[App Friday] Made by women, LXME app empowers women to take charge of their financial investments

Targeting women across life stages, lifestyles, and professions, LXME app provides them with the right knowledge and tools to take charge of their personal finances.

In India, many of us would recall our mothers saving aside some money from household expenses for emergencies or financial security. According to DSP Mutual Fund's 'DSP Winvestor Pulse 2019’ survey, only 33 percent of the women invest, as opposed to 64 percent men. Among them, only one-third take their own financial decisions, rather than having investments done on their behalf by someone else.

Mumbai-based fintech startup is making efforts to solve this ‘gender gap’ in financial independence by encouraging women across life stages, lifestyles, and professions to become financially independent.

A survey conducted by the startup with over 5,000 women across metros and Tier-I and II cities, in the age group of 25-45 and working across professions further indicated the key barriers that stop women from investing their own money. They were lack of awareness, high association with risk, and most importantly, social orientation – the belief that investment is essentially a man’s domain.

Founded in 2018 by Priti Rathi Gupta, LXME app enables women to independently manage their money by providing them with the right knowledge and tools to take charge of their personal finances. Recently, it was awarded the title of ‘The Female Economy FinTech of the Year’ at the Financial Alliance for Women Hackathon.

So this week on YourStory’s App Fridays, we’ll see how the app works and how it connects with women interested in personal finance.

Let’s get started

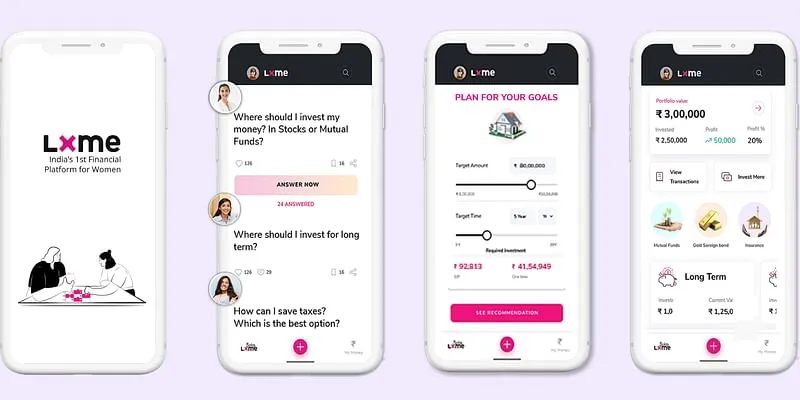

To start using the app, you have to sign-up using your mobile number. The first thing we notice after landing on the homepage is that the app has a minimalistic design aimed at making money management easier for women. This makes it stand out from other financial services platforms such as Indmoney or Groww. The app’s UI and UX are suitable for first-time investors looking out to explore financial planning.

On the homepage, you can scroll to see finance-related conversations, questions, posts etc. It also offers bite-sized learning courses to get acquainted with personal finance. You can also post questions such as what happens if you don’t pay your credit card bill, or what are the saving plans for monthly investment of Rs 3,000-5,000, etc. These questions are answered by experts and fellow community members.

BeingLXME Community

The BeingLXME community provides a social app experience where women can ask, learn, and engage in conversations around finances with other like-minded women by pressing the ‘plus’ button on the middle of the homepage, and posting a question. Similarly, users can answer a question that is akin to replying to a post on Facebook. Users can create posts, ask questions and conduct polls tagging LXME money coaches or other users, and engage with content through likes, answers, comments and votes.

While anyone can answer a question, we feel that questions should only be answered by verified users, because first-time investors would have little experience. Nonetheless, the app offers a space for community building with BeingLXME Community, which is the key differentiating factor for the app.

The community feed offers expert content in three formats:

- Blogs that regularly demystify financial jargon and topical updates from the world of finance and financial markets relevant to investors.

- Bite-sized learning modules on the basics of investing that have been designed as swipe cards with short stories, explaining concepts on investing in a relatable and easy manner.

- In-app challenges, webinars and sessions by experts on financial planning.

The app makers claim that the community is closely moderated by its dedicated community team with the help of moderation tools integrations.

Financial planning tools

Users can learn more about financial planning with financial calculators on topics such as retirement planning, tax planning, and other financial goals that help you evaluate how far are you from your goal and guide you to start your investment journey. These calculators enable informed financial planning.

Making transactions

Finally, once you are well aware of your financial goals and understand different financial instruments, the app has a ‘my money’ tab which is equipped with financial tools such as curated mutual fund plans and gold products for investment. Based on the financial goals and timelines, the app gives you curated investment or mutual funds plans like long-term plans, which is best suited for three or more years, and goals such as a child's education, retirement fund, buying a house, etc. It also has features for short-term plans, ultra-short-term plans, tax saving plans, and digital gold saving.

At the time of making the investment, the app also shows how much money will grow roughly in the given time frame. We did not do the transaction as it needed a KYC, which the company claims is done fully digital and is over in five minutes. After the investment, users can track their investments on the app dashboard. The dashboard also allows users to withdraw money, add more money to a plan, request a detailed report, and automate payments for SIPs through e-nach mandate.

The verdict

The app has hit the right spots when it comes to enabling women with the right knowledge and tools to take charge of their personal finances. The app features such as conversations, asking questions etc can help to counter societal stigma towards women investing and empower them, make them financially savvy, and invest their money.

While apps like , Coin by , Indmoney, , and more allow users to invest and learn about investing, the female-to-female community may give a sense of security and comfort to a lot of women. It will be even better if going forward, LXME can add all the finance schemes, benefits, and government schemes related to women under one platform.

Overall, the app is free, easy-to-use, and jargon-free, and we would recommend first-time women, investors, to give this app a try for its safe, judgement-free, and closed community for women to have peer-to-peer conversations and drive collective growth.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Edited by Kanishk Singh

![[App Friday] Made by women, LXME app empowers women to take charge of their financial investments](https://images.yourstory.com/cs/2/70651a302d6d11e9aa979329348d4c3e/lxme-1634814550658.jpg?mode=crop&crop=faces&ar=2:1?width=3840&q=75)

![[Funding alert] Venture Catalysts invests in wellness startup Green Cure](https://images.yourstory.com/cs/2/70651a302d6d11e9aa979329348d4c3e/Imagey8ho-1594190613192.jpg)