PayU abruptly calls off $4.7B acquisition of BillDesk after regulatory nod

PayU's parent company says agreement to buy BillDesk for $4.7 billion fell through after certain conditions were not met by September 30.

Sindhu Kashyaap

Monday October 03, 2022 , 5 min Read

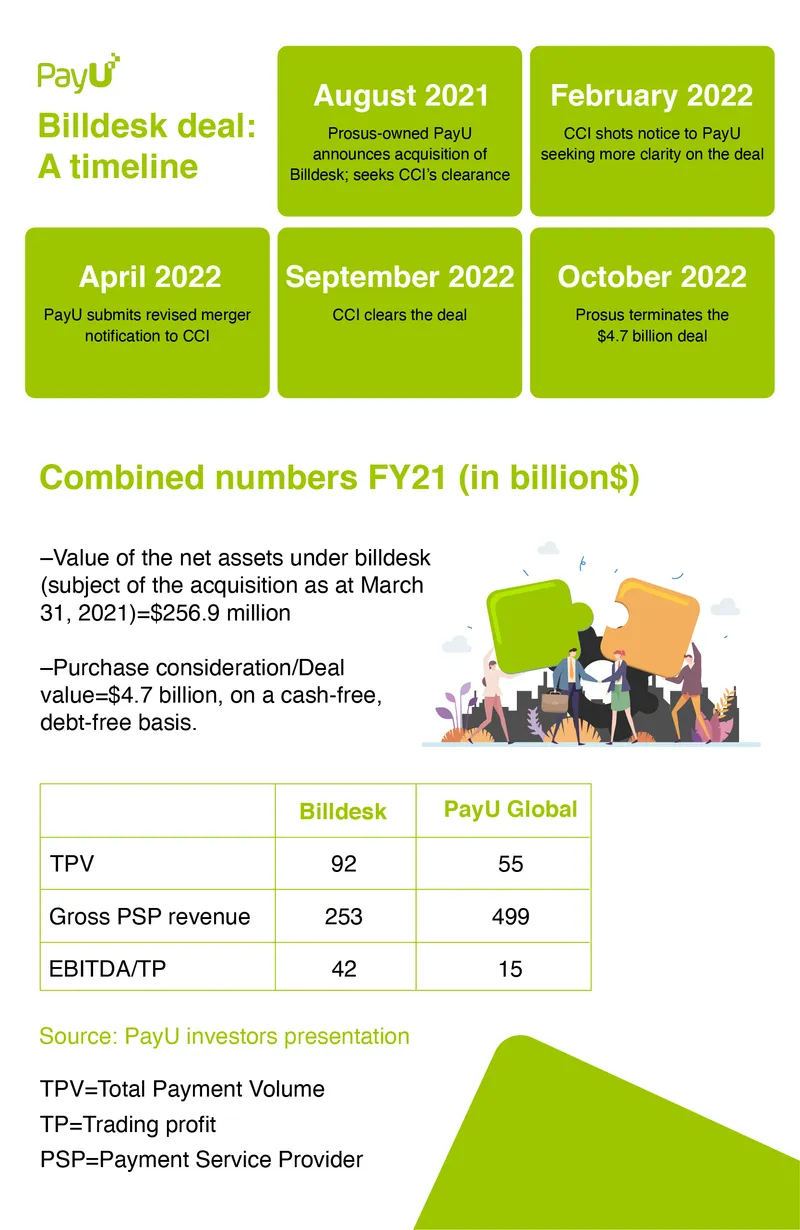

PayU Payments's much-awaited acquisition of BillDesk for $4.7 billion has been terminated, shortly after it was cleared by the competition watchdog, abruptly ending a potentially crucial deal for India's payments sector.

A merged PayU-BillDesk entity would have made for the largest payments company in the country, eclipsing rivals including Razorpay and Paytm that have been rapidly gaining scale. The deal was also significant because, if it had gone through, it would have been the second-largest buyout in India's internet sector, behind Walmart's $16-billion acquisition of Flipkart in 2016.

PayU's Netherlands-based parent, Prosus NV (previously Naspers), said in a statement Monday that the agreement was terminated automatically after certain conditions were not fulfilled by "the 30 September 2022 long stop date".

It was not immediately clear what those conditions were. PayU did not immediately reply to emailed queries, and BillDesk could not be reached for comments.

The all-cash deal was announced in August last year, when India's startup ecosystem was at its peak with a fundraising frenzy feeding a rapid growth wave. But the Competition Commission of India (CCI) took a year since to green-light the merger, the approval coming at a time when startup funding is drying and valuations are being questioned.

Buyer's remorse?

“The termination of the deal has nothing to do with regulatory compliance and clearance, but is an internal dealing among the companies,” a source privy to the developments at CCI told YourStory on condition of anonymity. “As far as we know, everything was sorted and cleared from the regulatory side, with no conditions or anything."

Speculation is rife that Prosus may have reevaluated the price it was paying for acquiring the Indian gateway business given the devalued funding winter scenario.

The head of a rival payments company, also declining to be identified, said Prosus may have called off the acquisition "because of the change in valuations globally from the time the deal was inked."

This could not be independently confirmed. But for context, the value of the net assets under BillDesk that were the subject of the acquisition as at March 31, 2021 were $256.9 million, while the purchase consideration was $4.7 billion on a cash-free, debt-free basis.

An industry expert indicated a potential instance of buyer's remorse, especially given the present market circumstances.

“There is no money to be made by processing payments. That is one of the biggest reasons why gateways like Razorpay are building a (value added services) ecosystem (lending, banking, payroll) around the core transaction processing as revenue drivers,” this person said.

While BillDesk has a well-established connect with banks and utility-payments companies, RBI’s increasing oversight of merchant discount rates (MDR), credit card fees, and lending rules is playing spoilsport for gateways. (MDR is the fee that merchants need to pay to card-issuing banks, payment networks such as VISA and Mastercard, and the bank providing the payment terminal or device.)

Besides, the National Payments Corporation of India, which facilitates services such as UPI and Bharat Payment System (BBPS) for utility payments, as well as banks are rolling out various products themselves, including gateways, at par with new-age fintech startups.

Stubborn roadblocks

The combined PayU-BillDesk entity would have emerged as one of top online payments providers—both globally and locally—with an annual total payment volume (TPV) of $147 billion.

The closest rival in India, Razorpay, clocked a TPV of $60 billion in 2021, and is aiming to hit $90 billion by the end of this year. CCAvenue, which is owned by Infibeam, is estimated to have an annual TPV of $18-20 billion.

This, obviously, triggered concerns of a ‘potential monopoly’ and a protracted scrutiny by CCI.

The antitrust regulator shot off a 30-page show-cause notice to PayU India contending that the combination was likely to cause an 'Appreciable Adverse Effect on Competition', and sought an explanation as to why a thorough investigation should not be launched on the deal.

Then in April, CCI asked PayU to file a fresh application, which allowed it to reset its enquiry that normally should have been concluded in 210 days, according to a report by The CapTable.

It finally cleared the deal on September 5, 2022. The merger, however, was yet to be cleared by the Reserve Bank of India.

Numbers sync

Mumbai-based BillDesk, Founded in 2000 by MN Srinivasu, Ajay Kaushal and Karthik Ganapathy and operated by parent IndiaIdeas, is among India's largest provider of online payment gateway services, helping businesses with settlements, collections, and reconciliations.

BillDesk’s revenue from operations grew 17.7% to Rs 2,124.2 crore in FY21 from Rs 1,804.7 crore in the year prior, while profit climbed to Rs 245.55 crore from Rs 211.22 crore, as per the company's latest available regulatory filings.

At the same time, its total expenses, including bank fees and service charges, which account for over 85% of the annual costs, grew 17.8% to Rs 1,613.03 crore in FY21.

PayU, on the other hand, reported a 48% jump in revenue to $304 million in FY22, driven by diversification of its merchant portfolio into segments such as financial services, ecommerce and bill payments.

The contribution of India revenue from new segments such as omnichannel, BBPS and data science increased from 20% in FY21 to 29% in FY22, Prosus had said.

“We’ve invested close to $6 billion in Indian tech to date, and this deal will see that increase to more than $10 billion," Bob van Dijk, Group CEO of Prosus, had said while announcing the deal last year.

"Together, PayU India and BillDesk will be able to meet the changing payments needs of digital consumers, merchants and government enterprises in India and offer state-of-the-art technology to even more of the excluded sections of society, while adhering to the regulatory environment in India and delivering robust consumer protection.”

(The copy has been updated to include context and comments from sources.)

Edited by Akanksha Sarma and Feroze Jamal