Financial literacy can help small businesses succeed in post COVID-19 era: Intuit QuickBooks India exec

In an exclusive interaction with SMBStory, Aditi Puri Batra bats for boosting financial literacy through technology solutions, and explains how Intuit QuickBooks is enabling small businesses to adopt such solutions.

Small businesses and MSMEs in India are currently facing challenging times in the wake of the coronavirus pandemic. The lockdown in India has disrupted various industries and crippled the cash flow in the MSME sector.

While small businesses mull halting production, changing their business model, and deferring payments, they also need to boost their financial literacy to understand their costs better.

Technology can play a key role in enabling financial literacy without disrupting business operations.

“With technology solutions to boost financial literacy, business owners can understand the true cost of running the business. This helps them decide the pricing for their products or services. They can also easily manage quotations, customer data, invoices, and GST with technology solutions,” says Aditi Puri Batra, Country Manager, Intuit QuickBooks India.

For 15 years, QuickBooks has been working in India to build financial management solutions for small businesses.

Intuit QuickBooks India Country Manager Aditi Puri Batra

In an exclusive interaction with SMBStory, Aditi explains why small businesses should boost financial literacy through technology solutions, and how Intuit QuickBooks is enabling some of them in doing so.

Edited excerpts from the interview:

SMBStory [SMBS]: What does Intuit QuickBooks do in India? What solutions does it offer small businesses?

Aditi Puri Batra [APB]: Intuit’s journey in India began in 2005 when we set up our research and development operations in Bengaluru. Over the years, India has grown to become an important market in our international portfolio, leading to the launch of Intuit QuickBooks range of products.

Intuit QuickBooks Online, a cloud-based financial management solution for small businesses, was launched in 2012. In 2019, we launched an online practice management solution specifically designed for Chartered Accountants (CAs) to grow their practice and easily manage their clients.

Together, QuickBooks Online and QuickBooks Online Accountant provide an integrated experience for practice management, accounting, and Goods and Services Tax (GST) filing in a single place. Our goal through our products is to make the life of our customers in India easier, be it small businesses or accountants, and enable them to leverage technology to grow their business. In the era of the shift to digital, we want to help small businesses make this transition more smoothly.

Currently, Intuit has a 1,000 plus strong workforce in India. We have seen robust growth as our customer base grew 45 percent to 50 percent year-on-year (YoY) in India and revenue grew 30 percent YoY in FY19. The number of CAs using QuickBooks Online in India grew 10 times in FY19.

SMBS: What is the extent of the damage faced by Indian small businesses due to the coronavirus pandemic?

APB: Reports suggest that MSMEs are facing losses to the tune of thousands of crores of rupees every day during the lockdown, but data inadequacy makes it difficult to put a number to it. The full extent of the damage will become clearer once various economic indicators are prepared and released by the government.

The important factor to consider is that nearly 6.4 crore MSMEs in India contribute to 29 percent of the GDP. The growth rate of our GDP has slowed from 4.9 percent last year to 1.9 percent in the last two months. This impacts small businesses in a major way as well.

A mere 6.3 percent of them have access to credit as per a research paper by the National Institute of Public Finance and Policy. In the post-COVID-19 world, access to credit will become more difficult. Thus, solving the liquidity woes of MSMEs is a major challenge before us today.

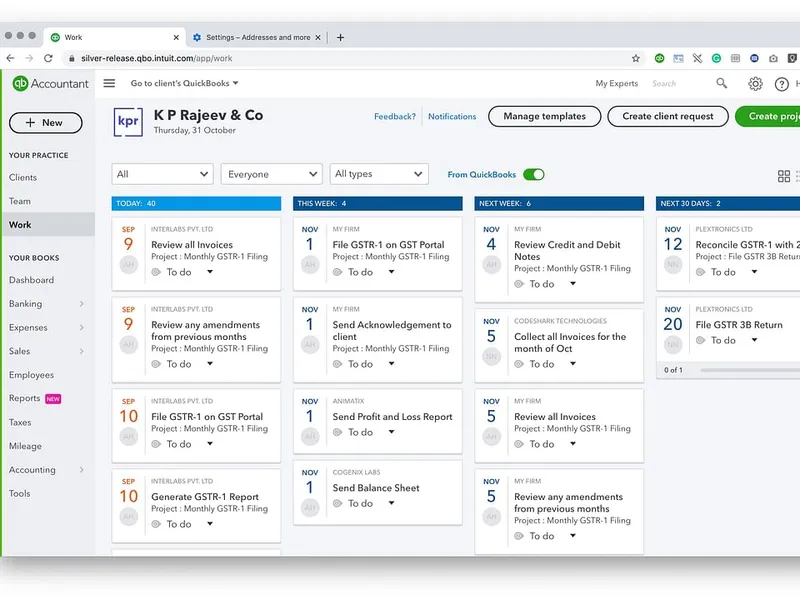

A snapshot of Intuit QuickBooks' Online Accountant

SMBS: How has Intuit QuickBooks been helping small businesses and MSMEs during this time?

APB: We have been exploring multiple ways to enable small businesses as they have an important role to play in uplifting the Indian economy when the lockdown ends.

One of our initiatives is the ‘Consult an Expert’ programme wherein small businesses can avail advice from an external pool of experts in the areas of accounting, taxation, cloud accounting, GST, budgeting, payroll, management reporting, and compliance.

The aim is to help them in financial and cash flow management during these challenging times. Through this free programme, they can get advice on tax filing, managing a virtual business, and financial planning for the upcoming fiscal.

Apart from this, we have created a COVID-19 microsite to give tips to small businesses on business continuity planning and customer and employee engagement strategies. Besides the tips, the microsite provides access to important resources created by various government ministries and departments relevant to the current scenario of COVID-19.

A few days ago, we launched the ‘India Small Business Relief Initiative’ in collaboration with Milaap to enable the small businesses that are facing difficulties in covering business expenses, to raise funds.

The Small Business Relief Initiative brings together Milaap’s crowdfunding platform with Intuit QuickBooks’ expertise, to provide local businesses with the resources and tools they require to start a crowdfunding campaign in a few clicks. Through the Milaap platform, qualifying businesses that are affected by COVID-19 can raise micro-grants to meet essential business expenses.

SMBS: What is the way forward for MSMEs in the next six months to one year?

APB: Today, the operations of many small businesses have come to a standstill as they do not have access to offices or access to clients’ data. Thus far, they were used to operating in a predominantly desktop environment.

Our customers are telling us about the transition to work from home and virtual being smoother for them as their data and work were already on the cloud. They are also aware of their financial health and cash flow situation – instances where there is opportunity to get money faster and where they can delay payments as they use tools that make it easier for them to do so.

This financial literacy will be critical as we come out of the lockdown. We will see a new normal and the best thing we can do now is to understand what this means for our business and to plan for it. Digital will inevitably become mainstream now. It is the new world order and we will see a much more rapid transition to virtual in the coming months.

Small businesses should be ready for the new normal of working from home. They need to be alive to this new reality and embrace remote working along with cloud-based tools and technology to enhance business productivity.

With cloud technologies, they can enhance their digital discoverability, acquire new customers, enter newer markets, and make digital transactions. Cloud, artificial intelligence, and blockchain will enable newer areas of business models and opportunities that will make it easier for small businesses to digitise.

Small businesses should also keep their customers informed on their operations through regular updates via the company website, social media, WhatsApp, phone calls, and one-on-one emails.

SMBS: What is your advice to small businesses for building a recovery mindset?

APB: Humans have overcome every challenge that has come our way and we will overcome this as well, it may just take us longer. My advice would be to realise this fact as we think of recovery. There will be a new normal and we should prepare for that now.

Small businesses should forecast worst-case scenarios and put together a plan for dealing with those even before they arise. They should devise an internal and external communication strategy to communicate with investors, employees, and contractors, and create a chain of command so that messaging goes through proper channels.

Small businesses should plan for how they can do more with less – scarcity breeds innovation and their scenarios should look at achieving more with fewer resources or cash flow that they may have. They should focus on strong unit economics as that will become essential in the new world.

They can prioritise a few things that have maximum impact and drive this clarity for their teams with these priorities. Further, it is an important time to communicate with customers but appropriately – communication should be meaningful to people. This helps build higher trust and a longer-term relationship.

Small businesses should also have a business continuity plan. More importantly, they should investigate their cash flow sources and create plans for alternative providers along with risk assessments to help them better prepare for gains or losses. Above all, they should keep their investors and shareholders informed about plans that may affect their revenue.

Edited by Javed Gaihlot