7 Basic laws every startup entrepreneur should know about

An entreprenuer solves a problem faced by people. For this, he/she should make sure that every move is precise. But don’t forget that it should be considered legit in the eyes of law. So, every entrepreneur should keep in mind certain laws to keep the business honest and think of the long term proposition of the business.

Hence, before you solve people’s problem and start serving them, consider these 7 basic laws that every startup founder in India should know about.

1. Formalize your business structure

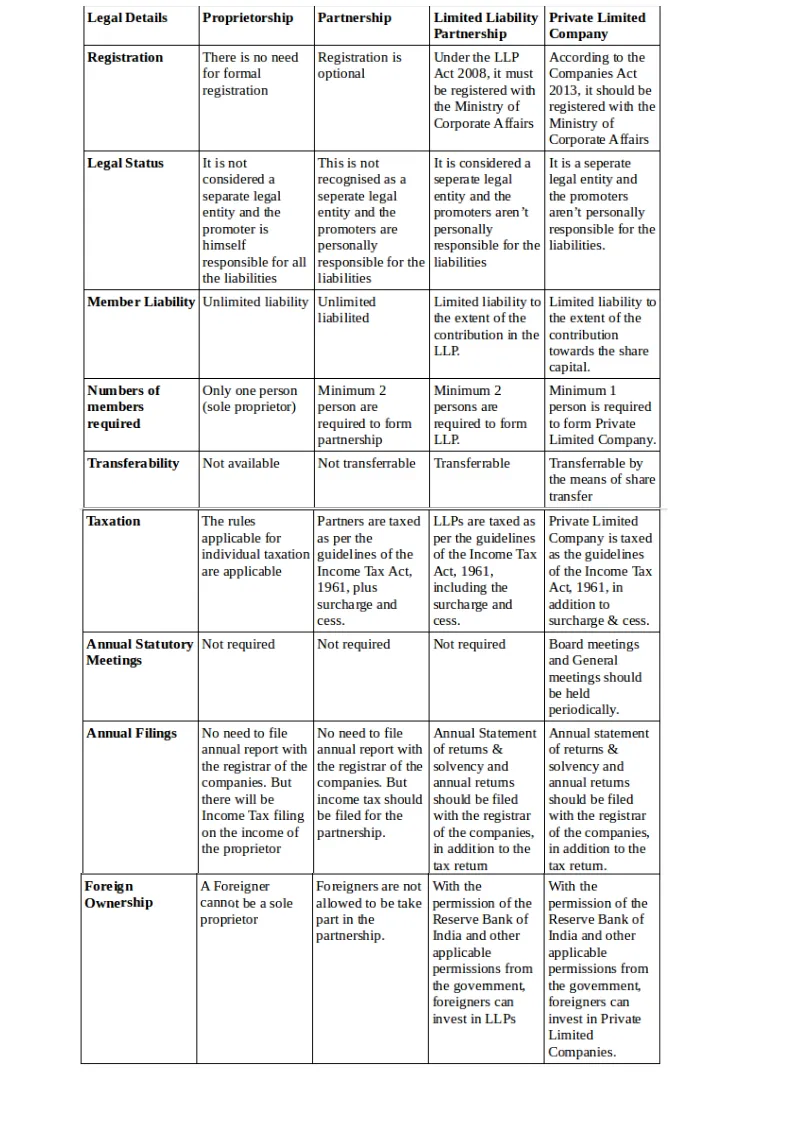

You need to make sure what is the nature of the business and the type of it. There are multitudes of business structure you can choose from. It could be sole proprietorship, limited liability partnership, private limited, public limited, etc. This decision is very important as it shouldn’t conflict your overall vision & purpose of doing this business.

Every type of business comes with some legal applications with it that you should know about.

2. Necessary Licenses

After selecting the type of business, you need to be take care of acquiring certain licenses. These licenses vary according to the nature of the business. Before launching your startup, you need to understand different licenses. In the case of the absence of appropriate licenses, your business might get into legal battles at the inception. These are as follows:

- The most common license that is applicable to every business is the Shop and Establishment Act. It is applicable to every business where trade, business or profession is carried out.

- If you wish to start an e-commerce company, you need licenses like VAT registration, Service Tax Registration, Professional Tax etc.

- Or if you want to establish a restaurant then you may require licenses like Food Safety License, Certificate of Environmental Clearance, Prevention of Food Adulteration Act, Health Trade License etc. In addition to the above mentioned licenses.

3. Familiarize with the Taxation & Accounting laws

Different type of businesses attract different taxes which you should be aware of beforehand. According to the ‘Startup India programme’ launched by the Government Of India, there are many tax exemptions you can benefit from. But before that, there are some conditions for your startup to qualify for these exemptions and these are:

- The total lifespan of the startup should not be more than 7 years (10 years for a biotech)

- Is registered as a Limited Liability Partnership, Limited Liability Company or Private Limited Company.

- The total turnover should not exceed 25crores annually.

- There shouldn’t be an existing business that split or reconstructed into a startup.

It is very crucial for every business to maintain proper books of accounts and audit them from time to time to ensure that taxation rules are adhered to.

4. Beware of Labour Laws

Irrespective of the size of the establishment, you need to adhere to the labour laws. These laws could be with regard to minimum wages, gratuity, PF payment, weekly holidays, maternity benefits, sexual harassment, payment of bonus and so on.

A startup registered under startup India programme have the option to complete self-declaration for 9 labours laws within 1 year and get an exemption from the labour inspection. The 9 laws are as follows:

- The Industrial Disputes Act, 1947

- The Trade Unit Act, 1926

- Building and Other Constructions Workers’ (Regulation of Employment and Conditions of Service) Act, 1996

- The Industrial Employment (Standing Orders) Act, 1946

- The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979

- The Payment of Gratuity Act, 1972

- The Contract Labour (Regulation and Abolition) Act, 1970

- The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

- The Employees’ State Insurance Act, 1948.

In order to continue with the exemption, the startup can file the self-declaration for the second and third year as well.

Also, if a startup has a well-defined employee policy, then that can provide an edge over other startups. This policy, could help in talent acquisition and retention. Moreover, this could boost employee’s morale and overall productivity.

5. Protection of Intellectual Property Rights.

If you have a secret sauce or an algorithm in this high-tech world, then it is important that you should take note of this law. According to this, you can patent your innovative product or an improved process of making something, or a trademark than gives you exclusive right over selling under a specific name. All this comes under Intellectual Property rights.

A Startup can leverage the ‘Scheme for Startups Intellectual Property Protection’ (SIPP) under the ‘Startup India programme’.

- This scheme was set up to protect & commercialize your intellectual property. The facilitators of the scheme are empanelled by the Controller General of Patents, Trademarks and Design.

- This panel of facilitators also help the startup by providing advisory services, assisting in patent filing and disposal of patent application. This is done in addition to various other services at a minimum charge.

6. Effective management of the contracts

Contracts are very effective to the ensure the normal functioning of any project or to provide recourse in case of non-performance. Under the Indian Contract Act, 1872 a contract is legit when

- A contract is made by the free consent of the parties competent to contract

- It is for a lawful consideration with a lawful object

- And are not expressly declared to be void

While starting a venture, employee contracts need to be taken care of carefully. It is highly recommended to outline the details about the salary, scope of work and stock options (if any) with even your first employees. This would drastically reduce risks at a later point of time.

NDAs or Non-Disclosure Agreement is another important contract that startup might find useful. Any startup discusses its ideas with a host of people from the investors to the employees to customers. And because of this, there is a huge possibility of the theft of the ideas presented. Which is where NDAs come into play. This prevents the information from spreading not only from the people inside but also with the people outside the organization.

7. Winding up of business

It might be nightmarish to think of winding up of business before starting up. But it is often said that you should prepare for the worst and hope for the best. So the process of winding up should be done systematically as many people are involved with the functioning of the company.

There are 3 ways to wind up a company and these are

- Fast track exit mode

- Court or tribunal route

- Voluntary closure

Out of all the 3 ways mentioned above, the best option is to choose fast track exit mode. It takes less time to shutdown a company with minimal cost involved. For this, 2 conditions are necessary

- First, the company should not have any assets or liabilities

- Secondly, there shouldn’t be any business operation for the past one year

If these conditions are met, then the company can struck off its name from the Registrar of the Companies (RoC).

And in the case of the voluntary closure, the shareholders and/or creditors need to be on the same page of winding up. Despite being an easy route, it is not often applicable and practical at times.

The third way of winding up via tribunal courts is not advisable at all. As it involves involves several meetings with various stakeholders leading to prolonged court proceedings.

There is another way of winding up of the company using the Insolvency and Bankruptcy Bill, 2015. In this case, an insolvency professional is hired to liquidate the assets of the company within 90 days, in accordance to the ‘Startup India Action Plan’.

This article is written by Anubhav, who is a Content Writer at LegalRaasta.

LegalRaasta is an online platform that provides expert legal services including ITR Filings, LLP Registration, Private Limited Company Registration, Partnership Registration and the list goes on. So what are you waiting for? Contact us now and get your business registered.