Whey ahead: Brands fortify staples with protein power as consumers turn health-conscious

With a growing trend of health-conscious consumers asking for higher value from their everyday consumable, D2C brands and legacy players alike are jumping on the proteinification trend.

Protein powders and bars have long been a mainstay among the fitness community, especially regular gym-goers who are focused on building up muscle mass.

However, in recent years, there has been a growing cognisance within the general public about protein deficiency, even in groups that don’t actively track calories and use protein for post workout muscle repair and growth.

This has prompted a slew of products from new-age D2C brands as well as legacy players to cater to the growing need for protein-infused products outside of the usual bars and powders.

“Post-COVID, Indian consumers are being more health conscious with consumers looking at what they eat, how much they eat. In this noise of carb intake and fat content, protein emerges as a sort of knight in shining armour, with no particular cons, just upsides. This has given rise to, what we like to call ‘proteinification’ of our foods,” says Nikunj Biyani, Co-founder of SuperYou.

Now, D2C brands are looking to help Indian consumers bulk up their diets and introduce protein in other forms, including daily breakfast staples like bread, milk, idlis and more.

Earlier this year, iD Fresh launched protein-rich idly and dosa batters, a speciality variant from its flagship batter products. Bengaluru-based Protein Chef has also been offering protein mixes for flour, multigrain protein atta, high protein South mixture (a savoury snack) and protein bread.

The Health Factory, which commands a significant share of bread sales on quick commerce platforms, offers zero-maida protein bread with two variants (38 grams of protein per loaf and 48 grams of protein per loaf). Other bread brands offering protein variants include Mille, Milky Mist, Aashirvaad, Britannia, and even some Amul products.

“Overall, people have begun to realise that the vegetarian Indian diet is protein deficient. This thought has now percolated across multiple levels; even if regular consumers may not actively be doing something about it. Also, they don't know how much they are deficient. But at least they now recognise they have a potential protein deficiency,” says Sudarshan Gangrade, Lo Foods, Founder and CEO. The company operates brands like DiabeSmart, Protein Chef, and KetoSmart.

Anandita, a 21-year-old media professional, started noticing a protein deficiency in her existing diet after listening to frequent discussions on social media about it. Since then, she has purchased protein powder, shifted to a protein bread, and has even tried to add protein paneer and milkshakes into her routine.

Anandita is part of a growing number of people who believe they consume less protein than they should. This cohort is trying to get more from their daily diet through options which provide better alternatives without looking at post-workout muscle repair as a key use case for protein.

For passive consumers who don't actively track their protein and calorie intake, adding additional habits like preparing and consuming protein shakes and special foods could be a hindrance over making slight changes to daily routines. The increasing availability of products that come without the hassle of extensive meal prep is making it simpler to boost protein intake on the go, Anandita concurs.

“Consumers are not looking to create new habits, they just want to improve their existing behaviour. We started with how we can make what consumers are eating every day - normal grains and flour- be higher in protein so that they are having a better version of their normal diet rather than changing their meals,” says Shauravi M, Co-founder of Wholsum Foods, which operates FMCG brands Slurrp Farm and Mille.

With brands trying to get a space with daily essentials, the majority of such products are inclined towards plant-based protein extracts, which pair better with home-cooked meals.

Plant-based proteins usually feature extracts like soy protein isolate, pea protein, and lentil protein extract along with products made from chickpea, ragi, jowar and flax seeds. While whey protein is derived from milk during the cheese-making process, it is filtrated and processed to different levels to turn it into a consumable, which impacts its appeal as a more “natural” source of protein, says Gangrade.

“Value-added and functional products are typically consumed as part of a meal. Therefore, working with plant-based sources is always beneficial, as consumers tend to prefer natural protein extracts for regular use. Since protein-based products need to be consumed consistently, this is another way to build high purchase frequency products,” says Rajat Diwaker, CEO (India), iD Fresh.

Do consumers know how much protein they really need?

Unlike iron and vitamins, whose deficiency is easier to detect with common blood tests, protein levels are measured through a host of tests and factors like body weight fluctuations and BMI levels. Besides a group of calorie-conscious health enthusiasts, general consumers are not actively monitoring protein in their body with regular tests.

“As per the Recommended Dietary Allowance (RDA) given by the Indian Council of Medical Research (ICMR) for Indians, the average Indian adult needs 0.8g-1gm per kg ideal body weight of protein, the average dietary intake is only close to 0.6 g per kg ideal body weight,” says a study released by Right to Protein Initiative.

This recommendation, however, is the bare minimum required for a sedentary lifestyle and each person’s ideal protein intake is subject to individual attributes and activity levels, says Aathira Sethumadhavan, a certified health and wellness coach.

The average Indian diet is also heavily reliant on refined carbohydrates, which results in lower fibre and protein intake, she adds.

”Our sedentary lifestyle along with high refined carb intake requires us to increase protein intake to counterbalance these factors. I personally believe you should consume at least 1.2 to 2 times your body weight in grams of protein. The minimum should be 1.2 times your per kg body weight,” explains Sethumadhavan, who has also used products from Prolicious and Slurrp Farm.

Taste and texture reign supreme

With everyone working with the same set of raw materials to offer protein, brands are banking on taste to grab rack space in consumers’ kitchens.

“At the end of the day, the micro differences in taste become your moat. For example, one person's protein pasta will taste better than another's, and that comes down to the effort put into testing and recipes. Over time, you build a brand around it. The next level is your ability to source cheaper than others, which further decides at what price point you reach the consumer,” says Shauravi.

Brands are pumping money into R&D to find cost-effective sources of protein and create the right formulation and ratios which don’t compromise taste and texture.

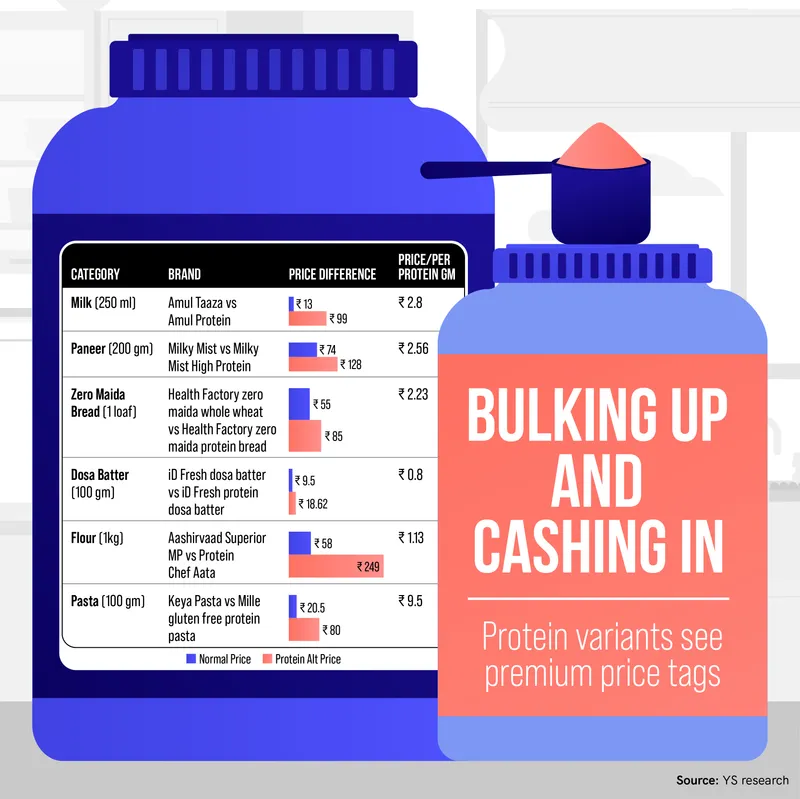

However, with the market still growing and new products and formats finding adoption with consumers, founders say it is difficult to peg what is a premium that consumers are willing to pay for superfoods like this.

“Overall, it is a pro-consumer product and if it's a good value, then people will buy. But it cannot be at an obnoxious premium. I believe people want to move to healthier products, but beyond 30 to 40% premium, nobody wants to pay and that is bound to hold in staples also,” believes Gangrade.

Other founders also echo a similar expectation, adding that brands could find a ready market even with up to a 25% premium on such products.

A premium range in an existing category is not just good news for brands who are riding on the premiumisation wave but for their choice of distribution channels as well, which lends the brand higher visibility and a focused target group. With its premium label, the segment has seen strong encouragement from quick commerce platforms, which are banking on premium and larger packs to push up their average order value.

Lo! Foods is currently focused on scaling Protein Chef among its house of brands. It launched Protein Chef on quick commerce platforms less than 10 months ago, and since then it has already overtaken all other channels including its own D2C channels, ecommerce platforms and traditional retail. It currently brings in 60% of all its consumer product sales. Wholesum Foods also flagged growing traction from quick commerce platforms, which is currently over 30%.

“Investors are particularly excited about categories that are better for consumers, which offer a healthy upside to consumers. There is an understanding that India is ready for ‘proteinified’ foods and that India is willing to pay a certain amount more, 15% to 25% for healthier alternatives,” adds Biyani.

A seminal trend that emerged earlier was consumers seeking products with "no nasties" across categories like beauty and food. This led to the growth of brands like MamaEarth and The Whole Truth, which focused on clean formulations and delivering exactly what was promised on the label. This has now become a basic requirement for the category, explains Vinay Singh, Co-Founder & Partner at Fireside Ventures, which counts brands like Slurrp Farm in its portfolio.

What this also means is that consumers now expect more bang for their buck from everyday products, whether that involves nutritional value for foods or product efficacy for beauty brands, Singh explains.

Investor action in the segment has also picked up with the health food boom, with protein and healthy snacking brands seeing a surge in funding. Earlier in February, PeakXV-backed health food brand The Whole Truth raised Rs 133.3 crore in its Series C funding round, with a 3.6x increase in valuation from its last round. It currently offers protein powders, protein bars and butter with a promise of complete transparency of its ingredients.

In December, Ranveer Singh-backed Super You raised a Series A round from Nikhil and Nithin Kamath’s Rainmatter Capital.

FMCG giants have also taken note of the consumer traction towards this niche. For instance, ITC acquired health-food brand Yoga Bar in 2023 in an all-cash deal worth Rs 225 crore, which closed in February this year.

Edited by Jyoti Narayan