MyGate

View Brand PublisherMyGate opens the door to revenue growth and business maturity en route to IPO

The company’s aspirations to go public highlight its strong growth trajectory, supported by financial strength and strategic expansions

In the ever-evolving landscape of community management and security solutions, continues to challenge the status quo and redefine the standards of safety, convenience, and connectivity within gated communities across India.

The company, founded in 2016, has transformed the living experience in gated communities, providing residents with enhanced security measures and streamlined management processes. It has become a fixture across gated communities across India, achieving significant scale, with 25,000 communities, over one billion visit validations annually, and facilitating Rs 3,000 crore in annual maintenance payments.

Simultaneously, the company has matured as a business, with success in its SaaS and advertising divisions while solidifying its market position. Let us examine how the Bengaluru-based team, started by Vijay Arisetty, Abhishek Kumar, and Shreyans Daga, is setting its sights on an aggressive plan to pursue an Initial Public Offering (IPO) within the next three years.

From product innovation to business growth

MyGate’s growth journey to 25,000 communities and 4 million families has been powered by its continuous innovation. MyGate offers a comprehensive suite of solutions, including communication tools, accounting modules, a property marketplace, a home services platform and more to meet the changing needs and expectations of users.

All of this innovation is on the back of a strong business model, as evidenced by its recent financials. The company’s revenues grew nearly 9 times from Rs 8 crore in FY21 to Rs 71 crore in FY23, showcasing MyGate's ability to drive sustainable revenue growth and backing its decision to pursue an IPO within the next three years.

Abhishek Kumar, Co-founder, MyGate, says, “We are in the strongest financial position and well capitalised to fund our future growth. In November 2023, we hit cash break-even and are on the path to a full year of profitability in the next financial year. As an organisation, we are confident of our growth trajectory and gearing up for an IPO three years from now.”

By going public, the company aims to access capital markets for funding to unlock new avenues for expansion and innovation.

The statistics highlight MyGate's market dominance and growth potential:

- The service has gained widespread adoption among residents of 25,000 gated communities, with over four million daily home visitor validations.

- MyGate facilitates society maintenance payments of over Rs 3,000 crore every year.

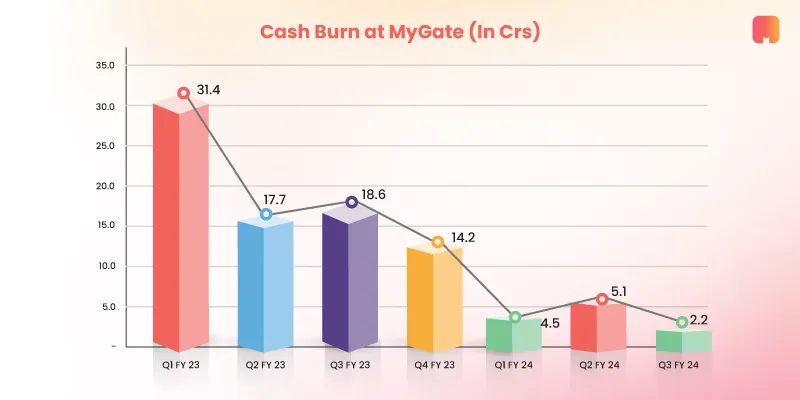

- It has successfully recorded zero cash burn in its core business in November 2023, demonstrating its unwavering commitment to financial discipline and operational efficiency.

- MyGate's ability to maximise resource utilisation resulted in a nearly 4X increase in revenue per employee.

Strategic initiatives driving MyGate's success

MyGate's success can be attributed to a series of strategic initiatives that have propelled its growth and solidified its market leadership:

- Product Innovation: MyGate continues to innovate, introducing new features and enhancements to its platform. From advanced security protocols to seamless communication tools, the innovative solutions set new standards for community management.

- Market Expansion: MyGate's reach extends across 27 major cities in India, serving a diverse range of gated communities. With a presence in metropolitan and Tier II cities, it has established itself as the premier solution for community management nationwide.

- Data Privacy: In addition to adhering to Indian regulation of privacy, MyGate has also implemented GDPR guidelines to put the control of information in the hands of its owners. This transparency framework helps provide top security standards to all users at every level of interaction.

- Financial Performance: MyGate's robust economic performance underscores its sound business model and effective execution strategies. With a revenue growth rate of 20% quarter on quarter for the past three quarters while keeping expenses low, it has demonstrated its ability to drive sustained revenue growth and profitability.

- Ad Platform Business: MyGate’s advertising business, launched in 2022, has taken off well, given its premium audience within consumption hotspots of the country. A combination of both national and international brands from across industries, such as Amazon, Myntra, Asian Paints, H&M, IKEA, Tanishq, Swiggy, HUL, Samsung, and others, use both the digital and offline channels it offers.

Further expansion

In addition to its ambitious IPO plans, MyGate is embarking on a new chapter of expansion with the launch of its business in the Middle East. This strategic move marks a significant milestone in the company’s global expansion efforts, signalling its intent to extend its innovative solutions beyond the borders of India.

Establishing a new office in Dubai underscores MyGate's commitment to serving gated communities and enhancing security measures on a global scale. By venturing into the Middle East market, the company aims to leverage its expertise in community management and security to address the needs of diverse regional communities.

As the company continues to grow and innovate, it remains committed to delivering cutting-edge solutions that empower gated communities and enhance the quality of living experience for residents everywhere.