Udemy sees surge in learners as Indians opt for GenAI upskilling: CEO Greg Brown

Udemy's President and CEO Greg Brown says the company is seeing traction in upskilling in India for GenAI, soft skills, and leadership. It is also leveraging AI to personalise learning and expand regional offerings.

Beyond the fight for AI dominance between ChatGPT and DeepSeek, generative AI is quietly making its way into classrooms. From customising learning lessons to summarising research papers and offering writing assistance, GenAI tools have become prevalent across learning levels.

Online learning and teaching platform Udemy too is riding the GenAI wave. It offers instructor-led courses and regional language options for local learners, all while leveraging AI to enhance learning experiences.

The platform has recently seen a “significant increase” in GenAI and course consumption from both enterprises and individual learners.

“Our growth engine is the enterprise side of our business, and the marketplace (consumer side) is the foundation for all of the content creation that fuels the growth in the enterprise,” the US-based startup’s President and CEO Greg Brown tells YourStory in an exclusive interview.

He highlights that the platform continues to see “strong signals in the enterprise (segment)” when it comes to upskilling, much of which is driven by India—a key market.

The CEO notes that organisations are currently focusing on three key areas of skilling.

First, there is a strong emphasis on GenAI skill development, with significant interest and growth in India—where Udemy has 16 million learners on its platform.

Second, companies are investing in soft skills development to complement GenAI competencies, ensuring that employees can apply AI effectively in their roles while maintaining crucial interpersonal skills.

Finally, leadership teams are being trained to understand and strategically apply GenAI, ensuring they can maximise its impact within their organisations.

Brown explains the reason behind the uptick in interest is the need to stay competitive in the job market. This is especially the case in India where more than 65% of the population is under the age of 35, and the need to stay ahead of the herd necessitates upskilling.

“In the past year alone, we saw 1.2 million GenAI enrolments from India—equivalent to more than two enrolments per minute,” Brown says, adding that he doesn’t expect that momentum to slow down.

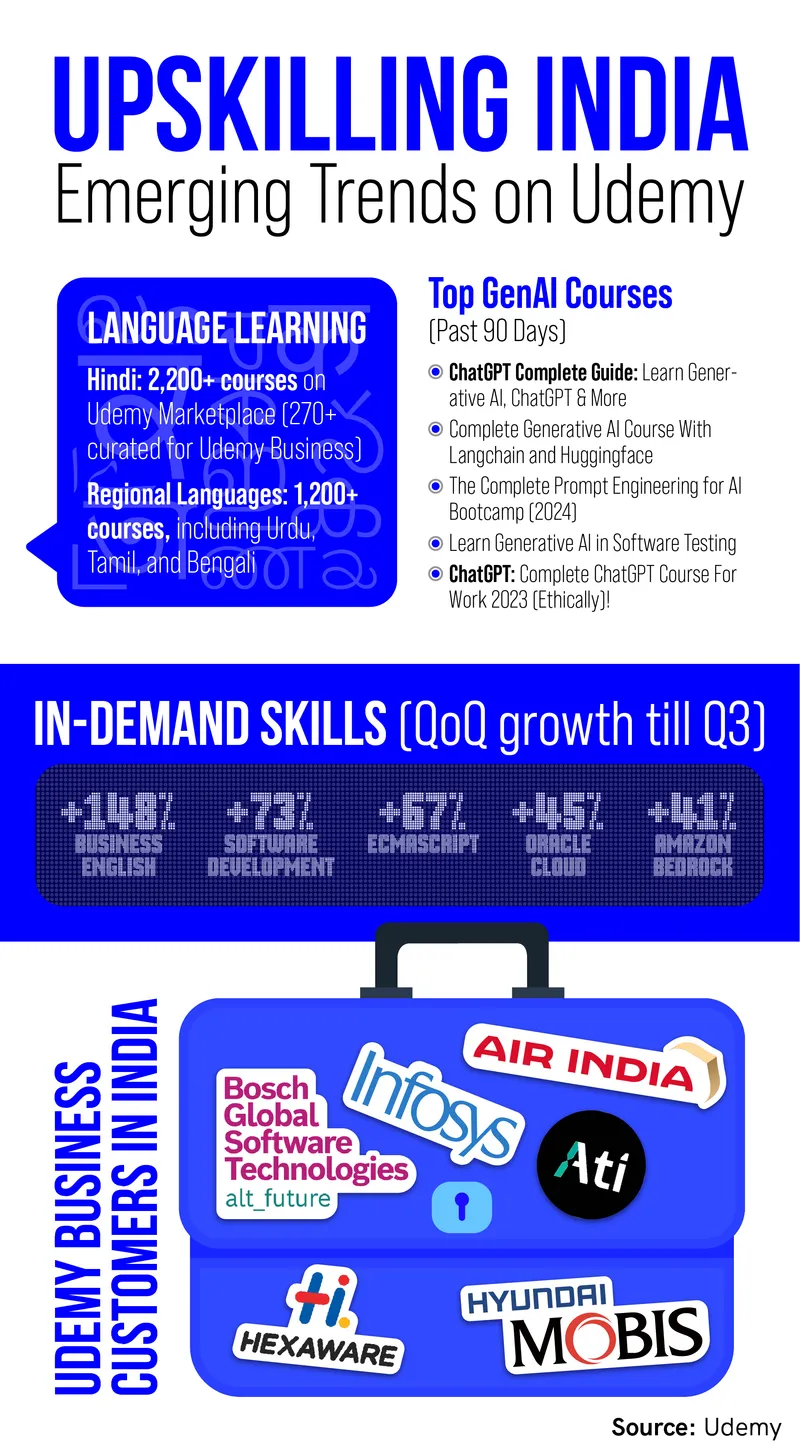

On the enterprise front, Udemy has over 17,000 customers on its platform, with around 300 being large enterprise customers in India. These include Infosys, Bosch Global Software Technologies, Air India, Hyundai Mobis, AMIDC Automation Technologies, and Hexaware Technologies, among others.

According to the Udemy chief, 2024 was a year of foundational education on GenAI within organisations, and 2025 will focus on the functional application of GenAI.

“What we are seeing now is organisations taking the next step, asking for our help, and that of other companies like ours, to assist them in developing a strategy and the skills necessary for the functional application of GenAI,” adds Brown.

Skilling: GenAI and beyond

As GenAI gains momentum, tech skills remain at the forefront, with strong demand for software engineering, data science, and cloud technologies like AWS, Google Cloud, and Microsoft Endpoint Manager. At the same time, there’s a growing focus on communication, teamwork, English grammar, and problem-solving.

According to Brown, some of these skilling trends in India are largely similar to trends outside the country. However, he notes a key difference: there is less demand for legacy programming skills, such as COBOL, in some other markets.

“More mature organisations are increasingly investing in business and soft skills, such as change management and leadership development. They are focusing on preparing their next generation of leaders,” Brown notes.

This places Udemy at an advantage as it offers a cohort-based management leadership track designed to help organisations develop leaders at all levels. Its global marketplace offers over 250,000 courses created by instructors worldwide “at the pace of change,” says the CEO.

He explains that as companies like OpenAI or Anthropic release their new technologies, the platform’s instructors quickly develop and update courses, ensuring they are available as soon as those releases launch.

“Our instructors make money in our marketplace and through our Udemy business collection when they release these updates. They are financially incentivised, so they are fully aligned with us,” Brown adds.

He points out that most of Udemy’s competitors are publishers and rely on contracting and paying instructors to develop and publish courses, while the platform does this in-house.

Speaking about the quality of the content, Brown notes that all courses on the platform undergo a ratings and review process, allowing them to identify highly rated courses, which are then included in the Udemy business collection. Udemy also leverages AI and machine learning to review any inappropriate language or content that doesn’t meet enterprise standards.

The platform constantly collects feedback from learners and organisations, covering course quality and identifying content gaps. This input is used to guide the instructors in developing new content.

Udemy’s competitors include Coursera, upGrad, Simplilearn, Great Learning, Eruditus, LinkedIn Learning, Skillshare, Pluralsight, edX, and Udacity.

Design: Nihar Apte

Leveraging AI

Its AI-powered solutions, introduced last year, also play a role in course curation. “Our skills mapping technology is tuned to be able to help with the curation and the personalisation of learning paths associated with native language courses, not just in India, but around the world,” says Brown.

The Udemy chief adds that the platform aims to automate the creation of personalised learning paths by assessing skills across the spectrum. Currently, it assesses technical skills, but by the end of 2025, it will be able to assess all skills, giving it a significant advantage.

Tapping into regional learning markets

While Udemy widely uses AI, when it comes to native language courses for Indian learners—developed by its 9,000-odd instructors in India—are not dubbed or translated.

“One of the things Indian learners appreciate is learning from instructors who are native to their culture. They understand the nuances of learning, teaching, and instruction in their market, as well as the language,” highlights Brown.

Udemy offers over 2,200 courses in Hindi on its marketplace, with more than 270 being curated courses in Udemy Business, its enterprise segment. In addition to Hindi, which is the most consumed language, there are over 1,200 courses available in regional languages such as Urdu, Tamil, Bengali, Telugu, Marathi, and Gujarati.

Market-specific strategies

In India, Udemy has over 100 employees, including in the Development Center of Excellence in Chennai, and sales and go-to-market teams across the country. This local presence helps the company tailor its platform, skills mapping, and AI assistant.

For instance, in India, learning and having a growth mindset are core values from birth, says Brown, adding that it’s inherent in the culture, and the way Indians approach learning is unique to their culture.

In Japan, while there is a strong growth mindset, the focus on learning differs, with SAP being a major area of investment for many organisations. This contrasts with India, where SAP is not as prominent. In the US, SAP is well-established, but tools like Salesforce and ServiceNow are more prominent.

Business as usual?

Udemy's total revenue increased 6% year-over-year (YoY) to $195.4 million in the quarter ended September 2024. Revenue from Udemy Business grew 16% YoY to $126.1 million, while revenue from the consumer segment declined 8% YoY to $69.3 million.

For the US-headquartered learning platform, India is one of its top three markets in terms of both business contribution and traffic, according to Brown.

“We will continue developing capabilities to meet the needs of our Indian customers as we move forward, from a product standpoint,” Brown notes. “We will continue to invest in expanding our presence in India,” he adds.

(The article was updated with an infographic.)

Edited by Kanishk Singh