Binance

View Brand PublisherFrom Bitcoin to Crypto Education: Top Priorities and Must-Have Features for Today’s Crypto Traders

Discover what drives crypto adoption in 2024 as traders prioritise Bitcoin, Ethereum, and trust in exchanges. This survey sheds light on the critical role of education and platform security in shaping the future of cryptocurrency trading.

Cryptocurrency, once a niche domain dominated by tech enthusiasts, has rapidly evolved into a global phenomenon, reshaping how people perceive and engage with finance. As adoption grows, so does the curiosity around how traders interact with the crypto ecosystem—what motivates them, the challenges they face, and the features they value most.

To uncover these insights, YourStory, powered by Binance, conducted a comprehensive survey targeting over 700 cryptocurrency enthusiasts worldwide. The survey not only delves into trading habits but also sheds light on the tools and platforms shaping their experiences.

From the dominance of top cryptocurrencies like Bitcoin and Ethereum to the growing importance of educational resources and trust in exchanges, the findings offer a glimpse into the preferences of modern crypto traders. These results also provide insights into the behaviours, barriers, and opportunities shaping the future of crypto adoption.

A young and diverse audience drives crypto interest

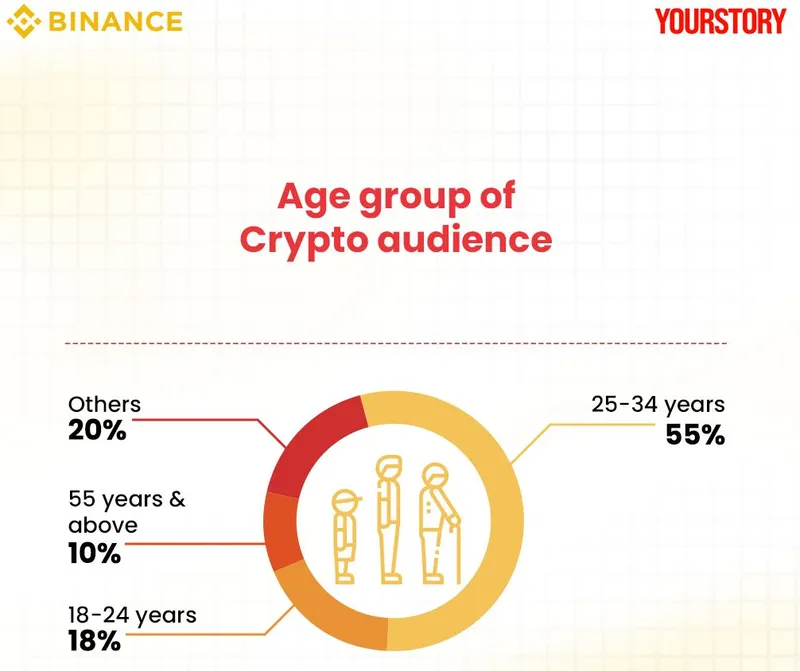

Cryptocurrency trading is predominantly popular among younger demographics, with 55% of respondents falling in the 25–34 age group and 18% aged between 18–24. Interestingly, 10% of respondents were over 55 years old, demonstrating growing interest among older, more experienced individuals. This age diversity highlights the widespread appeal of cryptocurrencies, from tech-savvy millennials to seasoned investors.

These statistics underline the diverse demographic embracing cryptocurrencies. Platforms should focus on creating tailored experiences and educational resources to address the needs of both younger, tech-savvy traders and older professionals exploring digital assets.

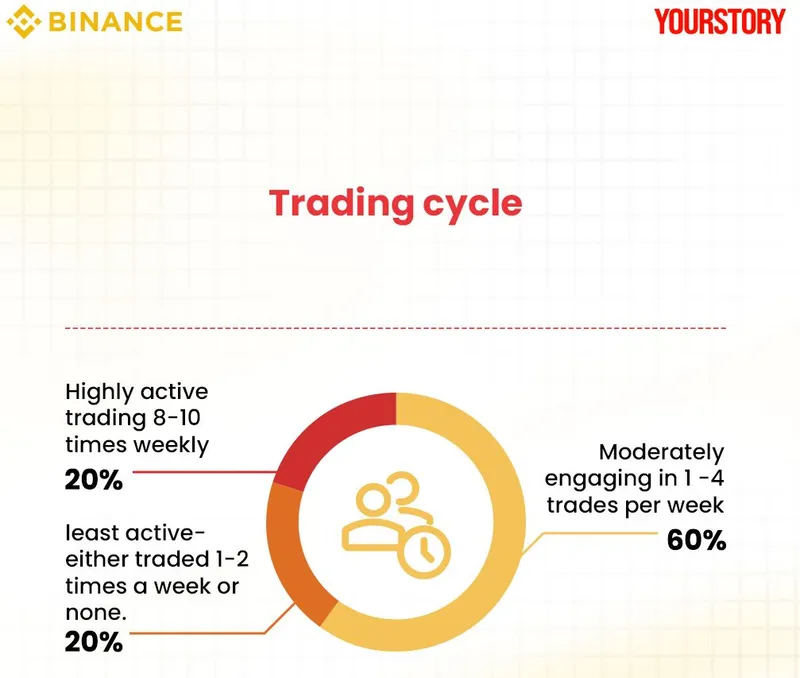

The survey revealed that 60% of respondents traded moderately, engaging in one to four trades per week, while 20% were highly active, trading 8–10 times weekly. When it came to asset preferences, Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) stood out, with 75% of traders transacting in these leading cryptocurrencies.

This preference suggests that while traders are open to exploring new assets, the most trusted and well-known cryptocurrencies dominate trading activities. Educational platforms should therefore focus on top assets while introducing advanced insights for niche altcoins.

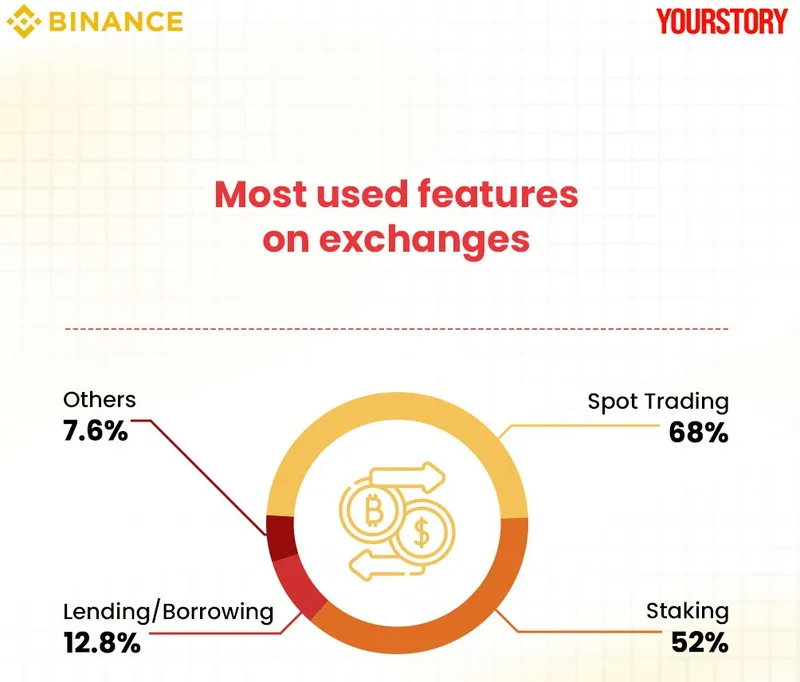

Spot trading and staking: Most-used features on exchanges

Among the features offered by exchanges, spot trading emerged as the most widely used, with 68% of respondents engaging with it. Staking followed closely at 52%, while more advanced functionalities like lending/borrowing (12%) and derivatives (8%) saw limited use. This indicates a significant opportunity to introduce traders to advanced financial tools through user-friendly guides and tutorials.

By focusing on simplifying access to advanced features, platforms can empower traders to diversify their strategies and explore the full spectrum of opportunities in cryptocurrency trading.

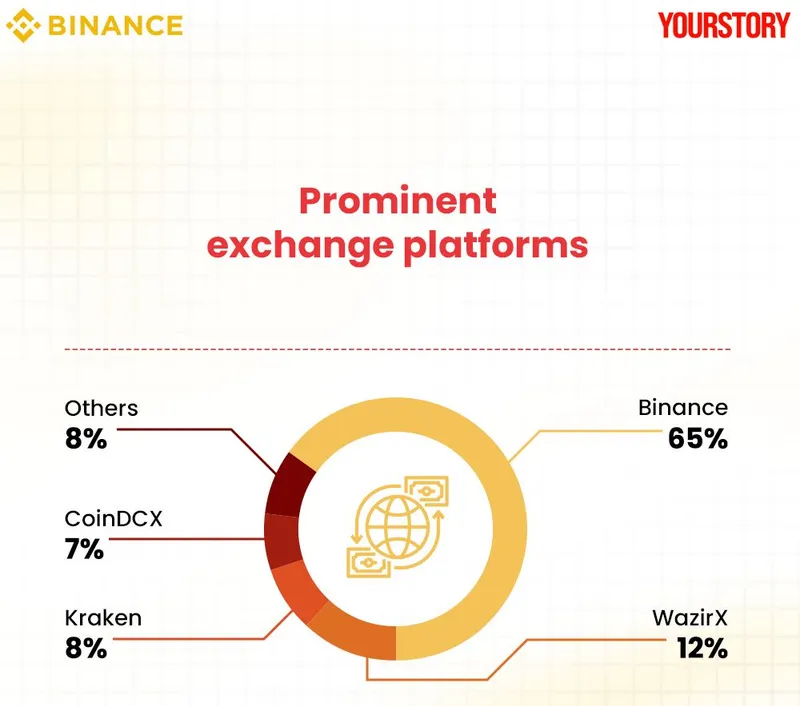

Binance leads the way, but competition grows

Unsurprisingly, Binance emerged as the preferred exchange, with 65% of respondents selecting it as their platform of choice. Other contenders included WazirX (12%), Kraken (8%), and CoinDCX (7%). Notably, 60% of respondents said they would recommend Binance to their peers, praising its comprehensive services and trustworthiness.

Trust in centralised exchanges: A double-edged sword

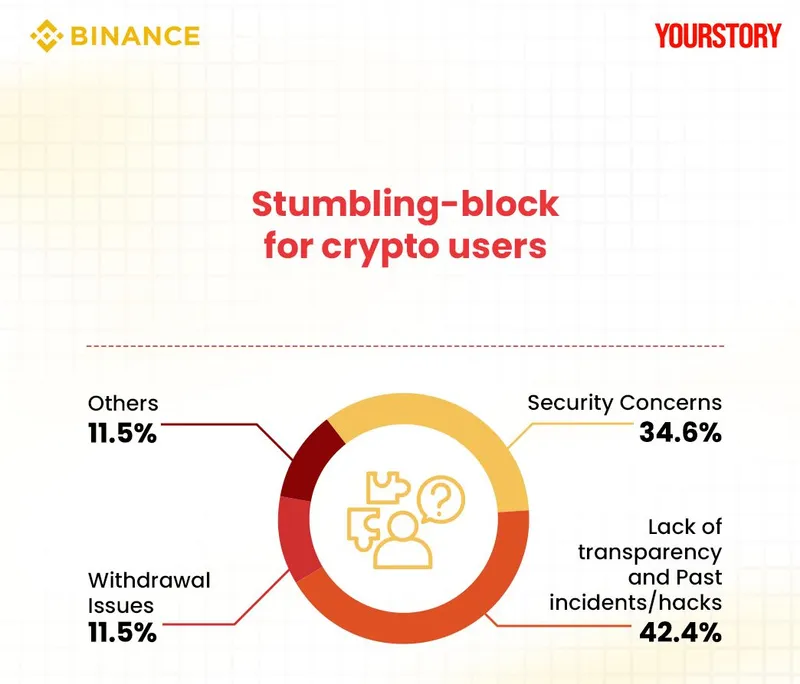

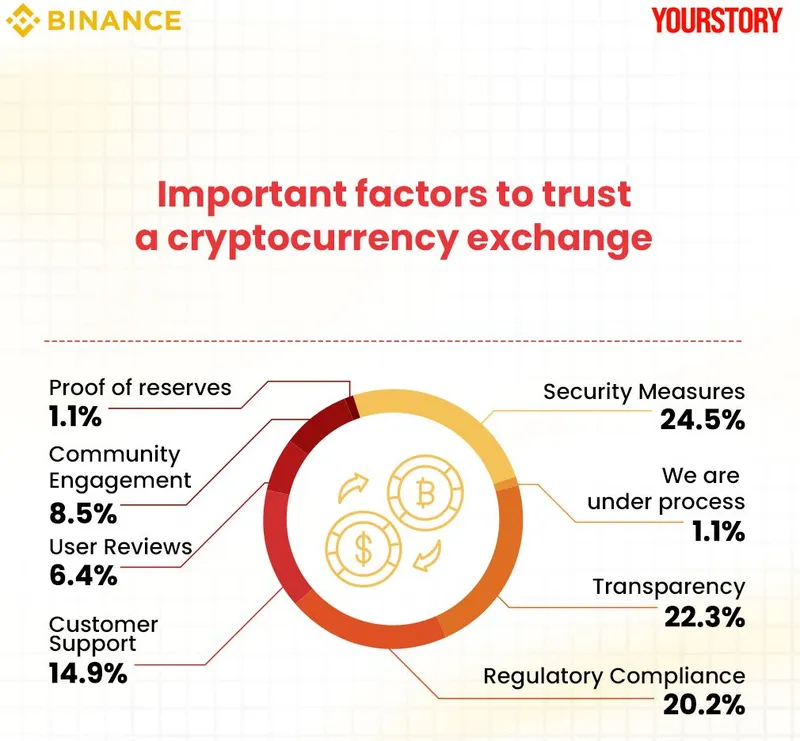

Trust in centralised exchanges remains a contentious issue. While 40% of respondents rated their trust levels as high (8–10), 35% expressed low-to-moderate trust (1–4). Concerns about security breaches, lack of transparency, and withdrawal issues were the key deterrents for sceptics, while those with higher trust cited regulatory compliance and robust security features as reassuring factors.To bridge this trust gap, exchanges must prioritise transparency, such as providing real-time proof of reserves, enhancing withdrawal processes, and improving customer support.

A key initiative in building trust is Binance’s Proof of Reserves (PoR) system, introduced about two years ago. This technology ensures that all user assets are backed 1:1 and offers verifiable transparency without compromising privacy, thanks to the use of zk-SNARKs. By incorporating user liabilities and collateral information, Binance has set a high standard for transparency in the industry. Exchanges that adopt similar PoR practices can demonstrate their commitment to safeguarding user assets, fostering greater confidence among both current and potential users.

In addition to enhancing transparency through PoR, Binance is also committed to supporting global law enforcement agencies in combatting financial crime. Through successful collaborations with authorities, such as the Enforcement Directorate in India and the Delhi Police, Binance has played a role in dismantling major fraud operations, including the E-Nugget scam and the M/s Goldcoat Solar renewable energy fraud. By providing technical expertise, blockchain analysis, and investigative support, Binance helps law enforcement trace illicit funds, freeze assets, and bring fraudsters to justice. These public-private partnerships demonstrate Binance's ongoing commitment to maintaining the integrity of the digital financial ecosystem and combating crypto-related crimes.

Barriers to learning: The education gap

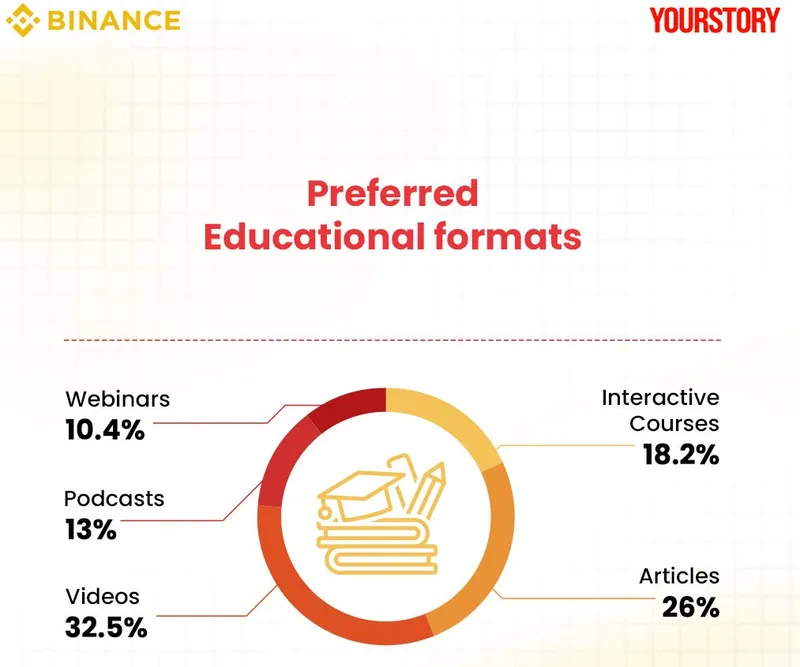

Despite the availability of educational resources from exchanges, 58% of traders reported rarely or never using them. The main barriers included lack of time (40%), difficulty finding relevant content (32%), and unawareness of existing resources (18%). This gap underscores the need for accessible and engaging educational materials tailored to the fast-paced lifestyles of crypto enthusiasts.

Platforms can address this by providing short-form video tutorials, interactive courses, and bite-sized articles that simplify complex concepts. Localised content catering to emerging markets can further enhance engagement.

Building a stronger crypto ecosystem

The survey has spotlighted the priorities and pain points of cryptocurrency traders worldwide. From the dominance of top cryptocurrencies and the popularity of spot trading to the educational gaps and trust challenges faced by exchanges, the findings present a roadmap for platforms to create more inclusive and user-friendly experiences.

By investing in education, improving transparency, and tailoring content to regional and demographic needs, exchanges can empower traders to navigate the complex world of cryptocurrencies confidently. As the crypto ecosystem evolves, collaboration between platforms and users will be key to ensuring sustainable growth and wider adoption of this transformative technology.