our used car transactions and financial services businesses. The trust and conviction of our investors will help us to accelerate our growth plans whilst we provide our customers with an experience that will continue to re-define car buying and selling.”

MobiKwik

Founders of MobiKwik: Upasana Taku (L) and Bipin Preet Singh (R).

IPO-bound fintech firm has turned unicorn after a recent secondary ESOP sale round led by former Blackstone India head Mathew Cyriac, sources aware of the development said.

MobiKwik employees exercised their ESOPs (Employee stock ownership) in a recently opened window by selling part of their shares in a secondary sale.

"The secondary round was led by ex-Blackstone India Head, Mathew Cyriac, who topped up his holding at almost double of his previous price," the sources said.

The transaction size could not be ascertained. "The transaction in the round took place at an enterprise valuation of around $1 billion," the sources said.

The last valuation shared by Mobikwik was $720 million in May 2021, after $20 million stake purchase by UAE's sovereign wealth fund Abu Dhabi Investment Authority.

MobiKwik Chairperson, Co-founder and COO Upasana Taku had said the number of equity shares that would arise from the full exercise of options granted implies 7 percent of the fully diluted outstanding shares.

The company has received markets regulator Sebi's approval to launch an initial public offering, through which it plans to raise up to Rs 1,900 crore.

The Gurugram-based company had filed the Draft Red Herring Prospectus (DRHP) for the initial public offering (IPO) with Sebi in July.

Acko

Varun Dua, Founder and CEO, Acko

, the insurtech startup founded in 2016 by Varun Dua and Ruchi Deepak, has redefined how insurance products are viewed and bought by consumers in a country through the digital route which has low penetration levels of this category.

Acko turned into a unicorn at a valuation of $1.1 billion after a Series D round of funding of $255 million, which was led by private equity companies General Atlantic and Multiples. The startup would be onto something different was quite visible when it had earlier raised a funding round from Amazon, Accel, Elevation Capital, Lightspeed, Flipkart co-founder Binny Bansal to name a few.

It has totally raised $450 million till now.

This insurtech startup is focused on three categories – two and four-wheeler vehicles, health, and electronic goods. The USP of Acko is that it provides customised plans where the policies come in byte-sized. Acko co-founder Varun Dua said, “Insurance and protection must work for people based on their unique risks and needs in a seamless, reliable fashion."

Now, Acko is looking to strengthen its offering especially in areas such as health insurance and take this category of financial protection product deep into the India market.

The Good Glamm Group

Close to two months after raising Rs 255 crore ($30.4 million) in funding, The Good Glamm Group has now raised $150 million in its Series D round led by Warburg Pincus and Prosus Ventures.

Darpan Sanghvi, Founder and CEO, The Good Glamm Group, told YourStory that the company will utilise this capital to invest in product development, support data science and technology research, increase its offline expansion, fund its working capital requirements while also expanding the content creation capabilities and digital reach of its brands , , , and .

The founder added, “This is just day one, and our journey from one to 10 starts now.”

The Group will also continue to make investments in more beauty and personal care brands. Darpan explained, “We are looking to acquire a total of six more brands in the personal care and beauty segment. Of them, we have already announced the acquisition of The Mom’s Co. We are looking at five more.”

CureFit

Mukesh Bansal, CEO of CureFit Healthcare

Curefit Healthcare became the 36th unicorn in 2021 at a valuation of $1.5 billion after foodtech giant Zomato announced that it has sold Fitso, its fitness business, to the startup for $50 million in the company's Q2FY22 earnings.

Zomato has also invested an additional $50 million in the startup, founded by Mukesh Bansal and Ankit Nagori.

Mensa Brands

Ananth Narayanan, Founder and CEO, Mensa Brands

The D2C (direct-to-consumer) house of brands startup has raised Series B funding of $135 million at a valuation of over a billion dollars. Mensa is now one of the fastest unicorns in Asia, after attaining the status within six months of its inception.

Mensa has so far raised a total of more than $300 million in equity and debt. The investment round was led by Alpha Wave Ventures | Falcon Edge Capital with participation from all existing investors — Accel Partners, Norwest Venture Partners, and Tiger Global Management. Prosus Ventures (Naspers) also invested in Mensa in this latest funding round. This also would be Prosus' first investment in the space.

The startup stated it is already profitable and intends to use the funding to continue partnering with founding teams of customer-loved brands and help them become household names. In addition, it’ll invest in hiring across functions and continue building out its tech platform and other growth capabilities.

NoBroker

Proptech startup NoBroker said it has raised $210 million in its Series E funding round, with its valuation crossing $1 billion and making it the latest entrant to the coveted unicorn club.

The funding round was led by General Atlantic, Tiger Global, and Moore Strategic Ventures.

NoBroker.com, which has now become India's first proptech unicorn, said it will use the funds to grow its community app and marketplace NoBrokerHood from 10,000 societies to one lakh societies over the next two years; improve its tech infrastructure; invest in its home and financial services; integrate AI/ML to make the process of finding and listing a rental hassle-free, and deepen its investments in resale and primary sale verticals.

Spinny

Spinny founders (from left): Niraj Singh, Mohit Gupta and Ramanshu Mahaur

Used car marketplace has announced raising $283 million in a Series E round of funding from new and returning investors.

The round was co-led by Abu Dhabi based ADQ and returning investor, Tiger Global and Avenir Growth, said a statement issued by the company.

Other investors in the round include Feroze Dewan's, Arena Holdings and Think Investments.

The round takes the total capital raised by Spinny to $530 million, valuing the company at nearly $1.8 billion.

The round is a mix of primary and secondary capital with $250 million being raised in primary and nearly $33 million being the secondary component. As part of the secondary share sale, select angels and seed investors will exit Spinny.

Spinny was founded in 2015 by Niraj Singh, Mohit Gupta, and Ramanshu Mahaur, and had acquired customer-to-customer used car marketplace Truebil in August 2020.

Upstox

Financial technology startup has crossed the billion-dollar valuation mark in its latest and ongoing fundraising round after raising $25 million from Tiger Global, a source familiar with the matter told YourStory.

Upstox did not immediately respond to YourStory's request for a comment or confirmation.

The startup is still in the process of completing the round, the source said. A second source acquainted with ongoing talks told YourStory that Tiger Global could invest $100 million in the startup, adding that the deal had not been finalised yet.

Entrackr first broke the news about Upstox's funding, saying that the online brokerage startup's valuation has surpassed Groww's, which was recently valued at $3 billion.

Slice

Rajan Bajaj, Founder and CEO, Slice

Bengaluru-based fintech startup is the latest entrant into the unicorn club, with a five-fold jump in valuation to $1 billion within six months.

The startup, which issues credit cards targeted at young professionals, raised $220 million in its Series B round led by New York-based investment firms Tiger Global and Insight Partners, said a statement.

The round also saw participation from notable angel investors Guillaume Pusaz and Binny Bansal, as well as new and returning investors including Advent International’s Sunley House Capital, Moore Strategic Ventures, Anfa, Gunosy, Blume Ventures, and 8i.

Pristyn Care

Gurugram-based healthtech startup has raised $96 million in its Series E round led by marquee investors such as Sequoia Capital Tiger Global Management, Winter Capital, Epiq Capital, Hummingbird Ventures , and .

Angel investors in this round include Kunal Shah, Founder & CEO, CRED; Deepinder Goyal, Co-founder & CEO, Zomato; Abhiraj Singh Bhal, Co-founder & CEO, Urban Company; and Varun Alagh, Co-founder & CEO, Mamaearth, the company stated.

With this funding, the valuation of Pristyn Care has more than doubled in the last seven months and is now at $1.4 billion, making it the latest digital health startup to become a unicorn.

The company plans to increase its geographical footprint by expanding to 50+ cities/towns and 1000+ surgical centres. Pristyn Care also intends to double its team size. With technology as the backbone of its operations, the company will hire highly qualified engineers, who will form a quarter of its new workforce.

Mamaearth

Ghazal Alagh and Varun Alagh, cofounders, Mamaearth

Honasa Consumer, which runs baby and mother care brand , has raised around $37.5 million in its latest funding round led by Sequoia, making it a unicorn.

In July 2021, Mamaearth had secured $50 million in a funding round led by Sofina Ventures. This round had pushed the company’s valuation to $730 million.

Mamaearth has approved the allotment of 839 Series F preference shares at an issue price of Rs 33,85,049 to raise around $37.5 million, according to regulatory filings.

The baby and mother care company has become the 43rd startup to join the unicorn club in 2021 and is one of the few unicorns to have a female co-founder.

GlobalBess

Delhi-headquartered ecommerce roll-up company is the latest startup to join India’s unicorn club after raising $111.5 million in a Series B round led by Premji Invest. Steadview Capital also joined the round as a new investor, while returning investors SoftBank and also participated in the round, said a statement issued by the company.

The company was valued at $1.1 billion in the current round, making it the second unicorn ecommerce roll-up entity after which turned a unicorn in November.

GlobalBees was founded in 2021 by co-founder at FirstCry Supam Maheshwari and Nitin Agarwal, former president and group CIO, CTO and chief digital officer at Edelweiss Financial Services. It had previously raised $150 million in a mix of debt and equity in July in a Series A round led by FirstCry.

(Written by Meha Agarwal, with inputs from Sindhu Kashyap, Sohini Mitter, Thimmaya Poojary, Aparajita Saxena, Trisha Medhi, Sujata Sangwan, Rishabh Mansur, Prasannata Patwa, and Payal Ganguly)

Edited by Tenzin Pema, Saheli Sen Gupta and Megha Reddy

![[Funding alert] Digit Insurance becomes first Indian unicorn for 2021; valued at $1.9B](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Unicorn-png-1610714296995.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Innovaccer joins unicorn club at $1.3B valuation with latest capital round](https://images.yourstory.com/cs/2/a09f22505c6411ea9c48a10bad99c62f/Imageqwpd-1614190445324.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Five Star Finance raises $234 M from KKR-led consortium, valued at $1.4 B](https://images.yourstory.com/cs/2/a9efa9c0-2dd9-11e9-adc5-2d913c55075e/165-VC-funding1552277843560.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Weekly funding roundup] Unicorns rule the roost with VC capital crossing $1B in Feb](https://images.yourstory.com/cs/2/f08163002d6c11e9aa979329348d4c3e/Weeklyimage-1577460362436.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Groww enters unicorn club after latest $83M fundraise](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/PHOTO-2021-04-07-17-52-26-1617798291703.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Gupshup turns unicorn after raising $100M from Tiger Global at $1.4B valuation](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Beerud-p-1617873547843.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] ShareChat joins the unicorn club with $502M funding from Lightspeed Ventures, Tiger Global](https://images.yourstory.com/cs/wordpress/2016/07/Founders-Farid_Bhanu_Ankush.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] SaaS startup Chargebee becomes unicorn after raising $125M in Series G round](https://images.yourstory.com/cs/2/b094ec506da611eab285b7ee8106293d/Imagekcpu-1611379989687.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Urban Company enters unicorn club with $2B valuation, following $188M fund raise](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/urban-clap-founders-1619536891684.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] B2B ecommerce startup Moglix joins unicorn club after raising $120M in Series E round](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/oieJyBFBlMFnCyJ-1599389844731.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Zeta raises $250M from Softbank Vision Fund, attains unicorn status](https://images.yourstory.com/cs/2/d72b5ef09db411ebb4167b901dac470c/Imagedcnm-1621866423378.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] BlackBuck joins the unicorn club with $67M Series E investment](https://images.yourstory.com/cs/2/a0bad530ce5d11e9a3fb4360e4b9139b/Imageow90-1580809370802.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] OfBusiness turns unicorn as valuation doubles to $1.5B in Softbank-led round](https://images.yourstory.com/cs/2/d72b5ef09db411ebb4167b901dac470c/Image71cx-1627709106233.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[The Turning Point] How Grofers, a unicorn in the making, was started to transform India’s unorganised grocery landscape](https://images.yourstory.com/cs/2/70651a302d6d11e9aa979329348d4c3e/2019-05-151557919436163-1625222578380.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)