Digital wallet transactions volume in Bahrain up by whopping 196.2%

The Digital Payment Landscape Report 2022 released by the Central Bank of Bahrain highlighted the key developments and innovations in Bahrain's fintech space.

Digital payments have picked up pace in Bahrain, according to the Digital Payment Landscape Report 2022 by the Central Bank of Bahrain (CBB).

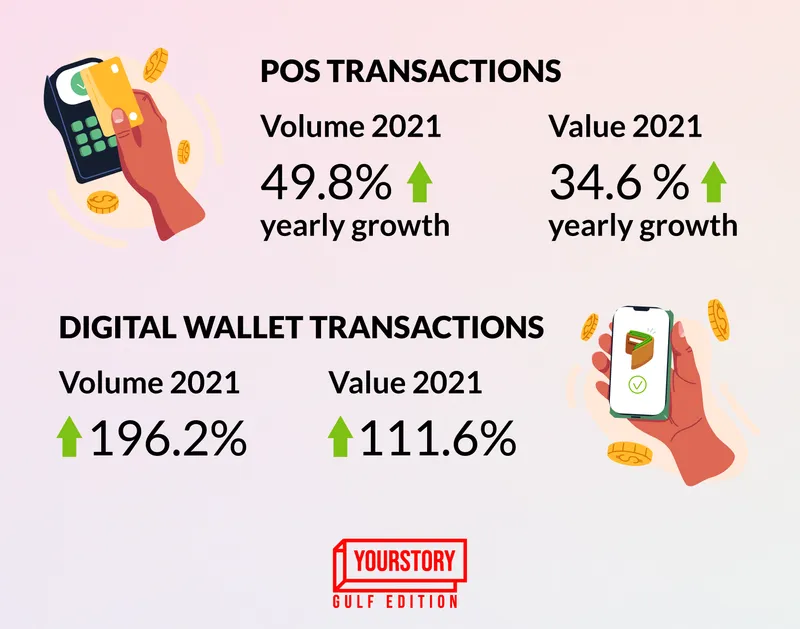

With emerging new technologies and changes in consumer behaviour, the country’s Point of Sale (PoS) transactions in 2021 grew in volume by 49.8% and in terms of value by 34.6%. For the same year, digital wallet transactions in the country also marked a growth of 196.2% in terms of volume and 111.6% in terms of value.

The pandemic served as a catalyst to accelerate the rapid digitalisation of the payment landscape, according to the report. Prioritisation of public health and safety concerns pushed people to shift towards contactless payment and socially distanced retail.

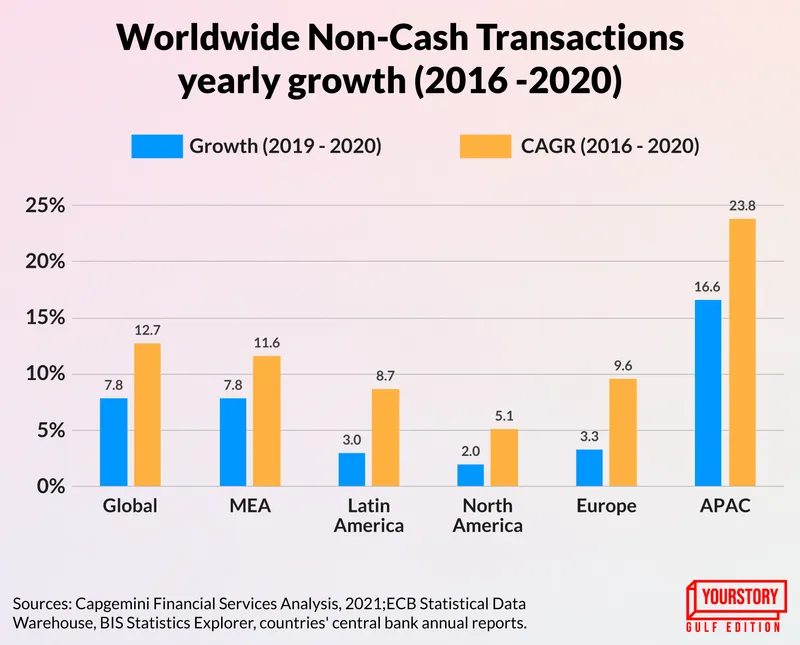

Worldwide non-cash transactions yearly growth (%) 2016–2020

More women are graduating in STEM in GCC but there is a long way to go: Survey

Growth of digital payments

The digitalisation of payment infrastructure in Bahrain has opened up multiple growth opportunities in customer engagement. Banks, telecom, and other service sectors have stepped in to deliver enhanced payment services for their customers.

Some of the digital tools introduced in the country include open banking, real-time banking services, the introduction of International Bank Account Numbers (IBAN), and regulatory sandboxes for fintech innovations.

The CBB launched Bahrain Open Banking Framework (Bahrain OBF) in 2020. Based on global ISO standards, the OBF was further customised to suit the country’s payment ecosystem.

Real-time banking service has given customers in Bahrain the ability to access their data, initiate transactions or pay bills using a suite of customised products and services.

CBB’s adoption of the International Bank Account Number or IBAN provides a safe environment for financial transactions across the country’s border and minimises delays and costs associated with incorrect account numbers. It also integrates the national banking system with the internationally accepted ISO numbering system to identify bank accounts.

In 2020, GCC member countries implemented the Arabian Gulf System for Financial Automated Quick Payment Transfer (AFAQ), a regional payment system that offers an additional channel of transferring funds through a faster and more secure means at lower transaction costs.

Operated by the Gulf Payments Company (GPC), AFAQ is a Real Time Gross Settlement service for cross-border payments between GCC countries, which aims to support the growth of trade and flow of investments between the GCC member states, and promotes economic diversification.

Bahrain digital payments yearly growth (%) 2021

The problem of empty miles led this founder to launch UAE’s Uber for trucking

Future innovations for Bahrain’s fintech

The CBB is working on a few financial instruments that will be introduced in the near future for improving the digital payment landscape of Bahrain. One of them is the Central Bank Digital Currency (CBDC), a digital version of the Bahraini Dinar.

This would help support customers making peer-to-peer payments, without the need for any intermediaries. It will mimic cash in every aspect while remaining intangible and virtual in nature and will be operating on Distributed Ledger Technology (DLT).

Another service in development is the Central Addressing System (CAS), which would ease the process of transferring funds by eliminating the need to input a long IBAN number. Instead, the system will summarise the IBAN number into a unique identifier such as a national ID, phone number, etc.

It works as a central addressing directory and allows participants to register their customers and map them to unique identifiers.

The CBB is also focussing on expanding its open banking services to open finance. This allows third-party providers (TPPs) to access customers’ account data and initiate payments. Open Finance will empower customers by enabling them to gain control over their financial data, help them make better informed financial decisions and get access to customised financial services.

Finally, the Request to Pay (R2P) will be both a module and a service that would enable applicable stakeholders to initiate a payment request from intended payers, such as individuals or businesses. R2P will support online integration with businesses and other entities, and it will be extended to other authorised channels.

Edited by Affirunisa Kankudti