A paper substitute for plastic bubble wrap, and other top stories of the week

Here’s the story of EcoCushion Paper, which helps businesses reduce the usage of plastic bubble wrap, and other top picks from SMBStory this week.

Packaging is the largest source of plastic pollution on our planet. While there is global development of businesses through the advent of the internet and ecommerce, the increase in the use of plastic has also surged, choking our oceans.

According to a WWF report, the amount of plastic in the ocean is expected to double in the next 15 years, and by 2050, there could be more plastic than fish in the sea (by weight).

The rising plastic usage alarmed Mahesh Agarwal (62) while he was shifting his belongings from Delhi to Mumbai. It was at this time, that he started his research to find a sustainable substitute for plastic bubble wrap.

EcoCushion Paper

For 40 years, Mahesh had worked with his cousins in a family business in Delhi. However, amid the pandemic, he moved to Mumbai to be with his children.

During the relocation process in 2020, Mahesh observed the amount of plastic used as protective packaging.

“There was plastic everywhere around the floor,” Varsha says, adding, “We all know plastic is harmful for the environment, but when we saw the amount used just for vacating our house, and how much problem it would pose for the environment, we were bound to contemplate on the overall use of plastic everyday by everyone around us.”

The incident gave Mahesh a reason to start a business again in his retirement age, and he started researching.

“Our father was sure he would find a solution to reduce plastic waste. We moved to Mumbai, and he spent initial six to eight months in the research, after which, he came up with the idea of making honeycomb paper wrap as a substitute for plastic bubble wrap,” says Varsha.

Honeycomb paper wrap is not new to the Indian market, and thousands of retailers and resellers sell imported paper wraps. However, , launched in June 2021, stands out for its in-house manufacturing facility and caters to the smallest orders of small businesses, which otherwise is not the case in the industry.

Other top picks of the week:

Meta announces no-cost EMI for advertisers

Meta (formerly Facebook) announced new working capital support — no-cost EMI — along with enhanced service support features for all advertisers and small businesses in India. The announcement was made during the second edition of the Grow Your Business Summit, Meta’s annual event dedicated to the growth agenda of Indian small businesses.

According to Meta, this feature—first launched in India—will allow advertisers and small businesses to pay Meta for their advertising campaigns in equated monthly installments over three months through partner banks at no additional interest to them.

Meta will bear the applicable interest payable to the bank and give it as an upfront discount to the business on its ad spending.

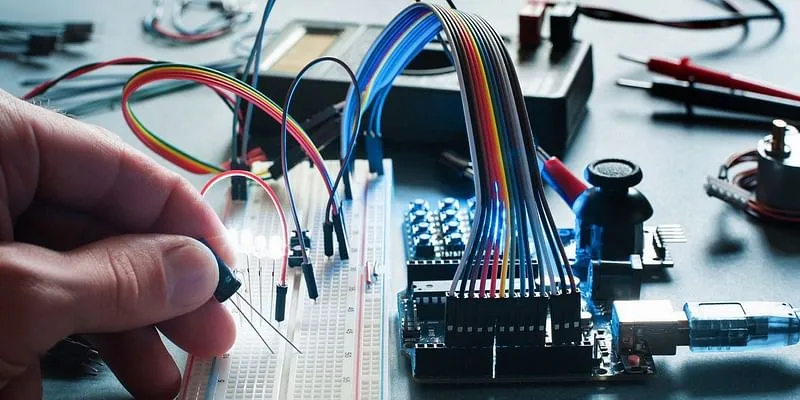

The road ahead for electronics manufacturing

The Indian electronics market, estimated to be around $75 billion last year, is expected to grow by 6-7% annually for the next six years. This was not the case if one were to assess the situation two years ago. There was a definite dent in manufacturing plants shutting down and demands lowering.

However, as everything gets better with time, so did the electronics industry. The best lesson we all learned from the pandemic was that we need to have in-house manufacturing units.

Due to the pandemic and trade shutting down, several manufacturers and retailers found it hard to keep up with demand. For instance, semiconductors and panels were so scarce in India that the television industry had months of backlog as parts were unavailable.

But not anymore. Due to several PLI schemes and the Make in India initiative, several plants are set up for end-to-end manufacturing in India. The Electronics Development Fund policy and the Modified Special Incentive Package Scheme are introduced to promote manufacturing.

Besides COVID-19, several other reasons are behind the increased production in the consumer electronics segment. Global shift in trade policies, the Ukraine-Russia war, work from home for corporates, revenge spending, and the US-China face-off, all combined, gave a platform to Indian electronics manufacturers to cater to India's and global manufacturing needs.

Edited by Suman Singh