[Funding roundup] Monrow Shoes, USEReady, HappyLocate, SustVest raise early-stage deals & more

Here are the Indian startups that announced early-stage funding rounds on May 18, 2022.

Footwear startup Monrow Shoes and Accessories raises an additional $1M led by LC Nueva, 9Unicorns, others

Women’s footwear brand Shoes and Accessories announced that it has secured an additional $1 million.

This year, the company saw interest from investors including LC Nueva Investment Partners, along with existing investors such as , , and . Apart from that, Playbook Fund has also invested in the brand for the first time.

In the month of March 2021, the brand also raised $1 million in funding.

As per the official statement, it will be utilising freshly infused funds to increase its market presence, expand its product portfolio, build the Monrow community, and strengthen its commitment to offering a world-class experience for customers through its innovative shoes and accessories.

Veena Ashiya, Founder and CEO, of Monrow Shoes and Accessories, said,

“Passion certainly pays off; through Monrow Shoes and Accessories, we want to show the world that if one is passionate about what they want to achieve, success and monetary returns will follow. We already have a strong product market fit, with our products being rated 4.3 out of 5, so we will use the funding for awareness generation. We envision the growth to be more than 3X in the coming year.”

USEReady receives growth capital from Boston-based PE firm Abry Partners

, a New York-headquartered strategic data and analytics partner, has received an undisclosed amount of growth capital from Boston-based private equity firm Abry Partners to double down on its investments and focus in the Indian market.

As per the startup, it plans to invest part of the funding to innovation and develop more IPs. A major part of the funds would be used to scale up its Indian operations by 5X.

The company is looking to hire 1,000 data analytics and engineers in India this year. Currently, the firm’s total headcount stands at 400 across six offices globally.

“With practices built around visual analytics, cloud data, AI/ML and engineering services, USEReady is a perfect partner to every modern CDO (Chief Data Officer). We have grown by over 55 percent in our order book and we felt the timing is right to bring on a reputed institutional partner, who understands scale. With this capital round, we plan to accelerate our expansion plans globally with a major focus in India,” said Uday Hegde, CEO at USEReady.

Founded in 2011 by Uday Hegde and Lalit Bakshi, USEReady has developed products in the world of data analytics, addressing gaps with technology vendor products.

The startup said it is investing in several Tier-II and Tier-III cities in India to develop data analytics talent. Recently, it opened offices in Mohali and Chandigarh, apart from Gurugram and Bengaluru. It also services its high tech and Fortune 500 clients from its New York, New Jersey, and Toronto offices.

Primarily serving customers in the banking, financial services, and insurance industries (BFSI), USEReady provides end-to-end solutions that help customers navigate complex challenges in legacy modernisation, data monetisation, data governance, and security, along with migration from on-premises to cloud.

Relocation platform HappyLocate raises $1.1M in Pre-Series A led by Inflection Point Ventures

Bengaluru-based relocation platform on Wednesday announced that it has raised $1.1 million in a Pre-Series A round led by . VM Ventures and RMZ Management also participated in the round.

As per release, the funds raised will be utilised towards enhancing operational excellence and corporate reach.

Ajay Tiwari, Co-founder and CEO, HappyLocate said,

“HappyLocate is on a mission to transform global mobility with technology and empathy. We are a customer-obsessed team and focus on significantly improving the relocation experience of India through our value system: reliability, transparency and convenience.”

Launched in 2016 by Ajay Tiwari and Sainadh Duvvuru, the startup caters to 50 enterprise clients, including Fortune 500 companies. With an over 30 percent quarterly growth, HappyLocate is managing over 1,000+ relocations every month.

The platform is transforming relocation experiences at some of the marquee brands including Coca-Cola, ITC Infotech, Diageo, United Breweries, Airbus, etc.

Vinay Bansal, Founder and CEO, Inflection Point Ventures said,

"HappyLocate, with a track record in this market, has emerged as one of the preferred partners for enterprises to use their relocation services. Since our last round in the company, we have seen the growth to be manifold and believe that the canvas is much bigger because with digitally enabled services, unorganised markets present a huge business opportunity for the company.”

MasterChow raises $1.2M led by Anicut Capital & others

, a ready-to-cook Asian cuisine brand, on Wednesday announced that it has raised $1.2 million in funding led by , an Indian investment firm managing alternative assets. The round also saw participation from , among other prominent D2C founders and angel investors.

The startup plans to deploy the funds to launch innovative new product categories while delivering a quality experience to its customers. It also aims to introduce a wider variety of flavours and plans to foray into the ready-to-eat segment to attract India's young consumers.

The brand wants to fortify its distribution network while maintaining a strong focus on its own D2C channel across India. It is also looking to hire for mid-senior level positions to further optimise its ecommerce channels and go deeper by engaging its core customer via a robust content strategy.

Sidhanth Madan, Co-founder, MasterChow said,

“We started MasterChow in 2020 with a mission to bring quality ready-to-cook Asian cuisine to every Indian household. Asian cuisine is the second-most loved cuisine in India but the lack of innovation and clean label products in the space was shocking. We come into existence to bridge this gap for the country with an emphasis on superior ingredients and convenience in preparing a great meal at home.”

Ashvin Chadha, Founding Partner, Anicut Capital said,

“The immense potential of the RTC segment coupled with the vision of MasterChow will surely disrupt the industry in the coming years. The sheer ability of MasterChow to bring restaurant quality Asian cuisine to the doorsteps of Indian households will empower them to lead the market for this segment in the next three to five years.”

D2C beauty and wellness startup WOW Skin Science raises primary capital from GIC

Leading D2C beauty and wellness brand is raising primary growth capital from Singapore’s sovereign wealth fund . WOW had earlier raised Rs 375 crore from ChrysCapital in April 2021.

As per the release, the platform intends to invest in brand building and talent resourcing across key functions and accelerate the innovation pipeline with a mix of organic launches and strategic inorganic investments with a vision to grow into a house of loved brands. As it executes this strategy, WOW will continue to focus on its core values of innovation and sustainability.

Manish Chowdhary, Co-founder, WOW Skin Science, said,

“This investment will enable us to drive sustainable yet disruptive growth and to strengthen our organisation with top-notch talent. We look forward to creating a future ready organisation along with our investors.”

Established in 2014, WOW Skin Science was born out of passion and vision to be pure and natural, backed by research and science, inspired by the beauty and wellness traditions from both the East and the West.

The brand is a pioneer in launching innovative and toxin-free products across natural ingredients such as onion seed oil, vitamin C, apple cider vinegar, 'ubtan', and omega 3 amongst others. WOW Skin Science is also taking innovative steps in sustainable packaging by reducing plastic usage and spreading awareness in the society through its green-hands initiative of shipping one crore seeds and making customers partners in their sustainability mission.

The startup claims that It is available across 2,500+ Walmart stores in the US and has featured in the bestsellers list on Amazon US.

Ashish Agrawal, Managing Director, ChrysCapital said,

“ChrysCapital is delighted to welcome GIC onboard the growth journey of WOW Skin Science as it scales multi fold to a formidable house of brands in beauty and personal care. We continue to be extremely confident of the strong brand resonance among the millennials and the outstanding team at the helm to make WOW one of the most loved D2C brands globally.”

SustVest raises $160,000 from angel investors

Gurugram-based , a sustainable Investment platform that allows retail investors to invest in fractional ownership of renewable energy projects like solar or EV (electric vehicle), recently raised $160,000 from angel investors. The funding was led by Paurush Sonkar, Founder and CEO, Stallions Capital, Balaji Vaidyanathan, and Sandeep Shetty, seasoned early-stage investors.

As per the release, the investment shall be utilised for product development, marketing and enhancing the brand in the market which will further allow the brand to provide the best-in-class sustainable platform in the Indian region.

Hardik Bhatia, Co-founder, SustVest said,

“At SustVest, we are offering the opportunity to invest directly into the asset, which generates predictable returns and is immune to speculation. Investing through SustVest generates better returns than debt, mutual funds, and FDs.”

“We have a robust expansion strategy in the pipeline and this investment will play a prominent role to make green investing affordable and accessible. In the next six months, we aim to onboard over 5,000 investors and have over Rs 10 crore worth of assets under management. We will be introducing new assets like greenhouses, small hydro and wind projects as we move,” he added.

Established in 2018 by 22-year-old BITS Pilani alumnus Hardik Bhatia, Sustvest is an investment platform that allows investors to invest in fractional ownership of clean energy assets like solar or EVs, with a ticket size as low as Rs 5,000 for commercial solar projects.

The investors can enjoy up to 15 percent per annum return from the income generated by the project. Investors shall hold digital ownership of these solar/EV assets, which are then leased to consumers who pay monthly rental, which is distributed proportionally to investors of the projects

SustVest already has $3 million worth of clean energy projects in the pipeline and over 800 investors have signed up.

“SustVest allows investors to taste a completely new asset class and that too with a green eco-friendly twist to it. I am confident that it is a matter of time before Indian Investors warm up to this asset class and SustVest becomes the go-to platform of choice” said Paurush Sonkar, Founder and CEO, Stallions Capital.

HealthySure secures additional funding from LetVenture founders, others

Employee welfare insurtech announced that it has raised additional funding from LetsVenture, founders and other notable investors, valuing the startup at around Rs 50 crore.

This move will help the company to further fuel its mission of offering innovative and affordable group health insurance-led solutions to the Indian workforce and their families.

The financing saw participation of new investors LetsVenture and founders Aditi Shrivastava – Founder - Pockets Aces; Sreeraman Mohan Girija – Co-founder of Fynd; Pankaj Vermani – Founder of Clovia; Sachin Shetty – Co-founder of Giva.

It had also announced a Pre-Series A funding of Rs 9 crore in February 2022.

Sanil Basutkar, Co-founder and Head of Product at HealthySure, said,

“We have seen phenomenal demand post-COVID-19 for employee health security and have generated $1 million+ of business in less than a year of operations. Organisations now understand the importance of having a healthy workforce and are ready to invest substantially to maintain that. We are seeing strong tailwinds in this market and this investor funding will now allow us to service the huge demand. We foresee 4X growth and will be covering 400+ organisations and 100,000+ lives in the coming year.”

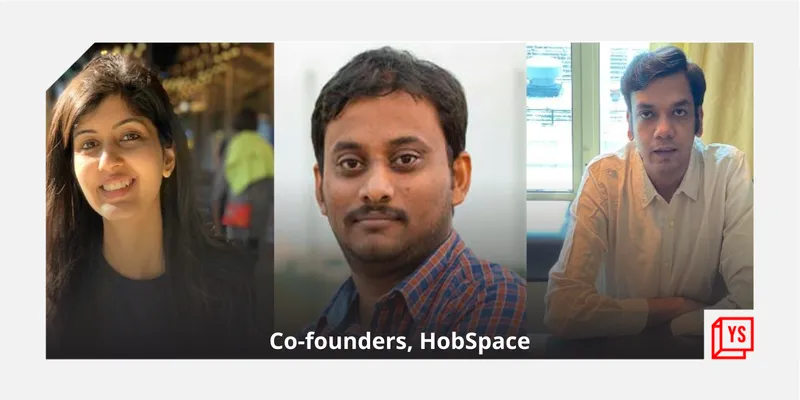

HobSpace raises $4.5M in Pre-Series A round

, a Mumbai-based global chess platform for kids, on Wednesday announced Pre-Series A funding of $4.5 million led by Mankekar Family Office, Artha Venture Fund, Siddharth Shah, Dharmil Sheth from API Holdings, and others.

As per the official statement, the funds raised will be used for deeper investment in product and technology, to enhance the overall experience for the students and to accelerate global expansion.

Harsh Jain, Co-founder of HobSpace, said,

“We are a mission-driven company and are pleased to accelerate the next step of growth through this funding. Today, there is no reason why a child living in India cannot receive quality training from a teacher in the US, or vice versa. At HobSpace, we are crossing borders to provide only the best-in-class chess learning to kids.”

HobSpace is an online chess learning and playing platform for children, having taught over 15,000 kids across North America, India, the United Kingdom, and other regions. It offers extensive coaching for complete beginners to professional players through highly skilled and renowned chess coaches that are internationally trained.

Priya G Sheth, Co-founder of HobSpace, stated,

“We believe that chess is not just a 21st century skill - i—t is, in fact, a life skill. Students who play chess early in life grow up to become well-rounded individuals. Playing chess challenges the intellect and makes kids smarter. The game challenges the mind and sharpens vital analytical, problem-solving, attention, and memory skills. HobSpace has created the perfect chess curriculum for kids that provides guided training, practice and game analysis.”

With specialised coaches based out of India, the US, the UK, and other countries, HobSpace enables children and teens to master the complexities of the game.

Bhaskar Raju Konduru, Co-founder of HobSpace, said,

“We are building a world-class online-first, global chess academy. The fresh round of funding will allow us to use technology to expand the global chess community and make chess coaching accessible to children all over the world.”

Edited by Kanishk Singh

![[Funding roundup] Monrow Shoes, USEReady, HappyLocate, SustVest raise early-stage deals & more](https://images.yourstory.com/cs/2/ba9e8080834311ec9e7e95cb06cf6856/Monrowfinal-1652858559343.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)