Fintech personal loans slump 15% in Q3 FY25, sharpest drop since COVID-19 lockdown: FACE

Fintech NBFCs account for 76% of sanction volumes but only 13% of the total personal loan sanction value in FY 24-25 (until December 2024), FACE said.

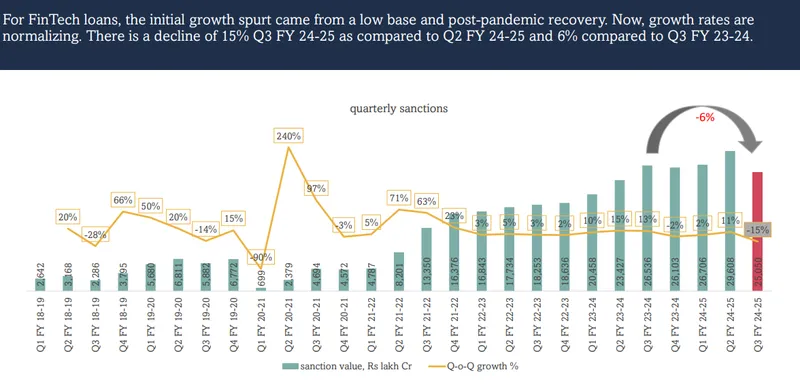

Indian fintech lenders disbursed Rs 25,050 lakh crore in personal loans during Q3 FY 24-25, marking a 15% decline from Rs 29,608 lakh crore in the previous quarter, according to a report by FACE.

This quarter-on-quarter decline is the sharpest since Q1 FY 20-21, when disbursal volumes plunged 90% to Rs 699 lakh crore from Rs 6,772 lakh crore following the nationwide COVID-19 lockdown, a report by Fintech Association for Consumer Empowerment (FACE), the RBI-recognized Fintech SRO, showed.

The fintech lending boom initially gained traction from a low base and post-pandemic recovery. After plummeting to Rs 699 lakh crore in sanctions during the lockdown, fintech loan disbursals rebounded sharply—surging 240% in the subsequent quarter to Rs 2,379 lakh crore.

Since then, disbursal values have grown steadily, though at a slowing pace. “Growth rates are normalizing,” FACE noted in its report.

The last time fintech loan disbursals saw a quarterly decline was in Q4 FY24, when volumes dipped 2% (Rs 433 lakh crore) from Rs 26,536 lakh crore in Q3 FY24.

"While fintech NBFCs account for only 13% of the total personal loan sanction value in FY 24-25 (until December 2024), they drive 76% of sanction volumes, reinforcing their position as key enablers of digital financial inclusion," FACE said.

In Q3 more than a third of loans were sanctioned to customers in Tier III and smaller cities. Additionally, individuals under 35 accounted for two-thirds of the total sanctioned loan value.

Edited by Jyoti Narayan