[2020 Outlook] Despite the economic slowdown, here's how Indian jewellers are betting big on investing in gold

2019 was a challenging year for both the real estate and the stock market, and this could see jewellery (gold in particular) emerge as a promising investment option in 2020.

India imports most of its gold. The country saw demand for the yellow metal falter in the second half of 2019. Local and international prices rose, and import duty was hiked from 10 percent to 12.5 percent. The liquidity crunch in the Indian economy also affected local demand.

Despite this, gold demand in India rose to 760.40 tonnes between January to December 2018, according to India Brand Equity Foundation data. Indian gold jewellers are positive for 2020 can usher in growth and new opportunities in the segment.

2019 was a difficult year for real estate and stock markets, and this could see jewellery (gold jewellery in particular) emerge as a favourable investment option in 2020.

“The current market scenario shows that equity markets and real estate are not able to garner the returns expected. This will give momentum to the jewellery sector. Consumers are now looking at jewellery as an investment option,” says Gautam Singhvi, co-founder and managing director of The Diamond Factory, a Mumbai-based jewellery brand.

Gautam Singhvi (right) and Prasanna Shetty (left), cofounders and managing directors, The Diamond Factory

In 2019, the real estate sector struggled with funding issues in the wake of the NBFC and banking crisis. This was coupled with poor demand for housing. In the same year, the Indian stock market emerged as a poorly-performing market.

The real estate and stock market situations have been exacerbated by the economic slowdown. In the first quarter of 2019-20, the GDP growth rate of the Indian economy slipped to five percent, the lowest in over six years. Lack of demand, suspension of production, factory shutdowns, and job cuts in several industries made headlines. In the second quarter, the growth rate fell to 4.5 percent - another six year low.

Besides the slowdown, the effect of the implementation of GST, demonetisation, and digital payments was felt among small businesses.

In 2020, the manufacturing sector could hold the biggest business opportunities for MSMEs and small businesses to come out of crisis mode. The government is expected to push up the number of MSMEs in India on a sustainable basis through various schemes and programmes.

Further, to combat the slowdown and to boost demand for local products, import substitution and a strong focus on exports are likely to pave the way ahead. The government is working on two policies to increase MSME exports and bring down imports by encouraging local production, said Union MSME and Road Transport Minister Nitin Gadkari last year.

This export focus in production is especially relevant for gold. India is the fourth largest exporter of gold products.

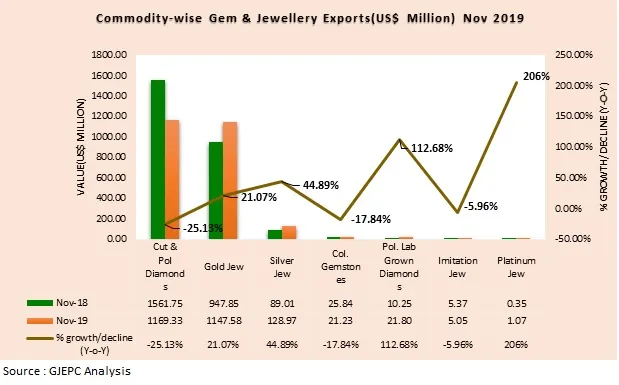

Gold jewellery exports grew 21 percent from November 2018 to November 2019, according to Gem & Jewellery Export Promotion Council (GJEPC) data.

Market opportunity

Based on their readings of the market, jewellery industry players and associations in India are betting big on gold. Prithviraj Kothari, National President, India Bullion and Jewellers Association (IBJA) told PTI gold price trends are rising and the market would soon reach a new high.

"The global economic slowdown and liquidity crisis in India and depreciation of the rupee against the US dollar will support the gold market. I am positive that in 2020, the gold prices will be in the range of Rs 38,000 on the downside and Rs 42,000 on the upside," he was quoted saying.

Jaipur-based jeweller TALISMAN expects fashion jewellery to sell well and become an independent segment. “We witnessed other fashion brands reinvent fashion with their fast-fashion business model, and the jewellery industry is undergoing a similar transformation. Customers want a new piece that is luxurious, but they want a new one every week,” said the brand’s founder and CEO, Rishabh Kothari.

Rishabh Kothari, Founder and CEO, Talisman

Iconic American luxury jeweller Tiffany & Co’s entry into India is another large bet. Reliance Brands Ltd (RBL) entered into a joint venture with Tiffany to open new stores in Delhi in the second half of fiscal 2019 and in Mumbai in 2020.

Tiffany and its subsidiaries design, manufacture, and market jewellery, watches, and luxury accessories – employing more than 5,000 artisans who cut diamonds and craft jewellery.

Volume growth for jewellers is expected to increase on the back of reintroduction of low cost gold metal loans and likely stabilisation of gold prices at lower levels.

Further, the Bureau of Indian Standards (BIS) revised the standard on gold hallmarking in India from January 2018.

An IBEF report explains: ‘The gold jewellery hallmark will now carry a BIS mark, purity in carat and fitness as well as the unit’s identification and the jeweller’s identification mark. The move is aimed at ensuring a quality check on gold jewellery.’

“Making hallmarking on gold jewellery compulsory has brought in compliance in the supply chain and has made quality standardised,” says Ahammed MP, Chairman, Malabar Gold & Diamonds. He believes this move can make 2020 another landmark year for the jewellery retail trade.

“Jewellery retailers have to organise their supply chains or make it hallmark regulation-complaint. Moreover, there will be an increased awareness of hallmarking among the consumers. The share of organised retail will increase further and the retail jewellery market will become more competitive,” he adds.

Ahammed MP, Chairman, Malabar Gold & Diamonds

He says gold will emerge a favourable investment option as the trust of investors and consumers become stronger due to reform and regulatory initiatives taken by the government.

Besides hallmarking, Gold Monetisation Scheme is a government measure aimed at the sect. It enables individuals, trusts, and mutual funds to earn interest on gold deposited with banks. The MoU signed between GJEPC and Maharashtra Industrial Development Corporation (MIDC) to build India’s largest jewellery park at Ghansoli in Navi-Mumbai is also an initiative that could spur growth in the segment.

“The market has seen a considerable improvement in the last six months. 2020 looks really good for the gold industry from the point of view of consumption, customer sentiment and the entire economic state of the country," says Saurabh Gadgil, chairman and managing director, PNG Jewellers.

Saurabh Gadgil, chairman and managing director, PNG Jewellers

"The interest of consumers has come back towards gold as an investment option. We estimate 2020 will help cover the under performance of the gold market in the last three years,” he adds.

Buoyed by the positive signs in this volatile market, jewellery brands are expanding, but not at the pace of Kalyan Jewellers, which has over 100 large format stores across the country. Joy Alukkas has over 60 stores in the country, and Jos Alukkas has around 30 stores in the southern region of the country.

Other jewellery companies are Firestar Diamonds, Bhima Jewellers, and Kiran Gems, all which are close on the heels of Kalyan - the largest jeweller in India by net worth.

(Edited by: Palak Agarwal)

![[2020 Outlook] Despite the economic slowdown, here's how Indian jewellers are betting big on investing in gold](https://images.yourstory.com/cs/21/98e25df018b511e988ceff9061f4e5e7/Jewellery-1578317837624.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)