This Delhi-based organisation is creating jobs for the semi-educated and unemployed

MIMO Technologies aims at financial inclusion of the semi-educated and the unemployed. It also strives to connect services to the remote parts of the country in an attempt to bridge the digital divide.

Mohammed Uvaish quit schooling at the age of 14 to support his family. He continued his family’s occupation of farming to make ends meet. A few years later, once he had the money, he went on to complete his BA and a diploma in mechanical engineering.

Despite getting a job, he could barely manage to meet his expenses with the basic salary that he received. But when MIMO Technologies, an organisation that helps the semi-educated and the unemployed get jobs, approached him with a job opportunity, things took a better turn for Uvaish, as it did for more than 8,000 others.

Lathika Reghunathan being conferred the Technology Woman Entrepreneur award at BW Disrupt Women Entrepreneur Summit (Image: MIMO Technologies)

Founded in 2016, MIMO Technologies (Minimum Investment | Maximum Outcome) aims to use its innovation to help people across India, especially in rural areas, enhance their earnings. The mobile application intermediates between the service providers, like banks and other institutions, and its field officers, typically underemployed youth.

“I needed to find a ‘wallet’ that could help the unbanked section of India who are without a banking licence,” Lathika tells Social Story.

Lathika Regunathan is the founder, CEO, and guiding light of MIMO Technologies Pvt Ltd. She has about 20 years of experience as the Director at Mann India, a software development company, focussed on LATAM markets. She also has experience of working at John Hopkins Institute.

“The mobile technology that is accessible to most of the country’s population became the solution to financial inclusion of a larger number of people, while also providing services to the most remote areas,” says Lathika.

Employing the unemployed

MIMO Technologies is a simple concept that was developed to put the screen time of a mobile phone user into better use.

“The smartphone has become an intimate part of people’s lives today. So, I wanted to help people find a way to monetise this medium,” Lathika explains. “This way, they can be included financially without letting their education get affected.”

The organisation has tied up with many partners in various sectors like BFSI, logistics, marketing, and software. These organisations provide specific services or micro jobs.

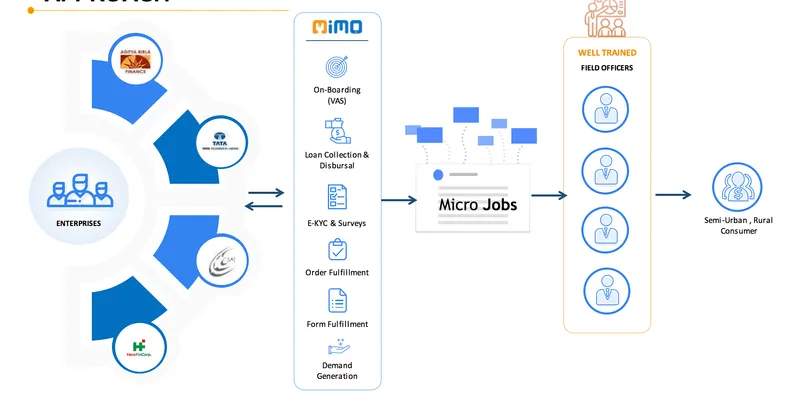

The MIMO approach

The services needed are broken into the simplest tasks possible, involving cash collection, marketing, logistics, mobile POS, and data digitisation, amongst others. The agents or field officers are trained in these services, which enables them to take up relevant tasks needed by the partners.

“The agents who are closest to the pin code where the tasks are required take it up based on their skill set,” says Lathika. “Through an automated system, the app identifies which partners are most suited to complete the required task. It is then left to the field officer, whether to take up the task or not.”

Each of these jobs can pay anything between Rs 10 and Rs 450. Based on their interest and the frequency of jobs, the field officers can make an earning of at least Rs 35,000 a month.

In addition, the app is multilingual and is available in English, Hindi and other regional languages like Kannada and Telugu and will soon be live in Tamil and Malayalam as well. This feature connects a larger number of people to opportunities in these languages as well.

Tie-ups and collaborations

“The first partner was RailTel, a government organisation that needed the field officers in local villages. They were the starting point in our endeavour,” says Lathika.

The organisation has tied up with many partners including Aditya Birla Finance Limited, Hero FinCorp, RBL Bank, Yes Bank, Myntra, ICICI Home Finance, among others.

MIMO Technologies was part of the Financial Inclusion Lab, an accelerator programme at CIIE.CO’s Bharat Inclusion Initiative, supported by Bill & Melinda Gates Foundation, JP Morgan, Michael & Susan Dell Foundation, Foundation and the Omidyar Network, and runs in collaboration with MicroSave Consulting.

MicroSave Consulting (MSC) conducted boot camps and diagnostic sessions to support MIMO. Moreover, a diagnostic field study by MicroSave Consulting helped MIMO understand different challenges that field officers face on the ground and develop measures to address them.

Currently, MIMO in collaboration with MicroSave Consulting is working on a research programme to increase the chances of field officers earn more than the current rate.

A game-changer for life

Says Mohammed Uvaish, MIMO beneficiary: “MIMO has been a game-changer for me. It not only provided me with an extra source of income but also helped me enhance my communication skills, leadership skills, and management skills.”

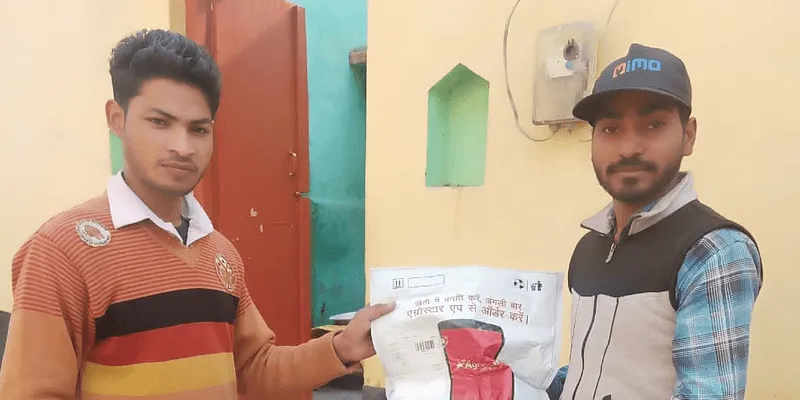

A MIMO field officer connecting rural India

Uvaish initially used to make about Rs 1,500 a month, but with hard work and consistency, he now earns about Rs 15,000 a month. He even helped many of his friends get jobs with MIMO.

As of today, MIMO has connected more than 135 service providers with about 8,648 field officers, who have further worked with more than 195 types of services across 19 states in India, with more than one lakh transactions every month.

COVID-19 impact

While the COVID-19 pandemic and the resultant lockdown hit many businesses hard, MIMO used the crisis to its advantage by introducing new schemes.

“Initially, the pandemic almost made the business come to a standstill. The number of transactions dropped drastically, though it was manageable,” says Lathika. “However, after this initial setback, we introduced new services like data digitisation which could be done by people from their homes.”

The archived documents containing data are sent by the partners. Field officers can sit at home and digitise the data by manually entering the details into the system.

Another service that was started was video verification. They can call the customers and do the verification through a video call. According to Lathika, this provided jobs to a number of people.

Way forward

Talking about the road ahead, Lathika says, “We have started working on the distribution sector and are working with companies to do various pilots. In addition, we will also consolidate our position in the financial sector. We are also trying to reach out to as many companies as possible to expand our business.”

Edited by Javed Gaihlot