This Way Of GST Registration & Filing May Surprise You [GST Council]

Getting indexed under the GST registration was not a doodle, ever! So, this time, we are here will the best guide on the way of GST registration & filing which may surprise you... [Title words of GST Council]

The Easiest || The Flexible || The Reliable - yes, the very way of GST Registration and even GST filing is going to surprise you.

You must be thinking - what is different in this way which makes it so surprising.

This is what, to which we are here today.

As mentioned the blog post is uttered by GST Council. GST council always tries to make the customer and registrar feel hassle-free. On and On, LeadingFile and Council experts together came up with a new method of getting registered and filings GST.

In an address to this, they published the complete information on their official website. For the sake of same, put in your view here at GST Registration & GST Registration eligibility.

Going forth, have a look at the guide along with an infographic in short, here - as follows:

GST Registration Process: Way Which Will Surprise You

Literally, without GST Registration your business is of no value.

Also, if you have a business and don’t have the GST registration, then in #BJP government you will not be surviving anymore.

The government will find you anyhow. This government is somewhat which rocked the India.

Don’t you think so? Too bad. The instance of Jammu Kashmir, to which the government removed the Article 370 and Article 35A.

This proves that the government is working really hard. So, the thing we meant is - If you don’t have GST number then have it today by getting registered under the GST.

For the sake of same -- take a wise step and find out an attorney that fits your needs. We will recommend you -- LeadingFile itself: they are best at all the business amenities.

Well, do you know the gst registration govt fees is Rupees Zero (0). Also, they charge no value than that of their official works.

Thus, in order to index your registration with the same firm, put in you click at the button, attached just down the paragraph.

Coming back to the subject: the surprising way of filing the GST registration, as follows:

01: Visit GST Portal

Firstly, visit the official GST portal. Over second, click on the services button.

Doing so will make you visible a registration button. Just click over that too. This will also make you visible a new registration option.

Don’t think much, just click to this also.

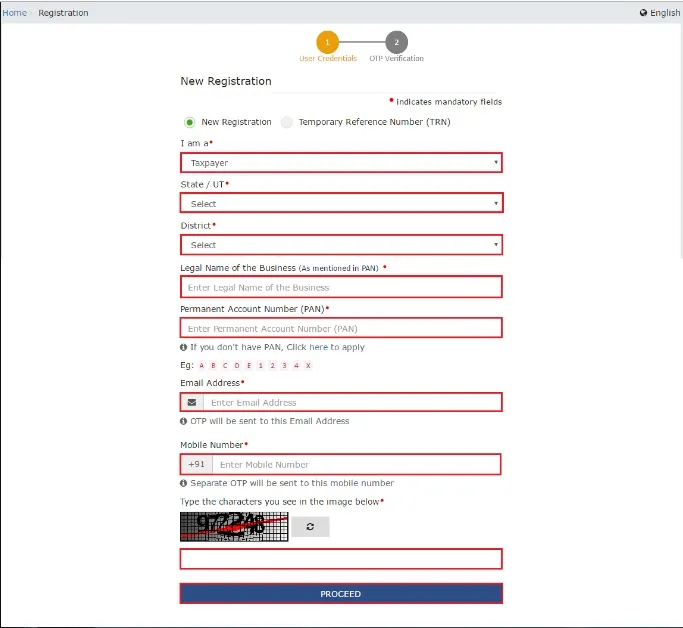

02: Complete OTP Validation & Generate TRN

Another major step, to this - we at first need to complete the OTP validation and then needs to generate the TRN.

Meanwhile, the new GST registration page is displayed, select the new registration from the same page.

But what for we need to generate the TRN. Interesting question; in case you left a GST registration application incomplete, the section TRN will help you to fill the old application from the same point where you left it.

Have a look…

Well, upon this all, you need to select the “PROCEED” button, mentioned at last of all the options.

Remember, fill the information at your own risk: a single mistake can lead to cancellation. That’s why we suggest taking a wise step and find out an attorney that fits your financial needs.

Also, they know the process by which they can avoid the cancellation and can file your GST registration in an easy and hassle-free manner.

And might that is only LeadingFile for you…!!!

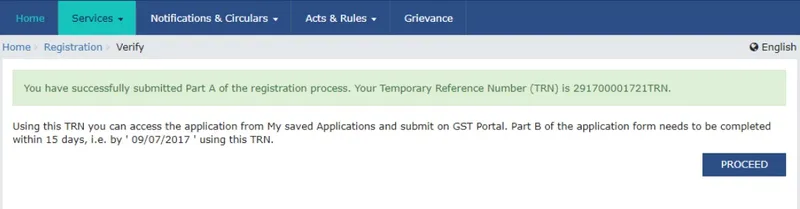

Task didn’t here, the next thing you need to do is OTP validation and TRN generation.

To this also, have a look via the image, mentioned as follows:

Finally to this step, click the “PROCEED” button.

Over next, have a look…

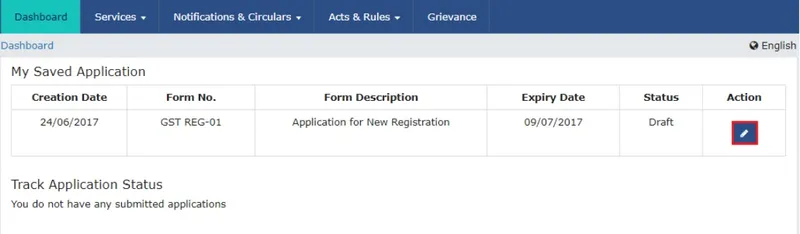

03: TRN Login

Upon having the TRN, let’s start with the login process, and later to getting logged in, take the action by pressing the ICON below the action menu.

Have a look...

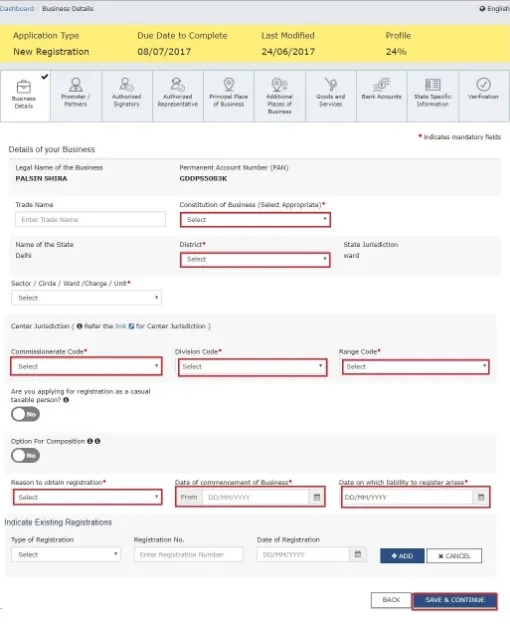

After this, you need to submit the overall business information.

To have a view of the same, make a view of the image as follows:

To this, fill all the necessary details. Also, remember that Asterisk “*” symbol block is mandatory to file.

Upon filing all the details, jump over the next step, as follows:

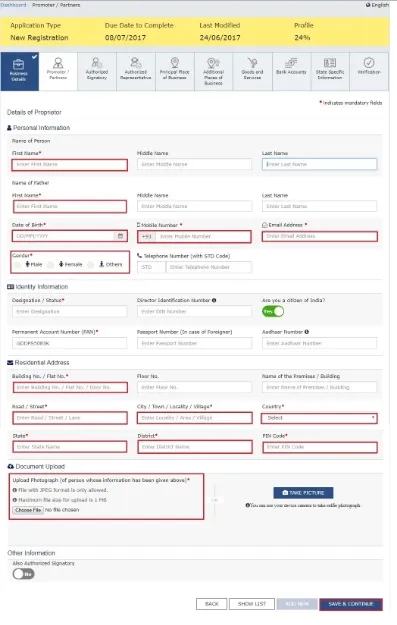

04: Submit The Overall Information Of Promoter

Under this step, you need to submit the overall information of the promoter.

In order to overlook the information which is required to be filed in the faith of promoter is elaborated through a image, as follows:

To this, fill all the necessary details. Also, remember that Asterisk “*” symbol block is mandatory to file.

Upon filing this information checklist, click over the “SUBMIT & CONTINUE” button.

Later to this, submit the authorized signatory information and later to that file the details of the principal place of your business.

For the sake of the same, have a look as follows:

Again, after filing all the required details, click over the “SUBMIT & CONTINUE” button.

Not only this but if you also have an additional place of business then file the information of the same, also.

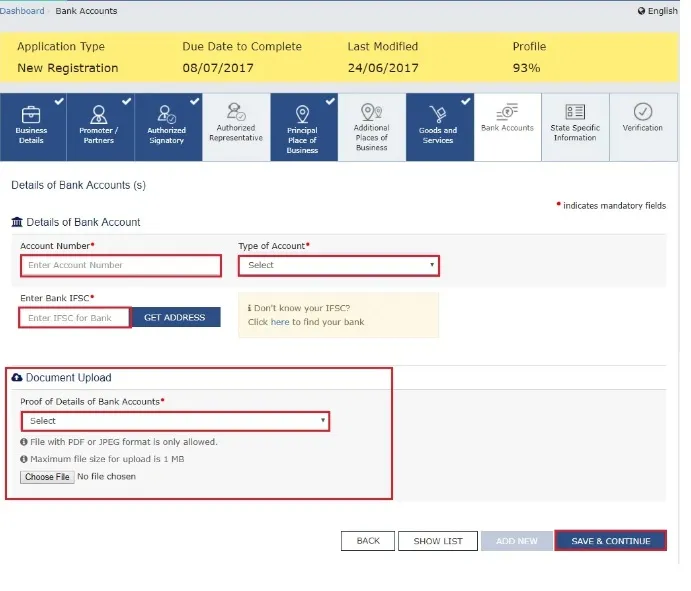

05: Goods + Services + Bank Account: Details

Under this alternative step, at first file the Goods and Services details. To this also, have a look at the image as follows:

Here you need to follow out the HSN chapter.

Over next, file the details of the bank account, illustrated as follows:

At last, after filing the details, click over the “SAVE & CONTINUE” option.

Now, verify your application and start availing the benefits of GST (Goods and Services).

Wish To Consult A GST Expert?

Actually, YourStory doesn’t provide the experts help but YourStory will suggest you a consultant which is rated on and on 99* i.e LeadingFile || Business Leading Innovation (Consultant).

Needless to say, LeadingFile provides the entire range of services required to register for GST. Also, they provide -- GST maintenance service.

Not only this much but they can also help you obtain GST registration, generate GST Invoices and file GST returns.

So, get in touch with LeadingFile GST experts, today!

![This Way Of GST Registration & Filing May Surprise You [GST Council]](https://images.yourstory.com/assets/images/placeholder.png)