How LICO Materials is transforming recycling of lithium-ion battery waste into a sustainable resource

The startup recycles, refurbishes, and recovers critical materials like lithium, cobalt, manganese, and nickel from end-of-life batteries, which can be used to make new batteries.

As the demand for electric vehicles (EVs) and renewable energy storage accelerates, the question of what happens to lithium-ion batteries at the end of their life becomes increasingly critical.

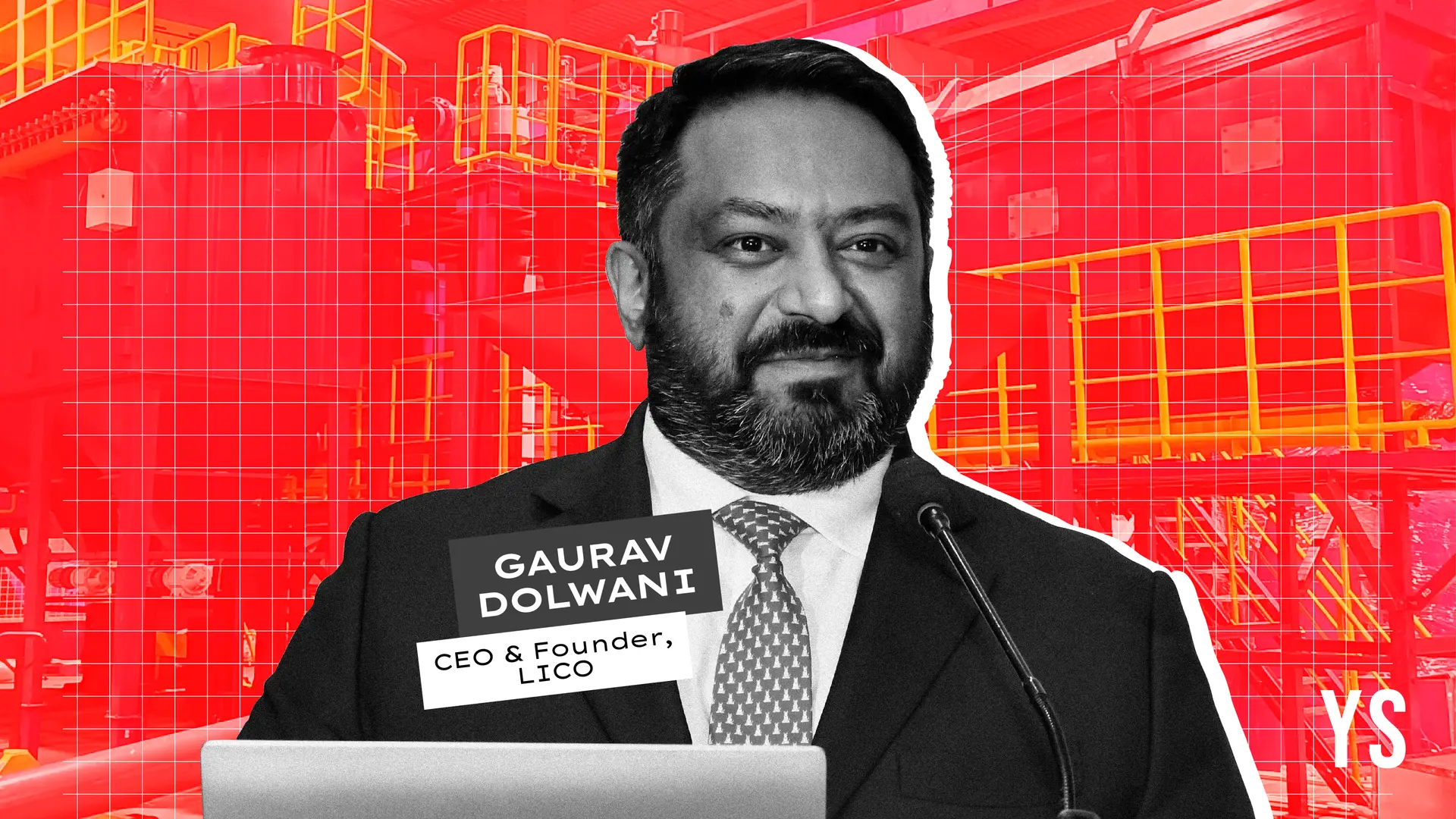

These batteries, which power EVs and energy storage systems, eventually degrade and lose their capacity to perform efficiently, leading to the challenge of managing battery waste. This is where LICO Materials, a venture founded by Gaurav Dolwani in 2021, is playing a transformative role.

Founded in 2021, aims to transform the recycling and refurbishment of lithium-ion batteries, with the goal of creating a sustainable circular economy.

The Mumbai-based startup recycles, refurbishes, and recovers critical materials like lithium, cobalt, manganese, and nickel from end-of-life batteries, which are then returned to battery manufacturers to be used in making new batteries.

“As electrification gained momentum, I discovered the stark reality that India lacked domestic sources for these materials. This alarming dependency prompted us to explore alternative sourcing strategies, ultimately leading to considering the end-of-life fate of lithium-ion batteries,” Dolwani says.

“Battery recycling is not just an option; it’s a priority for securing the future energy needs of our country,” he adds.

According to NITI Aayog, critical minerals and active materials used in lithium-ion battery production contribute to 33-58% of the total cost of the battery pack. As the demand for these materials increases, especially with the EV market set to grow by 250% in the next three to four years, sustainable practices such as battery recycling becomes crucial.

“I saw an opportunity to not only recover these materials but also reduce environmental impact—traditional mining practices come at a significant ecological cost, while recycling presents a much cleaner alternative,” Dolwani says.

The genesis of LICO Materials

Dolwani’s journey with battery recycling began with his previous venture, BORVO Resources Singapore, a mineral commodity trading business.

“As I explored the landscape of critical minerals in India, I was struck by a stark reality—our country relies entirely on imports for essential materials like lithium, cobalt, manganese, and nickel,” he explains.

His quest for solutions led him to recognise the potential of battery recycling, an area overlooked despite the metals industry’s successful recycling of aluminum and steel.

“Given the metal industry’s strong history of recycling aluminum, steel, and copper, I realised that battery recycling could be a game changer for our energy future,” Dolwani adds.

This insight laid the groundwork for the establishment of LICO Materials, which aims to improve sustainability in the EV sector and tackle the growing problem of lithium-ion battery waste management.

India’s push towards electric vehicles has seen a considerable increase in EVs on the roads despite initial slow momentum from the government and sector. This growing interest in EVs, along with an increasing reliance on lithium-ion batteries across various sectors such as consumer electronics (laptops, smartphones, etc.), represents a fundamental shift in how energy is consumed and stored in the country.

The recycling process

LICO’s recycling process begins with the collection and assessment of spent batteries, where usable ones are refurbished and non-functional batteries are prepared for recycling. The batteries are then mechanically shredded, crushed, and sorted using magnetic separation, vibration screening, and sieving techniques to separate materials like plastic, steel, aluminum foil, copper foil, and black mass.

“This process ensures zero waste and zero discharge, supporting eco-friendly recycling, thus recovering everything from spent batteries with no loss of critical materials,” says Dolwani.

A proprietary mechanical separation process delivers high-purity black mass, which undergoes further purification to extract critical metals such as lithium, cobalt, manganese, and nickel.

“The global industry standard recovery rate from mechanical separation is around 75-80%. At LICO, we have achieved a recovery rate as high as 92%, thanks to our optimised processes,” adds Dolwani.

These metals are then supplied back to battery manufacturers for reuse in new batteries. This entire process is conducted under a zero-liquid discharge principle, ensuring no harmful emissions are released into the environment.

LICO’s flagship facility in Mumbai has a processing capacity of 3,000 metric tonnes per year.

LICO also integrates AI-powered image recognition to automatically identify and categorise battery types and chemistries on conveyor belts, optimising sorting accuracy.

“Battery recycling is not a choice; it’s a priority for the energy needs of our country. We can achieve this with zero waste and zero discharge, ensuring that nothing is lost in the process,” he adds.

Business model and challenges

The India battery recycling market was valued at $1.97 billion in 2023 and is expected to grow at a strong CAGR of around 9.8% during the forecast period (2024-2030), according to UnivDatos report.

LICO generates revenue by selling minerals to battery manufacturers and paying for the raw materials. In the last financial year, the startup reported a revenue of Rs 30 crore and is targeting Rs 60 crore for the current financial year.

The bootstrapped startup has partnered with global giants like Samsung in Korea, the USA, the Philippines, and Malaysia to source batteries for recycling. “We have partnered with various OEMs, including MG Motors, to assist them in fulfilling their Extended Producer Responsibility (EPR) obligations, which underscores the importance of our services,” Dolwani shares.

LICO works with OEMs in the EV sector, the battery energy storage systems (BESS) sector, and consumer electronics manufacturers. These partnerships help the company meet EPR obligations and enhance the recycling ecosystem.

“OEMs need to view end-of-life batteries not just as waste but as valuable resources. By establishing long-term partnerships, we can create circular supply chains that benefit everyone involved,” he states.

To further bolster these efforts, Dolwani underscores the importance of educating consumers about responsible battery disposal. “Public awareness campaigns are crucial for promoting responsible disposal and recycling,” he emphasises.

Speaking about challenges, Dolwani says, “The absence of comprehensive regulations creates uncertainty and complicates our operations.” He advocates for a robust policy framework that can support and streamline the recycling ecosystem, enabling greater participation from all stakeholders.

Another challenge has been the shortage of skilled talent and established industry standards for defining parameters. Hence, the company has partnered with global leaders to optimise processes and improve efficiencies, aiming for better purity grade recovery of critical minerals.

What next?

LICO plans to build a larger facility in Bengaluru, which is set to open by December 2024. This facility aims to enhance the company’s annual capacity to 25,000 tonnes by 2026.

The startup is also planning to use hydrometallurgy technology to recover battery-grade metal salts from black mass during recycling, aiming to improve material purity and close the supply chain loop for battery manufacturers.

“By 2027, we aim to recycle batteries from 200,000 small electric cars annually, which relates to a saving of 100 million liters of water equivalent to 40 Olympic size swimming pools and saving of CO2 emissions equivalent to CO2 absorption by 37 million trees,” Dolwani explains.

“In the next 5-10 years, we aim to become the global leader in processing, with plans to establish multiple facilities across India and forge strategic partnerships with leading technology firms worldwide. Recycling is a mandate for energy security, and we are committed to making it a reality,” Dolwani says.

LICO currently competes with players such as , Attero Recycling Pvt Ltd, , ACE Green Recycling Inc., and Exigo Recycling. “Our proprietary eco-friendly technology enhances material recovery from end-of-life batteries, ensuring higher recovery rates of critical materials for reuse in new batteries, reducing the environmental footprint and providing a sustainable, cost-effective solution for the growing demand in electric vehicles and renewable energy sectors,” he adds.

Edited by Megha Reddy