How to Choose the Right Home Loan Provider (Guide)

If you still are looking for a way to get your dream home, here is a simple checklist while choosing the right home loan provider.

You must have been asking this from so long, how to choose the right home loan provider.

If you still are looking for a way to get your dream home, you are going to love this post.

Also, you can use it as a simple checklist while choosing the right home loan provider for your dream home.

Let’s dive right in.

#1: Loan Eligibility and Amount

Before going for a home loan provider you must ensure that you are eligible. You may find the different eligibility criteria offered by various banks.

The Age of the Applicant (18 to 70 years), Minimum Salary (Rs. 25,000 per month and above), Work Experience for Salaried applicant (3 years and above), Business Stability for Self-Employed applicant (5 years and above) and Minimum CIBIL Score (650).

Now you have the list of banks you are eligible for a home loan. It is a time to see what amount each bank has to offer. The maximum loan on property value changes (70% - 90%) when you go to different banks.

#2: Interest Rate they Offer

Now, you must check the interest rate before applying for the home loan. The interest rate is going to effect the EMI as well as total interest you are going to pay. You can use Home Loan Calculator to get a better info on your EMI.

You must see if the interest rate is fixed or floating. As by the term Fixed interest rate does not change, where as the floating interest rate changes as depending on the market condition. It is recommended to go for a fixed interest rate for shorter term (2-5 years) where as the floating interest rate for the long term.

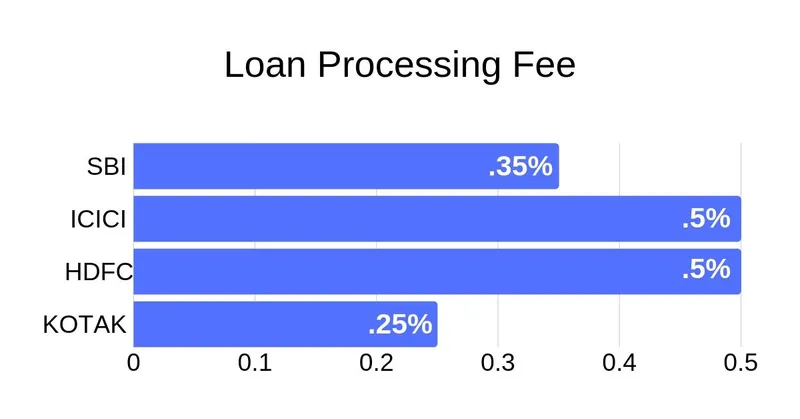

#3: Processing charges and prepayment

Home loan provider charge loan processing amount which is mostly 2% to 0.25% of the loan amount. Also there are other processing as well as legal fees such as transaction and home loan approval.

Before choosing a home loan approval you are suggested to make sure of these additional charges. In most of the banks loan processing fee is non-refundable, even the loan does not get approved. Some banks keep offering seasonal offers of zero charge on loan processing.

#4: Responsiveness of home loan provider to change in rates

This is also one of the important things you should consider before choosing the home loan provider. Check how they change the interest rate when there is a change in the RBI policy.

For example: If you see a bank usually reducing their interest rate corresponding to the rate cut in interest levied on them by the RBI, you should go for it.

#5: Go for Builder who gets you home loan Benefits

Several builders like Jain Housing arrange home loan for you and make it hassle free. So, apart from choosing the home loan provider you might want to consider builders as well. Some builders partner with several banks which brings you exclusive home loan benefits.

Legal Proof and Documentation

Most of the home loan provider do ask for documents regarding age, address income and more.

List of documents may vary when you go to the different banks. You must crosscheck before choosing a bank for your home loan.

Turnaround Time

The time bank takes to approve a loan as well as to distribute the amount is called its turnaround time.

Banks usually take around 5 days to approve a home loan once you provide all the necessary documents. Also there are several procedure banks following before distributing the amount which may vary from different banks.

Here are the 7 factors you must consider before choosing the right home loan provider for you.

Now, I suggest you to choose a home loan provider who is best as per the factors mentioned above. Rather than just considering them based on one or few factors instead.

![Top 10 Cheap Indian Press Release Distribution Services [Updated]](https://images.yourstory.com/cs/1/b3c72b9bab5e11e88691f70342131e20/LOGO-DESIGN-PR-INDIA-WIRE-03-1595693999405.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)