Venture capital inflow in February declines 77% as investors remain cautious

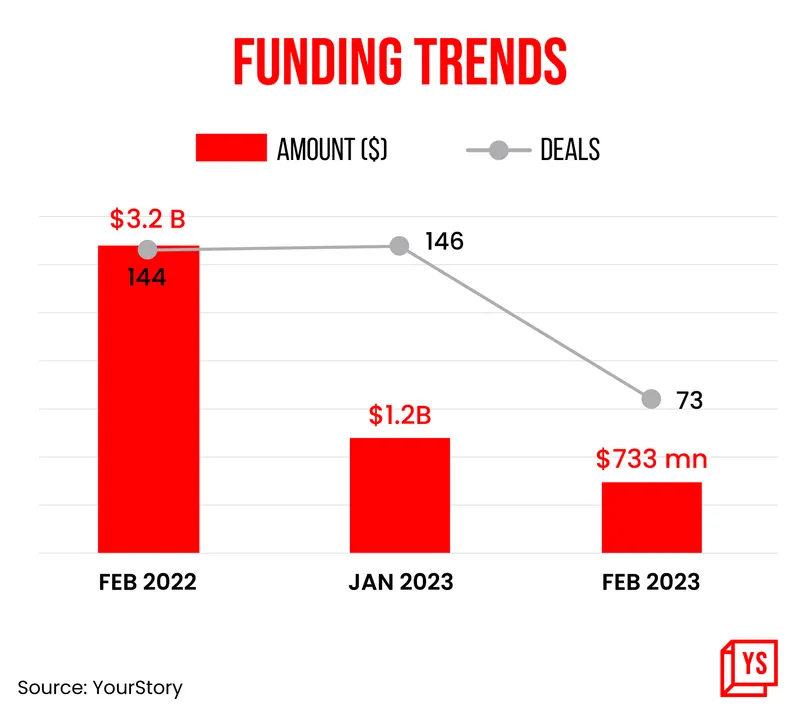

February marked the fourth time in the past year that venture funding into Indian startups on a monthly basis dropped below $1 billion.

For the Indian startup ecosystem, the funding winter remained stubborn in February, with the total cash inflow declining 77% from the same month a year earlier.

Total venture funding for February was $734 million, down from $3.2 billion in February 2022, according to data from Yourstory Research. This is the fourth time in the past year that venture funding into Indian startups on a monthly basis has dropped below $1 billion.

Venture funding showed some hope of a revival in January this year where it reached $1.2 billion but the downward trend resumed last month.

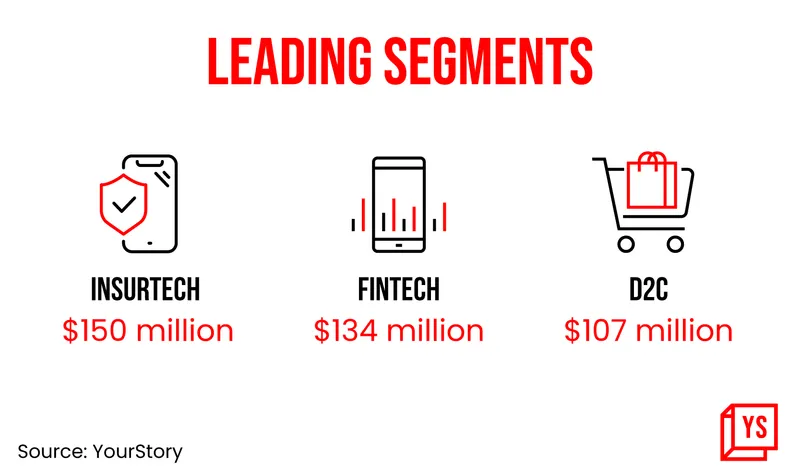

PhonePe, InsuranceDekho and FreshToHome topped the funding charts in February, with the trio raking in more than $100 million. In addition, there were 10 deals in the range of $20-35 million.

The grip of the funding winter on the startup ecosystem also played out in the number of deals for February, which stood at 73. This is the lowest number of transactions over the last year.

In terms of the sectors that received the highest funding in February, the number one position went to insurtech followed by fintech and D2C (direct to customer). These are also a reflection of the startups that raised over $100 million in February.

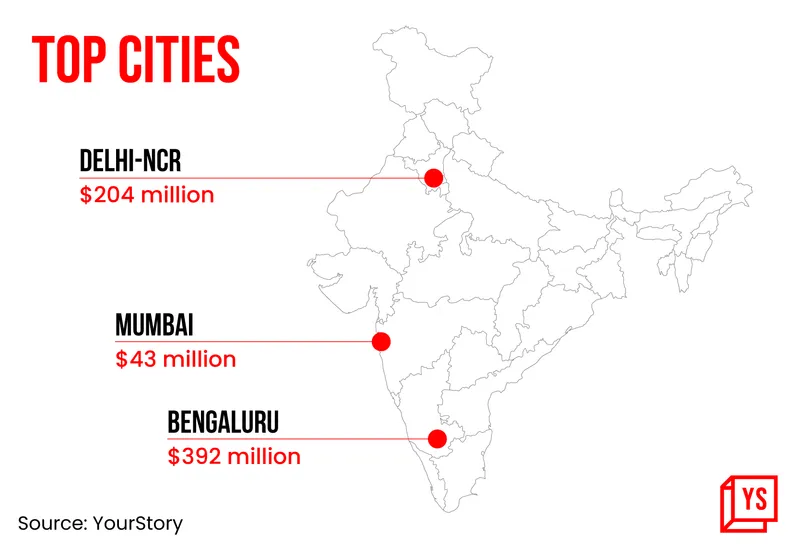

In terms of cities, Bengaluru retained the top spot on the funding chart, followed by NCR and Mumbai.

Is spring around the corner?

The startup funding winter has been largely driven by both global and local macroeconomic conditions.

The rising inflation rate in the United States and the resultant interest rate hike by the US Federal Reserve have been big factors in the lower capital inflow into the domestic startup ecosystem.

Besides, the domestic economy has not shown any major signs of growth, with the latest GDP data for the fourth quarter of 2022 at 4.4%, not giving much confidence.

This has resulted in startups focusing more on metrics such as profitability, sustainable growth and moderate employee addition.

However, this does not mean that capital is not available for startups as venture capital funds such as Accel, Elevation Capital, and Sequoia have already raised an estimated $6 billion in 2022 to deploy in startups.

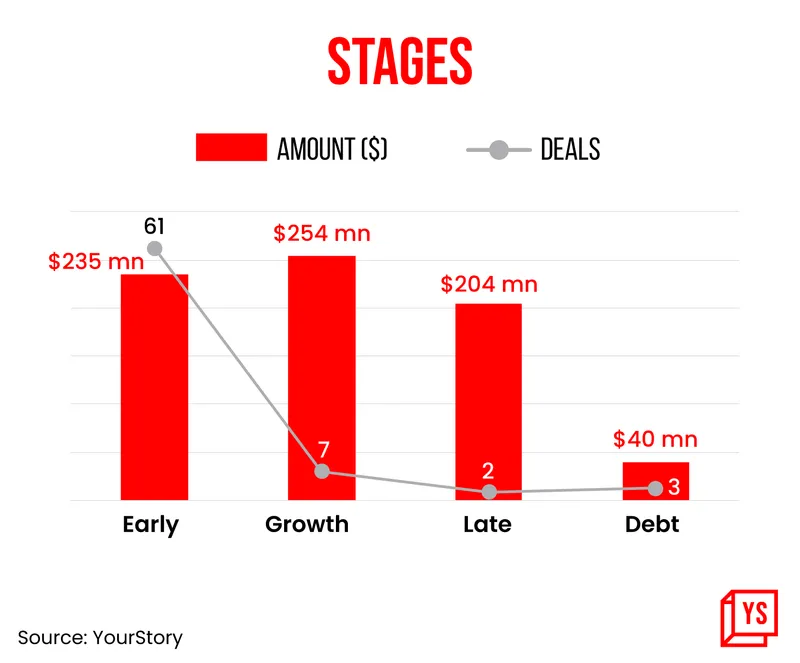

February also saw the continuation of the trend seen over the last year, where early-stage funding of startups accounted for the majority of the deals. Last month, such deals were 61 out of a total 73.

The question now remains—when will large funding deals arrive and signal the end of funding winter? Opinions are divided here as some believe an uptick could be seen from the second half of this year, while others say it could revive from next year.

Edited by Affirunisa Kankudti